Tender Offer Statement by Third Party (sc To-t)

12 Novembre 2021 - 9:53PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1)

or 13(e)(1) of the Securities Exchange Act of 1934

EMPRESA

DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A.

(Name of Subject Company (Issuer))

EMPRESA DE ENERGÍA DEL CONO SUR

S.A. (EDENOR)

And

SOUTH AMERICAN ENERGY LLP

(Names of Filing Persons (Offerors))

CLASS B

COMMON SHARES, par value 1 Peso per share (ISIN: ARENOR010020), including

Class B

Shares represented by American Depositary Shares

(Title of Class of Securities)

29244A102

(CUSIP Number of Class of Securities)

SCHEDULE 13E-3

RULE 13E-3 TRANSACTION STATEMENT UNDER SECTION 13(E) OF THE SECURITIES EXCHANGE ACT OF 1934

EMPRESA DE ENERGÍA DEL CONO SUR S.A. (EDENOR)

And

SOUTH AMERICAN ENERGY LLP

(Names of Filing Persons (Offerors))

CLASS B COMMON SHARES,

par value 1 Peso per share (ISIN: ARENOR010020), including

Class B Shares represented by American Depositary Shares

(Title of Class of Securities)

29244A102

(CUSIP Number of Class of Securities)

Nicolas Mallo Huergo

c/o Maipú 1252, 12th floor,

City of Buenos Aires, (CP1006),

Argentina

With a copy to:

Christopher C. Paci, Esq.

J.A. Glaccum, Esq.

Nicolas Teijeiro, Esq.

DLA Piper LLP (US)

1251 6th Ave.

New York, NY 10020

(212) 225-2000

(Name, Address

and Telephone Number of Person Authorized to Receive Notices and Communications on behalf of the Filing Persons)

CALCULATION OF FILING FEE

|

Transaction

Valuation(1)

|

Amount of Filing Fee

|

|

U.S.$114,593,327.92

|

U.S.$10,622.82

|

|

|

☐

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Estimated for purposes of calculating the filing fee pursuant to Rule 0-11(d)

only. The Transaction Valuation was calculated assuming the purchase of all outstanding Class B Shares (including Class B shares underlying

the American Depositary Shares), other than Class B Shares and ADSs owned directly or indirectly by the Filing Person or its affiliates

(including shares held as treasury shares) at a purchase price of 29.34 Argentine pesos (“Ps.”) per Class B Share and converted

into U.S. dollars based on the official selling exchange rate of Ps. 105.25 per U.S.$1.00 as reported by Banco de la Nación Argentina

on November 10, 2021. As of November 10, 2021, there were 411,075,965 issued and outstanding Class B Shares (including Class B Shares

underlying the American Depositary Shares) but excluding shares owned by the Filing Person or its affiliates (including shares held as

treasury shares).

|

Amount Previously Paid: N.A Filing

Party: Empresa de Energía del Cono Sur S.A. and South American Energy LLP

Form or Registration No.: N/A Date Filed: N/A

o Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions

to which the statement relates:

|

|

☒

|

third party tender offer subject to Rule 14d-1.

|

|

|

o

|

issuer tender offer subject to 13e-4.

|

|

|

☒

|

going-private

transaction subject to Rule 13e-3.

|

|

|

o

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting

the results of the tender offer:

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

|

|

o

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

☒

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Tender Offer Statement on this combined Schedule

TO and Schedule 13E-3 under cover of Schedule TO (this “Schedule TO”) is being filed by Empresa de Energía del Cono

Sur S.A. (“Edelcos”) and South American Energy LLP (“SAE”, and together with Edelcos the “Bidders”)

and relates to the offer by the Bidders to purchase any and all outstanding Class B shares, par value Ps. 1.00 per share (the “Class

B Shares”), including Class B Shares represented by American Depositary Shares (“ADSs”), of Empresa Distribuidora y

Comercializadora Norte S.A., a corporation organized under the laws of the Republic of Argentina (“EDENOR”).

The offer will be made on the terms and subject to

the conditions set forth in the offer to purchase dated November 12, 2021 (the "U.S. Offer to Purchase") attached hereto as

Exhibit (a)(1)(i) and incorporated herein by reference and in the related documents (which, together with any amendments or supplements

thereto, collectively constitute the "U.S. Offer"). The U.S. Offer is being made in conjunction with an offer by Edelcos in Argentina

for all outstanding Class B Shares (the "Argentine Offer," and together with the U.S. Offer, the "Offers"). The price

offered in the Argentine Offer is the same on a per Class B Share basis as the Offer Price in the U.S. Offer. This Schedule TO is

intended solely for (i) holders of Class B Shares that are U.S. residents (under the meaning of Rule 14d-1(d) under the U.S. Securities

Exchange Act of 1934, as amended) and (ii) holders of Class B Shares represented by American Depositary Shares (each representing rights

to 20 Class B Shares). The information set forth in the U.S. Offer to Purchase is incorporated herein by reference with respect to Items

1 through 11 of this Schedule TO. This Schedule TO is being filed on behalf of the Bidder.

|

|

(a)(1)(vi)

|

Notice of Offer to Purchase Shares of Class B Shares Issued by Edelcos, as made public on July 29, 2021. (English translation) (incorporated

herein by reference to Exhibit 1 of Edelcos’s pre-commencement communication filing on Schedule TO on July 29, 2021).

|

Item 13. Information Required by Schedule 13E-3.

The information set forth in the Offer to Purchase

is incorporated by reference herein in answer to Items 1 through 16 of Schedule 13E-3, except to those items as to which information is

specifically provided below.

Item 2 to Schedule 13E-3. Subject Company Information

|

|

(e)

|

Prior

Public Offerings: None.

|

Item 13 to Schedule 13E-3. Financial Information

|

|

(a)(1)

|

Edenor's audited consolidated financial statements included in pp. F-1 to F-65 of its annual report on Form 20-F for the fiscal year

ended December 31, 2020, are incorporated herein by reference.

|

|

|

(a)(2)

|

Financial Information: Not Applicable.

|

|

|

(b)

|

Pro forma financial

information: Not Applicable.

|

The financial information incorporated herein by reference

may be obtained in the manner described under "Where You Can Find More Information About EDENOR" in "THE TENDER

OFFER—Section 8. Certain Information About EDENOR" of the Offer to Purchase.

Item 14 to Schedule 13E-3. Persons/Assets, Retained, Employed, Compensated

or Used.

|

(b)

|

Employees and Corporate Assets: None.

|

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 12, 2021

|

|

EMPRESA DE ENERGÍA DEL CONO SUR S.A.

|

|

|

|

|

|

/s/ Nicolas Mallo Huergo

|

|

|

Name: Nicolas Mallo Huergo

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

/s/ Nicolas Mallo Huergo

|

|

|

Name:

Nicolas Mallo Huergo

|

|

|

Title: Authorized

Signatory

|

|

|

SOUTH AMERICAN ENERGY LLP

|

|

|

|

|

|

/s/ Nicolas Mallo Huergo

|

|

|

Name: Nicolas Mallo Huergo

|

|

|

Title: Authorized Signatory

|

|

|

|

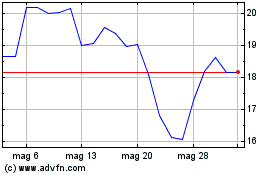

Grafico Azioni Empresa Distribuidora Y ... (NYSE:EDN)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Empresa Distribuidora Y ... (NYSE:EDN)

Storico

Da Mag 2023 a Mag 2024