UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

AMENDMENT NO. 2 (RULE 14D-100)

Tender Offer Statement under Section 14(d)(1)

or 13(e)(1) of the Securities Exchange Act of 1934

EMPRESA

DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(Name of Subject Company (Issuer))

EMPRESA DE ENERGÍA DEL CONO SUR

S.A.

And

SOUTH AMERICAN ENERGY LLP

(Names of Filing Persons (Offerors))

CLASS B

COMMON SHARES, par value 1 Peso per share (ISIN: ARENOR010020), including Class B Shares represented by American Depositary

Shares

(Title of Class of Securities)

29244A102

(CUSIP Number of Class of Securities)

SCHEDULE 13E-3

RULE 13E-3 TRANSACTION STATEMENT UNDER SECTION 13(E) OF THE SECURITIES EXCHANGE ACT OF 1934

EMPRESA DE ENERGÍA

DEL CONO SUR S.A. (EDENOR)

And

SOUTH AMERICAN ENERGY

LLP

(Names of Filing Persons (Offerors))

CLASS B

COMMON SHARES, par value 1 Peso per share (ISIN: ARENOR010020), including

Class B Shares represented by American Depositary Shares

(Title of Class of Securities)

29244A102

(CUSIP Number of Class of Securities)

Nicolas Mallo Huergo

c/o Maipú 1252, 12th floor,

City of Buenos Aires, (CP1006),

Argentina

With a copy to:

Christopher C. Paci, Esq.

J.A. Glaccum, Esq.

Nicolas Teijeiro, Esq.

DLA Piper LLP (US)

1251 Avenue of the Americas

New York, NY 10020

(212) 335-4970

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications on behalf of the Filing Persons)

CALCULATION OF FILING FEE

|

Transaction

Valuation(1)

|

Amount of Filing Fee

|

|

U.S.$114,594,527

|

U.S.$10,622.82

|

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Estimated for purposes of calculating the filing fee pursuant to Rule 0-11(d)

only. The Transaction Valuation was calculated assuming the purchase of all outstanding Class B Shares (including Class B shares underlying

the American Depositary Shares), other than Class B Shares and ADSs owned directly or indirectly by the Filing Person or its affiliates

(including shares held as treasury shares) at a purchase price of 29.34 Argentine pesos (“Ps.”) per Class B Share and converted

into U.S. dollars based on the official selling exchange rate of Ps. 105.25 per U.S.$1.00 as reported by Banco de la Nación Argentina

on November 10, 2021. As of November 10, 2021, there were 411,075,965 issued and outstanding Class B Shares (including Class B Shares

underlying the American Depositary Shares) but excluding shares owned by the Filing Person or its affiliates (including shares held as

treasury shares).

|

Amount Previously Paid: US$10,622.82 Filing

Party: Empresa de Energía del Cono Sur S.A. and South American Energy LLP

Form or Registration No.: Schedule TO-T Date Filed: November

12, 2021

☐ Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions

to which the statement relates:

☒ third

party tender offer subject to Rule 14d-1.

☐ issuer

tender offer subject to 13e-4.

☒ going-private

transaction subject to Rule 13e-3.

☐ amendment

to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting

the results of the tender offer:

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

☐ Rule

13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

☒

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Amendment No. 2 (this “Amendment”)

amends and supplements the Tender Offer Statement on a combined Schedule TO and Schedule 13E-3 under cover of Schedule TO originally filed

on November 12, 2021 (together with any subsequent amendments and supplements thereto, the

“Schedule TO”) by Empresa de Energía del Cono Sur S.A. (“Edelcos”) and South American Energy

LLP (“SAE”, and together with Edelcos the “Bidders”) and relates to the offer by the Bidders to

purchase any and all outstanding Class B shares, par value Ps. 1.00 per share (the “Class B Shares”), including Class

B Shares represented by American Depositary Shares (“ADSs”), of Empresa Distribuidora y Comercializadora Norte S.A.,

a corporation organized under the laws of the Republic of Argentina (“Edenor”).

The offer is being made on the terms and subject to

the conditions set forth in the offer to purchase dated November 12, 2021 (the “U.S. Offer to Purchase”) incorporated

herein by reference and in the related documents, except that such information is hereby amended and supplemented to the extent specifically

provided herein (which, together with any amendments or supplements thereto, collectively constitute the “U.S. Offer”).

The U.S. Offer is being made in conjunction with an offer by Edelcos in Argentina for all outstanding Class B Shares (the “Argentine

Offer,” and together with the U.S. Offer, the “Offers”). The price offered in the Argentine Offer is the

same on a per Class B Share basis as the Offer Price in the U.S. Offer. This Schedule TO is intended solely for (i) holders of Class B

Shares that are U.S. residents (under the meaning of Rule 14d-1(d) under the U.S. Securities Exchange Act of 1934, as amended) and (ii)

holders of Class B Shares represented by ADSs (each representing rights to 20 Class B Shares). This Schedule TO is being filed on behalf

of the Bidders.

Except as otherwise set forth in this

Amendment, the information set forth in the Schedule TO remains unchanged.

Items 1 through 11 of Schedule TO;

Items 1 through 16 of Schedule 13E-3.

The U.S. Offer to Purchase and Items

1 through 11 of the Schedule TO and Items 1 through 16 of Schedule 13E-3, to the extent such items incorporate by reference the information

contained in the U.S. Offer to Purchase, are hereby amended and supplemented as follows.

The information set forth in the U.S.

Offer to Purchase is incorporated herein by reference with respect to Items 1 through 11 of this Schedule TO and Items 1 through 16 of

Schedule 13E-3, except that such information is hereby amended and supplemented to the extent specifically provided herein.

|

|

1.

|

The cover page is hereby amended by adding a new paragraph after the first paragraph on the cover page

as follows:

|

“As of November 11, 2021,

the last trading day prior to the publication of this Statement, (i) the Offer Price of Ps.29.34 per Class B Share is below Ps.66.70,

the closing trading price per Class B Share on the BYMA (as defined herein) and (ii) the aggregate Offer Price of Ps.586.80 for the twenty

(20) Class B Shares underlying each ADS is significantly below Ps.1,334, the aggregate closing trading price for twenty (20) Class B Shares

on the BYMA. Accordingly, holders of Class B Shares (including holders of ADSs who surrender their ADSs and take possession of Class B

Shares) tendering into the U.S. Offer would receive less per Class B Share than the then current market price per Class B Share if the

current market price per Class B Share exceeds the Offer Price on the Expiration Date, as applicable.”

|

|

2.

|

The penultimate paragraph on the inside cover page is hereby amended and restated in its entirety as follows:

|

“On August 9, 2021, the board of

directors of Edenor (the “Board of Directors”) issued a favorable opinion on the reasonableness of the price offered by the

Bidder under the Argentine Offer, consisting of Ps.29.34 per Class B Share (or U.S.$0.28 per Class B Share, using the selling exchange

rate of Ps.105.25 per U.S.$1.00 reported by Banco de la Nación Argentina on November 11, 2021), under the Argentine Offer, based

on the BA Advisors Valuation Report (as defined below). The Company did not consider updating the BA Advisors Valuation Report in light

of the recent increase in the trading price of Class B Shares after the BA Advisors Valuation Report was produced because such an update

is not required under Argentine law. In such Board of Directors’ meeting the executive officers of Edenor holding Class B Shares expressed their

intention not to participate in the Argentine Offer. Under U.S. law, within 10 (ten) business days after the day the U.S. Offer is commenced,

Edenor is required by the Securities Exchange Act of 1934 (the “Exchange Act”) to file with the U.S. Securities and Exchange

Commission (“SEC”) and distribute to holders of Class B Shares that are U.S. residents a Tender Offer Solicitation/Recommendation

Statement on Schedule 14D-9 containing a statement of the position of the Board of Directors of Edenor with respect to the U.S. Offer.”

|

|

3.

|

The section entitled “Forward-Looking Statements” on page 4 of the cover pages is hereby deleted

in its entirety.

|

|

|

4.

|

“Summary Term Sheet—The U.S. Offer” is

hereby amended by adding the following disclosure after the last sentence thereof:

|

“As of November 11, 2021,

the last trading day prior to the publication of this Statement, (i) the Offer Price of Ps.29.34 per Class B Share is below Ps.66.70,

the closing trading price per Class B Share on the BYMA (as defined herein) and (ii) the aggregate Offer Price of Ps.586.80 for the twenty

(20) Class B Shares underlying each ADS is significantly below Ps.1,334, the aggregate closing trading price for twenty (20) Class B Shares

on the BYMA. Accordingly, holders of Class B Shares (including holders of ADSs who surrender their ADSs and take possession of Class B

Shares) tendering into the U.S. Offer would receive less per Class B Share than the then current market price per Class B Share if the

current market price per Class B Share exceeds the Offer Price on the Expiration Date, as applicable.”

|

|

5.

|

“Summary Term Sheet—What does the Board of

Directors of Edenor think of the Offers” is hereby amended to delete the language “and a Transaction Statement on Schedule

13E-3” on page 3 of the section entitled “Summary Term Sheet.”

|

|

|

6.

|

“Special Factors—Recent Changes in the Market

Price of Edenor Class B Shares” is hereby amended by amending and restating such disclosure as follows on page 2 of the section

entitled “Special Factors”:

|

“Following

July 29, 2021, the date of the announcement of the Offers (the “Announcement Date”), the market price per Class B Share on

the BYMA has increased significantly. As of November 11, 2021, the last trading day prior to the Commencement Date, (i) the closing price

per Class B Share on the BYMA was Ps.66.7 which is approximately one hundred and twenty seven percent (127%) more than the Offer Price

and (ii) the closing price of twenty (20) Class B Shares underlying each ADS was Ps.1,334, which is approximately one hundred twenty seven

percent (127%) more than the aggregate offering price of twenty (20) Class B Shares. This increase in the trading price of Edenor’s

Securities was in line with the increase in the trading prices of the equity securities of other Argentine energy public companies during

the relevant period. See “THE TENDER OFFER—Section 7. Certain Information about the Class B Shares and ADSs.”

|

|

7.

|

“Special Factors—Position of Edenor’s

Board of Directors Regarding Fairness of the U.S. Offer” is hereby by amended to delete the language “and a Transaction Statement

on Schedule 13E-3” on page 15 of the section entitled “Special Factors”.

|

|

|

8.

|

“The Tender Offer—Section 3. Procedures for

Participating in the U.S. Offer” is hereby amended by amending and restating the first sentence of the first paragraph under “Defects

in Tendering in the Offer. Falsehood or Inaccuracy of Tendering Holder’s Representations” as follows on page 11 of the section

entitled “The Tender Offer”:

|

“All questions as to the

form of documents and the validity, form, eligibility, including time of receipt, and acceptance for purchase of any tender of Class B

Shares will be determined by us in our sole discretion, which determination shall be final and binding on all parties, subject to the

right of the tendering holder to challenge such determination in a court of competent jurisdiction.”

|

|

9.

|

“The Tender Offer—Section 3. Procedures for

Participating in the U.S. Offer” is hereby amended by amending and restating the first sentence of the second paragraph under “General”

as follows on page

|

12 of the section entitled “The

Tender Offer”:

“All questions as to

the form of documents and the validity, form, eligibility, including time of receipt, and acceptance of any tender of Class B Shares will

be determined by us in our sole discretion, which determination shall be final and binding on all parties, subject to the right of the

tendering holder to challenge such determination in a court of competent jurisdiction.”

|

|

10.

|

“The Tender Offer—Section 4. Withdraw Rights”

is hereby amended by amending and restating the first sentence of the third paragraph under “General” as follows on page 13

of the section entitled “The Tender Offer”:

|

“All questions as to the

form and validity, including time of receipt, of any notice of withdrawal will be determined by us, in our sole discretion, and our determination

will be final and binding, subject to the right of the tendering holder to challenge such determination in a court of competent jurisdiction.”

|

|

11.

|

“The Tender Offer—Section 10. Certain Legal

and Regulatory Matters” is hereby amended by amending and restating the first sentence of the paragraph under ““Going

Private” Transactions” as follows on page 26 of the section entitled “The Tender Offer”:

|

“Because we are an affiliate

of Edenor for the purposes of Rule 13e-3 under the Exchange Act, this U.S. Offer constitutes a “going private” transaction

pursuant to Rule 13e-3.”

|

|

12.

|

“The Tender Offer—Section 11. Fees and Expenses”

is hereby amended by amending and restating the fourth paragraph thereof and following table on page 28 of the section entitled “The

Tender Offer”:

|

“The following is an estimate of the fees

and expenses to be incurred by us:

|

|

|

|

|

Filing Fees

|

|

U.S.$10,622.82

|

|

U.S. Receiving Agent and U.S. Information Agent Fees

|

|

U.S.$32,500

|

|

Valuation Report Fees

|

|

Ps.2,691,875

|

|

Legal Fees

|

|

U.S.$310,000

|

|

Printing, Mailing and Miscellaneous Fees and Expenses

|

|

U.S.$85,000

|

|

|

|

|

|

Total in U.S. dollars

|

|

U.S.$438,122.82

|

|

Total in Argentine pesos

|

|

Ps.2,691,875”

|

Explanatory note: Attached as Exhibit (a)(1)(i) of

this Amendment is a conformed and repaginated copy of the U.S. Offer to Purchase, dated November 12, 2021, giving effect to this Amendment.

References to page numbers above refer to page numbers of the original U.S. Offer to Purchase.

|

|

(a)(1)(ii)

|

U.S. Form of Acceptance Letter.*

|

|

|

(a)(1)(iii)

|

U.S. Form of Withdrawal for Shares.*

|

|

|

(a)(1)(iv)

|

Form of Letter to Broker for American Depositary Shares.*

|

|

|

(a)(1)(v)

|

Form of Letter to Clients for use by Broker

for American Depositary Shares.*

|

|

|

(a)(1)(vi)

|

Notice of Offer to Purchase Shares of Class B Shares Issued by Edelcos, as made public on July 29, 2021. (English translation) (incorporated

herein by reference to Exhibit 1 of Edelcos’s pre-commencement communication filing on Schedule TO on July 29, 2021).*

|

|

|

(a)(1)(vii)

|

Form of summary advertisement, dated November 12, 2021.*

|

|

|

(a)(1)(viii)

|

Text of Press Release issued by the Bidder on November

12, 2021.*

|

|

|

(c)(i)

|

Accounting Certification issued by PKF Audisur S.R.L., an independent accounting firm,

dated July 27, 2021 (English translation).*

|

|

|

(c)(ii)

|

Valuation Report issued by Buenos Aires Advisors, S.C., an independent firm, dated August 9, 2021 (English translation).*

|

|

|

(d)(i)

|

Share Purchase Agreement entered into by and among Empresa de Energía del Cono Sur S.A., as buyer, and Pampa Energía

S.A., as seller, dated December 28, 2020.*

|

* Previously filed.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

EMPRESA DE ENERGÍA DEL CONO SUR S.A.

/s/ Ricardo Nicolás Mallo Huergo

Name: Ricardo Nicolás Mallo Huergo

Title: Authorized Signatory

SOUTH AMERICAN ENERGY LLP

/s/ Ricardo Nicolás Mallo Huergo

Name: Ricardo Nicolás Mallo Huergo

Title: Authorized Signatory

Dated: November 30, 2021

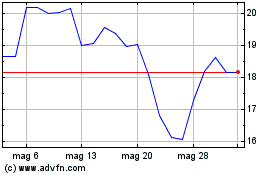

Grafico Azioni Empresa Distribuidora Y ... (NYSE:EDN)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Empresa Distribuidora Y ... (NYSE:EDN)

Storico

Da Mag 2023 a Mag 2024