2nd UPDATE: Actelion: Tracleer Misses Main Goal In IPF Study

01 Marzo 2010 - 11:54AM

Dow Jones News

Swiss biotech Actelion Ltd.'s (ATLN.VX) shares slide Monday on

news it will shelve development of its key drug Tracleer to treat a

deadly lung disease, disappointing investors who had high hopes the

drug could eventually double the company's sales with the new

treatment area. Actelion, based in Allschwil, Switzerland, said

Tracleer, generically known as bosentan, didn't show a relevant

improvement for patients with idiopathic pulmonary fibrosis, or

IPF. However, the company said it has other assets in the pipeline

with which it can still tackle the market believed worth several

billions in sales.

Still, investors sold the company's shares and at 1000 GMT, the

stock was down 8.30 Swiss francs ($7.73), or 15%, at CHF46.45 in a

higher Swiss market.

Data from the trial, dubbed BUILD-3, which involved more than

600 patients, suggests that one of Actelion's other drugs,

macitentan, might have better chances in IPF, the company said.

Macitentan is currently in mid-stage trials and will deliver first

data in the second half of 2011.

"We'll then decide if we'll start late-stage trials with

macitentan in idiopathic pulmonary fibrosis," company spokesman

Roland Haefeli said.

Biotech analyst Carri Duncan at Sal. Oppenheim said while

Actelion now stresses that it still has a drug under development

that it is exploring in the area of idiopathic pulmonary fibrosis,

"this is a very difficult indication and it's hard to say if any of

their other assets will be successfully." She rates the stock at

neutral.

"The news is another big blow for Actelion because the sales

potential of bosentan in IPF would have been high, and last

December, results from another trial with the experimental sleeping

pill almorexant also had a negative read-out, rasing safety

concerns," said Sibylle Bischofberger of Zuercher Kantonalbank.

Analysts and investors will now turn to the second half of 2010,

awaiting information on another late-stage drug, clazosentan, which

seeks to prevent blood vessel spasms that can occur after brain

bleeding, as well as the information on macitentan in IPF, expected

in the second half of 2011.

Company spokesman Haefeli said that Monday's news doesn't change

the company's financial targets for 2010 to grow sales by more than

10% and cash earnings before interest and taxes by almost 20%.

Actelion, Europe's largest biotech company by sales, generates

the bulk of its sales with Tracleer. The drug has become the

standard treatment for patients who suffer from hypertension in the

lungs, but sales momentum has been slowing in recent quarters.

In 2009, Actelion generated sales of CHF1.77 billion, around

CHF1.51 billion of which came from Tracleer.

The possible failure to expand the use of Tracleer is increasing

the risk of Actelion becoming a takeover target, some analysts

say.

Companies previously mentioned as possible bidders include Swiss

drug maker Novartis AG (NVS), Chicago-based Abbot Laboratories

(ABT) and GlaxoSmithKline PLC (GSK), Actelion's development partner

for the experimental sleeping pill almorexant.

Among Actelion's larger shareholders with stakes of more than 5%

are fund managers such as Fidelity Management & Research or BB

Biotech, as well as the company itself while Blackrock Inc. and

Mellon Bank hold between 3% and 5%.

Company Web Site: http://www.actelion.com

-By Julia Mengewein, Dow Jones Newswires; +41 43 443 80 45;

julia.mengewein@dowjones.com

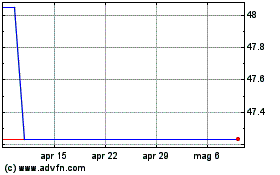

Grafico Azioni BB Biotech (PK) (USOTC:BBAGF)

Storico

Da Apr 2024 a Mag 2024

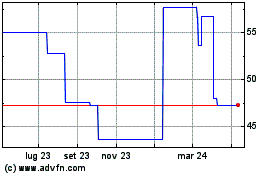

Grafico Azioni BB Biotech (PK) (USOTC:BBAGF)

Storico

Da Mag 2023 a Mag 2024