2nd UPDATE: Biotech Actelion Gets Lift On M&A, Shakeup Hopes

04 Febbraio 2011 - 5:52PM

Dow Jones News

Switzerland's Actelion Ltd (ATLN.VX) drew investor interest

Friday on hopes a shakeup of the company's top brass could pave the

way for a takeover of Europe's largest biotech.

Shares in the group surged more than 4% after investment firm

Elliott Advisors Ltd. sent a letter to Actelion's board, asking for

chairman Robert Cawthorn and chief executive Jean-Paul Clozel to

resign from the board.

The fund, a unit of U.S. hedge fund Elliott Management, also

pushed for the election of an independent chairman, who should

consider the sale of the firm.

"Pressure is building up on Actelion and CEO Clozel to do

something," said Beat Stuber of Zurich-based asset manager Johnson

& Stuber. "A takeover is possible. Maybe it's only a question

about the price." Johnson & Stuber, which manages asset worth

around 600 million Swiss francs, holds Actelion shares.

Actelion has been considered a takeover candidate since last

October after several drug development setbacks raised concerns

about the company's ability to stay independent.

Criticism of CEO Clozel accelerated during that time. According

to shareholders, who declined to be named, Clozel's failed attempt

to push for the development of novel drugs has irked investors.

Actelion's hopes to bring sleeping pill Almorexant to market

were dashed in January on safety concerns. Its experimental drug

clazosentan also failed to meet study goals.

Large shareholders such as Fidelity Management and Swiss

investment company BB Biotech AG (BION.EB) have reacted by reducing

their holdings in Actelion.

Fidelity, which held 2.88% of the company's shares as of April

2010, according to Swiss bourse data, couldn't be immediately

reached for comment.

BB Biotech, which holds about 4.85% of the company's shares,

declined to comment on Elliott's action. "We think the stock is

undervalued and that Actelion is an attractive company," said

Daniel Koller, head of the management team at BB Biotech.

Investors such as Bermuda-based Orbis Investment Ltd, which as

of November 4, 2010, held around 3% of the company's stock, and

Elliott, which holds more than 5% of Actelion, have built up stakes

in recent months.

Orbis declined to comment.

Elliott Advisors has been an active follower of Actelion and

last December reached out to the company in private to discuss the

firm's future. After several failed attempts to get in contact with

the firm, it made its concerns public.

Actelion Friday confirmed the receipt of the letter from Elliott

and said its board was discussing the issues, which Elliott wants

to have discussed at the company's annual general meeting on May

5.

Potential bidders for Actelion include U.K.-based

GlaxoSmithKline Plc (GSK), which has a drug research partnership

with Actelion, U.S.-based Amgen Inc (AMGN), Eli Lilly & Co

(LLY) and Bristol-Myers Squibb Co (BMY).

No official offer has been made and the companies have

repeatedly declined to comment on such market speculation.

Actelion said in November it is in regular dialogue with

industry participants, but CEO Clozel repeatedly said the company

wants to stay independent.

Despite the criticism of Clozel, the French executive is

considered one of Switzerland's most successful managers. The

trained cardiologist helped found the company in 1997 out of a

spin-off from Roche Holding AG (ROG.VX) and succeeded in bringing

blockbuster Tracleer to market. That success made Actelion one of

the rare Swiss biotech company's to perform well on the country's

stock exchange.

According to analyst estimates, a potential bidder may pay up to

70 francs per Actelion share, valuing the biotech at about 9

billion Swiss francs.

Despite the hedge fund pressure, Bank Sarasin said a bid for

Actelion was unlikely as the patent expiry of Tracleer in 2015

could hold off potential bidders.

Shares of Actelion were 4.3% higher at 54.75 francs in late

Friday trade.

Company website: http://www.actelion.com

-By Goran Mijuk , Dow Jones Newswires; +41 43 443 8047;

goran.mijuk@dowjones.com

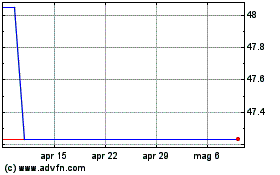

Grafico Azioni BB Biotech (PK) (USOTC:BBAGF)

Storico

Da Apr 2024 a Mag 2024

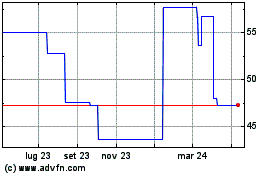

Grafico Azioni BB Biotech (PK) (USOTC:BBAGF)

Storico

Da Mag 2023 a Mag 2024