XRP flips Ether’s FDV amid change in market dynamics

14 Marzo 2025 - 8:16PM

Cointelegraph

XRP’s fully diluted valuation (FDV) has surpassed Ether

(ETH), according to

March 14 data from CoinGecko.

The FDV flip signifies a reversal of fortune for both layer-1

(L1) blockchain networks behind the tokens, as XRP Ledger’s

decentralized finance (DeFi) ecosystem gains traction and Ethereum

grapples with competition from rival L1s, such as Solana.

As of March 14, XRP’s FDV stood at nearly $235 billion, more

than $1 billion higher than Ether’s, according to CoinGecko.

Ether’s market capitalization still leads at $233 billion versus

XRP’s $136 billion, the data shows.

FDV measures the cumulative value of all existing tokens,

whereas market capitalization only counts tokens already in

circulation.

XRP’s developer, Ripple Labs, holds a multibillion-dollar

allocation of its chain’s native token.

Cryptocurrencies by FDV. Source:

CoinGecko

Related:

XRP Ledger unveils institutional DeFi

roadmap

Changing fortunes

XRP’s price has risen by more than 300%, to around $2.3 per

token, since President Donald Trump prevailed in the US elections

on Nov. 5.

Trump said he wants America to become the “world’s crypto

capital” and has appointed industry-friendly leadership to key

regulators.

The thawing US regulatory environment is especially beneficial

for XRP, which prioritizes enterprise users and

unveiled an institutional DeFi roadmap in February.

As of January, XRP’s native decentralized exchange (DEX) has

handled more than $1 billion in swap transactions since

launching in 2024.

The XRP token saw further support when Trump said he planned to

include XRP in a proposed US Digital Asset Stockpile alongside

other cryptocurrencies, such as Solana (SOL) and Cardano (ADA).

The stockpile will only comprise assets

acquired by law enforcement and other legal proceedings and

will not buy crypto.

The US Securities and Exchange Commission is

reportedly “in the process of wrapping up” an enforcement

action against Ripple that has beleaguered the XRP developer since

2020.

The regulator has already dropped actions against crypto firms

such as Coinbase, Kraken and Uniswap.

Meanwhile, Ether’s spot price has struggled since March 2024,

when the network’s Dencun upgrade cut transaction fees by

approximately 95%.

As of March, trading volume on Solana, which prioritizes fast

transaction execution and was central to 2024’s memecoin frenzy,

rivals that of Ethereum and all of its layer-2 scaling chains

combined.

Magazine:

‘Hong Kong’s FTX’ victims win lawsuit, bankers bash

stablecoins: Asia Express

...

Continue reading XRP flips Ether’s FDV amid change

in market dynamics

The post

XRP flips Ether’s FDV amid change in market

dynamics appeared first on

CoinTelegraph.

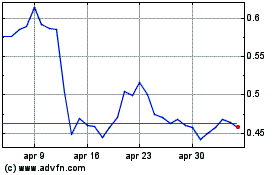

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Apr 2024 a Apr 2025