BONK Struggles To Sustain Gains As Selling Pressure Mounts

13 Dicembre 2024 - 5:30PM

NEWSBTC

BONK finds itself under increasing selling pressure as its recent

rally falters, raising concerns about the token’s ability to

sustain its upward momentum. Struggling to maintain its gains, the

price has started a fresh drop toward the $0.00002962 key support

level, indicating a possible bearish continuation. This

pivotal zone is under scrutiny as a failure to hold could trigger

further downward movement, amplifying pessimistic sentiment. Such a

scenario may lead to heightened volatility, with participants

watching for either signs of a recovery or indications of a deeper

correction. Technical Indicators Point To Potential Decline BONK is

currently trading below the 100-day Simple Moving Average (SMA), a

key technical indicator that gauges market sentiment changes. This

positioning below the SMA typically signals a bearish outlook as it

indicates that the average price over the past 100 days is lower

than the current price. Related Reading: BONK Finds Stability At

$0.00004002, Can Bulls Spark A Comeback? The fact that BONK is

trading below the 100-day SMA raises concerns about the strength of

its recent rally and suggests that selling pressure is currently

outweighing buying interest, with prices poised for further losses.

With the market sentiment turning negative, there is a high risk of

continued declines unless a significant reversal occurs.

Additionally, the Relative Strength Index (RSI) has begun to drop

again after previously reaching the 50% threshold. Specifically,

the decline in the RSI indicator signals a potential weakening of

bullish momentum, suggesting that buying pressure is fading.

Typically, the RSI’s movement toward lower levels implies that

market sentiment may be becoming more cautious with the increase in

the risk of bearish action. As the RSI moves away from the neutral

zone, it could signal growing selling pressure, reinforcing the

potential for a deeper pullback in BONK’s price. Selling Pressure

Intensifies: How Low Can BONK Go? Selling pressure on BONK has been

mounting, leading to a decline in its price as the recent rally

fizzles out. With the token trading below the 100-day Simple Moving

Average (SMA) and the Relative Strength Index (RSI) showing signs

of weakening momentum, the outlook for BONK is increasingly

bearish. Related Reading: Is BONK Rally In Jeopardy? Technical

Indicators Confirm Weakness If the selling pressure persists, the

price could continue to drop, possibly testing key support levels

like $0.00002962. A sustained break below this level could cause

further losses, with the next target being the $0.00002320 support

level. However, if the meme coin experiences a rebound at

$0.00002962, it could initiate a fresh climb toward the $0.00004002

mark. Successfully breaking above this resistance might shift the

momentum, potentially triggering a rally beyond the 100-day SMA and

targeting the $0.00006247 resistance level. Featured image from

LinkedIn, chart from Tradingview.com

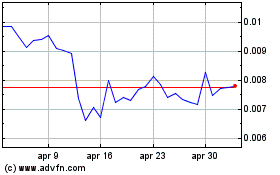

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Mar 2024 a Mar 2025