Ethereum Solo Staking Made Easier? Vitalik Buterin Supports Lower Entry Requirements

04 Ottobre 2024 - 7:00AM

NEWSBTC

Ethereum (ETH) co-founder Vitalik Buterin advocates reducing the

ETH solo staking requirement to lower the entry barrier and promote

greater network decentralization. Buterin Sees 32 ETH Requirement

As A Barrier Responding to Ethereum educator Anthony Sassano on X

regarding solo staking, Buterin expressed concern that the current

32 ETH requirement presents a bigger obstacle than bandwidth

limitations. Related Reading: Vitalik Buterin Proposes A Privacy

Fix for Ethereum For those unfamiliar, solo staking on Ethereum

requires an individual validator to stake at least 32 ETH –

approximately $75,200 at the current market price of $2,352. Solo

staking allows crypto investors to earn passive income while

directly contributing to the security of the Ethereum network.

Buterin views this high entry threshold as a barrier that prevents

smaller ETH holders from participating. He suggested temporarily

increasing bandwidth requirements to reduce the minimum staking

deposit to 16 or 24 ETH. Buterin elaborated: It’s net-good for both

staking accessibility and scale. Then once we figure out peerdas,

bandwidth reqs go back down, and once we figure out orbit SSF, the

deposit minimum can drop to 1 ETH. It’s important to note that ETH

holders can still stake with as little as 1 ETH by using

third-party staking services, centralized platforms, or staking

pools. However, these options don’t offer the same level of control

over one’s ETH as solo staking, where the node operator retains

full custody of their holdings. During the Ethereum Singapore 2024

event in September, Buterin emphasized the significance of solo

stakers in bolstering Ethereum’s security and decentralization to

tackle potential 51% attacks. At the event, Buterin said that even

a small increase in the proportion of solo stakers on the Ethereum

network could work as an “extra layer of defense” for both security

and privacy. Ethereum Layer-2 Solutions Continue To Thrive While

the 32 ETH barrier may discourage small-scale ETH enthusiasts from

solo staking, they can still benefit from the growing popularity of

Ethereum layer-2 solutions, which have made transactions more

affordable. For instance, in June 2024, layer-2 scaling platform

Optimism announced the launch of open-source and permissionless

fault proofs, enabling users to verify off-chain transactions’

validity securely. Similarly, in August 2024, asset manager

Franklin Templeton approved another layer-2 solution when it

launched its OnChain US Government Money Fund (FOBXX) on the

Arbitrum network. Related Reading: Ethereum Layer 2 Networks Just

Set A New Record Similarly, crypto exchange Coinbase’s Ethereum

layer-2 rollup Base has witnessed rapid adoption as its total value

locked (TVL) currently stands at slightly over $2.12 billion,

according to data from DeFiLlama. As layer-2 solutions continue to

succeed, their positive impact may extend to the Ethereum network.

Crypto analysts, such as CryptoBullet, predict that ETH could rally

in Q4 2024. ETH is trading at $2,352 at press time, down 3.5% in

the past 24 hours. Featured image from Unsplash, chart from

Tradingview.com

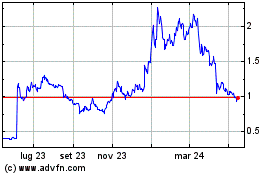

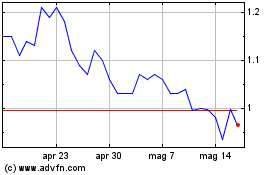

Grafico Azioni Arbitrum (COIN:ARBUSD)

Storico

Da Mar 2025 a Mar 2025

Grafico Azioni Arbitrum (COIN:ARBUSD)

Storico

Da Mar 2024 a Mar 2025