Bitcoin Price Crashes Below $30K As Markets Show Signs Of Paranoia

10 Maggio 2022 - 6:50AM

NEWSBTC

Bitcoin has lost almost 10% of its value during the past 24 hours,

falling below $30,000 for the first time since July 2021. And one

analyst worries that the largest cryptocurrency might fall even

worse. BTC’s Tuesday decline is more than 55 percent lower than its

November 2017 all-time high of $69,000. Year-to-date, Bitcoin

prices have decreased by 34%. Year-to-date, Bitcoin prices have

decreased by 34%. The world’s most sought-after crypto asset

plunged to $29,870.30 around 8 p.m. EST, TradingView data shows.

Suggested Reading | Shiba Inu: Biggest Dollar Holding Among

Wealthiest Ethereum Whales Bitcoin Drop Correlated To Stocks

Traditional financial markets and cryptocurrencies both saw a

sell-off as a result of the Federal Reserve’s aggressive monetary

tightening and recession fears. The last time the largest

cryptocurrency by market value dipped below the $30,000 level was

on July 20, 2021, when it reached $29,301 before rebounding. As

institutions have joined the Bitcoin and cryptocurrency markets

over the past year, their correlation with stock prices has grown.

Consequently, Wall Street is having a difficult day as tech stocks

continue to experience significant selloffs. The Nasdaq index

decreased by 4.3%. BTC total market cap at $594 billion on the

daily chart | Source: TradingView.com Analyst Sees BTC Dropping

Lower Bitcoin could “perhaps receive a mini-bounce near $35,000,

but unless we break the trend line at around $37,000, I’m

predicting for $29,000 in the coming weeks or week,” says crypto

analyst Wendy O in a new social media video. Numerous

cryptocurrency investors have suggested that Bitcoin is the digital

era’s version of gold, a potential flight-to-safety investment and

inflation hedge. The price behavior of cryptocurrencies, however,

implies that the market does not view these extremely volatile

assets as reliable value repositories during times of economic

instability. Suggested Reading | Bitcoin Carnage Continues As BTC

Disintegrates To $34K Crypto Market Feeling The Pinch For Weeks

Similarly to the stock market, the cryptocurrency market has been

under pressure for weeks as investors cope with sustained growing

inflation, the ongoing swirl of economic events deriving

increasingly from Russia’s invasion of Ukraine, and stricter U.S.

monetary policy by the Fed. “Bitcoin’s long-term fundamentals are

intact, but a recovery to record highs will take a very long time.

Bitcoin will begin to stabilize when the carnage on Wall Street

finishes, and many investors are still in panic-selling mode right

now,” Edward Moya, senior market analyst at Oanda, stated. The

central bank increased interest rates by 50 basis points last

week and pledged to shrink its holdings; instead of purchasing

bonds to stimulate the economy, it will dispose of them to

combat inflation. The values of cryptocurrencies are quite

volatile. Experts say this is something crypto investors will

continue to face. Featured image Pexels, chart from TradingView.com

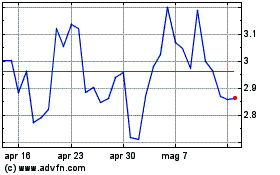

Grafico Azioni BOND (COIN:BONDDUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni BOND (COIN:BONDDUSD)

Storico

Da Mar 2024 a Mar 2025

Notizie in Tempo Reale relative a BOND (Criptovaluta): 0 articoli recenti

Più BOND Articoli Notizie