Is The Bitcoin Open Interest Too High Or Can The BTC Price Still Rally?

16 Aprile 2025 - 2:00PM

NEWSBTC

The Bitcoin open interest has remained on the high side despite the

price declines, suggesting that interest in the leading

cryptocurrency by market cap remains abundant. This interest is no

doubt a good thing for the crypto market, especially in the

long-term. But looking back at previous trends involving the

Bitcoin open interest, it is concerning that the value is still so

high and this could hinder a recovery for the Bitcoin price from

here. Bitcoin Open Interest Still Above $56 Billion Data from the

Coinglass website shows that the Bitcoin open interest is still

quite high and not far off from its November 2024 highs after the

BTC price hit a new peak above $109,000. This consistently high

open interest signifies traders still taking considerable positions

in the digital asset despite its price falling over 20% since then,

something that could be a hindrance to recovery. Related Reading:

Analyst Who Called Dogecoin Price Rally In 2024 Predicts 300% Rally

In April The total Bitcoin open interest is currently sitting at

$56.17 billion, falling approximately 22% from its all-time high of

$71.85 billion. This shows a close correlation between how much the

price has fallen compared to the open interest. However, the open

interest remaining this high could have some negative implications

for the BTC price and the crypto market by extension. For example,

looking at the chart above, it is obvious that Bitcoin has seen its

largest moves upward when the open interest has been low. This

suggests that the lack of market pressure gives bulls the space to

push the price upward. Hence, with the open interest still so high,

it could be much harder to push the price higher. Given this, the

BTC price could see further decline before there is more recovery

from here. BTC Price Crash Below $70,000 Imminent? Besides the

Bitcoin open interest remaining high, a crypto analyst has also

given reasons why the BTC price could see a crash from here. The

first factor given is the fake bullish divergence. According to the

analysis, the RSI may be showing a bullish divergence but the price

action isn’t following it. Hence, this could lead to a bull trap,

pulling traders into losses as the price crashes. Related Reading:

Is The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out

How It Could Get To $71 Another factor given is the fact that the

Bitcoin price has broken a trendline support after falling to the

low $80,000s. This suggests that bullish momentum is weakening and

the recent recovery might not hold. Given the factors listed above,

the crypto analyst expects the Bitcoin price to fall another 20%

from here. The target is placed at $69,149, which is an all-time

high from 2021. “This level coincides with the intersection of the

mid-channel support line and horizontal price structure,” the

analyst explains. Featured image from Dall.E, chart from

TradingView.com

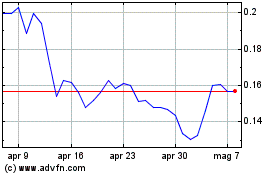

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Apr 2024 a Apr 2025