Bitcoin Mining Firm CEO Predicts Start Of ‘Supercycle’, What It Means

05 Marzo 2024 - 6:00PM

NEWSBTC

In a series of statements made on X (formerly Twitter), Marc van

der Chijs, the CEO of the publicly traded Bitcoin mining firm Hut

8, shared an optimistic outlook on the future of Bitcoin,

suggesting that the cryptocurrency may be on the brink of a

‘supercycle.’ “I think I have never been more bullish about Bitcoin

than I am right now,” he remarked, pointing to the cryptocurrency’s

recent performance and the absence of widespread hype as a prelude

to what he terms a ‘supercycle.’ Understanding the concept of a

‘supercycle’ is crucial to grasping van der Chijs’ perspective.

Unlike regular market cycles that see periodic rises and falls, a

supercycle in the Bitcoin domain refers to an extended period of

bullish growth over several years. This phase is characterized by a

substantial increase in adoption, demand, and price, often leading

to far-reaching economic implications. In essence, a supercycle

marks a paradigm shift where the asset’s value escalates

dramatically, supported by a continuous inflow of investment and a

growing consensus about its long-term viability. To come to this

conclusion, Van der Chijs’ prediction hinges on several

observations and trends within the Bitcoin sector. Why A Bitcoin

Supercycle Could Be Possible First, he notes a significant shift

towards Bitcoin ETFs by funds, including yesterday’s landmark

announcement from Blackrock’s Strategic Income Opportunities Fund.

This movement signifies a robust institutional interest that could

feed a constant stream of investment into Bitcoin, setting the

stage for a supercycle. “This will be a constant flow of new money

into the ETFs. […] The flows into the ETF are getting bigger, not

smaller,” van der Chijs remarked. With financial advisors poised to

recommend Bitcoin ETFs to clients following a regulatory settling

period, van der Chijs sees a torrent of new capital on the horizon.

This anticipation is not unfounded, considering the groundbreaking

success of the Bitcoin ETF launch, which he cites as “the most

successful ETF launch ever.” Related Reading: $1.3+ Trillion:

Bitcoin Market Cap Sets New Record All-Time High Corporate

strategies around Bitcoin also play a pivotal role in van der

Chijs’ supercycle theory. He points to Microstrategy’s aggressive

leverage-based Bitcoin purchases as a harbinger of a trend where

companies increasingly view Bitcoin not just as an investment, but

as a fundamental aspect of their financial strategy. This shift,

according to van der Chijs, could prompt other CEOs to follow suit,

further accelerating Bitcoin’s ascendancy. Moreover, a critical

mass of financial advisors is on the brink of recommending Bitcoin

ETFs to clients, pending the expiration of regulatory and due

diligence waiting periods. This opens the gates for substantial new

investments from a segment traditionally cautious about direct

cryptocurrency investments. “They can’t sell the ETF during the

first 90 working days (internal regulations mostly because of DD),

although they are fast tracking it for this ETF,” van der Chijs

stated. FOMO And A Self-Fulfilling Prophecy The speculation around

unidentified large-scale Bitcoin acquisitions adds another layer to

the supercycle narrative. Van der Chijs alludes to the intrigue

surrounding a wallet that has been steadily accumulating Bitcoin,

hinting at the involvement of a billionaire possibly akin to Jeff

Bezos. “Since November 2023 a wallet has been adding on average

about 100 BTC per day, the wallet now contains over 50,000 BTC,” he

states, pointing to the potential for influential figures to

catalyze broader market movements. Another argument is potential

purchases by nation-states. Although nation-state involvement in

Bitcoin has been minimal, with El Salvador being a notable example,

any increase in such activities could trigger a domino effect. The

participation of nation-states in the Bitcoin market could

significantly elevate Bitcoin’s status as a sovereign asset class.

Related Reading: Bitcoin Proves European Central Bank Wrong: Hits

All-Time High Against Euro Next, the retail sector remains largely

on the sidelines in the current cycle, but van der Chijs

anticipates a surge in retail interest following new all-time highs

and increased media coverage. This could initiate a FOMO cycle,

drawing more investment from traditional asset classes into

Bitcoin. Last, van der Chijs mentions the concept of a

self-fulfilling prophecy: As Bitcoin continues to rise without

significant dips due to constant new money inflow, more people and

institutions will entertain the concept of a supercycle. This, in

turn, could lead to increased capital allocation to Bitcoin, making

the supercycle more likely. Macroeconomic Implications Of A

Supercycle Van der Chijs’ theory also touches on the potential

macroeconomic implications of a Bitcoin supercycle, predicting a

significant shift in wealth and power structures. The

redistribution of wealth could see Bitcoin at the center of a new

economic order, with traditional asset classes potentially losing

ground. In conclusion, Marc van der Chijs outlines a compelling

case for a forthcoming Bitcoin supercycle, supported by a

confluence of institutional, corporate, speculative, and retail

trends. He acknowledged the speculative nature of his prediction,

“Right now I think there is a chance of maybe 10% that this will

happen and that chance is (very slowly) going up.” However, the

implications could be massive. “[I]t will change the existing world

order. It will suck money out of the stock and bond markets, out of

gold and other commodities, and even out of real estate (global

housing prices could collapse). This will lead to BTC prices that

we can’t even imagine today, potentially millions of dollars per

BTC.” At press time, BTC traded at $67,806. Featured image created

with DALL·E, chart from TradingView.com

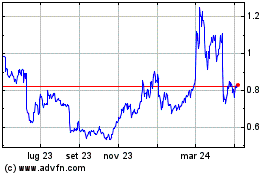

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Mar 2025 a Apr 2025

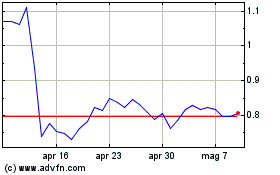

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Apr 2024 a Apr 2025