Will Bitcoin Break $74,000 Driven By TradFi FOMO?

27 Marzo 2024 - 5:00PM

NEWSBTC

Willy Woo, an on-chain analyst, believes the Bitcoin

upswing is far from over. Citing the development in the Bitcoin

Macro Oscillator and the possibility of traditional finance jumping

on the bandwagon (FOMO), the odds of BTC rallying in at least two

strong legs up in the coming session could not be discounted.

On-Chain Data Signals More Upside For Bitcoin In a post on X, Woo

remains confident about what lies ahead for the world’s most

valuable cryptocurrency. Based on on-chain development, there are

indicators that the coin may firmly push higher, breaking above the

current lull. Related Reading: AI Tokens Fetch.AI, AGIX, OCEAN Talk

Merger, Surge Double Digits Bitcoin remains mostly range-bound when

writing, trading within a tight zone capped by $73,800 on the upper

end and $69,000 as immediate support. Even with analysts being

confident of what lies ahead, the coin has failed to overcome

strong selling momentum from sellers to breach all-time highs in a

buy-trend continuation. From how the coin is set up, the current

sideways movement may be accumulation or distribution, depending on

the breakout direction. For instance, any upswing above $72,400

might spur demand, lifting the coin towards $73,800. Conversely,

losses below $69,000 and the middle BB might see BTC slump to March

5 lows or even lower. Will TradFi FOMO And Short Squeeze Lift BTC?

Even with the slowdown in upside momentum, Woo says there is strong

potential for “another solid leg up.” The analyst also added that

there could be two surges if TradFi investors “FOMO” into Bitcoin.

In the 2017 bull run, the rally to $20,000 was primarily due to

retailers jumping in and FOMOing on the coin. With spot

Bitcoin exchange-traded funds (ETFs) available in the United

States, speculation is that more institutions and high-net-worth

individuals are buying the coin. If BTC rips higher, breaking

$74,000, more inflow will likely be into the multiple spot Bitcoin

ETFs, fueling demand. Related Reading: Litecoin ETF Rumors Fuel 10%

Surge As Institutions Hint At Interest This bullish outlook comes

when other analysts expect Bitcoin to surge in the sessions ahead.

In a post on X, one analyst says the incoming short

squeeze will likely propel the coin above March highs. Whenever a

short squeeze happens, prices rise, forcing sellers to buy back at

higher prices, accelerating the uptrend. The assessment is behind a

record-breaking gap between institutional investors betting on

price increases and hedge funds selling the coin. Feature

image from DALLE, chart from TradingView

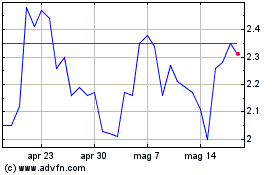

Grafico Azioni Fetch (COIN:FETUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Fetch (COIN:FETUSD)

Storico

Da Apr 2024 a Apr 2025