FET Breaches Key SMA Level, Will Bears Push Prices Lower?

20 Novembre 2024 - 10:00PM

NEWSBTC

The price of Fetch.ai (FET) has slipped below its critical 100-day

Simple Moving Average (SMA), raising concerns about the potential

for further downside toward the next support level at $1. This

breach marks a pivotal moment for the asset, opening the door for

negative pressure to take hold. As FET navigates this crucial

phase, market participants are closely monitoring its ability to

recover above the SMA or risk deeper declines. FET’s recent slip

below the 100-day SMA, a significant technical indicator, and its

implications for future price movements will be analyzed in this

article. It will also explore whether this breach signals a

continuation of bearish momentum or a possible recovery, providing

insights into key levels and scenarios to watch in the coming days.

Analyzing Bearish Momentum: Is A Deeper Decline Likely For FET? FET

has fallen below the 100-day SMA on the 4-hour chart, signaling

downbeat strength as the price approaches the $1 support zone. This

breakdown indicates reduced buyer interest, giving bears control of

the market. Holding at $1 could trigger a reversal, while a breach

below may lead to more declines toward lower support levels. Also,

the 4-hour Relative Strength Index (RSI) has fallen below the

critical 50% level, currently at 44%, indicating a shift toward

bearish sentiment and growing selling pressure as FET struggles to

regain upward momentum. With the RSI under 50%, sellers are taking

control, and if the RSI fails to recover above this threshold, the

pessimistic trend may continue. Traders should watch for any signs

of a reversal or if the price remains under pressure, potentially

leading to further drops. Related Reading: FET At Risk Of Further

Decline? RSI Signals Sustained Bearish Pressure On the daily chart,

FET is showing strong negative strength, highlighted by a bearish

candlestick pattern that has pushed the price below the 100-day

SMA. This pattern implies that sellers are firmly in control of the

market, relentlessly driving the price lower and prompting a strong

likelihood of additional drops in the near term. Finally, the 1-day

RSI analysis suggests that FET may face extended losses, as it

remains below the 50% threshold, reflecting a continued bearish

trend. With selling pressure likely dominating, the chances of

further declines are high. A recovery above the 50% level could

signal a potential reversal, but FET continues to struggle to

regain an upward momentum for now. Navigating Risks And

Opportunities In FET’s Price Action Navigating the risks and

opportunities in FET’s price action requires a careful assessment

of key technical indicators and market sentiment. As FET trades

below its 100-day SMA and the 4-hour RSI drops below the 50%

threshold, bearish momentum is gaining traction, which could signal

more downside toward the $1 support range. Related Reading: FET

Price Under Pressure: RSI Flags Extended Bearish Move Toward $0.966

However, opportunities for a reversal may arise if the asset

manages to hold above key support levels or if buying pressure

resurges, driving the RSI back above 50% and reclaiming the 100-day

SMA. Meanwhile, this could pave the way for a potential move toward

the $1.8 resistance level. Featured image from Medium, chart from

Tradingview.com

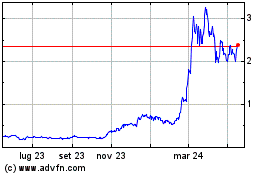

Grafico Azioni Fetch (COIN:FETUSD)

Storico

Da Feb 2025 a Mar 2025

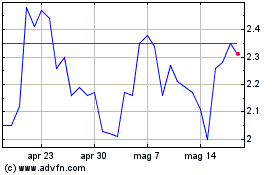

Grafico Azioni Fetch (COIN:FETUSD)

Storico

Da Mar 2024 a Mar 2025