The Fed Blinked — The Bitcoin Bull Run Return Is Now Inevitable

20 Marzo 2025 - 2:00PM

NEWSBTC

On Wednesday, the US Federal Reserve decided to leave its benchmark

interest rate unchanged in the 4.25%–4.5% range – and Bitcoin

reacted instantly. The pause, while widely anticipated, came with a

slightly revised outlook that includes a slower timeline for future

rate cuts and a notable adjustment to the central bank’s balance

sheet reduction pace. According to the Federal Open Market

Committee (FOMC) statement, the Fed’s “Dot Plot” now indicates only

two 25 basis-point rate cuts for this year—fewer than many market

participants expected in December. Policymakers stressed that while

interest rates remain in restrictive territory, the timing of

actual cuts hinges on the path of economic indicators, particularly

inflation and employment. However, the latest statement no longer

asserts that inflation and employment are “in balance,” reflecting

the Committee’s growing concern about economic uncertainty. But

perhaps the most significant pivot was the Fed’s announcement that

it will slow the reduction of its bond holdings, commonly known as

“quantitative tightening” (QT). Related Reading: Bitcoin Whales Are

Back—Could This Be the Catalyst for the Next Rally? Beginning in

April, the monthly runoff for government bonds will drop from $25

billion to $5 billion—a substantial downshift that many analysts

consider a prelude to a more accommodative stance if economic or

market conditions deteriorate. What This Means For Bitcoin Shortly

after the Fed’s announcement, Bitcoin rallied roughly 4–5%, briefly

surpassing the USD 86,000 level. Nik Bhatia—founder of The Bitcoin

Layer and author of Bitcoin Age—took to his latest video update to

dissect the decision’s implications. “Bitcoin up 4% on the news

that the Fed slows QT and is still committed to cutting interest

rates,” Bhatia said at the start of his analysis, noting that the

market had been laser-focused on whether the central bank would

modify its quantitative tightening approach. Bhatia explained how

the reduction of the monthly runoff cap from $25 billion to $5

billion can loosen liquidity constraints in the overall system:

“Now the Fed is also still contracting its balance sheet, but now

it will do so by only five billion a month as opposed to 25 billion

a month, and that is a material change,” he said. Related Reading:

Bitcoin Bull Run Isn’t Over: Cathie Wood Predicts $1.5 Million

“This isn’t some, ‘Hey, we’re on the cusp of QE now just ‘cause we

went from 25 to a five,’ but the first step is to get the balance

sheet to stop shrinking … so that if the Fed needs to pivot, it can

go quickly from 5 billion in QT a month to some modest expansion.”

Bhatia underscored that such a move can fuel market risk appetite:

“The market sees the Fed for what it is: it supports credit

creation which expands balance sheets across the world, and that

flow ends up in asset prices … some of those assets can be stocks,

Bitcoin—[and] other financial assets.” Other experts are even more

drastic in their assessment. BitMEX co-founder Arthur Hayes stated

via X: “JAYPOW delivered, QT basically over Apr 1. The next thing

we need to get bulled up for realz is either SLR exemption and or a

restart of QE. Was BTC $77k the bottom, prob. But stonks prob have

more pain left to fully convert Jay to team Trump so stay nimble

and cashed up.” Jamie Coutts, Chief Crypto Analyst at Realvision,

pretty much agrees: “After last night, QT is effectively dead (for

some time). Treasury volatility has backed right off and is now

mirroring the decline in DXY from earlier this month. This is all

extremely liquidity-positive.” At press time, Bitcoin traded at

$85,881. Featured image created with DALL.E, chart from

TradingView.com

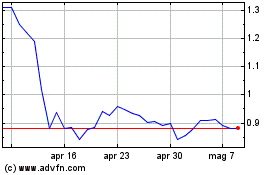

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Apr 2024 a Apr 2025