Is XRP price going to crash again?

19 Marzo 2025 - 9:12AM

Cointelegraph

XRP (XRP) price has recovered from

its low of $1.89 reached on March 11, but it’s still trading below

a key resistance zone. Will XRP’s price sustain the recovery or

drop further in the coming days?

XRP/USD daily chart. Source:

Cointelegraph/TradingView

XRP funding rates show bearish

sentiment

One of the clearest signs that there is more trouble ahead for

XRP is the presence of negative funding rates and decreasing

open interest

(OI) in its futures markets.

Related:

XRP’s role in US Digital Asset Stockpile raises

questions on token utility — Does it belong?

Key points:

-

Funding rates are periodic payments made between long and short

traders in perpetual futures contracts to keep prices aligned with

the spot market.

-

When this metric turns negative, it means short sellers are

paying longs, indicating that bearish sentiment dominates.

-

XRP funding rates are hovering below 0%, indicating bearish

sentiment dominates the market.

XRP perpetual futures funding rates across all exchanges.

Source: Glassnode

-

Negative funding rates discourage new buyers from entering the

market, as holding long positions becomes less profitable.

-

If this trend persists, XRP could face a sharp decline as market

confidence erodes further.

-

Similarly, XRP’s OI in the futures market has dropped from its

local peak of $5.67 billion on Jan. 17 to $2.4 billion as of March

18.

XRP futures open interest. Source: Glassnode

-

Historically, assets with declining open interest struggle to

maintain upward momentum, as capital leaves the market.

-

For XRP, this could mean that even minor selling pressure might

trigger a cascade of liquidations, especially if leveraged

positions are forced to close.

-

Without renewed interest from institutional or retail traders,

XRP’s price more downside.

XRP’s market structure hints at a retest of

$1.90

XRP’s price action on the four-hour candle chart has painted an

inverted V-shaped pattern, as shown in the chart below.

Key takeaways:

-

An inverted V-shaped chart pattern occurs when the price of an

asset rises rapidly to a peak in a steep, near-vertical ascent and

then falls just as abruptly, forming a shape that resembles an

upside-down "V."

-

This indicates that the buying pressure has become

exhausted.

-

The supplier congestion zone between $2.35 and $2.42 is acting

as an area of stiff overhead resistance. This is also where the

100-period simple moving average (SMA) and 200 SMA currently

sit.

-

The relative strength

index (RSI) has dropped below the 50 mark, asserting the

sellers’ dominance in the market.

-

The bears will now attempt to break the support zone between

$2.28, i.e. the 50 SMA, and $2.20.

-

Losing this level would see XRP price drop toward the neckline

of the prevailing chart pattern at $2.01.

-

A close below this level would confirm the continuation of the

downtrend, with the next logical move being the zone between the

Feb. 28 low of $1.94 and the range low at $1.89, reached on March

11.

XRP/USD four-hour chart. Source:

Cointelegraph/TradingView

-

The bulls must hold above the 50 SMA to stop the downtrend from

continuing.

-

This will increase the chances for XRP to break above

the $2.35 and $2.42 supply zone and later to the pattern’s

high at $2.47, invalidating the bearish outlook.

Popular crypto analyst Dark Defender remains optimistic about

XRP’s ability to recover from the downtrend and enter price

discovery.

“The primary correction on the weekly, daily frame and 4-hour

structure is over for XRP,” the analyst said in a

March 17 post on X.

Although there will be more “minor ups and downs” along the way,

he added, the altcoin has “started Wave 1 with an aim of

$5.85.”

Key levels to watch for Dark Defender are support at $2.22 as

support and resistance at $3.39.

“The upcoming weeks will be fantastic.”

XRP/USD daily chart. Source: Dark Defender

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Is XRP price going to crash

again?

The post

Is XRP price going to crash again? appeared

first on

CoinTelegraph.

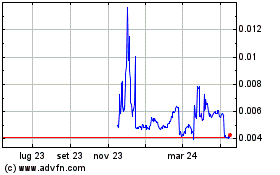

Grafico Azioni Four (COIN:FOURRUSD)

Storico

Da Mar 2025 a Apr 2025

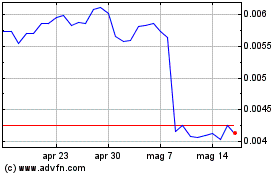

Grafico Azioni Four (COIN:FOURRUSD)

Storico

Da Apr 2024 a Apr 2025