Ethereum’s Futures Market Points To Potential Breakout—Here’s What You Need To Know

26 Settembre 2024 - 4:30AM

NEWSBTC

Ethereum, the second-largest cryptocurrency by market

capitalization, is signaling a potential price recovery based on

recent data from its perpetual futures market. According to a

CryptoQuant analyst named Shayan, Ethereum’s futures market has

noticed a notable shift that could indicate an upcoming price

surge. The key to this analysis lies in the 30-day moving average

of Ethereum’s funding rates, which has started to show a slight

bullish trend after a period of decline. Related Reading: Ethereum

Price Poised for a Comeback: Can It Break $2,700? Futures Market

Suggests Ethereum’s Price Breakout Is Near The funding rate in

perpetual futures contracts is a crucial indicator that helps

identify whether market participants are predominantly buying or

selling Ethereum. A positive funding rate signals more aggressive

buying activity, whereas a negative rate suggests that sellers are

in control. Shayan notes that Ethereum’s funding rates have

recently experienced an uptick, reflecting an increase in buyer

activity, which has coincided with a broader market rebound. This

development suggests that the market sentiment toward Ethereum may

shift toward a more bullish outlook, potentially setting the stage

for further price increases. Shayan noted: Recently, the 30-day

moving average of ETH funding rates has shown a slight bullish

shift after a prolonged period of decline. This shift has coincided

with a broader market rebound and an uptick in Ethereum’s price,

suggesting a possible change in market sentiment. Shayan highlights

this change as an early indication of a potential price recovery

for Ethereum. According to the analyst, for Ethereum to maintain

its upward momentum, the funding rates will need to stay in

positive territory, reflecting sustained demand in the futures

market. However, should funding rates reverse and turn negative

again, this could signal a pause or even a reversal in Ethereum’s

price growth. Ethereum Market Performance So far, Ethereum has

struggled to make any further significant move since it recently

reclaimed the $2,600 mark. Although the asset has fallen below this

price mark today, ETH has increased by more than 10% in the past

week. With its current market performance now trading for $2,589,

at the time of writing, it is evident that Ethereum is yet to

reflect the bullish momentum suggested by its perpetual market.

Related Reading: Ethereum Gains On Bitcoin Following Fed Rate Cut:

Altseason Soon? Regardless, given that ETH has broken above the

$2,100, analysts such as Crypto Patel have suggested further upward

move for the asset. According to Patel, a break above this level

makes the next target $5,500 to $6,000. $ETH Chart Update Next

Target: $5500-$6000 Best Accumulation Zone: $2500-$2100 Long Term

Target: $8000-$10,000#Ethereum bounced strongly from the $2100

level (channel support), and with the next resistance at

$5500-$6000, I’m expecting the next stop for #ETH to be $6000

pic.twitter.com/eLOa5pIrIN — Crypto Patel (@CryptoPatel) September

21, 2024 Featured image created with DALL-E, Chart from TradingView

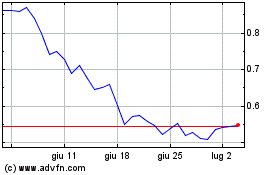

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Apr 2024 a Apr 2025