Ethereum Rally Incoming? Analyst Predicts Breakout Beyond $2,100

27 Marzo 2025 - 12:30AM

NEWSBTC

Ethereum, the second-biggest cryptocurrency, is getting a lot of

attention right now. Some experts who watch the market closely

think its price could go above $2,100 soon. They’ve been looking at

how Ethereum’s price has been moving and see patterns that suggest

it might be heading up. Related Reading: Shiba Inu ETF

Proposal—Could This Be SHIB’s Breakout Moment? Short-Term Signs

Point Upward One analyst, Crypto Patel, shared his thoughts on the

social media platform X. He pointed out a setup on the Ethereum

chart that looks promising for a price increase. Patel said

Ethereum made a strong move upwards, which changed the way the

market is structured. This happened after the price reacted to a

level he had already identified as a good place for buyers to step

in. #Ethereum Prints Bullish Displacement – Swing High Liquidity in

Sight$ETH Price respecting bullish POI with clear displacement on

tap. Currently testing mitigation block post-retest. Anticipating

bounce to sweep swing high liquidity at $2128.12. ➡️ Entry:

$2064.60 ➡️TP:… pic.twitter.com/5Q2q5xrNpM — Crypto Patel

(@CryptoPatel) March 25, 2025 Right now, Ethereum’s price is

bouncing off a key area around $2,064. This area is called a

mitigation block, and it often shows strong buying interest from

big investors. The idea is that these investors use this zone to

adjust their previous orders before continuing to push the price in

a certain direction. Patel suggests that buying in this upper part

of the mitigation zone lines up with how these big players often

operate. The target price Patel mentioned is $2,128. This level is

what’s known as a swing high liquidity zone. These zones often have

a lot of stop-loss orders and pending buy orders clustered

together. If the price moves into this area, it could trigger those

orders and cause a sharp move, allowing investors to profit before

the price possibly changes direction. Patel set a stop-loss for

this trade at $2,027, just below the mitigation block. This helps

limit potential losses if his prediction is wrong. Long-Term

Pattern Looks Familiar Another analyst, TimeFreedomROB, also posted

on X. He compared Ethereum’s current weekly price pattern to what

happened between 2018 and 2020. His chart shows Ethereum breaking

below an ascending triangle pattern, which is similar to how it

broke below a descending triangle before its big recovery in 2020.

Back then, Ethereum’s price hit a low point and then soared from

under $100 to almost $4,800. #ETH 1W Price is showing the Same type

of Break below support as last Cycle 👀 Will Price Recover Rapidly

Like Last Time? 📈 pic.twitter.com/uoIDTd5w8L — TimeFreedom ®️0️⃣🅱️

⚡ (@TimeFreedomROB) March 25, 2025 Currently, Ethereum is trading

near $2,060. It recently dropped below the $2,300 mark and tested a

lower trendline around $1800. This area also lines up with price

levels where there was a lot of demand in previous years. Related

Reading: Tron And Bitcoin: Will A Block Reward Cut Boost TRX Price?

The analyst’s chart suggests this could be the final dip before a

significant price increase, similar to what happened in past

cycles. The area between $1,800 and $2,000 has acted as a strong

support level in the past. For Ethereum’s price to confirm a return

to an upward trend on the weekly chart, it needs to climb back

above the $2,200 to $2,400 range. As of now, Ethereum is trading at

$2,064. Over the last week, it has gained 6%. Its total market

value is $250 billion, and the amount of Ethereum traded in the

last 24 hours is $11.71 billion. These analysts are presenting

scenarios based on how Ethereum’s price has behaved in the past,

but it’s important to remember that the cryptocurrency market can

be unpredictable. Featured image from Gemini Imagen, chart from

TradingView

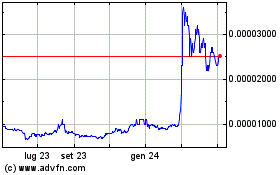

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Mar 2025 a Apr 2025

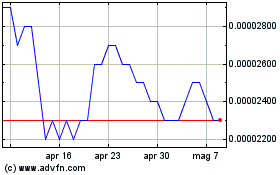

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Apr 2024 a Apr 2025