CertiK exec explains how to keep crypto safe after $1.4B Bybit hack

19 Marzo 2025 - 3:30PM

Cointelegraph

The February hack against Bybit sent ripples through the

industry after $1.4 billion in Ether-related tokens was stolen from

the centralized exchange, reportedly by the North Korean hacking

collective Lazarus Group, in what was the most costly crypto theft

ever.

The fallout from the hack has left many people wondering what

went wrong, whether their own funds are safe, and what should be

done to prevent such an event from happening again.

According to blockchain security company CertiK, the massive

heist represented

roughly 92% of all losses for February, which saw a nearly

1,500% increase in total lost crypto from January as a result of

the incident.

On Episode 57 of Contelegraph’s The Agenda podcast,

hosts Jonathan DeYoung and Ray Salmond speak with CertiK’s chief

business officer, Jason Jiang, to break down how the Bybit hack

happened, the fallout from the exploit, what users and exchanges

can do to keep their crypto secure, and more.

Are crypto wallets still safe after Bybit hack?

Put simply, Lazarus Group was able to pull off the massive hack

against Bybit because it managed to compromise the devices of all

three signers who controlled the multisignature SafeWallet Bybit

was using, according to Jiang. The group then tricked them into

signing a malicious transaction that they believed was legit.

Does this mean that SafeWallet can no longer be trusted? Well,

it’s not so simple, said Jiang. “It is possible that when the Safe

developer’s computer got hacked, more information was leaked from

that computer. But I think for the individuals, the likelihood of

this happening is rather low.”

He said there are several things the average user can do to

drastically increase their crypto security, including storing

assets on cold wallets and being aware of potential phishing

attacks on social media.

Source: CertiK

When asked whether hodlers could see their Ledger or Trezor

hardware wallets exploited in a similar manner, Jiang again said

that it’s not a big risk for the average user — as long as they do

their due diligence and transact carefully.

“One of the reasons that this happened was that the signers were

like a blind-send-signing the order, just simply because their

device did not show the full address,” he said, adding, “Make sure

that the address you are sending to is what you’re intending to,

and you want to double check and triple check, especially for

larger transactions.”

“I think after this incident, this is probably going to

be one of the things the industry will try to correct itself, to

make the signing more transparent and easier to recognize. There

are so many other lessons being learned, but this is certainly one

of them.”

How to prevent the next multibillion-dollar exchange hack

Jiang pointed to a lack of comprehensive regulations and

safeguards as a potential element contributing to the ongoing

fallout from the hack, which fueled debates over the limits of

decentralization after

several validators from crosschain bridge THORChain refused to

roll back or block any of Lazarus Group’s efforts to use the

protocol to convert its funds into Bitcoin

(BTC).

“Welcome to the Wild West,” said Jiang. “This is where we are

right now.”

“From our view, we think crypto, if it is to be flourishing, it

needs to hug the regulation,” he argued. “To make it easy to be

adopted by the mass general here, we need to hug the regulation,

and we need to figure out ways to make this space safer.”

Related:

Financial freedom means stopping crypto MEV attacks —

Shutter Network contributor

Jiang commended Bybit CEO Ben

Zhou on his response to the incident, but he also pointed out

that the exchange’s bug bounty program prior to the hack had a

reward of just $4,000. He said that while most people in

cybersecurity are not motivated by money alone, having larger bug

bounties can potentially help exchanges stay more secure.

When asked about the ways exchanges and protocols can motivate

and retain top-tier talent to help protect their systems, Jiang

suggested that security engineers don’t always get the credit they

deserve.

“A lot of people say that the first-degree talent goes to the

developers because that’s where they will get most rewarding,” he

said. “But it’s also about us giving enough attention to the

security engineers. They carry a huge responsibility.”

“Cut them some slack and try to give them more credit.

Whether it’s monetary or whether it’s recognition, give them what

we can afford, and make it reasonable.”

To hear more from Jiang’s conversation with The Agenda

— including how CertiK carries out audits, how quantum computing

and AI will impact cybersecurity, and more — listen to the full

episode on Cointelegraph’s Podcasts page,

Apple

Podcasts or Spotify. And don’t

forget to check out Cointelegraph’s full lineup of other shows!

Magazine:

Bitcoin vs. the quantum computer threat — Timeline and

solutions (2025–2035)

This article is for

general information purposes and is not intended to be and should

not be taken as legal or investment advice. The views, thoughts,

and opinions expressed here are the author’s alone and do not

necessarily reflect or represent the views and opinions of

Cointelegraph.

...

Continue reading CertiK exec explains how to keep

crypto safe after $1.4B Bybit hack

The post

CertiK exec explains how to keep crypto safe after

$1.4B Bybit hack appeared first on

CoinTelegraph.

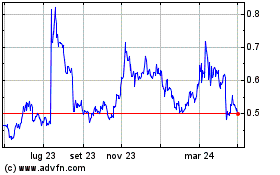

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Mar 2025 a Mar 2025

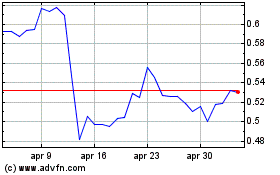

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Mar 2024 a Mar 2025