Here’s what happened in crypto today

27 Marzo 2025 - 2:44PM

Cointelegraph

Today in crypto, a new Bitpanda survey revealed less than 20% of

European banks offer crypto services despite increasing investor

demand and regulatory clarity in the region, the US Senate passed a

motion to kill the Internal Revenue Service’s (IRS) DeFi broker

rule to President Donald Trump, who is expected to sign it, and

Hyperliquid delisted JELLY token perpetual futures citing “evidence

of suspicious market activity.”

Most EU banks fail to meet rising crypto investor demand —

Survey

European banks and financial institutions may be underestimating

the demand for cryptocurrency services, with

fewer than one in five offering digital asset products,

according to a new survey by crypto investment platform

Bitpanda.

The study surveyed 10,000 retail and business investors across

13 European countries and found that more than 40% of business

investors already hold cryptocurrencies, with another 18% planning

to invest in the near future.

Yet, only 19% of surveyed financial institutions said their

clients showed strong demand for crypto products, suggesting a 30%

gap between actual investor adoption and perceived interest.

Crypto investments of EU private investors by country.

Source:

Bitpanda

Moreover, only 19% of surveyed European financial institutions

are offering crypto services, while over 80% of institutions

acknowledge crypto’s growing importance.

Related:

Michael Saylor’s Strategy surpasses 500,000 Bitcoin

with latest purchase

Still, some European banks are recognizing the growing demand

for digital assets, with 18% of surveyed financial institutions

planning to expand their crypto service offering, particularly

offerings related to crypto transfers.

Senate sends resolution killing IRS DeFi broker rule to

Trump

The US Senate

passed a resolution on March 26 to revoke a Biden-era rule that

would have required decentralized finance (DeFi) protocols to

report to the Internal Revenue Service, which will now head to

President Donald Trump, who has supported killing the rule.

The Senate voted 70-28 to pass the motion to repeal the

so-called IRS DeFi broker

rule that aimed to require DeFi platforms, such as

decentralized exchanges, to file their gross proceeds from crypto

sales and include information on those involved in the

transactions.

The White House’s AI and crypto czar, David Sacks, has

previously said Trump supports killing

the rule.

Source: DeFi

Education Fund

Critics of the rule said it would lump decentralized platforms

with too onerous rules, which would hamper crypto innovation, while

those who opposed the resolution said it would create a tax evasion

loophole.

The Senate was widely expected to pass the resolution as it

originally passed a version of it in early March. The House made a

copycat due to Constitutional budget rules, which it passed on

March 11.

Hyperliquid delists JELLY perps, citing ‘suspicious’

activity

Hyperliquid has delisted

perpetual futures tied to the JELLY token after identifying

“evidence of suspicious market activity” involving the trading

instruments, the blockchain network said.

The Hyper Foundation, Hyperliquid’s ecosystem nonprofit, will

reimburse most affected users for any losses related to the

incident, Hyperliquid said in a March 26 post

on the X platform.

“All users apart from flagged addresses will be made whole from

the Hyper Foundation,” Hyperliquid said. “This will be done

automatically in the coming days based on onchain data.”

Hyerliquid added that the perpetuals exchange’s primary

liquidity pool, HLP, has clocked a positive net income of around

$700,000 in the past 24 hours.

The incident began when a trader “opened a massive $6M short

position on JellyJelly” and then “deliberately self-liquidated by

pumping JellyJelly’s price on-chain,” Abhi, founder of Web3 company

AP Collective, said in an X

post.

Had Hyperliquid not closed the position, the perpetuals exchange

could have faced “full liquidation if JellyJelly reaches $150M

mcap,” Abhi added.

Source: Hyperliquid

Gracy Chen, CEO of cryptocurrency exchange Bitget, later

criticized

Hyperliquid’s handling of the incident, saying it put the

network at risk of becoming “FTX 2.0.”

The decision to delist the contracts, which was reached by

consensus among Hyperliquid’s relatively small number of

validators, flagged existing concerns about the popular network’s

perceived centralization.

“Despite presenting itself as an innovative decentralized

exchange with a bold vision, Hyperliquid operates more like an

offshore [centralized exchange],” Chen said, after saying

“Hyperliquid may be on track to become FTX 2.0.”

...

Continue reading Here’s what happened in crypto

today

The post

Here’s what happened in crypto today appeared

first on

CoinTelegraph.

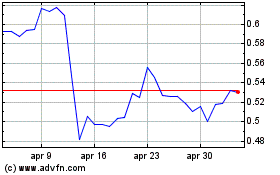

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Mar 2025 a Mar 2025

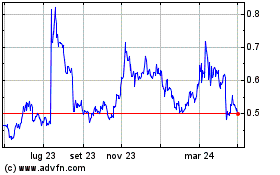

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Mar 2024 a Mar 2025