Bitcoin Price Just Crashed 7% On Trump’s Tariff Shock

03 Aprile 2025 - 2:30PM

NEWSBTC

The Bitcoin price plunged by 7.2%—from $88,526 to $82,150—within

the span of four hours following the reciprocal tariff announcement

by US President Donald Trump on Wednesday. The precipitous drop

aligns with a broader market rout set off by what has been

described as one of the largest tariff packages in modern US

history. Bitcoin Crashes After Trump’s Tariff Bombshell On

Wednesday afternoon, markets were jolted by a sweeping set of

“reciprocal tariffs” that President Trump claimed would be levied

on 185 countries “all at once.” The news sent ripples across global

finance, with the S&P 500 futures market reportedly shedding $2

trillion of market capitalization in under 15 minutes. According to

The Kobeissi Letter (via X): “Reciprocal tariffs are officially

HERE: President Trump just announced tariffs on 185 countries AT

ONCE, one of the largest tariffs in US history. S&P 500 futures

erased -$2 TRILLION of market cap in under 15 minutes. ” Related

Reading: Bitcoin’s Fate Hinges on This Critical ‘Dead Cross’ Signal

— What’s Next for BTC? The initial press coverage noted a 10%

baseline tariff. However, as Trump spoke, the scheme’s complexity

and scope became more apparent. He clarified that tariffs would be

“reciprocal” but set to half of whatever rate another country

currently imposes on US goods—a figure well beyond the 10% baseline

in many cases. China, for instance, reportedly applies 67% tariffs

on certain imports from the United States, suggesting a 34% tariff

reciprocally aimed at Chinese imports. Meanwhile, the European

Union could face a 20% tariff. “This is VASTLY different than a 10%

tariff across the board,” The Kobeissi Letter pointed out, adding

that these significantly higher rates created massive volatility.

At one point in Trump’s announcement, the S&P 500 futures

reversed from being up 2% to dropping 4%—an abrupt

6-percentage-point swing in under 20 minutes. By the time the “Make

America Wealthy Again Event” concluded, the markets had sustained

those losses, with Nasdaq 100 futures indicating a potential

500-point decline from prior levels. Bitcoin, which was up 8.9%

since Monday morning, instantly experienced the same turmoil,

shedding 7.2% of its value. Julio Moreno, Head of Research at

CryptoQuant, remarked via X: “I hope Bitcoiners learn that Trump’s

tariffs are a net negative for Bitcoin and the US economy.” Related

Reading: Is The Bitcoin Bull Run Over? Watch This Key Price He

further elaborated: “Trump has introduced too much uncertainty to

the world economy with his tariffs. There’s a high enough chance of

recession if the tariffs last long enough. This of course has hit

Bitcoin and crypto prices in spite of a positive regulatory

environment and [the Strategic Bitcoin Reserve].” Economic

Projections While the precise long-term effects remain unclear,

several prominent institutions have already issued forecasts.

JPMorgan analysts warn: “On a static basis, today’s announcement

would raise just under $400 billion in revenue, or about 1.3% of

GDP, which would be the largest tax increase since the Revenue Act

of 1968. We estimate that today’s announced measures could boost

PCE prices by 1–1.5% this year… This impact alone could take the

economy perilously close to slipping into recession. And this is

before accounting for the additional hits to gross exports and to

investment spending.” Simultaneously, The Kobeissi Letter noted

that the average US tariff rate—once the new set of duties is

enforced—could exceed levels not seen since World War II. They

cautioned that the White House’s targeted tariff revenue of $600

billion per year may be optimistic, suggesting only half that

amount might materialize based on current data. Additional

exemptions—such as copper, pharmaceuticals, semiconductors, and

lumber—amplified the confusion, indicating that the tariffs will

vary widely by sector and country of origin. UBS, as quoted by The

Kobeissi Letter, also raised the alarm about inflation: “BREAKING:

UBS says a permanent implementation of President Trump’s reciprocal

tariffs would result in inflation rising to 5%. This would be a

result of prices rising to ‘adjust to the higher costs of imports.’

We are on the verge of 5% inflation and negative GDP growth.”

Although President Trump hinted at forthcoming “largest tax cuts in

American history,” markets did not bounce back on that news. He

specified that Medicare, Medicaid, and Social Security benefits

would be spared from cuts, but investors and analysts appeared more

focused on the immediate shock from the tariff package. At press

time, BTC recovered to $83,207. Featured image created with DALL.E,

chart from TradingView.com

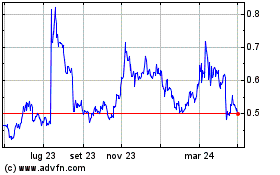

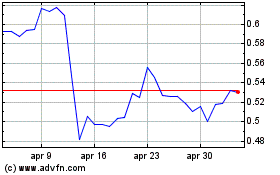

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Apr 2024 a Apr 2025