XRP To $15? Pundit Explains How ETFs Could Trigger Massive Rally

15 Aprile 2025 - 12:30PM

NEWSBTC

Crypto pundit Zach Rector’s has published a bold projection that

XRP could surge to $15 as soon as institutional inflows driven by

exchange-traded funds (ETFs) increasingly reshape market dynamics.

In his analysis, Rector contends that the anticipated inflows from

XRP exchange-traded funds (ETFs) could transform the asset’s

valuation landscape. His projection is rooted in conservative

assumptions and is underpinned by JPMorgan’s earlier forecasts,

which suggested that XRP ETFs might secure between $4 billion and

$8 billion in new capital during their first year. Rector centers

his model on the lower $4 billion figure, arguing that even this

modest amount could set the stage for a dramatic market cap

expansion. How High Can XRP Rise With A Spot ETF? Central to his

thesis is what he terms the “market cap multiplier.” This metric,

which he describes as “the ratio of the change in an asset’s market

capitalization to the net inflows it receives,” serves as the

engine behind his bullish scenario. Rector elaborated on the

concept during one of his presentations: “When you witness a

short-term event where XRP’s market capitalization surges

dramatically with relatively low inflows, it highlights how

sensitive the valuation can be to capital entering the market.”

Related Reading: XRP Reaches ABC Pattern Top—Analyst Says $6.50+

Targets Still In Play He illustrated this with a striking example

from April 12, 2025. On that day, over the course of eight hours,

XRP’s market cap increased by $7.74 billion even though the net

inflows were only $12.87 million—a phenomenon that translated into

an extraordinary multiplier of 601x. “That moment was a wake-up

call,” Rector noted, “a clear demonstration of how leveraged the

digital asset market can be under the right conditions.” Despite

this explosive example, Rector exercised caution by choosing a

considerably more conservative multiplier of 200x for his primary

analysis. With this multiplier, the $4 billion inflow assumption

would generate an $800 billion increase in market capitalization.

When added to XRP’s then-current market cap of roughly $125

billion, the theoretical total valuation climbs to nearly $925

billion. Given an estimated circulating supply of 60 billion XRP

tokens, this scenario would result in a per-token price close to

$15. “Even a conservative read on market trends points to a level

of appreciation that is nothing short of transformative,” Rector

explained. In discussing the underpinning assumptions, Rector was

unequivocal about the limitations of his model. “Two things that

are not included in this equation that do play a factor would be

the futures market and then also the XRP ledger decentralized

exchange activity,” he stated. Related Reading: XRP Tests Ascending

Triangle Resistance – Can Bulls Reach $2.40 Level? Beyond the

technicalities of his multiplier methodology, the broader market

context lends weight to Rector’s optimistic forecast. Institutional

momentum is evident, as evidenced by a surge in regulatory filings

for spot XRP ETFs. Nine prominent financial institutions—among them

Grayscale, VanEck, Ark Invest, and WisdomTree—have sought approval

from the US Securities and Exchange Commission. “The fact that

established asset managers are stepping forward to file for an XRP

ETF is a signal in itself,” Rector commented. The SEC’s

acknowledgment of these filings, coupled with the buzz around the

Ripple legal settlement, has bolstered market sentiment. “There’s a

tangible sense of optimism in the air,” Rector added.

Notwithstanding the supportive environment, Rector remains measured

in his outlook. He pointed to the underwhelming performance of

Ethereum ETFs for context. Since their introduction in July 2024,

Ethereum ETFs have only attracted about $2.28 billion in inflows.

“This is a reminder that even with strong institutional interest,

the transition from traditional finance to digital assets is not

always straightforward,” Rector remarked. International

developments have further reinforced the narrative. In March 2025,

Brazil took a significant step by approving a spot XRP ETF, while

the NYSE Arca recently debuted Teucrium Investment Advisors’

leveraged XRP ETF. “Global regulatory acceptance is key,” Rector

asserted, “and as more jurisdictions warm up to digital assets, we

can expect a more vibrant and dynamic market.” He concluded: “While

no forecast is foolproof, the trends we are witnessing today

suggest that a milestone like $15 per XRP isn’t just wishful

thinking—it could very well be within reach.” At press time, XRP

traded at $2.14. Featured image created with DALL.E, chart from

TradingView.com

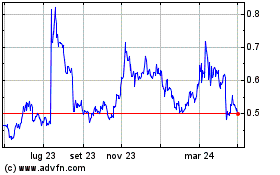

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Mar 2025 a Apr 2025

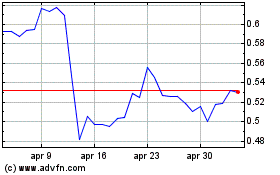

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Apr 2024 a Apr 2025