EUROBIO SCIENTIFIC: CONCLUSION OF AN AGREEMENT BETWEEN EUROBIO

SCIENTIFIC AND A CONSORTIUM LED BY EUROBIO SCIENTIFIC'S TEAM OF

ENTREPRENEURS AND MANAGERS, IK PARTNERS AND NEXTSTAGE AM WITH A

VIEW TO FILE A VOLUNTARY TENDER OFFER AT A PRICE

NOT FOR DISTRIBUTION, PUBLICATION OR

RELEASE, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN THE UNITED

STATES OR TO ANY US PERSON, OR TO ANY OTHER JURISDICTION IN WHICH

THE DISTRIBUTION, PUBLICATION OR RELEASE WOULD BE

UNLAWFUL.

CONCLUSION OF AN AGREEMENT BETWEEN

EUROBIO SCIENTIFIC AND A CONSORTIUM LED BY EUROBIO SCIENTIFIC'S

TEAM OF ENTREPRENEURS AND MANAGERS, IK PARTNERS AND NEXTSTAGE AM

WITH A VIEW TO FILE A VOLUNTARY TENDER OFFER AT A PRICE OF €25.30

PER EUROBIO SCIENTIFIC SHARE

- The Offer Price represents

a premium of 67.5 % over the volume-weighted average share price

over 60 trading

days1and of 39 % over

the last closing price of Eurobio Scientific shares prior to the

announcement of the Offer

- The Board of Directors of

Eurobio Scientific:

- has unanimously approved

the principle of the proposed transaction in accordance with the

recommendations of the ad hoc

committee, without prejudice to the review of the

contractual documentation and the Offer documentation to be carried

out by the independent expert

- will meet at a later date

to issue a reasoned opinion on the Offer after consultation with

the Company's social and economic committee (“CSE”) and receipt of

the independent expert's report

- An ad

hoc committee, comprising a majority of

independent directors and chaired by one of them, supervises the

work of Ledouble SAS, which has been chosen as the independent

expert

- The Offer is expected to be

filed at the end of September with the AMF (French financial

markets authority) and will be subject to the prior approval of the

competent merger control and foreign investment control authorities

in France and Italy.

Paris, July

31st, 2024, 9:00

pm

Eurobio Scientific

(FR0013240934, ALERS), a leading French group in the field of

specialty in vitro medical diagnostics (the

"Company"), announces that funds managed by

NextStage AM and IK Partners, together with Mr. Denis Fortier, CEO,

and other members of the Company's Board of Directors and senior

management2, have decided to form a consortium (the

"Consortium") in order to launch a voluntary

tender offer for all of the outstanding Eurobio Scientific shares

(the "Offer"), which may be followed, if the

conditions are met, by a squeeze-out.

The Company's Board of Directors, which met on

July 31st 2024, approved the principle of the proposed

transaction, which would accelerate Eurobio Scientific's organic

and inorganic growth plan. The Offer, which would enable the

Company's shareholders to benefit from a significant and immediate

liquidity opportunity, will be made at a price of 25.30 euros per

Eurobio Scientific share (the "Offer Price"),

which represents a premium of 39 % over its last closing price

prior to the announcement of the Offer and of 67.5 % over its

volume-weighted average price over 60 trading days.

The Board also authorised the conclusion of a

cooperation agreement in connection with the Offer between the

Company and EB Development SAS, a company indirectly wholly-owned

by funds managed by IK Partners and intended to be jointly owned,

directly or indirectly, by the members of the Consortium (the

"Bidder"), if the Offer is successful.

An important step in securing the

Company's development

The Company's ambition is to pursue its

development in the fields of infectious diseases, transplantation

and oncology. The Company realized that the listing of its shares

did not provide the flexibility theoretically offered by the stock

market for its financing, and that it did not have the financial

resources to support its development. Furthermore, in an

environment that penalises mid caps, the cost and constraints

associated with the listing seem less and less justified. The

objective of the proposed Offer is to back the Company with a new

institutional partner, IK Partners, a leading European private

equity firm with the resources and support of a large international

organisation, to meet its needs. The members of the Consortium

recognize the Group's positioning in the field of in vitro

diagnostics and life sciences, and are convinced that going private

would provide a better environment for development.

The proposed Offer meets all of the Company's

strategic objectives and would enable it to pursue its development

plan with a shareholder base that actively supports its

strategy.

The Board of Directors of Eurobio

Scientific approves the Offer pending the opinion of the CSE and

the conclusions of the independent expert.

Following the recommendation of its ad

hoc committee composed of Mr. Patrick de Roquemaurel (chairman

of the committee and independent director), Mr. Michel Picot

(independent director) and Mr. Hervé Duchesne de Lamotte, the Board

of Directors of the Company, which met on July 31st,

2024, expressed a positive preliminary opinion under the terms of

which the directors unanimously and favourably approved the

principle of the Offer, it being specified that this opinion will

be reviewed in accordance with the detailed study of the terms and

conditions of the draft Offer and the report to be drawn up by the

independent expert.

This decision was taken unanimously by the

directors, it being specified that, having declared, prior to the

Board meeting, the potential conflict of interest in which they

find themselves as a result of the conclusion of an Investment

Agreement with the other members of the Consortium, Ms. Catherine

Courboillet, Mr. Denis Fortier, Mr. Jean-Michel Carle-Grandmougin,

Mr. Hervé Duchesne de Lamotte and EurobioNext, represented by Mr.

Grégoire Sentilhes, directors who are also members of the

Consortium, undertook to vote in accordance with the recommendation

of the ad hoc committee in order to avoid any potential

conflict of interest and to ensure that the quorum and majority

required for the validity of the decision of the Company's Board of

Directors were met.

On the proposal of the ad hoc

committee, and in accordance with the provisions of Article 261-1

of the General Regulation of the Autorité des marchés

financiers (French financial markets authority, or the

"AMF"), the Board of Directors has confirmed

Ledouble, represented by Olivier Cretté (8, rue Halévy - 75009

Paris +33 (0)1 43 12 57 16 - ocrette@ledouble.fr), as the

independent expert responsible for issuing a report on the

financial terms of the Offer (including the possible implementation

of a squeeze-out procedure), and the absence of related agreements

likely to affect the equal treatment of shareholders. The

conclusion of the report will take the form of a fairness

opinion.

The Board of Directors has also decided to

initiate today an information-consultation procedure with the

CSE.

After considering the opinion of the CSE and the

report of the independent expert, the Board of Directors of the

Company will issue, on the prior recommendation of its ad

hoc committee, a reasoned opinion on the Offer and its

consequences for the Company, its shareholders and its

employees.

The reasoned opinion of the Board of Directors,

together with the report of the independent expert, will be

appended to the final reply document prepared by the Company and

approved by the AMF.

Cooperation agreement between the

Company and EB Development SAS

The cooperation agreement for the Offer between

the Company and the Bidder was authorised by the Board of Directors

on July 31st, 2024, in accordance with the procedure for

regulated agreements. Mr. Denis Fortier, Mr. Jean-Michel

Carle-Grandmougin, Mr. Hervé Duchesne de Lamotte, Ms. Catherine

Courboillet and EurobioNext, represented by Mr. Grégoire Sentilhes,

directors and members of the Consortium, did not take part in the

decision.

Under the terms of this agreement, the Company,

in particular:

-

undertook not to tender its treasury shares (i.e., to date, 206,743

shares in the Company) to the Offer;

-

undertook to refrain from soliciting, initiating or encouraging

tender offers competing with the Offer and, more generally, any

alternative transaction with any person other than the Bidder;

and

- and,

more generally, entered into reciprocal cooperation undertakings

customary in tender offers.

The Company has also undertaken to conduct the

Group's activities in the normal course of business between the

signing of the cooperation agreement and the end of the Offer

period.

Investment Agreement

On July 31st, 2024, the members of

the Consortium entered into an investment agreement in order to set

out the main terms and conditions of the Offer and of the

investment by its members for the purposes of the Offer (the

"Investment Agreement"). Under the terms of the

Investment Agreement, the Bidder and the members of the Consortium

declared that they were acting in concert within the meaning of

article L. 233-10 of the French Commercial Code and

EurobioNext, a shareholder and director of the Company, has

undertaken to contribute to the Bidder all of the shares of the

Company that it holds (i.e. 34.04% of the share capital and

theoretical voting rights of the Company3), by way of a

contribution in kind with effect before the first

settlement-delivery of the Offer if the Offer is successful.

Commitments to contribute to the

Offer

On June 7th, 2024, Echiumbio Holding

B.V., holding 9.42% of the Company's share capital to date,

committed to IK Partners to tender the Company shares it holds to

the Offer. In addition, under the terms of the Investment

Agreement, Mr. Denis Fortier, Mr. Hervé Duchesne de Lamotte and Ms.

Cathie Marsais have undertaken to tender the shares of the Company

that they hold, which together represent 0.12% of the Company's

share capital.

These commitments may be revoked if a competing

tender offer has been declared compliant by the AMF and opened at a

price higher than the Offer Price, and if the Bidder does not file

a competing improved tender offer.

Conditions precedent and timetable for

the Offer

It is expected that the draft Offer document and

draft reply document will be filed at the end of September by the

Bidder and the Company respectively, so that the Offer can be

submitted to the AMF in October 2024.

In accordance with applicable regulations, the

filing of the Offer is subject to the appointment of an investment

services provider, approved to carry out underwriting activities

and guaranteeing the content and irrevocable nature of the

commitments made by the Bidder, and to the issue by the AMF of an

opinion of conformity of the Offer.

The Offer is subject to the condition precedent

of the authorization from the European Commission under merger

control regulations, it being specified that the Bidder reserves

the right to waive this condition, and the opening of the Offer is

subject to the prior authorization from the competent foreign

investments control authorities in France and Italy.

Subject to the issue by the AMF of its opinion

on the conformity of the Offer, the Offer will be opened in the

days following the Bidder's obtaining the necessary authorizations

for the control of foreign investments in France.

In addition to the mandatory expiry threshold

provided for in Article 231-9, I, 1° of the AMF's General

Regulation, the Offer will be subject to a waiver threshold

pursuant to Article 231-9, II of the AMF's General Regulation,

allowing the Bidder to withdraw the Offer if less than 66.66% of

the Company's shares and theoretical voting rights are tendered at

the end of the Offer.

Pre-offer period

This press release opens a pre-offer period

within the meaning of the AMF General Regulation.

Disclaimer:

This press release has been prepared for

information purposes only. It does not constitute a public

offering. The distribution of this press release may be subject to

specific regulations or restrictions in certain countries. This

press release is not intended for persons subject to such

restrictions, either directly or indirectly. This press release is

not for release, publication or distribution, directly or

indirectly, in the United States of America or in any other

jurisdiction in which such release, publication or distribution is

unlawful or subject to any specific procedures or requirements.

Accordingly, persons in possession of this press release are

required to inform themselves about and to observe any local

restrictions that may apply. Failure to comply with legal

restrictions may constitute a violation of applicable securities

laws and regulations in any of these countries. Eurobio Scientific

S.A. and the members of the Consortium accept no liability for any

breach by any person of such restrictions.

About Eurobio Scientific

Eurobio Scientific is a key player in the field of specialty in

vitro diagnostics. It is involved from research to manufacturing

and commercialization of diagnostic tests in the fields of

transplantation, immunology and infectious diseases, and sells

instruments and products for research laboratories, including

biotechnology and pharmaceutical companies. Through many

partnerships and a strong presence in hospitals, Eurobio Scientific

has established its own distribution network and a portfolio of

proprietary products in the molecular biology field. The Group has

approximately 290 employees and four production units based in the

Paris region, in Germany, in the Netherlands and in the United

States, and several affiliates based in Dorking UK, Sissach

Switzerland, Bünde Germany, Antwerp Belgium, Utrecht in The

Netherlands and Milan in Italy.

Eurobio Scientific's reference shareholder is the EurobioNext

holding company which brings together its two directors,

Jean-Michel Carle and Denis Fortier, alongside the "Pépites et

Territoires" by AXA & NextStage AM investment program, managed

by NextStage AM.

For more information, please visit: www.eurobio-scientific.com

The company is publicly listed on the Euronext Growth market in

Paris

Euronext Growth BPI Innovation, PEA-PME 150 and Next Biotech

indices, Euronext European Rising Tech label.

Symbol: ALERS - ISIN Code: FR0013240934 - Reuters: ALERS.PA -

Bloomberg: ALERS:FP |

Contacts |

Groupe Eurobio Scientific

Denis Fortier, Chairman and CEO

Olivier Bosc, Deputy CEO / CFO

Tel. +33(0) 1 69 79 64 80 |

Calyptus

Mathieu Calleux

Investors Relations

Tel. +33(1) 53 65 68 68 - eurobio-scientific@calyptus.net |

About IK Partners

IK Partners (“IK”) is a European private equity firm focused on

investments in the Benelux, DACH, France, Nordics and the UK. Since

1989, IK has raised more than €17 billion of capital and invested

in over 190 European companies. IK supports companies with strong

underlying potential, partnering with management teams and

investors to create robust, well-positioned businesses with

excellent long-term prospects. For more information, visit

www.ikpartners.com

About Nextstage AM

NextStage AM is an independent management company based in Paris,

approved by the AMF, that has cultivated since its creation in 2002

an "entrepreneur-investor" philosophy, and is one of the pioneers

and leaders of innovative and patient growth capital in France.

NextStage AM has developed, step by step, a multi-strategy Private

Equity platform that represents in terms of assets, directly and

indirectly, €8 billion of AUM at the end of June 2024. NextStage AM

invests in a limited number of SMEs and ETIs (81 portfolio

companies as of 30/06/2024), French and European, innovative and

growing, to which it provides entrepreneurial expertise as an

investor, and strong operational support throughout their

transformation. NextStage AM provides long-term support to these

SMEs and ETIs involved in smart health, environmental innovation,

and digital transformation. NextStage AM gives them the means to

accelerate their development and their innovative capacity to

become “Champions” on their markets, both in France and

internationally, through organic and/or external growth.

https://www.nextstage-am.com

1 Volume-weighted average price over 60 trading days until July

30th, 2024.

2 Mr. Denis Fortier (CEO), Ms. Cathie Marsais (Deputy CEO), Mr.

Olivier Bosc (Deputy CEO), Mr. Jean-Michel Carle-Grandmougin

(Deputy CEO and Director) and Mr. Hervé Duchesne de Lamotte

(Director)

3 Based on the total number of shares and theoretical voting rights

in the Company determined in accordance with article 223-11 of the

AMF's General Regulations as at July 31st, 2024, i.e.

10,248,871 ordinary shares corresponding to 10,248,871 theoretical

voting rights.

- PR_Eurobio Scientific_Projet_Offre_EN_3107

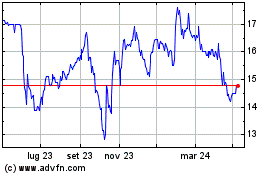

Grafico Azioni Eurobio Scientific (EU:ALERS)

Storico

Da Feb 2025 a Mar 2025

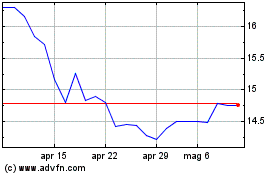

Grafico Azioni Eurobio Scientific (EU:ALERS)

Storico

Da Mar 2024 a Mar 2025