Swiss Franc Eases Following SNB Rate Hike

23 Marzo 2023 - 8:26AM

RTTF2

The Swiss franc that traded higher in the European session on

Thursday following the Swiss National Bank's decision to raise its

key interest rate retraced its gains shortly.

The SNB raised its policy rate by 0.5 percentage points to 1.5

percent, as expected.

"It cannot be ruled out that additional rises in the SNB policy

rate will be necessary to ensure price stability over the medium

term," the bank said in the statement.

The central bank said it stands ready to be active in the

foreign exchange market as necessary.

On Wednesday, the Federal Reserve raised interest rate by 25

basis points and signaled a pause in its rate-hike cycle soon amid

the recent turmoil in the banking sector.

The franc fell to 1.1302 against the pound and 0.9180 against

the greenback, after rising to a 6-day high of 1.1228 and a 9-day

high of 0.9118, respectively in early deals. If the currency drops

further, 1.15 and 0.94 are possibly seen as its next support levels

against the pound and the greenback, respectively.

The franc retreated to 0.9990 against the euro, from a high of

0.9934 hit at 4:30 am ET. This may be compared to a 3-week low of

0.9997 seen at 2:25 am ET. The franc had ended yesterday's trading

session at 0.9952 against the euro. The franc may find support

around the 1.04 level.

The franc remained firm at 143.71 against the yen, up from a

2-day low of 142.55 touched at 11:15 pm ET. The pair was valued at

143.11 when it ended trading on Wednesday. Next near term

resistance for the currency is likely seen around the 146.00

level.

Looking ahead, the Bank of England's monetary policy

announcement is due at 8:00 am ET. The BoE is widely expected to

raise its key rate by 25 basis points to 4.25 percent from 4

percent.

U.S. weekly jobless claims for the week ended March 18 and new

home sales for February will be published in the New York

session.

Eurozone flash consumer sentiment index for March will be out at

11 am ET.

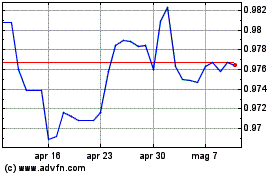

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Feb 2025 a Mar 2025

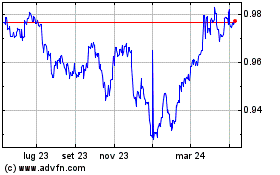

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Mar 2025