U.S. Dollar Declines Ahead Of Inflation Data

09 Agosto 2024 - 3:35PM

RTTF2

The U.S. dollar dropped against its major counterparts in the

New York session on Friday, as investors await key inflation data

due next week for more clues about the potential size of a rate cut

in September.

Traders trimmed bets on aggressive Federal Reserve easing

following the release of the latest weekly jobless claims data.

Investors focus on a slew of economic data, including CPI, PPI

and retail sales due next week to help determine the Fed's rate cut

trajectory.

In an interview with the Providence Journal, Boston Fed

President Susan Collins said that policy easing should begin soon

if inflation continues to cool.

"If the data continue the way that I expect, I do believe that

it will be appropriate soon to begin adjusting policy and easing

how restrictive the policy is," Collins said.

The greenback fell to 1.0931 against the euro and 0.8632 against

the franc, off its early highs of 1.0909 and 0.8671, respectively.

The currency may locate support around 1.12 against the euro and

0.85 against the franc.

The greenback touched 1.2773 against the pound, setting a 3-day

low. The currency is poised to challenge support around the 1.31

level.

The greenback weakened to 146.26 against the yen, from an early

2-day high of 147.81. The currency is seen finding support around

the 142.00 level.

The greenback eased to 1.3721 against the loonie. This may be

compared to an early more than 2-week low of 1.3718. If the

currency falls further, it is likely to test support around the

1.33 region.

In contrast, the greenback recovered to 0.6566 against the

aussie and 0.6004 against the kiwi, from an early more than 2-week

low of 0.6605 and a 3-week low of 0.6034, respectively. The

currency is likely to locate resistance around 0.64 against the

aussie and 0.57 against the kiwi.

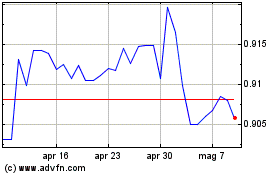

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2025 a Mar 2025

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Mar 2025