TIDMDNLM

RNS Number : 0732A

Dunelm Group plc

18 January 2024

18 January 2024

Dunelm Group plc

Second quarter and first half trading update

Continued sales growth and strong gross margin performance

Dunelm Group plc ("Dunelm" or "the Group"), the UK's leading

homewares retailer, updates on trading for the 26-week period ended

30 December 2023.

Q2 Q2 YoY H1 H1 YoY

-----------------

Total sales GBP483m +1.0% GBP872m +4.5%

-------- -------- -------- -------

Digital % total

sales(1) 37% +2ppts 36% +2ppts

-------- -------- -------- -------

(1) Digital includes home delivery, Click & Collect and

tablet-based sales in store

Highlights

-- Strong sales growth in the first half, with total sales

increasing by 4.5% to GBP872m, driven by volume

-- Continued sales growth in Q2 in a challenging market, with

total sales increasing by 1.0% against very strong comparatives

(underlying Q2 growth was 14% last year(2) ) and the digital sales

mix up 2ppts to 37%

-- Increased gross margin by 160bps in the first half, while offering outstanding value

-- Opened three new stores during the second quarter, taking the

total to 183, and remain on track to achieve our full year store

opening plans

-- Our PBT expectations for the full year are in line with

market expectations(3)

(2) Total growth of 18% in Q2 FY23 benefitted from the timing of

our Winter Sale. Underlying growth in Q2 FY23 was 14%

(3) Company compiled consensus average of analysts' expectations

for FY24 PBT is GBP202m , with a range of GBP199m to GBP207m

Continued sales growth against a strong comparative period

We are pleased to report strong sales growth of 4.5% during the

first half, with 1.0% growth delivered in Q2, driven by volume,

against a particularly strong comparative period when sales grew by

14% on an underlying basis. We are confident that we are continuing

to gain share(4) in a market which has been characterised by

volatile week-to-week trading patterns, particularly through Q2,

reflecting the ongoing pressures on consumers' discretionary

spend.

Customers continued to be attracted to the choice and value we

consistently offer across our ranges. We were particularly pleased

with sales in our cook and dine category, which benefitted from

improved ranges as we have developed our product mastery, and

strong sell through of our Christmas products.

(4) We will report market share as usual using GlobalData at our

Interim results in February

Gross margin

We delivered sales growth whilst also achieving significant

improvements in gross margin, evidencing our ability to offer

outstanding value alongside disciplined promotional activity. Gross

margin in H1 was 160bps higher than FY23, benefitting from

improvements in freight rates, which were slightly better than

expected. We expect headwinds in the second half, however we remain

comfortable with our guidance for a year-on-year gross margin

increase of c.100bps.

Strategic and operational update

During the quarter, we made further strategic progress. The

opening of three new stores in Q2 saw us extend our total retail

system to 183 stores, and we have now opened a total of four stores

so far this financial year, in a variety of formats and sizes. We

are delighted by the enthusiastic response from our local

communities to these new stores and are on track with our store

opening plans for the full year.

We also continued with our plans to improve the customer

proposition across our total retail system. We increased choice

through expanding ranges across our categories, and continued to

optimise dunelm.com, which performed well during our busiest

trading weeks, with improvements to both site speed and customer

experience.

We launched our 'Home of Homes' brand platform with our

marketing campaign which ran until November. This Christmas, our

community-focused 'Delivering Joy' initiative continued to go from

strength to strength, with our colleagues and customers donating

over 125,000 gifts to local good causes, twice as many as last

year.

Outlook

Growth in the first half was driven by customer demand for our

consistent, outstanding value proposition. Whilst we are conscious

that the outlook for consumer spending remains unpredictable and

market conditions volatile, we are confident that we can deliver

further market share gains and retain our tight operational grip on

costs. Our expectations for full year PBT are in line with market

expectations(5) .

(5) Company compiled consensus average of analysts' expectations

for FY24 PBT is GBP202m , with a range of GBP199m to GBP207m

Nick Wilkinson, Chief Executive Officer, commented:

"The breadth of our range and outstanding value of our

proposition continues to be well received by customers, resulting

in a strong sales performance for the first half despite a tough

market backdrop.

"Consumers remain under pressure and are actively seeking true

value at all price points. Our customer offer and positioning as

the 'Home of Homes' resonates particularly well in this

environment, and we are confident we have continued to gain market

share. At the same time, our strong operational grip continues to

help us navigate the difficult environment and manage our

margins.

"Supporting our communities remains at the heart of Dunelm and I

would like to thank all our colleagues and customers for making our

recent Delivering Joy campaign our biggest ever, donating an

incredible 125,000 gifts to local good causes during the Christmas

period.

"Looking ahead, we remain excited about the compelling

opportunity for growth for our business. We have continued to

execute at pace on our strategic plans, opening four new stores

over the first half of the year, whilst continuing to expand our

ranges and improve our digital offer. Our new Spring collections

look fantastic in store and are being really well received by

customers as we reach the end of our Winter Sale, leaving us well

placed to make further progress in the months ahead."

For further information please contact:

Dunelm Group plc investorrelations@dunelm.com

Nick Wilkinson, Chief Executive Officer

Karen Witts, Chief Financial Officer

MHP 07595 461 231

Oliver Hughes / Rachel Farrington / Charles Hirst dunelm@mhpgroup.com

Next scheduled event:

Dunelm will make its interim results announcement on 14 February

2024 . There will be an in-person presentation for analysts and

institutional investors in the morning at 9.30am, hosted at Peel

Hunt LLP, 100 Liverpool Street, London, EC2M 2AT, as well as a

webcast and conference call with a facility for Q&A. For

details, please contact christian.harte@mhpgroup.com . A copy of

the presentation will be made available at

https://corporate.dunelm.com

Quarterly analysis:

52 weeks to 29 June 2024

Q1 Q2 H1 Q3 Q4 H2 FY

---------- ---------- ---------- --- --- --- ---

Total sales GBP389.6m GBP482.9m GBP872.5m

---------- ---------- ---------- --- --- --- ---

Total sales

growth +9.2% +1.0% +4.5%

---------- ---------- ---------- --- --- --- ---

Digital % total

sales 35% 37% 36%

---------- ---------- ---------- --- --- --- ---

52 weeks to 1 July 2023

Q1 Q2 H1 Q3 Q4 H2 FY

---------- ---------- ---------- ---------- ---------- ---------- ------------

Total sales GBP356.7m GBP478.3m GBP835.0m GBP423.3m GBP380.5m GBP803.8m GBP1,638.8m

---------- ---------- ---------- ---------- ---------- ---------- ------------

Total sales

growth -8.3% +17.6% +5.0% +6.1% +6.1% +6.1% +5.5%

---------- ---------- ---------- ---------- ---------- ---------- ------------

Digital % total

sales 33% 35% 34% 36% 39% 37% 36%

---------- ---------- ---------- ---------- ---------- ---------- ------------

Notes to Editors

Dunelm is the UK's market leader in homewares with a purpose 'to

help create the joy of truly feeling at home, now and for

generations to come'. Its specialist customer proposition offers

value, quality, choice and style across a growing range of

products, spanning multiple homewares and furniture categories and

including services such as Made to Measure window treatments.

The business was founded in 1979 by the Adderley family,

beginning as a curtains stall on Leicester market before expanding

its store footprint. The business has grown to 183 stores across

the UK and has developed a successful online offer through

dunelm.com which includes home delivery and Click & Collect

options. 152 stores now include Pausa coffee shops, where customers

can enjoy a range of hot and cold food and drinks.

From its textiles heritage in areas such as bedding, curtains,

cushions, quilts and pillows, Dunelm has built a comprehensive

offer as 'The Home of Homes' including furniture, kitchenware,

dining, lighting, outdoor, decoration and DIY. The business

predominantly sells specialist own-brand products sourced from

long-term, committed suppliers.

Dunelm is headquartered in Leicester and employs over 11,000

colleagues. It has been listed on the London Stock Exchange since

October 2006 (DNLM.L) and the business has returned over GBP1bn in

distributions to shareholders in the last ten years(6) .

(6) Ordinary dividends plus special dividends plus special

distributions

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRMLTMTJBBRI

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

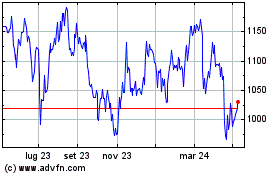

Grafico Azioni Dunelm (LSE:DNLM)

Storico

Da Mar 2025 a Apr 2025

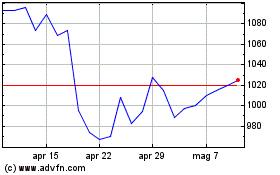

Grafico Azioni Dunelm (LSE:DNLM)

Storico

Da Apr 2024 a Apr 2025