TIDMESKN

RNS Number : 5520S

Esken Limited

06 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION

FOR IMMEDIATE RELEASE

6 November 2023

ESKEN LIMITED

("Esken", the "Group" or the "Company")

Publication of Circular

Notice of General Meeting

Notification of Transfer from Premium Listing to Standard

Listing

Irrevocable Undertakings

Further to the announcement by Esken, the aviation and renewable

energy group, on 1 November 2023 (the "Disposal Announcement")

regarding the conditional disposal of its wholly owned subsidiary,

Esken Renewables Limited ("Esken Renewables") (the "Disposal") ;

the proposal to transfer the Company's listing from the Premium

Listing segment of the Main Market of the London Stock Exchange to

the Standard Listing segment (the "Proposed Transfer"); and the

Company's proposed new Executive Remuneration Scheme, Esken today

announces that the UK Financial Conduct Authority (the "FCA") has

approved a circular in relation to the above matters (the

"Circular") which will be published and posted or made available to

Shareholders shortly.

The Disposal, the Proposed Transfer and the implementation of

the Executive Remuneration Scheme, are all subject, inter alia, to

approval of Shareholders at a general meeting of the Company (the

"General Meeting").

The General Meeting will be held at 9.30 a.m. on 24 November

2023, at the offices of the Company, Third floor, 15 Stratford

Place, London, England W1C 1BE.

A copy of the Circular is available for download from the

Company's website at www.esken.com . In compliance with 9.6.1 of

the Listing Rules, copies of the Circular and Notice of General

Meeting has been submitted to the National Storage Mechanism and

will be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

All defined terms in this announcement, unless otherwise stated,

shall have the same meaning as in the Disposal Announcement.

Recommendation

The Board believes the Disposal and the Proposed Transfer, and

the Resolutions in respect of the same to be proposed at the

General Meeting to be in the best interests of Shareholders as a

whole.

As the Executive Directors will not be participating in any

recommendation in respect of the Executive Remuneration Scheme, the

Non-Executive Directors believe the Executive Remuneration Scheme

and the Resolution in respect of the same to be proposed at the

General Meeting of the Company to be in the best interests of

Shareholders as a whole.

Accordingly, the Board unanimously recommends that Shareholders

vote in favour of the Resolutions in respect of the Disposal and

the Proposed Transfer and the Non-Executive Directors unanimously

recommend that the Shareholders vote in favour of the Resolution in

respect of the Executive Remuneration Scheme.

The directors intend to vote in favour of the Resolutions in

respect of their own beneficial holdings amounting, in aggregate

2,212,070 Ordinary Shares (representing 0.22 per cent. of the

existing issued ordinary share capital of the Company), which

shares are included within the number of shares in respect of which

the Company has received irrevocable undertakings as set out

below.

Notification of intention to transfer

As announced in the Disposal Announcement, the Board intends to

transfer the Company's listing from the Premium Listing segment of

the Main Market of the London Stock Exchange to the Standard

Listing segment (the "Proposed Transfer").

Under the Listing Rules, the Proposed Transfer requires prior

approval of Shareholders by way of special resolution. Shareholders

will therefore be asked to vote on a special resolution relating to

the Proposed Transfer at the General Meeting. If the Proposed

Transfer does not occur because the Transfer Resolution does not

pass, the Company's Premium Listing will continue.

The date of the Proposed Transfer must not be less than 20

business days after the passing of the Transfer Resolution at the

General Meeting. The Company intends to implement the Proposed

Transfer according to the most efficient timeline possible. Subject

to the passing of the Transfer Resolution, the Company intends to

apply for the Proposed Transfer, and anticipates that the effective

date of the Proposed Transfer will be 22 December 2023.

Irrevocable Undertakings

The Company has received irrevocable undertakings to vote in

favour of the Disposal Resolution and the Transfer Resolution at

the General Meeting in respect of 526,953,870 Ordinary Shares in

aggregate (representing approximately 51.4 per cent. of the issued

ordinary share capital of the Company), including in respect of the

Ordinary Shares in which the directors are beneficially

interested.

As such, the Company has received irrevocable undertakings in

favour of the Disposal Resolution in respect of a sufficient number

of Ordinary Shares so as to ensure that the Disposal Resolution

will pass.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Each of the times and dates in the table below is indicative

only and may be subject to change. Please refer to the notes for

this timetable set out below.(1)(2)(3)

Announcement of the Disposal 1 November 2023

Publication and posting of the Circular 6 November2023

and the Notice of General Meeting

Latest time and date for receipt of 9.30 a.m. on 22 November

proxy forms or electronic appointments 2023

Record time for entitlement to vote 6.00 p.m. on 22 November

at the General Meeting 2023

General Meeting 9.30 a.m. on 24 November

2023

Announcement of the results of the 24 November 2023

General Meeting

Expected date of Completion of the early December 2023

Disposal (4)

Expected effective date of Proposed 22 December 2023

Transfer (4)

Notes:

1. The times and dates set out in the expected timetable of

principal events above are subject to change by the Company, in

which event details of the new times and dates will be

notified.

2. References to times above are to London time.

3. If you have any queries on the procedure for completion and

submission of the proxy forms you should contact the Company

registrar on 0371 664 0300 (or +44 (0) 371 664 0300 if calling from

outside the United Kingdom). Calls are charged at the standard

geographic rate and will vary by provider. Calls outside the United

Kingdom will be charged at the applicable international rate. The

helpline is open between 9.00 a.m. and 5.30 p.m. (London time),

Monday to Friday excluding public holidays in England and Wales.

Please note that the Company registrar cannot provide any

financial, legal or tax advice and calls may be recorded and

monitored for security and training purposes.

4. Completion is subject to certain conditions as specified in

the Circular (Summary of the Key Terms of the Disposal), which

include, amongst others, shareholder approval at the General

Meeting. The expected date of Completion is subject to change and

Completion will not necessarily occur immediately following the

General Meeting or necessarily before the expected effective date

of the Proposed Transfer.

Enquiries:

Esken Limited C/o Teneo

Canaccord Genuity

Adam James, Emma Gabriel (Sponsor and Joint Broker)

Chris Robinson, Ben Spencer (Financial Adviser)

0207 523 8000

Teneo

Olivia Peters /Giles Kernick

020 7353 4200

esken@teneo.com

Important Notices

Cautionary statement

This announcement is not intended to, and does not constitute,

or form part of, any offer to sell or an invitation to purchase or

subscribe for any securities or a solicitation of any vote or

approval in any jurisdiction. Shareholders are advised to read

carefully the formal documentation in relation to the Disposal once

it has been despatched. Any response to the Disposal should be made

only on the basis of the information in the formal documentation to

follow.

This announcement has been prepared for the purpose of complying

with the applicable law and regulation of the United Kingdom and

information disclosed may not be the same as that which would have

been disclosed if this announcement has been prepared in accordance

with the laws and regulations of jurisdictions outside the United

Kingdom.

Important information relating to financial adviser

Canaccord Genuity Limited (the "Sponsor"), which is authorised

and regulated in the United Kingdom by the Financial Conduct

Authority, is acting solely for the Company, and for no-one else,

as sponsor, broker and financial adviser in connection with the

Disposal and the Proposed Transfer and will not be responsible to

anyone other than the Company for providing the protections

afforded to its clients or for providing advice to any other person

in relation to the Disposal and the Proposed Transfer, the content

of this announcement or any other matters described in this

announcement. To the fullest extent permitted by law, neither the

Sponsor nor any of its affiliates assumes any responsibility

whatsoever for or makes any representation or warranty express or

implied, in relation to the contents of this announcement,

including its accuracy, completeness or verification or for any

other statement made or purported to be made by it, or on its

behalf and nothing contained in this announcement is, or shall be,

relied upon as a promise or representation in this respect whether

as to the past, present or future, in connection with the Company,

the Group, Esken Renewables, the Continuing Group, the Disposal or

the Proposed Transfer. The Sponsor and its affiliates accordingly

disclaim to the fullest extent permitted by law all and any duty,

responsibility and liability whether

arising in tort, contract or otherwise which it might otherwise

be found to have in respect of this announcement or any such

statement or otherwise.

Publication on website

A copy of this announcement will be available for inspection on

the Company's website at: www.esken.com. For the avoidance of

doubt, the contents of this website are not incorporated into and

do not form part of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CIRFLFSDLLLRIIV

(END) Dow Jones Newswires

November 06, 2023 12:45 ET (17:45 GMT)

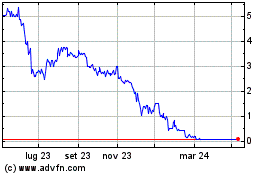

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Mar 2025 a Apr 2025

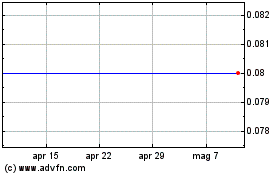

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Apr 2024 a Apr 2025