TIDMPFP

RNS Number : 9798U

Pathfinder Minerals Plc

29 November 2023

The information contained within this announcement was deemed by

the Company to constitute inside information as stipulated under

the UK Market Abuse Regulation

29 November 2023

Pathfinder Minerals plc

("Pathfinder" or the "Company")

Proposed Acquisition of Rome Resources Ltd

Proposed Subscription to raise GBP1.275 million

and

Suspension of Trading in the Company's Ordinary Shares

Pathfinder Minerals PLC (AIM: PFP), an AIM Rule 15 cash shell,

is pleased to announce that the Company has entered into

non-binding heads of terms regarding a potential acquisition of the

entire issued share capital and to be issued share capital of Rome

Resources Ltd ("Rome Resources"), which would constitute a reverse

takeover under the AIM Rules for Companies (the "AIM Rules")

(together the "Proposed Acquisition").

Related to the Proposed Acquisition, the Company has agreed to

lend Rome Resources up to CA$2,500,00 million on an unsecured

basis, subject to the finalisation of loan documentation (the "Loan

Agreement") with Rome Resources.

Pathfinder is also pleased to announce that it has conditionally

raised approximately GBP1,275,000 million (before expenses) by way

of a subscription of (the "Subscription") 425,000,000 new ordinary

shares of 0.1 pence each in the Company (the "Ordinary Shares") at

0.30 pence per new Ordinary Share (the "Issue Price"). As part of

the Subscription, the Company will issue one new warrant for every

two Ordinary Shares subscribed for, exercisable at a price of 0.45

pence for a period of up to two years from the date of re-admission

following completion of the Proposed Acquisition (the "Warrant"),

with each Warrant entitling the holder to acquire one new Ordinary

Share upon exercise of the Warrant. Accordingly, it is anticipated

that 212,500,000 Warrants will be issued. As part of the terms and

conditions of the Warrants, in the event that any fundraise in

conjunction with the re-admission of the enlarged group to trading

on AIM is completed at a price below 0.30 pence per new Ordinary

Share, then the exercise price of the Warrants will reset to a

price equal to the fundraise price at re-admission.

The Proposed Acquisition remains subject to a number of factors,

including the completion of due diligence to the satisfaction of

both parties, regulatory and shareholder approval, as well as the

negotiation and entry into a final binding acquisition agreement.

Accordingly, there can be no certainty that a final binding

acquisition agreement will be reached or that the Proposed

Acquisition will complete, nor or on the terms outlined in this

announcement.

Information about Rome Resources

Rome Resources is a Canada-based mineral exploration company

which is currently listed on the TSX Venture Exchange ("TSX-V")

under trading symbol "RMR". Rome Resources has entered into option

agreements to acquire 51 per cent. indirect interests in two

contiguous properties located in the Walikale District of the North

Kivu Province in eastern Democratic Republic of Congo which are

referred to collectively as the "Bisie North Tin Project".

Rome Resources has made recent discoveries of tin, copper, zinc

and silver on both permits, which are situated only 8km North and

on-trend from Alphamin Resources (AFM.TSX) Mpama North and South

Tin mines. Alphamin is the highest-grade tin producer in the World

mining at a grade of 4.5% tin and accounting for approximately 4%

of global supply from the Mpama North mine alone.

Rome Resources' audited financial accounts for the year ended 30

September 2022 state that the company incurred a loss of

approximately CA$0.698 million and held assets totalling

approximately CA$0.749 million. More recently, Rome Resources'

unaudited management accounts state that for the three months ended

31 March 2023 the company incurred a loss of approximately CA$1.044

million and as at 31 March 2023 the company held assets totalling

approximately CA$5.5 million.

Paul Barrett, Executive Director of Pathfinder, commented:

"We are extremely excited to announce the entry into non-binding

heads of terms for the Proposed Acquisition. Historically the UK

market has been a natural home for exploration companies with

operations in Africa, and in this respect we are confident that the

Proposed Acquisition will be well received.

"Notwithstanding the need for further drilling, the results of

the maiden drill campaign have shown that there is potential for a

world class discovery in these permits in terms of grades.

"We look forward to updating shareholders as the Proposed

Acquisition progresses."

Dr. Georg Schnura, Non-Executive Director of Rome Resources,

commented:

"We are very happy to have signed the non-binding heads of terms

with Pathfinder. Following completion of the Proposed Acquisition,

Rome Resources will have access to the UK's deep pool of liquidity

as well as the international investor base positioned in London,

whom we believe have deep knowledge of the Africa natural resources

market."

Suspension

The Proposed Acquisition would constitute a reverse takeover

under rule 14 of the AIM Rules. Therefore, the Proposed Acquisition

would be subject, inter alia, to the approval of the Company's

shareholders. As such, a further announcement with full details of

the Proposed Acquisition will be issued at the appropriate time and

an admission document published and sent to the Company's

shareholders with a notice of general meeting.

In accordance with rule 14 of the AIM Rules, the Company's

Ordinary Shares will be suspended from trading on AIM with effect

from 7:30 a.m. today. The Company's Ordinary Shares will remain

suspended until such time as either an admission document is

published, or an announcement is released confirming that the

Proposed Acquisition is not proceeding.

The Company will release further announcements as and when

appropriate.

Enquiries:

Pathfinder Minerals Plc

Paul Barrett, Executive Director

Tel. +44 (0)20 3143 6748

Allenby Capital Limited (Nominated Adviser and Broker)

John Depasquale / Vivek Bhardwaj (Corporate Finance)

Stefano Aquilino / Joscelin Pinnington (Sales & Corporate

Broking)

Tel. +44 (0)20 3328 5656

Further details in relation to the Proposed Acquisition

The Company and Rome Resources have also entered into a binding

exclusivity agreement pursuant to which Rome Resources has granted

the Company a period of exclusivity until 15 April 2024 to

consummate the Proposed Acquisition ("Long Stop Date").

It is intended that the Proposed Acquisition would be affected

by way of a Canadian Plan of Arrangement pursuant to the British

Columbia Business Corporations Act (the "Plan of Arrangement"). The

headline consideration payable pursuant to the Proposed Acquisition

is stated in the non-binding heads of terms as GBP15,940,891 or

CA$27,418,332 using an exchange rate of 1.72 GBP:CAD, to be settled

by the issue of new Ordinary Shares in the Company. In this

respect, the Company proposes to issue to the shareholders of Rome

Resources a total of 3,188,178,220 new Ordinary Shares at an

implied price of 0.50 pence per new Ordinary Share, representing a

3.28% discount to the 12 month volume weighted average price (VWAP)

for Pathfinder's Ordinary Shares, being 0.517p.

The Proposed Acquisition will be subject to, inter alia, the

approval of the TSX-V and the satisfaction of any conditions

imposed by them.

It is intended that following the successful completion of the

Proposed Acquisition and readmission of the enlarged group to

trading on AIM, the enlarged group will no longer maintain its

quotation on the TSX-V.

The Loan Agreement

The Company has agreed to provide Rome Resources with a loan for

working capital purposes. The loan will be advanced in two tranches

with CA$500,000 expected to be paid within 5 business days of this

announcement. CA$2,000,000 is anticipated to be paid within 5

business days of completion of the Company's Subscription, as

detailed below. The loan will be repayable after 12 months (from

the date of the last drawdown) but the repayment date can be

extended by a further 12 months if the Proposed Acquisition

terminates prior to the Long Stop Date. The loan will carry a fixed

interest payment equal to 10% of the principal amount, which will

increase to 15% if the Proposed Acquisition terminates prior to the

Long Stop Date.

In conjunction with the loan, Rome Resources has agreed to issue

to Pathfinder up to 10,000,000 warrants to subscribe for new common

shares in Rome Resources ("Rome Shares") at a price of 25 cents per

Rome Share, exercisable until the maturity date of the Loan.

Following completion of the Plan of Arrangement and therefore the

Proposed Acquisition, these warrants will be cancelled. Rome

Resources has also agreed to issue to the Company an additional

10,000,000 warrants to subscribe for new Rome Shares if the

Proposed Acquisition terminates prior to the Long Stop Date. The

issuance of any such warrants is subject to the approval of the

TSX-V.

Details of the Subscription

The Subscription will result in the issue of a total of

425,000,000 new Ordinary Shares at the Issue Price (together the

"Subscription Shares") as well as 212,500,000 Warrants. It is

intended that the net proceeds of the Subscription will be used

towards, amongst other things, funding the advisory fees associated

with the Proposed Acquisition and general working capital.

In order to implement the Subscription, the directors of the

Company (the "Directors" or the "Board") will require further

authorities, under sections 551 and 571 (respectively) of the

Companies Act 2006, to allot the Subscription Shares, as well as

212,500,000 Warrants, and to disapply statutory pre-emption rights

in respect of such allotments (the "Resolutions").

The Subscription Shares and the Warrants will be issued

conditional, inter alia, on the passing of the Resolutions by

shareholders of the Company (the "Shareholders") at a general

meeting to be convened (the "General Meeting"). A notice of the

General Meeting will be circulated in due course.

The Subscription Shares, when issued and fully paid, will rank

pari passu in all respects with the existing Ordinary Shares in

issue and therefore will rank equally for all dividends or other

distributions declared, made or paid after the issue of the

Subscription Shares.

The Subscription is conditional, inter alia, upon the passing of

the Resolutions at the General Meeting and admission to trading on

AIM ("Admission") in respect of the Subscription Shares. The

Subscription is not conditional on completion of the Proposed

Acquisition, and in this respect, for the avoidance of doubt the

General Meeting to be convened in relation to approving, amongst

other matters, the Subscription is not to approve the Proposed

Acquisition.

The Company will release further announcements as and when

appropriate, including, inter alia, in relation to the proposed

General Meeting and Admission of the Subscription Shares.

Total voting rights

On Admission, the Company will have 1,057,494,834 ordinary

shares of 0.1 pence each in issue, each with one voting right.

There are no shares held in treasury. Therefore, the Company's

total number of ordinary shares in issue and voting rights will be

1,057,494,834 and this figure may be used by shareholders from

Admission as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDDBDBDSDDGXI

(END) Dow Jones Newswires

November 29, 2023 02:00 ET (07:00 GMT)

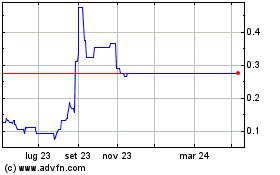

Grafico Azioni Pathfinder Minerals (LSE:PFP)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Pathfinder Minerals (LSE:PFP)

Storico

Da Mar 2024 a Mar 2025