TIDMSYS1

RNS Number : 8145H

System1 Group PLC

01 August 2023

1 August 2023

System1 Group PLC (AIM: SYS1)

("System1" or "the Group" or "the Company")

Preliminary results for the year ended 31 March 2023

System1 Group, the marketing decision-making platform, announces

its unaudited preliminary results for the year ended 31 March

2023.

Highlights

2023 2022

("FY23") ("FY22") Change**

Management Basis* GBPm GBPm %

------------------------------------- ---------------- --------------- -----------

Platform Revenue ("Predict &

Improve") 17.4 12.4 40%

Other Revenue (Bespoke consultancy) 6.0 11.7 -48%

---------------- --------------- -----------

Total Revenue 23.4 24.1 -3%

Gross profit 19.7 20.2 -2%

Adjusted operating costs (18.9) (19.2) -1%

---------------- --------------- -----------

Adjusted profit before taxation 0.8 1.0 -24%

================ =============== ===========

2023 2022 Change**

Statutory Basis GBPm GBPm %

------------------------------------- ---------------- --------------- -----------

Revenue 23.4 24.1 -3%

---------------- --------------- -----------

Gross profit 19.7 20.2 -2%

Operating costs (19.3) (19.6) -1%

Other operating income 0.3 0.3 18%

---------------- --------------- -----------

Profit before taxation 0.7 0.9 -23%

Tax charge (0.3) 0.0 n.m

---------------- --------------- -----------

Profit for the financial year 0.4 0.9 -58%

================ =============== ===========

Diluted earnings per share 3.2p 7.4p

* Adjusted Operating Costs exclude impairment, interest, share

based payments, bonuses and commissions, severance costs and

government grants. Adjusted figures exclude items, positive and

negative, that impede easy understanding of underlying performance.

See note 4 to the consolidated financial statements for further

information.

** Year-on-year percentage change figures are based on unrounded

numbers.

-- Growing sales momentum: H2 Platform Revenue GBP9.8m 29% up on H1 GBP7.6m

-- Full-year platform Revenue GBP17.4m, up 40% year-on year

representing 74% of group revenue (FY22: 52%)

-- Non-platform bespoke consultancy revenue increased slightly

in H2 ending the year at GBP6.0.

-- Gross profit margin improved in H2 resulting in an 84.2%

margin for the year, higher than in FY22 (83.8%)

-- Adjusted Operating Costs, statutory operating costs and headcount all 1% lower than in FY22

-- GBP4m cash investment in platform, products and IP, of which

GBP1.2m capitalised, GBP0.2m amortised (FY22: nil, nil). TYX

platform fully automated across all 3 product groups with

additional features

-- US IP Litigation settled out of court in June 2023

-- Net cash GBP5.7m at 31 March, GBP2.5m revolving credit

facility fully repaid in November 2022

Commenting on the Company's results, James Gregory, Chief

Executive Officer, said:

"The business delivered a strong second half year and created

momentum that has carried through into FY24 with profitable growth

across our platform offering. We are relentlessly executing the

plan outlined in the strategic review with a go-to-market strategy

aimed at winning with the world's largest businesses; new product

channels (digital and audio) amplified by new partnerships, all

spearheaded by a realigned executive team and John Kearon leading

the charge on US growth."

The Company can be found at www.system1group.com.

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

For further information, please contact:

System1 Group PLC Tel: +44 (0)20 7043 1000

James Gregory Chief Executive Officer

Chris Willford, Chief Financial Officer

Canaccord Genuity Limited Tel: +44 (0)20 7523 8000

Simon Bridges / Andrew Potts

BUILDING MOMENTUM

FY23 has truly been a year of 2 halves as we have moved from a

period of design and transition to one of relentless commercial

execution. This shone through in our second-half performance. H1

delivered revenue of GBP10.5m down 15% vs prior first half year,

while we addressed the underlying structural issues in the US that

had caused revenue to decline there in FY22 and started a thorough

strategic review of the whole group and how best to grow the

business to create shareholder value. With renewed strategic focus

in H2, we delivered GBP12.9m revenue, up 10% vs the second half of

FY22, as we executed a refined go-to-market strategy, with a

realigned Executive team and clarity of mission.

While total revenue was down for the year (-3% vs FY22), we saw

improving platform growth of 34% H1 FY23 vs prior year and 45% in

H2 FY23 vs prior year, up 40% for FY23 vs prior year as a whole.

This was driven by 44% growth in our data (Predict Your) products

and 23% growth in our data-led consultancy (Improve Your) offer. In

3 years, we have built out a GBP17m platform business that provides

automated, accurate predictions and world class improvement

insights across the advertising, innovation and brand tracking

universe.

We continued investment in developing the platform and product

suite, as well as investing in our sales and marketing functions to

build out the growth engines of the business, while ensuring costs

were held flat (at GBP19m) and gross profit margin was up (to

84.2%). With the core Test Your Ad, Test Your Idea and Test Your

Brand product suite fully automated by May 2022, we increased the

breadth of the offer to cover all marketing channels (Digital and

Audio were recently added to the TV, Print and Outdoor advertising

offering). A year of focussed fame building, amplified by new

partnerships resulted in strong growth in the number of new

platform clients in FY23 (net increase of 31), and new revenue (net

increase of GBP5m, of which GBP3m was from clients recruited in

FY23).

The strategic review offered the business a moment to reflect

and refine its strategy, clarifying how our customers of today and

the future buy marketing predictions and insights and ensuring we

have the capability, structure and focus to deliver these. We have

increased the volume of the voice of the customer in our decision

making; we are clear on how our understanding of emotions drives

business profit, allowing us a unique way in to work with Chief

Marketing Officers in the world's largest advertisers compared with

traditional market research agencies. We are dedicated to creating

a performance-based culture, relentlessly focussed on execution

against our strategy.

As I've recently taken on the role of CEO, I am indebted to the

support and trust of our staff, executive team, board and

shareholders who have backed our refined go-to-market strategy as

well as the continued partnership of our suppliers and commitment

of our industry-leading customers. Personally, I am also incredibly

thankful for continued wise-counsel and support from John Kearon,

throughout the transition this year as we look to take System1 to

the next level of continued, repeatable and sustainable business

growth.

PROGRESS ON STRATEGIC REVIEW INITIATIVES

In FY23, we undertook a thorough strategic review, considering

the best options for growing the business and increasing

shareholder value. The Review validated our existing successful

focus on automated 'Test Your' and 'Improve Your' services for

testing and improving creative content, including all forms of

advertising and product innovations, underpinned by our

world-leading IP, brand tracking and the TYA Premium (formerly

AdRatings) database. We set out clear objectives on areas of

specific focus.

CLARITY ON THE UNIQUE SELLING PROPOSITION

System1 offers unmatchable predictiveness alongside

market-beating speed and value. We translate the language of

creativity, into the language of business - money! Measuring

emotion underpins everything we do, which is why we can be so

predictive.

We have built our product, platform and data-led consultancy

offer on clear IP, that understands and evaluates how emotion

translates to business performance and ultimately profit. We have

tested over 175,000 ads, ideas and brands, through over 12.5

million surveys in over 75 markets, culminating in measurement of

over 27 million emotional responses. Our data science team works

continuously with our product teams to ensure we create and retain

high levels of predictiveness across all products.

Predictiveness alone is not enough, which is why we have

automated the platform that powers our products and data-led

consultancy, allowing us to offer incredible speed, with

predictions provided in under 24 hours, and at a price point that

is competitive.

We know this is why customers come to System1 in the first

instance, and why they remain for years as they see the ROI (Return

on Investment) on their marketing investments.

INCREASED FOCUS ON NON-TV FORMATS

While TV remains crucial to any marketer, digital marketing

spend now accounts for over 50% of global advertising spend and

campaigns are more omnichannel than ever before. So we have built

our offering to cover the full breadth of advertising campaigns,

offering testing for Digital and Audio, alongside our existing

offer of TV, Print and Outdoor. We have also created new

partnerships for these offers, to build credibility, increase fame

and also provide direct access to a large, targeted client

base.

TARGET THE WORLD'S LARGEST ADVERTISERS WITH THE AIM TO GENERATE

RECURRING AND REPEATABLE REVENUE STREAMS

We are fortunate to already work with many of the world's

largest advertisers and have learnt how to embed System1 as a

fundamental part of their marketing and creative process.

Recognising the scale and size of these opportunities, we are

focussed on becoming the partner of choice to all large

advertisers, who have both capacity and funding to test at scale

and the capability to use the predictions and insight to design and

improve marketing campaigns and product development.

We recognise at the same time the opportunity that could exist

to target the long tail of marketing spend, across a very large

number of small businesses and have the ability to serve this

market through our automated self-serve platform. We can also

leverage our partnerships with media platforms such as LinkedIn or

ITV to speak directly with these business without heavy investment

in SEO, SEM and above the line marketing. However, the current

market price point for testing, alongside the capability of these

smaller businesses to use predictions and insights prevent it from

being a likely short-term opportunity for revenue generation for

System1.

WORK WITH COMMERCIAL PLATFORM AND MEDIA PARTNERS TO REDUCE

CUSTOMER ACQUISITION COSTS AND PROVIDE SCALE AND FAME

We have a clear business model to ensure that our partnerships

with global media platforms, creative agencies, industry partners

and professional service firms is successful.

1. Partnerships provide credible fame with global reach.

Our new partnerships are focussed on increasing global presence

in specific channels and each launched with joint thought

leadership content to promote the partnership and grow System1's

fame.

- Pinterest (digital advertising in Europe)

- Finecast (addressable TV advertising US, UK, Canada, Australia)

- Teads (mobile advertising US and UK)

- JCDecaux (out-of-home advertising US and UK)

2. Partnerships provide direct or indirect access to a large customer base.

This access can be formal and direct, such as our partnership

with LinkedIn, where we are part of the LinkedIn B2B Edge

programme, helping LinkedIn grow its advertising revenues by

increasing the effectiveness of the advertisers on their

platform.

This can also be informal, such as our partnership with ITV,

where we jointly host events to promote our thought leadership,

directly to the ITV customer base.

The value we bring to our partners is our ability to help them

increase the spend of their customers on their platforms, or

through their businesses. The value they bring us is increased

credibility, amplification of fame and access to the world's

largest marketing spenders.

SIGNIFICANTLY INCREASE THE FOCUS ON US GEOGRAPHIC MARKET

The US has historically been the largest business for System1

and remains the largest opportunity for growth. A whopping US$321bn

of advertising spend is forecast in 2023, 43% of global advertising

market spend, as well as the US accounting for 53% of global market

research expenditure.

FY23 was a year of re-establishing our team and presence in the

US, as we brought in new leadership with Jason Chebib appointed GM

Americas and John Kearon being in the US to lead our new business

team. We have seen this now kick in to deliver a promising pipeline

of new business prospects. Good progress was made in Q4 where we

won new mandates from 3 of the country's 25 biggest advertising

spenders, including the largest. In H2 the US delivered its highest

half year of revenue since FY21, and standard product revenue

increased by 23% for the year as a whole.

We have set up a new US advisory team that will amplify our fame

and provide introductions to the business, as well as local market

advice. The role of the advisory team will be to help the Company

grow revenue quickly in the US. The team will be led by Jon Bond,

founder of New York agency Kirshenbaum & Bond and now active in

the MarTech space. Noah Brier, a New York digital leader, will also

be on the team. He is the founder of BrXnd.ai, co-founder of

Variance and Percolate and one of the leading talents in the US

MarTech space. We are in discussions with other prominent US sector

specialists to join this team.

OUTLOOK

FY24 has started promisingly, continuing the momentum of revenue

growth and new wins from H2 FY23. We expect the growth in platform

revenue to continue, which taken together with the levelling out of

revenue in bespoke consultancy, should lead to overall revenue

growth in FY24. The launch of TYA Digital and TYA Audio products

early in FY24 has increased TYA's addressable market. The new

global partnerships provide access to prospective customers,

thereby increasing our reach. One year in, our US commercial team

is making good progress and we are continuing to focus marketing

and business development investment in the US. We have signed 3 new

global mandates for world-leading advertisers already this year and

are excited about the prospects in the pipeline.

Once more, thank you to our staff whose daily efforts are the

energy behind our business, to our customers for their commitment

to delivering marketing that works and to our shareholders for

their support as we deliver on the potential of the business.

JAMES GREGORY - CEO

Financial Review

Overview

2023 2022 Change Change**

GBPm GBPm GBPm %

---------------- -------------- ------------ ---------

Platform Revenue ("Predict

& Improve") 17.4 12.4 4.9 40%

Other Revenue (Bespoke consultancy) 6.0 11.7 (5.6) -48%

---------------- -------------- ------------ ---------

Total Revenue 23.4 24.1 (0.7) -3%

Direct Costs (3.7) (3.9) (0.2) -8%

Gross profit 19.7 20.2 (0.5) -2%

Adjusted operating costs* (18.9) (19.2) (0.3) -1%

---------------- -------------- ------------ ---------

Adjusted profit before taxation* 0.8 1.0 (0.2) -24%

Statutory profit before taxation 0.7 0.9 (0.2) -23%

Tax credit/(charge) (0.3) 0.0 (0.3) nm

---------------- -------------- ------------ ---------

Statutory profit for the financial

year 0.4 0.9 (0.5) -58%

================ ============== ============ =========

*All figures in the Financial Review are presented in millions

rounded to one decimal place unless specified otherwise. Percentage

movements are calculated based on the numbers reported in the

financial statements and accompanying notes. Adjusted Cost and

Profit figures are as defined in the Highlights section.

** Year-on-year percentage change figures are based on unrounded

numbers.

KPIs

2023 2022

Platform Revenue % total Revenue 74 52

Platform Revenue growth % 40 na

Gross Profit % Revenue 84.2 83.8

Adjusted EBITDA GBPm (1) 1.8 2.1

Adjusted EBITDA % Revenue 8 9

"Rule of 40" (2) 48 na

Free cash flow(3) (3.1) 2.5

Net cash GBPm 5.7 8.7

(1) Statutory profit before taxation + share-based payments

+ interest, depreciation and amortisation

(2) Platform Revenue growth %+ Adjusted Group EBITDA

% Group Revenue

(3) Cash flow after interest and before debt raising/reduction,

buybacks/dividends

Revenue performance

Platform revenue rose by GBP4.9m (40%) in the year to GBP17.4m

with particularly strong growth in automated ad-testing revenues.

Predict Your platform revenue rose 44% fuelled by the continued

success of Test Your Ad. Improve Your platform-led consultancy

revenue increased by 23%. Overall platform revenue represented 74%

of total revenue in FY23, compared with 52% in the previous year.

In line with recent trends, other revenue, primarily bespoke

consultancy, fell GBP5.6m year on year as customers continued to

adopt the standard platform products, and the company focussed its

resources on the TYX platform-based product suite.

The Communications product group, including Test Your Ad, grew

by GBP0.9m (6%) year-on-year, notably in the UK and the US.

Communications revenue, including ad-testing, accounted 68% of all

revenue in FY23 (FY22: 62%) Brand tracking revenues increased by

GBP0.4m (13%) helped by wins in the Americas and APAC. Innovation

revenues were down in all regions, GBP2.0m (35%) lower overall than

the previous year, with the launch of Test Your Idea arriving too

late in the year to reverse the trend. The geographic spread of the

business remained similar to the previous period. The Americas

region grew for the second consecutive year helped by a buoyant

LatAm performance, and the UK again showed double-digit growth year

on year. Continental Europe was affected, particularly in the first

half of the year, by customers' budgetary response to the Ukraine

invasion and associated economic shocks.

Expenditure

Total expenditure fell by GBP0.4m versus last year, with direct

costs and administrative expenses each GBP0.2m lower. The reduction

in direct costs was due partly to lower sales volume and partly to

improved cost management, with gross profit margin rising to 84.2%

from 83.8%.

Adjusted operating expenditure

The company invested an additional GBP0.7m in customer

acquisition costs, mainly additional employee costs in Sales and

Marketing, and a further GBP0.4m in IT development in order to

accelerate the development of the platform. Adjusted operating

costs featured increased investment in the sales, marketing and IT

development teams. These investments in platform revenue growth

were funded by reductions totalling GBP1.0m in operational expenses

including savings in outsourced services and the capitalisation of

GBP1.2m platform development costs. Travel and entertaining

expenditure increased by GBP0.3m from a very low base with the

return of international travel after two years of restrictions

caused by the Covid pandemic.

Other expenditure

Other expenditure comprises expenditure items and

charges/credits which are excluded from adjusted operating

expenditure. Other expenditure was broadly unchanged year on year

with a GBP0.4m reduction in the share-based payment charge being

offset by the non-repetition of a prior-year credit relating to

IFRS16 lease impairment reversal, and reductions in sabbatical

provision releases and government innovation grant funding.

Profit before taxation

Adjusted profit before taxation for the year of GBP0.8m was

GBP0.2m lower than the previous year owing to the flow through of

slightly lower sales volumes. Likewise, statutory profit before tax

of GBP0.7m was GBP0.2m lower than last year.

Tax

The Group's effective tax rate increased from -1% (tax credit)

to 44%. This is due mainly to the impact of R&D tax credits

(GBP0.5m recognised in FY22, GBPnil in FY23). R&D claims for

FY22 and FY23 are in progress, but are yet to be approved and have

not been recognised in the financial statements.

Funding and liquidity

Cash net of debt reduced from GBP8.7m to GBP5.7m during the

year, with the outflows concentrated in H1 reflecting continued

investment in the TYX platform and customer acquisition costs

during a period of reduced customer demand in Europe following

Russia's invasion of Ukraine. A further GBP0.1m was spent on

repurchasing shares in H1 before the programme was suspended ahead

of the Group's review of strategic options in the autumn. Operating

cash flow trends improved in H2 in line with revenue and

profitability, the latter being helped by improved gross margins

and lower year-on-year adjusted operating costs. The Group repaid

in full a GBP2.5m revolving credit facility in November after

reviewing the outlook for interest rates and the expected cash

requirements and replaced it with an as-yet unutilised overdraft

facility.

Some GBP4.0m cash was invested in product innovation and

development in the year, related primarily to the TYX marketing

predictions platform, development of new intellectual property,

automated prediction products and the TYA Premium (formerly

AdRatings) database.

Litigation

On 27 September 2021, the Company filed a complaint for

trademark infringement, unfair competition and deceptive trade

practices at the United States District Court Southern District of

New York against System1 LLC ("LLC"), since renamed System1 Inc.,

an omnichannel customer acquisition marketing provider, over their

infringing use of the mark "SYSTEM1". On 30 June 2023 the Company

announced that a settlement had been reached with LLC. The parties

have signed a global agreement which governs the co-existence of

their respective use of the "System1" mark in connection with their

operations. As part of this agreement, the Company is receiving a

fixed undisclosed payment payable in instalments. The parties have

agreed to keep further detail of their agreement confidential.

CHRIS WILLFORD - CFO

Consolidated Income Statement (unaudited)

for the year ended 31 March 2023

Note 2023 2022

GBP'000 GBP'000

------------------ -------------------

Revenue 3 23,410 24,097

Cost of sales (3,692) (3,898)

------------------ -------------------

Gross profit 3 19,718 20,199

Administrative expenses (19,203) (19,383)

Other operating income 340 289

Operating profit 855 1,105

Finance expense (136) (160)

Profit before taxation 719 945

Income tax (expense)/credit (315) 10

Profit for the financial year 404 955

================== ===================

Attributable to the equity

holders of the Company 404 955

------------------ -------------------

Earnings per share attributable

to equity holders of the Company

Basic earnings per share 5 3.2p 7.4p

Diluted earnings per share 5 3.2p 7.4p

Consolidated Statement of Comprehensive Income (unaudited)

for the year ended 31 March 2023

2023 2022

GBP'000 GBP'000

=========== ==========

Profit for the financial year 404 955

=========== ==========

Other comprehensive income:

Items that may be subsequently reclassified to profit/(loss)

Currency translation differences on translating foreign operations 227 342

----------- ----------

Other comprehensive profit for the period, net of tax 227 342

Total comprehensive income for the period attributable to equity holders of the Company 631 1,297

=========== ==========

Consolidated Balance Sheet (unaudited)

as at 31 March 2023

Registered company no. 05940040

Note 2023 2022

GBP'000 GBP'000

------------- ------------

ASSETS

Non-current assets

Property, plant, and equipment 1,162 2,054

Intangible Assets 1,396 382

Deferred tax asset 203 292

------------- ------------

2,761 2,728

Current assets

Contract assets 102 198

Trade and other receivables 6,344 4,492

Income tax receivables 55 -

Cash and cash equivalents 5,719 11,174

------------- ------------

12,220 15,864

Total assets 14,981 18,592

============= ============

EQUITY

Attributable to equity holders of the Company

Share capital 132 132

Share premium account 1,601 1,601

Merger reserve 477 477

Foreign currency translation reserve 423 196

Retained earnings 5,974 5,857

------------- ------------

Total equity 8,607 8,263

------------- ------------

LIABILITIES

Non-current liabilities

Provisions 353 432

Lease liabilities 362 1,417

------------- ------------

715 1,849

Current liabilities

Provisions 101 77

Lease liabilities 1,094 1,091

Borrowings - 2,500

Contract liabilities 764 991

Income taxes payable - 267

Trade and other payables 3,700 3,554

------------- ------------

5,659 8,480

Total liabilities 6,374 10,329

Total equity and liabilities 14,981 18,592

============= ============

Consolidated Statement of Cash Flows (unaudited)

for the year ended 31 March 2023

Note 2023 2022

GBP'000 GBP'000

--------------- ------------

Net cash used in/generated from operations (87) 4,098

Tax paid (541) (63)

--------------- ------------

Net cash used in/generated from operating activities (628) 4,035

Cash flows from investing activities

Purchases of property, plant, and equipment (30) (79)

Purchase of intangible assets (1,225) (59)

--------------- ------------

Net cash used by investing activities (1,255) (138)

Net cash flow before financing activities (1,883) 3,897

Cash flows from financing activities

Interest paid (136) (161)

Property lease liability payments (1,052) (1,218)

Purchase of own shares (135) (567)

Repayment of borrowings (2,500) -

--------------- ------------

Net cash used by financing activities (3,823) (1,946)

Net (decrease)/increase in cash and cash equivalents (5,706) 1,951

Cash and cash equivalents at beginning of year 11,174 9,008

Exchange gain on cash and cash equivalents 251 215

Cash and cash equivalents at end of year 5,719 11,174

=============== ============

Office lease costs are not included within "Net cash flow before

financing activities" (the Company's key cash flow performance

indicator). "Net cash flow before financing activities", adjusted

for office leases, known by the Company as "Operating cash flow" is

shown below:

2023 2022

GBP'000 GBP'000

------------- -----------

Net cash flow before financing activities (1,883) 3,897

Net cash flow for property leases (1,115) (1,307)

------------- -----------

Operating cash flow (2,998) 2,590

------------- -----------

Consolidated Movements in Net Cash/(Debt)

Cash and Lease

cash equivalents Borrowings liabilities Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------ ----------- ------------- ---------

At 1 April 2022 11,174 (2,500) (2,508) 6,166

Cash flows (5,706) 2,500 1,051 (2,155)

Non-cash charges

Interest on lease liabilities - - (64) (64)

Exchange and other non-cash movements 251 - 65 316

At 31 March 2023 5,719 (0) (1,456) 4,263

================== =========== ============= =========

Consolidated Statement of Changes in Equity (unaudited)

for the year ended 31 March 2023

Foreign

currency

Share premium translation Retained

Note Share capital account Merger reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- --------------- --------------- --------------- --------------- --------

At 31 March 2021 132 1,601 477 (146) 5,170 7,234

Profit for the

financial year - - - - 955 955

Other

comprehensive

income:

- currency translation

differences - - - 342 - 342

Total comprehensive

income - - - 342 955 1,297

Transactions

with owners:

Employee share

options:

- value of employee

services - - - - 299 299

Purchase of treasury

shares - - - - (567) (567)

At 31 March 2022 132 1,601 477 196 5,857 8,263

============== =============== =============== =============== =============== ========

Profit for the

financial year - - - - 404 404

Other

comprehensive

income:

- currency translation

differences - - - 227 - 227

Total comprehensive

income - - - 227 404 631

Transactions

with owners:

Employee share

options:

- value of employee

services - - - - (153) (153)

Purchase of treasury

shares - - - - (134) (134)

At 31 March 2023 132 1,601 477 423 5,974 8,607

============== =============== =============== =============== =============== ========

Notes to the Consolidated Financial Statements

for the year ended 31 March 2023

1. General information

System1 Group PLC (the "Company") was incorporated on 19

September 2006 in the United Kingdom. The Company's principal

operating subsidiary, System1 Research Limited, was at that time

already established, having been incorporated on 29 December 1999.

The address of the Company's registered office is 4 More London

Riverside, London, England, SE1 2AU. The Company's shares are

listed on the AIM Market of the London Stock Exchange ("AIM").

The Company and its subsidiaries (together the "Group") provide

market research data and insight services. The Chief Executive's

Statement and the Finance Review provide further detail of the

Group's operations and principal activities.

The unaudited summary financial information set out in this

announcement does not constitute the Group's consolidated statutory

accounts for the years ended 31 March 2023 and 2022. The results

for the year ended 31 March 2023 are unaudited. The statutory

accounts for the year ended 31 March 2023 will be finalised on the

basis of the financial information presented by the Directors in

this preliminary announcement and will be delivered to the

Registrar of Companies in due course. The statutory accounts are

subject to completion of the audit and may also change should a

significant adjusting event occur before the approval of the Annual

Report.

The statutory accounts for the Group for the year ended 31 March

2022 have been reported on by the Group's auditor and delivered to

the Registrar of Companies. The auditor's report on those accounts

was unqualified and did not include references to any matter which

the auditors drew attention by way of emphasis without qualifying

their report and did not contain statements under section 498(2) or

(3) of the Companies Act 2006.

The unaudited summary financial information set out in this

announcement have been prepared using the accounting policies as

described in the 31 March 2022 audited year end statutory accounts

and have been consistently applied. The preliminary announcement

for the year ended 31 March 2023 was approved by the Board for

release on 1 August 2023.

2. Basis of preparation

The Group has prepared its consolidated financial statements in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 and applicable law.

The consolidated financial statements have been prepared under the

historical cost convention.

The preparation of financial statements in accordance with

International Financial Reporting Standards ("IFRS") requires the

use of certain critical accounting estimates. It also requires

management to exercise its judgement in the process of applying the

Group's accounting policies.

Items included in the financial statements of each of the

Group's entities are measured using the currency of the primary

economic environment in which the entity operates ("the Functional

Currency"). The consolidated financial statements are presented in

Pounds Sterling (GBP), which is the Company's functional and

presentation currency. The financial statements are presented in

round thousands unless otherwise stated.

3. Segment information

The financial performance of the Group's geographic operating

units ("Reportable Segments") is set out below.

2023 2022

----------- -----------

Revenue Revenue

GBP'000 GBP'000

----------- -----------

By location of

customer

Americas 9,428 9,043

United Kingdom 8,895 7,918

Rest of Europe 3,741 5,463

APAC 1,346 1,673

----------- -----------

23,410 24,097

Segmental revenue is revenue generated from external customers

and so excludes intercompany revenue and is attributable to

geographical areas based upon the location in which the service is

delivered.

Consolidated balance sheet information is regularly provided to

the Executive Directors (the Chief Decision-Making officers) while

segment balance sheet information is not. Accordingly, the Company

does not disclose segment balance sheet information here.

2023 2022

------------- -----------

Revenue Revenue

GBP'000 GBP'000

------------- -----------

By product type

Predict Your (data) 14,060 9,747

Improve Your (data-led consultancy) 3,311 2,683

------------- -----------

Standard (platform) revenue 17,371 12,430

Other consultancy (non-platform) 6,039 11,667

------------- -----------

Total revenue 23,410 24,097

By product group

Communications (Ad Testing) 15,879 14,955

Brand (Brand Tracking) 3,669 3,295

Innovation 3,862 5,847

------------- -----------

23,410 24,097

As the Company is domiciled in the UK, its consolidated

non-current assets, other than financial instruments and deferred

tax assets are as follows:

2023 2022

GBP'000 GBP'000

------------ ------------

Non-current assets

United Kingdom 2,204 1,846

Rest of world 354 590

------------ ------------

2,558 2,436

4. Reconciliation between Operating Costs and Adjusted Operating Costs

2023 2022

GBP'000 GBP'000

--------------------- ---------------

Administrative expenses 19,203 19,383

Finance expense 136 160

--------------------- ---------------

Total operating costs 19,339 19,543

===================== ===============

Less: Adjusting items

Impairment - (235)

Compensation for loss of

office 39 81

Bonus and commissions expense 453 268

Share-based payment expense (171) 270

Other interest expense 73 70

Other staff costs (82) (211)

Trademark litigation 111 150

--------------------- ---------------

423 393

Adjusted operating costs 18,916 19,150

===================== ===============

5. Earnings per share

2023 2022

----------- ------------

Profit attributable to equity holders of the

Company, in GBP'000 404 955

Weighted average number of Ordinary Shares

in issue 12,698,398 12,863,257

Basic earnings per share 3.2p 7.4p

Profit attributable to equity holders of the

Company, in GBP'000 404 955

Weighted average number of Ordinary Shares

in issue 12,698,398 12,863,257

Share options 12,888 12,881

----------- ------------

Weighted average number of Ordinary Shares

for diluted earnings per share 12,711,286 12,876,138

Diluted earnings per share 3.2p 7.4p

Basic earnings/(losses) per share is calculated by dividing the

profit or loss attributable to equity holders of the Company by the

weighted average number of Ordinary Shares in issue during the

year.

Diluted earnings/(losses) per share is calculated by adjusting

the weighted average number of shares outstanding assuming

conversion of all dilutive share options to Ordinary Shares.

Options are included in the determination of diluted earnings per

share if the required performance thresholds would have been met

based on the Group's performance up to the reporting date, and to

the extent that they are dilutive.

Employee options of 1.3 million (2022: 1.2 million) have not

been included in the calculation of diluted EPS because their

exercise is contingent on the satisfaction of certain criteria that

had not been met at 31 March 2023.

6. Dividends

The Company did not pay an interim dividend in the year ended 31

March 2023 and does not propose the payment of a final

dividend.

No dividends were paid to directors in the years ended 31

March

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MZGFNLMGGFZM

(END) Dow Jones Newswires

August 01, 2023 02:00 ET (06:00 GMT)

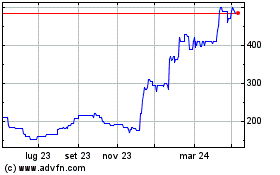

Grafico Azioni System1 (LSE:SYS1)

Storico

Da Feb 2025 a Mar 2025

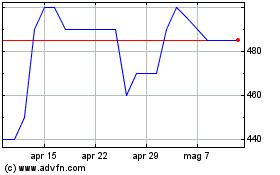

Grafico Azioni System1 (LSE:SYS1)

Storico

Da Mar 2024 a Mar 2025