Gate City Capital Management, LLC

8725 West Higgins Road, Suite 530

Chicago, IL 60631

(312) 825-1228

January 25, 2025

Warren Lada

Chairman of the Board

Saga Communications, Inc.

73 Kercheval Avenue

Grosse Pointe Farms, Michigan 48236

Dear Mr. Lada,

Gate City Capital Management, LLC (“Gate

City”) beneficially owns 13.8% of the common stock of Saga Communications, Inc. (“Saga” or the “Company”).

As long-term shareholders, our team appreciates the relationship and open dialogue we have enjoyed with you and other members of the Saga

team.

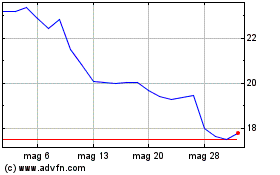

Over the past year, Gate City has been

disappointed by the Company’s financial results and subsequent decline in Saga’s share price. Our team attributes the reduction

in profitability to a sharp increase in expenses as Saga pursues a digital strategy. Based on the questions I poised to the board and

management team at the annual meeting, this additional spending appears to have been made with little consideration to the return on investment

of these expenditures and with few financial targets in place to determine whether this spending ultimately proved successful. The increase

in digital spending also appears to have been rushed, as evidenced by the elevated level of turnover observed for digital employees and

the recent termination of the relationship with a digital services partner that was not profitable for Saga. The capital allocation policies

of Saga have also been disappointing, with Saga overpaying for the recent acquisition and failing to repurchase any meaningful shares

despite a large decline in the share price.

To reverse these disappointing results, Gate City proposes the

following value-accretive policies:

| · | Significantly reduce spending on digital initiatives and partner with a third party that possesses

the resources and expertise required to successfully execute the Company’s digital strategy. |

| · | Implement a cost cutting program to better align Station Operating Expenses with revenues and return

Corporate, General, and Administrative expenses to under $10 million annually. |

| · | Commit to refreshing the Board of Directors. |

| · | Revise management's incentive compensation structure to incorporate value-enhancing financial metrics

such as free cash flow generation and return on invested capital to align with long-term shareholder value creation. |

| · | Utilize the Company’s cash balance to aggressively repurchase stock at or near current prices

and initiate negotiations with the Edward K. Christian Trust to purchase the trust’s remaining shares. |

| · | Discontinue the pursuit of any new acquisitions until Saga’s profitability returns to historical

levels and the Company’s valuation more accurately reflects its intrinsic value. |

Our team is excited to work with you to implement these proposals

and create long-term value for shareholders. We are available to travel to Grosse Pointe Farms to discuss these opportunities at your

earliest convenience.

Michael Melby, CFA, FRM

Founder and Portfolio Manager

Gate City Capital Management, LLC

CC: Saga Communications Board of Directors

Gate City Capital Management, LLC

8725 West Higgins Road, Suite 530

Chicago, IL 60631

(312) 825-1228

February 10, 2025

Corporate Secretary

Saga Communications, Inc.

73 Kercheval Avenue

Grosse Pointe Farms, Michigan 48236

Re: Notice of Intent to Nominate Directors at the Company’s

2025 Annual Meeting of Shareholders

To Whom It May Concern,

In accordance with the Schedule 14A filed

for the registrant Saga Communications, Inc. (“Saga” or the “Company”) for its 2024 Annual Meeting

of Shareholders (the “2024 Proxy”) and the Company Bylaws (dated as of April 20, 2020) (the “Bylaws”),

Gate City Capital Management, LLC (“Gate City”) shall nominate the following individuals for election as directors

to the Board of Directors (the “Board”) of Saga at the Company’s 2025 Annual Meeting of Stockholders (the “2025

Annual Meeting”): Michael T. Melby, Nicholas J. Bodnar, Ryan A. Hornaday, and Christopher T. Young.

We understand from the 2024 Proxy that

the Board will be comprised of seven members. Holders of the Class A Common Stock will vote as a single class for all seven directors,

with each share of Class A Common Stock entitled to one vote. Holders of Class A Common Stock are not entitled to cumulative voting in

the election of directors. Each nominee has agreed to serve as a director if elected. We believe that all of these nominees, as required

by Saga’s Corporate Governance Guidelines, possess the highest personal and professional ethics, integrity, and values, and are

committed to representing the long-term interests of the shareholders as a whole. Further, each nominee has demonstrated business acumen

and has committed to serve on the Board. We have determined that each nominee meets the standards for “independent” directors

within the meaning of NASDAQ’s listing requirements and based on the Board’s application of the standards of independence

set forth in our Corporate Governance Guidelines. Further we intend to file with the Securities and Exchange Commission a notice that

sets forth the information required by Rule 14a-19 under the Securities Exchange Act not later than March 14, 2025.

In accordance with the 2024 Proxy (applicable

section detailed below), we provide the following information concerning Mr. Michael T. Melby.

Shareholder proposals which are not to be included in our

proxy statement for the 2025 Annual Meeting of Shareholders and shareholder nominations of persons for election to the Board must be submitted

in accordance with our bylaws, which set forth the information that must be received no later than February 12, 2025 (with respect to

proposals) and February 11, 2025 (with respect to nominations).

Source: Saga 2024 Proxy

| 1. | The nominee’s name, age, principal occupation and employer. |

Michael T. Melby (44), Founder and Portfolio Manager of

Gate City Capital Management, LLC

| 2. | The nominee’s business address and residential address and telephone number. |

Business Address: 8725 West Higgins Road, Suite 530,

Chicago, IL 60631

Home Address: (Provided to the Company)

Business Phone: (Provided to the Company)

Home Phone:

(Provided to the Company)

| 3. | A biographical profile of the nominee, including educational background and business and professional

experience. |

Michael Melby is the founder and portfolio manager

of Gate City Capital Management, a micro-cap value focused investment firm. Before starting Gate City, Michael worked as a research analyst

at Crystal Rock Capital Management where he covered the consumer, restaurant, retail, and gaming sectors. Michael previously worked at

Deutsche Bank Securities in their Debt Capital Markets group and at the University of Notre Dame Investment Office where he focused on

natural resources, fixed income, and risk management. Michael earned an MBA from the University of Chicago Booth School of Business where

he graduated with Honors and a BBA in Finance from the University of Notre Dame where he graduated Summa Cum Laude. Michael is a CFA Charterholder

and has earned the Financial Risk Manager designation.

Gate City believes that Mr. Melby’s qualifications

to serve on the Board of Directors include his vast investing experience and executive experience. Gate City believes Mr. Melby brings

executive, investment, and capital allocation experience and Gate City strongly supports the nomination of Mr. Melby for election to the

Board of Directors of the Company at its 2025 Annual Meeting of Stockholders.

A copy of Mr. Melby’s biographical sketch is enclosed.

| 4. | Any relationship between the nominee and the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and all other information necessary for the Board to determine whether

the nominee meets the Board’s independence standards and qualifies as independent. |

Mr. Melby is the Founder and Portfolio Manager of Gate

City Capital Management, LLC. Gate City serves as an adviser to and manages certain funds and accounts that are shareholders of Saga.

| 5. | The classes and number of shares of stock of the Company beneficially and of record owned by the nominee. |

Through his affiliation with Gate City, Mr. Melby has

beneficial ownership of 863,845 shares of Class A stock of the Company. Gate City is not the record holder of any shares.

| 6. | Any other information relating to the nominee (including a written consent of the nominee to serve as

a Director if elected) that would be

required to be disclosed in a proxy statement or other filing required to be made in connection with the solicitation of proxies for the

election of Directors pursuant to the SEC’s proxy rules; and |

| 7. | Any other information regarding the nominee that the Shareholder wishes the Board to consider in evaluating

the recommended nominee. |

Mr. Melby’s written consent letter is enclosed.

In accordance with the Company’s 2024 Proxy, we provide the

following information concerning Mr. Nicholas J. Bodnar

| 1. | The nominee’s name, age, principal occupation and employer. |

Nicholas J. Bodnar (34), Partner, Gate City Capital Management,

LLC

| 2. | The nominee’s business address and residential address and telephone number. |

Business Address: 8725 West Higgins Road, Suite 530,

Chicago, IL 60631

Home Address: (Provided to the Company)

Business Phone: (Provided to the Company)

Home Phone:

(Provided to the Company)

| 3. | A biographical profile of the nominee, including educational background and business and professional

experience. |

Mr. Bodnar has been a Partner at Gate City Capital Management

since 2016. Prior to that, he earned a Bachelor’s degree in Economics from The University of Michigan-Flint.

Gate City believes that Mr. Bodnar’s qualifications

to serve on the Board of Directors include his vast investing, executive, and industry experience. Gate City believes Mr. Bodnar brings

executive, investment, industry, and capital allocation experience and Gate City strongly supports the nomination of Mr. Bodnar for election

to the Board of Directors of the Company at its 2025 Annual Meeting of Stockholders.

A copy of Mr. Bodnar’s biographical sketch is enclosed.

| 4. | Any relationship between the nominee and the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and all other information necessary for the Board to determine whether

the nominee meets the Board’s independence standards and qualifies as independent. |

Mr. Bodnar is a Partner at Gate City Capital Management,

LLC. Gate City serves as an adviser manages certain funds and accounts that are shareholders of Saga.

| 5. | The classes and number of shares of stock of the Company beneficially and of record owned by the nominee. |

At present, Mr. Bodnar does not hold any shares of stock

of the Company

| 6. | Any other information relating to the nominee (including a written consent of the nominee to serve as

a Director if elected) that would be

required to be disclosed in a proxy statement or other filing required to be made in connection with the solicitation of proxies for the

election of Directors pursuant to the SEC’s proxy rules; and |

| 7. | Any other information regarding the nominee that the Shareholder wishes the Board to consider in evaluating

the recommended nominee. |

Mr. Bodnar’s written consent letter is enclosed.

In accordance with the Company’s 2024 Proxy, we provide the

following information concerning Mr. Ryan A. Hornady

| 1. | The nominee’s name, age, principal occupation and employer. |

Ryan A. Hornaday (51),

Executive Vice President, Chief Financial Officer

and Treasurer

Emmis Corporation

| 2. | The nominee’s business address and residential address and telephone number. |

Business address:

40 Monument Circle, Suite 700

Indianapolis, IN 46204

Residential address:

(Provided to the Company)

Phone number: (Provided to the Company)

| 3. | A biographical profile of the nominee, including educational background and business and professional

experience. |

Mr. Hornaday has over 25 years of public company experience

in the radio industry and has served as Chief Financial Officer of Emmis Corporation since 2015. From 2019 to 2021, Mr. Hornaday also

served as Chief Financial Officer of MediaCo Holding, Inc., which owns and operates two radio stations in New York City. From 1999 to

2015, Mr. Hornaday served in various finance, treasury, and investor

relations roles at Emmis. From 1996 to 1999, Mr. Hornaday

worked for Arthur Andersen in its audit practice. Mr. Hornaday graduated Summa Cum Laude from Ball State University in 1996.

Gate City believes that Mr. Hornaday’s qualifications

to serve on the Board of Directors include his vast executive, industry, and board experience. Gate City believes Mr. Hornaday brings

executive, industry, and capital allocation experience and Gate City strongly supports the nomination of Mr. Hornaday for election to

the Board of Directors of the Company at its 2025 Annual Meeting of Stockholders.

A copy of Mr. Hornaday’s biographical sketch is enclosed.

| 4. | Any relationship between the nominee and the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the

Company) and all other information necessary for the Board to determine whether the nominee meets the Board’s independence standards

and qualifies as independent. |

No business relationship exists between Mr. Hornaday

and the Company, directly or indirectly, and that Mr. Hornaday would qualify as an independent director

| 5. | The classes and number of shares of stock of the Company beneficially and of record owned by the nominee. |

At present, Mr. Hornaday does not hold any shares of stock

of the Company

| 6. | Any other information relating to the nominee (including a written consent of the nominee to serve as

a Director if elected) that would be

required to be disclosed in a proxy statement or other filing required to be made in connection with the solicitation of proxies for the

election of Directors pursuant to the SEC’s proxy rules; and |

| 7. | Any other information regarding the nominee that the Shareholder wishes the Board to consider in evaluating

the recommended nominee. |

Mr. Hornaday’s written consent letter is enclosed.

In accordance with the Company’s 2024 Proxy, we provide the

following information concerning Mr. Christopher Young.

| 1. | The nominee’s name, age, principal occupation and employer. |

Christopher T. Young, 56

Chief Financial Officer – The Weather Channel

EVP - Allen Media Group

| 2. | The nominee’s business address and residential address and telephone number. |

Business: The Weather Channel, 300 Interstate North

Parkway SE, Atlanta, GA, 30339 Residential: (Provided to the Company)

| 3. | A biographical profile of the nominee, including educational background and business and professional

experience. |

Christopher T. Young has been the Weather Channel's

Chief Financial Officer and Executive Vice President, Allen Media Group since July 2024. Previously, he was the Chief Financial Officer

of Entravision Communications, one of the largest Spanish language media companies traded on the New York Stock Exchange. Prior to that,

Christopher served as president of Vista Media, a Los Angeles based outdoor advertising company from 2004 until 2008. From 2000 to 2004,

Mr. Young served as Vista Media's Chief Financial Officer. Prior to Vista Media, Christopher worked with the Bank of Montreal, where he

was responsible for corporate finance activity for the broadcasting and outdoor advertising industries. Mr. Young’s prior experience

includes tenures at both the Bank of Tokyo in its corporate finance group and the Chase Manhattan Bank. Mr. Young holds a Bachelor of

Arts degree in Economics from Columbia University.

Gate City believes that Mr. Young’s qualifications

to serve on the Board of Directors include his vast executive, industry, and board experience. Gate City believes Mr. Young brings executive,

industry, and capital allocation experience and Gate City strongly supports the nomination of Mr. Young for election to the Board of Directors

of the Company at its 2025 Annual Meeting of Stockholders.

A copy of Mr. Young’s biographical sketch is enclosed.

| 4. | Any relationship between the nominee and the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the

Company) and all other information necessary for the Board to determine whether the nominee meets the Board’s independence standards

and qualifies as independent. |

No business relationship exists between Mr. Hornaday

and the Company, directly or indirectly, and that Mr. Hornaday would qualify as an independent director

| 5. | The classes and number of shares of stock of the Company beneficially and of record owned by the nominee. |

At present, Mr. Young does not hold any shares of stock

of the Company

| 6. | Any other information relating to the nominee (including a written consent of the nominee to serve as

a |

Director if elected) that would be

required to be disclosed in a proxy statement or other filing required to be made in connection with the solicitation of proxies for the

election of Directors pursuant to the SEC’s proxy rules; and

| 7. | Any other information regarding the nominee that the Shareholder wishes the Board to consider in evaluating

the recommended nominee. |

Mr. Young’s written consent letter is enclosed.

In addition, Gate City provides the following information.

| 1. | Gate City’s full name, principal occupation, and employer. |

Gate City is a registered investment advisor to institutional

and high net worth investors. Gate City is not acting in concert with any affiliate or other person in connection with this nomination.

| 2. | Gate City’s address and telephone number. |

Gate City’s principal offices are located at 8725

West Higgins Road, Suite 530, Chicago, IL 60631

(312) 825-1228.

| 3. | The classes and number of shares of stock of the Company owned beneficially and of record by Gate City,

including, if Gate City is not a Shareholder of record, proof of ownership of the type referred to in the SEC’s proxy rules. |

As of February 10, 2025, Gate City was the beneficial owner

of 863,845 shares of the Company’s Class A common stock, representing 13.8% of the outstanding shares of the Class A common stock.

A copy of the most recent Schedule 13D filed on behalf of Gate City and its affiliates, dated January 8, 2025 is enclosed.

As of January 8, 2025, Gate City was not the record owner

of any of the Company’s Class A common stock.

| 4. | A description of all arrangements and understandings between Gate City and each nominee being nominated by Gate City and any other person or persons (including

their names) pursuant to which the nominee is being recommended by the Shareholders; and |

| 5. | Any other information relating to Gate City that would be required to be disclosed

in a proxy statement or other filing required to be made in connection with the solicitation of proxies for the election of Directors

pursuant to the SEC’s proxy rules. |

There are no arrangements or understanding between Gate

City and Mr. Melby, Mr. Bodnar, Mr. Hornaday, and Mr. Young or others pursuant to which Mr. Melby, Mr. Bodnar, Mr. Hornady and Mr. Young

are being nominated by Gate City.

| 6. | Whether Gate City intends to deliver a proxy statement and form of proxy to holders. |

Gate City may determine to deliver a proxy statement and

form of proxy.

Gate City and the nominees agree to make available to the

Board of Directors all information reasonably requested in furtherance of the valuation of this nomination

This letter and all attachments hereto are submitted in a

good faith effort to satisfy Saga requirements. Should this letter and/or any attachment hereto be deemed deficient in any way, please

contact me at the above address and phone number above so that any deficiency may be cured. Gate City reserves all rights available to

it under applicable law.

This letter and all attachments hereto are submitted in

a good faith effort to satisfy Saga requirements under the 2024 proxy and its Articles and Bylaws. Should this letter and/or any

attachment hereto be deemed deficient in any way, please contact me at the above address and phone number above so that any

deficiency may be cured in a timely matter. In the absence of such prompt notice, Gate City will assume that the Company agrees that

this letter complies in all respects with the requirements. Gate City reserves all rights to substitute a director nominee in the

event that any nominee is unable to, or for good cause will not, serve as a nominee or director. The provision of this letter is not

an admission that the procedures set forth in the proxy or Bylaws are legal, valid or binding. In addition, the Gate City reserves

all rights to challenge the validity of the proxy and Bylaws and reserves all rights to assert a claim for any damages or costs that

Gate City or its affiliates may sustain or incur, including attorneys’ fees, in connection with disputes over the validity of

this letter or the Bylaws. Gate City reserves the right to withdraw or modify this letter at any time. Gate City reserves all rights

available to it under applicable law, rule and regulation.

Gate City intends to be present at the

2025 Annual Meeting of Stockholders in person or by proxy to nominate Mr. Melby, Mr. Bodnar, Mr. Hornaday, and Mr. Young to serve as directors

of the Company, and Gate City intends to continue to own the shares of the Company through the date of the Annual Meeting.

Sincerely,

Michael Melby

Founder and Portfolio Manager

| Cc: | Saga Board of Directors |

| | Sam Bush – Chief Financial Officer - Saga |

Grafico Azioni Saga Communications (NASDAQ:SGA)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Saga Communications (NASDAQ:SGA)

Storico

Da Apr 2024 a Apr 2025