Accredited Home Lenders Holding Co. to Acquire Aames Investment Corp.; Combination Will Triple Accredited's National Retail Mor

25 Maggio 2006 - 2:15PM

Business Wire

Accredited Home Lenders Holding Co. (Nasdaq:LEND), a nationwide

mortgage company specializing in non-prime residential mortgage

loans, and Aames Investment Corporation (NYSE:AIC) today announced

a definitive agreement pursuant to which Accredited will acquire

Aames. Aames originates non-prime mortgage loans through a network

of 76 retail branch offices and three regional wholesale operations

centers, while Accredited originates non-prime mortgage loans

through 45 retail branches and 15 regional wholesale operations

centers. As a result of the acquisition, the combined business is

expected to attain the following rankings in the non-prime

industry: -- Sixth largest retail originator -- Twelfth largest

overall originator -- Ninth largest non-prime mortgage portfolio --

Nineteenth largest servicing portfolio "Aames' nationwide franchise

will almost triple Accredited's retail branches, creating one of

the nation's largest independent retail originators," said James A.

Konrath, chairman and chief executive officer of Accredited. "Aames

has a strong retail platform headed by two experienced, savvy

senior managers who understand running a business for profit." Mr.

Konrath added, "In addition to the benefits to our retail platform,

we expect to reduce non-interest expenses significantly by

eliminating redundant overhead and operating costs, as well as by

merging Aames' wholesale group with little overlap. Also, we

anticipate being able to improve Aames' profitability by enhancing

the execution of whole-loan sale and securitization activity, as

well as lowering the cost of funds." The stock-and-cash transaction

values Aames at approximately $340 million, or $5.35 per share at

yesterday's closing prices. Of the $340 million purchase price,

approximately $109 million, or 32% of the purchase price, will be

paid in cash to Aames stockholders. The remainder will be paid in

Accredited's common stock at an exchange ratio of 0.0700 shares of

Accredited's common stock for each share of Aames common stock.

Aames may be required to distribute dividends to stockholders to

satisfy certain REIT tax requirements. The amount of the total

consideration represented by cash will be reduced by REIT

dividends, if any, to Aames stockholders between now and closing.

"This transaction allows our stockholders to participate in the

future opportunities of a company with deep financial resources and

proven operational skills," said A. Jay Meyerson, chairman and

chief executive officer of Aames. "Accredited already ranks among

the most profitable and lowest cost originators, and it offers the

best platform for the continued development of our unique retail

business." Integration The companies share many similarities in

cultures and business approaches. Both companies rely on both

wholesale and retail channels to originate non-prime mortgages.

Accredited intends to retain substantially all of Aames' retail

operations. Accredited will integrate Aames' wholesale operations

into its existing wholesale business. Michael Matthews, chief

production officer at Aames, will become director of integration of

wholesale and retail operations at Accredited. James Fullen, chief

operations officer at Aames, will become Accredited's director of

retail operations. In addition, Mr. Meyerson will join Accredited's

board, along with one other nominee proposed by Aames. "This

acquisition will allow us to build on the strength of our proven

business model, which emphasizes profitable origination and

portfolio growth, minimize our net cost to originate, and leverage

our experienced management team," Mr. Konrath added. "The non-prime

mortgage experience and talent throughout Aames is a terrific

cultural fit with Accredited. We are pleased to offer Aames'

stockholders this exceptional opportunity to share in the growth of

Accredited's platform." The agreement has been unanimously approved

by both companies' boards. A condition of closing is approval by

both companies' stockholders, as well as regulatory authorities and

customary closing conditions. The transaction is expected to close

during the third quarter. "This combined company will achieve

significant synergies and bring together two strong management

teams with records of prudent growth," said Mr. Meyerson of Aames.

"Today's capital markets climate limits our ability to economically

raise new capital to fuel our future growth. Accredited, with its

strong operating skills and capital base, is well positioned to

move our people and our operations to the next level and reward our

stockholders." Financial Expectations Anticipating a closing date

in the third quarter, Accredited anticipates a dilutive impact on

earnings per share in 2006 of $1.00 to $1.35 per share, depending

on the actual closing date. Accredited expects the transaction to

be accretive to GAAP earnings in 2007. The accretion assumes, among

other items, improvement in Aames' cost to originate, whole loan

sale execution and financing costs. In addition, Accredited expects

to receive a benefit in its cash tax payments from a portion of

Aames' unused net operating tax loss carry-forwards.

Representations Accredited Home Lenders Holding Co. is represented

in the transaction by its financial advisor, J.P. Morgan Securities

Inc., and its legal counsel, DLA Piper Rudnick Gray Cary. Aames

Investment Corporation is represented by its financial advisor,

Credit Suisse, Inc., and its legal counsel, Sullivan & Cromwell

LLP. Conference Call Accredited will host a conference call on May

25, 2006 at 1 p.m. EDT (10 a.m. PDT) to discuss the transaction.

The call will be available by telephone and webcast. The telephone

number for the conference call is 866-713-8563 for callers in the

United States, or 617-597-5311 for international callers. The

participant passcode is 70029313. The call will be webcast by CCBN

and can be accessed live at Accredited's website --

http://investors.accredhome.com. A replay of the conference call

will be archived on the website, as well as the accompanying slide

presentation. About Accredited Home Lenders Holding Co. Accredited

Home Lenders Holding Co. is a mortgage company operating throughout

the U.S. and in Canada. Accredited originates, finances,

securitizes, services and sells non-prime mortgage loans secured by

residential real estate. Founded in 1990, the company is

headquartered in San Diego with a market capitalization of

approximately $1.2 billion, 2005 originations of $16.6 billion, a

$9.7 billion portfolio as of December 31, 2005 and $156 million of

net income for 2005. Accredited's experienced management team,

profit-centered culture, leading cost structure and strong capital

markets relationships have enabled it to deliver exceptional

results to shareholders, including 540% cumulative return since its

IPO in February 2003 as of March 31, 2006. Accredited's earnings

per share has grown at a compound annual growth rate of 19% over

the past two years. Additional information may be found at

http://investors.accredhome.com. About Aames Investment Corp.

Headquartered in Los Angeles, Calif., Aames originates mortgage

loans in 47 states. Aames Financial is a 50-year-old national

mortgage banking company focused primarily on originating non-prime

residential mortgage loans through wholesale and retail channels

under the name "Aames Home Loan." Additional information may be

found at www.aames.com. Forward-Looking Statements Certain matters

discussed in this news release, including without limitation the

expected benefits of the merger, constitute forward-looking

statements within the meaning of the federal securities laws.

Actual results and the timing of certain events could differ

materially from those projected in or contemplated by these

forward-looking statements due to a number of factors, including

but not limited to: interest rate volatility and the level of

interest rates generally; the nature and amount of competition and

the availability of alternative loan products not offered by the

company; general political and economic conditions; the

sustainability of loan origination volumes; the availability of

financing for the origination of mortgage loans; the ability of the

company to sell or securitize mortgage loans; the company's ability

to grow its portfolio; the ability of the company to manage costs;

and other risk factors as outlined in Accredited Home Lenders

Holding Co.'s and Aames Investment Corporation's annual reports on

Form 10-K for the period ended December 31, 2005, their reports on

Form 10-Q for the first quarter of 2006, and other documents filed

with the SEC. Additional Information In connection with the pending

transaction, Accredited Lenders Holding Co. ("Accredited") will

file with the SEC a Registration Statement on Form S-4 containing a

Proxy Statement/Prospectus for the stockholders of Aames Investment

Corporation ("Aames"). Aames stockholders are urged to read the

Registration Statement and the Proxy Statement/Prospectus when they

are available, as well as all other relevant documents filed or to

be filed with the SEC, because they will contain important

information about Accredited, Ames and the proposed transaction.

The final Proxy Statement/Prospectus will be mailed to stockholders

of Aames after the Registration Statement is declared effective by

the SEC. Aames stockholders will be able to obtain the Registration

Statement, the Proxy Statement/Prospectus and any other relevant

filed documents for free at the SEC's website (www.sec.gov). These

documents can also be obtained for free from Accredited Home

Lenders by directing a request to Investor Relations, 15090 Avenue

of Science, San Diego, CA 92128. Accredited, Aames and their

respective directors and officers may be deemed to be participants

in the solicitation of approvals from Aames stockholders in respect

of the proposed transaction. Information regarding the participants

of Accredited and Aames will be available in the Proxy

Statement/Prospectus, which will be filed with the SEC. Additional

information regarding the interests of such participants will be

included in the Registration Statement containing the Proxy

Statement/Prospectus that will be filed with the SEC.

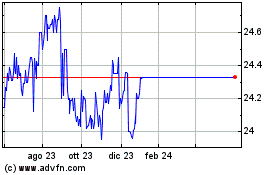

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Mar 2025 a Mar 2025

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Mar 2024 a Mar 2025