Air Lease Corporation Announces Closing of Offering of €600 Million of Senior Unsecured Medium-Term Notes

28 Marzo 2024 - 11:31AM

Business Wire

Air Lease Corporation (NYSE: AL) (the “Company”) announced the

closing on March 27, 2024 of its previously announced offering of

€600 million aggregate principal amount of 3.70% senior unsecured

medium-term notes due April 15, 2030 (the “Notes”). The Notes

mature on April 15, 2030 and bear interest at a rate of 3.70% per

annum, payable annually in arrears on April 15 of each year,

commencing on April 15, 2024.

“We are pleased to announce the successful closing of our

inaugural EUR bond offering. The deal saw strong support and

subscription from a broad array of European and global investors

allowing us to upsize the transaction and price at an attractive

cost of funds. The EUR market will serve as another strategic

component of our global funding program as we seek to diversify our

sources of liquidity,” said Greg Willis, Executive Vice President

& Chief Financial Officer of Air Lease Corporation.

The Company intends to use the net proceeds of the offering for

general corporate purposes, which may include, among other things,

the purchase of commercial aircraft and the repayment of existing

indebtedness.

BBVA, Deutsche Bank, J.P. Morgan, NatWest Markets, and Societe

Generale acted as joint book-running managers for the offering of

the Notes.

The Notes were offered pursuant to the Company’s effective shelf

registration statement, previously filed with the Securities and

Exchange Commission (the “SEC”) on May 7, 2021, and a pricing

supplement, dated March 20, 2024, supplementing the prospectus

supplement, dated May 7, 2021, supplementing the base prospectus,

dated May 7, 2021.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy the Notes, nor shall there be any

sale of the Notes in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements relating to the intended use of

proceeds. Such statements are based on current expectations and

projections about the Company’s future results, prospects and

opportunities and are not guarantees of future performance. Such

statements will not be updated unless required by law. Actual

results and performance may differ materially from those expressed

or forecasted in forward-looking statements due to a number of

factors, including but not limited to unanticipated cash needs, and

those risks detailed in the Company’s filings with the SEC,

including the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240328618678/en/

Investors:

Jason Arnold Vice President, Investor Relations

Phone: +1 310.553.0555 Email: investors@airleasecorp.com

Media:

Laura Woeste Senior Manager, Media & Investor Relations

Ashley Arnold Senior Manager, Media & Investor Relations

Phone: +1 310.553.0555 Email: press@airleasecorp.com

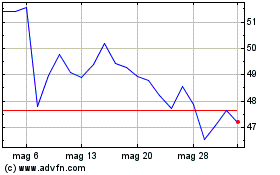

Grafico Azioni Air Lease (NYSE:AL)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Air Lease (NYSE:AL)

Storico

Da Mar 2024 a Mar 2025