UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant

☒

Filed by a Party other than the ☐

Registrant

Check the appropriate box:

| |

☐ |

|

Preliminary Proxy Statement |

| |

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☒ |

|

Definitive Proxy Statement |

| |

☐ |

|

Definitive Additional Materials |

| |

☐ |

|

Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

| |

| Templeton Global Income Fund |

| |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| |

☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

(5) |

Total fee paid: |

| |

|

|

| |

|

|

| |

☐ |

|

Fee paid previously with preliminary materials. |

| |

☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

|

|

|

|

| |

|

|

| |

|

(1) |

|

Amount previously Paid:

|

| |

|

|

| |

|

(2) |

|

Form, schedule or registration statement No.:

|

| |

|

|

| |

|

(3) |

|

Filing party:

|

| |

|

|

| |

|

(4) |

|

Date filed:

|

Templeton

Global Income Fund

September 26, 2023

Dear Shareholder:

You are cordially invited to attend the Special

Meeting of Shareholders (the “Special Meeting”) of Templeton Global Income Fund (the “Fund”) to be held on October 25, 2023 at 12:00 p.m., Eastern Time. You will be able to participate in the Special Meeting and vote by visiting www.virtualshareholdermeeting.com/GIM2023SM.

At the Special Meeting, shareholders of the

Fund (“Shareholders”) will vote on a proposal to approve a new investment management agreement between the Fund and Saba Capital

Management, L.P. (“Saba” and such new investment management agreement, the “New Management Agreement”). If approved,

the New Management Agreement will replace the current amended and restated investment management agreement, dated June 1, 2014, as amended

on May 13, 2020, between the Fund and Franklin Advisers, Inc. (“Franklin”), the Fund’s current investment adviser, (the

“Existing Management Agreement”).

In light of the Fund’s

underperformance, the Board of Trustees of the Fund (the “Board”) established a special committee, consisting solely of

independent trustees who have no affiliation with Franklin or Saba (the “Special Committee”), to, among other things,

evaluate and explore potential avenues, options or alternatives to improve the Fund’s performance. The Special Committee

ultimately decided to commence a search for and select a new investment adviser for the Fund. The Board, with the trustees of the

Board affiliated with Saba having recused themselves (the “Unaffiliated Board”), recommended the selection of Saba as

the Fund’s investment manager as a result of a request for proposal (“RFP”) process.

At a meeting of the Board held on August 14,

2023, the Unaffiliated Board, including all of the trustees of the Board who are not “interested persons” of the Fund as such

term is defined under the Investment Company Act of 1940, as amended (the “1940 Act” and such trustees, the “Non-interested

Trustees”), after careful consideration and upon the recommendation of the Special Committee, determined to select Saba to serve

as the investment manager of the Fund and to assume responsibility for providing the investment management services that are currently

provided to the Fund by Franklin (the “Adviser Transition”), and to approve the New Management Agreement in connection with

such Adviser Transition. The New Management Agreement must also be approved by Shareholders to become effective.

As described in the accompanying Proxy Statement,

while certain terms of the New Management Agreement differ from the terms of the Existing Management Agreement in certain respects, there

will be no change in investment management fees payable by the Fund under the New Management Agreement. Upon the effective date of the

New Management Agreement, all investment management and administrative services will no longer be provided by Franklin or Franklin Templeton

Services, LLC, the Fund’s current administrator. The Fund expects, at its expense, to retain a third-party independent administrator

to provide administrative services to the Fund.

The Unaffiliated Board, including all of

the Non-interested Trustees, has approved the New Management Agreement and believes it to be in the best interests of the Fund and its

Shareholders. Subject to obtaining approval by Shareholders of the New Management Agreement, and to the satisfaction of various other

conditions that are described in the enclosed Proxy Statement, it is expected that the Adviser Transition will be effected on the date

the New Management Agreement becomes effective.

Proposed Changes

| · | There is no proposed change to the Fund’s investment objective of seeking high current income and

capital appreciation. |

| · | Shareholders are being asked to make the Fund’s investment objective

“non-fundamental” in order to provide the Fund with greater investment flexibility subsequent to the Adviser Transition, such

that in the event a change in the objective is sought in the future, which is not currently expected, the Board

can effectuate that change without shareholder approval. |

| · | If Shareholders approve the New Management Agreement, upon the Adviser Transition, the Fund would also

expand its principal investment strategy to invest globally in debt and equity securities of public and private companies, which includes,

among other things, investments in closed-end funds, special purpose acquisition companies, and public and private debt instruments. The

expanded strategy would also allow the Fund to utilize derivatives, including total return swaps, credit default swaps, options and futures,

in seeking to enhance returns and/or to reduce portfolio risk. In addition, on an opportunistic basis, the Fund may also invest up to

15% of its total assets in private funds that focus on debt, equity or other investments consistent with the Fund’s investment objective. |

| · | In light of the aforementioned expanded strategy, shareholders are also being asked to remove the Fund’s

current fundamental policy mandating that at least 65% of the Fund’s total assets be invested in at least three countries and in

various types of debt instruments. |

| · | Following the completion of the Adviser Transition, the Fund’s name will change to “Saba Capital

Income & Opportunities Fund II”. The common shares of the Fund will continue to be listed on the New York Stock Exchange, although

the ticker symbol will change upon the change in the name of the Fund to “SABA”. |

These proposed changes may result in corresponding

changes to the Fund’s risk profile. For the risks associated with the proposed changes in the investment strategy upon the Adviser

Transition, please refer to our response to Q8 in the Q&A section of the Proxy Statement.

Further details regarding the business to be

conducted at the Special Meeting are more fully described in the accompanying Notice of Special Meeting and Proxy Statement.

It is important that your shares be represented

at the Special Meeting. If you are unable to attend the Special Meeting virtually, I urge you to complete, date and sign the enclosed

proxy card and promptly return it in the envelope provided, vote your shares by telephone, or vote via the Internet. Your vote is important.

| |

| Sincerely yours, |

| Garry Khasidy |

| Chairperson of the Special Committee and Trustee on the Board |

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting of

Shareholders

to Be Held on OCTOBER 25, 2023.

This Proxy Statement and Notice of the Special

Meeting of Shareholders are

available at: www.proxyvote.com

The following information applicable to the

Special Meeting may be found in the Proxy Statement and accompanying proxy card:

| |

• |

|

The date, time and location of the Special Meeting; |

| |

• |

|

A list of the matters intended to be acted on and our recommendations regarding those matters; |

| |

• |

|

Any control/identification numbers that you need to access your proxy card; and |

| |

• |

|

Information about attending the Special Meeting and voting. |

Templeton

Global Income Fund

September 26, 2023

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 25, 2023

To the Shareholders of Templeton Global Income

Fund:

The Special Meeting of Shareholders (the “Special

Meeting”) of Templeton Global Income Fund (the “Fund”) will be held on October 25, 2023 at 12:00 p.m., Eastern Time for

the following purposes:

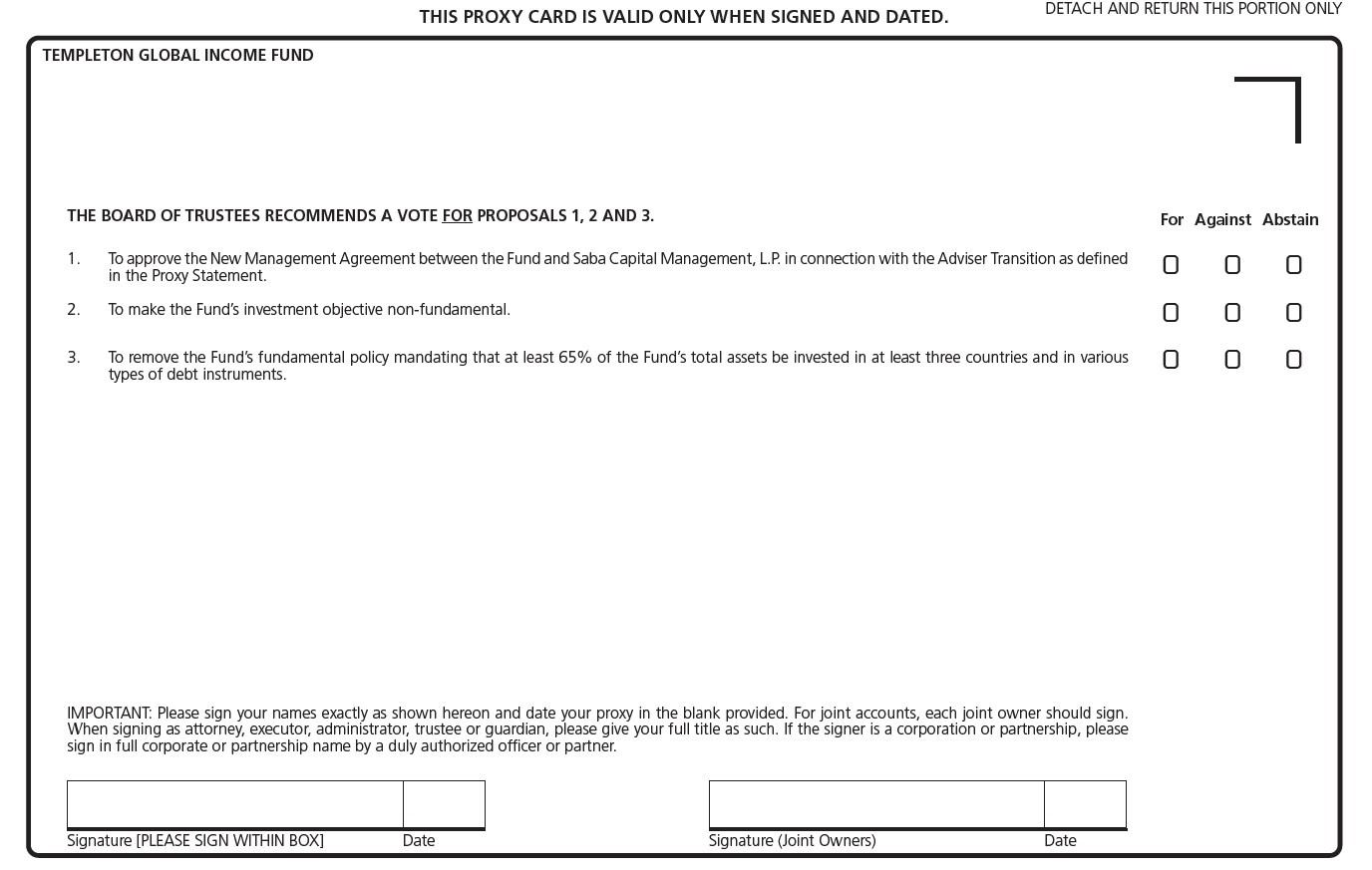

| |

1. |

To approve the New Management Agreement (as defined below) between the Fund and Saba Capital Management, L.P.; |

| |

2. |

To

make the Fund’s investment objective non-fundamental; and |

| |

3. |

To remove the Fund’s fundamental policy mandating that at least 65% of the Fund’s total assets be invested in at least three countries and in various types of debt instruments. |

You will be able to participate in the Special

Meeting and vote by visiting www.virtualshareholdermeeting.com/GIM2023SM. Prior to the Special Meeting you will be able

to vote electronically at www.proxyvote.com.

THE UNAFFILIATED BOARD UNANIMOUSLY RECOMMENDS THAT

YOU VOTE “FOR” EACH OF THE PROPOSALS.

Each proposal is discussed in greater detail

in the enclosed Proxy Statement. You have the right to receive notice of and to vote at the Special Meeting if you were a shareholder

of the Fund (“Shareholder”) of record at the close of business on September 15, 2023. Whether or not you expect to attend

the Special Meeting virtually, please sign the enclosed proxy and return it promptly in the self-addressed envelope provided, submit

your vote by calling toll free at the telephone number indicated on the enclosed proxy card, or submit your vote through the Internet

website as indicated on the proxy card. Instructions are shown on the proxy card. In the event there are not sufficient votes for a quorum

or to approve any of the foregoing proposals at the time of the Special Meeting, the Special Meeting may be adjourned in order to permit

further solicitation of proxies by the Fund.

You may change your mind after you send in your proxy card or authorize

your shares by telephone, through the Internet or at the Special Meeting. Please refer to our response to Q18 in the Q&A section below

for details on how to revoke your proxy.

| |

| By Order of the Board of Trustees, |

| Garry Khasidy |

|

Chairperson of the Special

Committee

and Trustee on the Board |

September 26, 2023

This is an important meeting. To ensure

proper representation at the Special Meeting, please complete, sign, date and return the proxy card in the enclosed, self-addressed envelope,

vote your shares by telephone, or vote via the Internet. Even if you vote your shares prior to the Special Meeting, you still may attend

the meeting virtually and change your vote.

If you have any questions about the Special

Meeting or any of the proposals after reading the accompanying Proxy Statement, please contact our proxy solicitor, Campaign Management,

LLC:

Strategic Shareholder Advisor and Proxy Solicitation

Agent

15 West 38th Street, Suite #747, New York, New York

10018

North American Toll-Free Phone:

1-855-422-1042

Email: info@campaign-mgmt.com

Call Collect Outside North America: +1 (212) 632-8422

GENERAL INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

Q1: Why did you send me this Proxy

Statement?

| A: |

The Fund sent you this Proxy Statement and the enclosed

proxy card because the Board of Trustees of the Fund (the “Board”), excluding the trustees affiliated with Saba (the “Unaffiliated

Board”), is soliciting your proxy to vote at the Special Meeting. The Special Meeting will be held on October 25, 2023 at 12 p.m., Eastern Time. You will be able to participate in the Special Meeting and vote by visiting www.virtualshareholdermeeting.com/GIM2023SM.

This Proxy Statement summarizes the information regarding

the matters to be voted upon at the Special Meeting. However, you do not need to attend the Special Meeting to vote your shares. You may

simply complete, sign, and return the enclosed proxy card, submit your vote by calling toll free at the telephone number indicated on

the enclosed proxy card, or vote your shares through the Internet, as indicated on the proxy card.

As of September 15, 2023, the date for determining

Shareholders entitled to vote at the Special Meeting (the “Record Date”), there were 102,746,371 of the Fund’s common

shares of beneficial interest. If you owned shares on the Record Date, you are entitled to one vote for each whole share you owned as

of that date, and any fractional share shall be entitled to a proportionate fractional vote. The Fund began mailing this Proxy Statement

on or about September 26, 2023 to all Shareholders entitled to vote their shares at the Special Meeting. |

Q2: What am I being asked to vote

on?

| A: |

At the Special Meeting, Shareholders are being asked to vote for the following proposals: |

| |

1. |

To approve the New Management Agreement between the Fund and Saba Capital Management, L.P.; |

| |

2. |

To

make the Fund’s investment objective non-fundamental; and |

| |

3. |

To remove the Fund’s fundamental policy mandating that at least 65% of the Fund’s total assets be invested in at least three countries and in various types of debt instruments. |

Q3: What is the quorum requirement

for the Special Meeting?

| A: |

A quorum of Shareholders must be present at the Special

Meeting for any business to be conducted. The presence at the Special Meeting, virtually or by proxy, of the holders of a majority of

the shares outstanding and entitled to vote on the Record Date will constitute a quorum. Abstentions will be treated as shares present

for quorum purposes. However, abstentions will be disregarded in determining the “votes cast” on a proposal and will thus

have the same effect as a vote “against” the proposal.

The Special Meeting may be adjourned for any reason

by vote of the holders of shares entitled to vote holding not less than a majority of the shares present virtually or by proxy at the

Special Meeting, or by the chairperson of the Board in consultation with the chairperson of the Special Committee. The persons named as

proxies will vote those proxies for such adjournment, unless marked to be voted against any proposal for which an adjournment is sought,

to permit the further solicitation of proxies. On the Record Date, there were 102,746,371 of the Fund’s shares outstanding and entitled

to vote. Thus, 51,373,186 shares must be represented by Shareholders present at the Special Meeting or by proxy to have a quorum. |

Q4: What is the Adviser Transition?

| A: |

On August 3, 2023, a special committee (the “Special

Committee”), consisting solely of independent trustees who have no affiliation with Franklin Advisers, Inc., the Fund’s current

investment adviser (“Franklin”) or Saba Capital Management, L.P. (“Saba”), met and unanimously voted to recommend

that the Board approve, both the selection of Saba as the new investment adviser for the Fund (the “New Investment Adviser”)

and a new investment management agreement between the Fund and Saba (the “New Management Agreement”). At a meeting of the

Board held on August 14, 2023, the Unaffiliated Board,

including all of the trustees of the Board who are not “interested persons” of the Fund as such term is defined under the

Investment Company Act of 1940, as amended (the “1940 Act” and such trustees, the “Non-interested Trustees”),

determined, after careful consideration and upon the recommendation of the Special Committee, subject to approval of the New Management

Agreement by the Shareholders, to select Saba to serve as the New Investment Adviser and to assume responsibility for providing investment

management services that are now provided to the Fund by Franklin (the “Adviser Transition”), and approve the New Management

Agreement in connection with such Adviser Transition. The New Management Agreement must be approved by Shareholders to become effective.

Effective upon the Adviser Transition, neither Franklin nor its affiliates will provide services to the Fund.

The material terms of the New Management Agreement

differ from the material terms of the current investment management agreement between the Fund and Franklin (the “Existing Management

Agreement”) in certain respects, including to reflect the fact that the Fund expects to retain SS&C’s ALPS Fund Services,

Inc., a third-party administrator, to provide administrative services to the Fund (at the Fund’s expense) as part of the Adviser

Transition. Upon the effective date of the New Management Agreement, all investment management and administrative services will no longer

be provided by Franklin or Franklin Templeton Services, LLC (“FT Services”), the Fund’s current administrator. |

Q5: Why am I being asked to vote

on the New Management Agreement?

| A: |

The 1940 Act requires that a new investment management agreement be approved by both a majority of the Non-interested Trustees and “a majority of the outstanding voting securities,” as defined under the 1940 Act. Therefore, Shareholders are being asked to approve the New Management Agreement with Saba. The Non-interested Trustees believe that the approval of the New Management Agreement will provide the benefits to the Fund discussed below. The Unaffiliated Board, including all of the Non-interested Trustees, has approved the New Management Agreement and believe it to be in the best interests of the Fund and its Shareholders. |

Q6: What are the benefits of the

Adviser Transition to the Fund and its Shareholders?

| A: |

After discussing and considering the Special Committee’s

recommendations, the Unaffiliated Board has concluded that the retention of Saba, in light of its investment capabilities and track record

(see “Board Consideration of the Approval of the New Management Agreement” under Proposal I below), better positions the Fund

to achieve improved risk-adjusted returns and achieve its investment objectives. Saba is a global alternative asset management firm that

seeks to deliver superior risk-adjusted returns for a diverse group of clients. Founded in 2009 by Boaz Weinstein, the Firm is a pioneer

of credit relative value strategies and capital structure arbitrage.

The Unaffiliated Board, as well as the Special Committee,

considered that the Fund will gain access to the senior management team of Saba. Under the Adviser Transition, Boaz Weinstein is expected

to replace Michael Hasenstab Ph.D. as President of the Fund and Pierre Weinstein (no relation to Boaz Weinstein) is expected to replace

Matthew T. Hinkle as Chief Executive Officer. Boaz Weinstein, Pierre Weinstein, Paul Kazarian, Xavier Riera, Vish Shah and Alexander Brown

will serve as portfolio managers of the Fund.

In evaluating potential benefits to the Fund

and its Shareholders, the Special Committee also considered Saba’s organization, philosophy of management, historical performance

and methods of operations, including the following specific considerations, among others:

·

Saba’s experience and record in managing and operating various funds, including Saba’s

experience in managing Saba Capital Income & Opportunities Fund, a publicly-traded registered closed-end fund managed by Saba (“BRW”)

that has a principal investment strategy that is substantially similar to that which Saba has proposed for the Fund.

·

Access to Saba’s sophisticated investment advisory platform and resources, including Saba’s

credit investment experience and resources as well as its capabilities in identifying and making alternative opportunistic investments

that are intended to generate additional attractive risk-adjusted returns.

·

Information showing that Saba is able to attract and retain personnel necessary to provide quality

investment advisory services to the Fund.

In addition, the Unaffiliated Board, as well as the

Special Committee, considered that the proposed fees under the New Management Agreement are lower than the management fees payable by

BRW.

For discussion about new investment strategy, investment type and related

risks, please refer to our response to “Q8: How will the Adviser Transition affect the Fund’s investment objective and strategy?”. |

Q7: What are the conditions of the Adviser

Transition?

| A: |

The consummation of the Adviser Transition is subject to approval of the New Management Agreement by the Shareholders. It is expected the Adviser Transition will be effected following such approval, on or about January 1, 2024. Upon the effective date of the New Management Agreement, all investment management services will no longer be provided by Franklin. Franklin will continue to be paid until the Existing Management Agreement is terminated pursuant to its terms. |

Q8: How will the Adviser Transition

affect the Fund’s investment objective and strategy?

| A: |

There is no proposed

change to the Fund’s investment objective of seeking high current income and, secondarily, capital appreciation; except that in

connection with the Adviser Transition, and as described in the enclosed Proxy Statement, Shareholders are being asked to approve making

the investment objective “non-fundamental”, i.e., such that in the event a change in the objective is sought in the future,

which is not currently expected, shareholder approval would not be required. Furthermore, Saba has indicated that, upon the Adviser Transition,

its principal investment strategy for the Fund would align more closely with that of BRW such that in

pursuit of the Fund’s investment objective (to provide investors with a high level of current income, with a secondary goal of capital

appreciation), the Fund will invest globally in debt and equity securities of public and private companies, which includes, among other

things, investments in closed-end funds, special purpose acquisition companies, and public and private debt instruments. The Fund

also may utilize derivatives, including total return swaps, credit default swaps, options and futures, in seeking to enhance returns and/or

to reduce portfolio risk. In addition, on an opportunistic basis, the Fund may also invest up to 15% of its total assets in private funds

that focus on debt, equity or other investments consistent with the Fund’s investment objective. Under this modified strategy, the

Fund’s portfolio is expected to be invested materially in credit investments. However, the modified strategy would also position

the portfolio to potentially have greater exposure to other types of investments and strategies intended to achieve the Fund’s investment

objective. In connection with this, shareholders are also being asked to remove the Fund’s current fundamental policy mandating

that at least 65% of the Fund’s total assets be invested in at least three countries and in various types of debt instruments.

As a result of the proposed modified strategy, the

Fund would be subject to additional principal risks associated with the following investments, among others, to which the Fund is not

materially subject at this time:

· Equity

Securities. Equity securities are subject to equity market risk, i.e., the general

risk that the market value of equity securities may fall or rise with the broader equity markets. Equity securities are also subject to

issuer risk, i.e., that the value of the issuer’s securities will fall due to the issuer performing poorly or below expectations.

· Closed-End

Funds. Securities issued by closed-end funds (the “CEFs”) are subject

to the risks associated with the CEF’s underlying investments.

· Private

Securities, including Private Funds. Private investments are generally illiquid or are materially less marketable

than publicly-traded securities. Realization of value from such investments may be difficult in the short-term, or may have to be made

at a substantial discount compared to other freely tradable investments. Private issuers are also generally subject to less disclosure

requirements than public reporting companies and thus there may be less information about the issuer available prior to the investment,

which could increase issuer risk.

· Distressed

Securities. Certain debt instruments purchased may be non-performing and possibly in default. In any reorganization or liquidation

proceeding, the Fund may lose its entire investment, may be required to accept cash or securities with a value less than the Fund's

original investment and/or may be required to accept payment over an extended period of time.

· Short

Selling. A short sale involves the risk of a theoretically unlimited loss, in that the price of the underlying security could theoretically

increase without limit, thus increasing the cost to the Fund of buying those securities to cover the short position or resulting in the

inability of the Fund to cover the short position.

· Index

Options. An index option fluctuates with changes in the market values of the securities included in the index.

In addition, because the value of an index or index option depends upon movements in the level of the index rather than the price of

a particular asset, whether the Fund will realize gains or losses from the purchase or writing of options on indices depends upon movements

in the level of instrument prices in the assets generally or, in the case of certain indices, in an industry or market segment, rather

than movements in the price of particular assets. |

Q9: Will the Fund continue to be

publicly traded after the Adviser Transition?

| A: |

Yes. The shares of the Fund will continue to be traded on the New York Stock Exchange under the new ticker symbol “SABA”. |

Q10: Will the Fund’s name change?

| A: |

The Board has approved the change in the Fund’s name to “Saba Capital Income & Opportunities Fund II” subject to and effective upon the completion of the Adviser Transition. |

Q11: Will the investment management fees

payable to Saba under the New Management Agreement increase as a result of the Adviser Transition?

| A: |

No, The investment management fees payable to Saba under the New Management Agreement will not increase as a result of the Adviser Transition. The investment management fee payable under the New Management Agreement will continue to be calculated daily and paid monthly based on the average daily net assets of the Fund at the same rates as those under the Existing Management Agreement, as folows:

|

| |

Annualized Fee Rate |

Net Assets |

| |

0.700% |

Up to and including $200 million |

| |

0.635% |

Over $200 million, up to and including $700 million |

| |

0.600% |

Over $700 million, up to and including $1 billion |

| |

0.580% |

Over $1 billion, up to and including $5 billion |

| |

0.560% |

Over $5 billion, up to and including $10 billion |

| |

0.540% |

Over $10 billion, up to and including $15 billion |

| |

0.520% |

Over $15 billion, up to and including $20 billion |

| |

0.500% |

In excess of $20 billion |

Q12: Will the Fund have any third-party

administrative expenses that the Fund is not currently paying as a result of the Adviser Transition?

| A: |

Yes. As a

result of the Adviser Transition, Saba expects to recommend that the Fund retain SS&C’s ALPS Fund Services, Inc. to

provide independent administrative services to the Fund. Under the anticipated arrangement, the Fund would pay SS&C’s ALPS

Fund Services, Inc. a monthly administration fee at an annual rate of approximately 0.05% of the Fund’s net assets plus a

monthly $7,000 fixed fee. These fees will be incremental to the management fees borne by the Fund and thus will cause the

Fund’s net expense ratio to be slightly higher after the Adviser Transition. Currently, FT Services provides various

administrative services to the Fund at no additional cost to the Fund. |

Q13: How do the Unaffiliated Board

recommend that I vote with respect to the proposal to approve the New Management Agreement?

| A: |

In evaluating the New Management Agreement, both the Special Committee and the Unaffiliated Board, including all of the Non-interested Trustees, reviewed materials furnished by Saba and after careful consideration based on the recommendation of the Special Committee, the Unaffiliated Board unanimously recommend that you vote “FOR” the proposal to approve the New Management Agreement. |

Q14: Do any of the Fund’s trustees

or officers have an interest in the approval of the New Management Agreement that is different from that of the Fund’s Shareholders

generally?

| A: |

As described in this Proxy Statement under “Conflicts of Interests of Our Trustees and Officers in the Adviser Transition”, three of the members of the Board are employed by Saba. One of them is chairman of the Board of the Fund. These trustees have conflicts of interests in connection with the vote on the New Management Agreement. Accordingly, they did not serve on the Special Committee. They also recused themselves from the deliberations and determinations of the Board with regard to the engagement of Saba and the New Management Agreement. Two other trustees serve as independent board members of BRW and are not affiliated with Saba. These two trustees did not serve on the Special Committee, but are Non-interested Trustees of the Fund and participated in the Board deliberations and determinations with regards to the engagement of Saba and the New Management Agreement. Three other trustees were nominated by Saba in proxy contests conducted by Saba at the 2021 and 2022 annual meetings of the Fund. These trustees are not affiliated with Saba, and they are Non-interested Trustees of the Fund. They served on the Special Committee and participated in the Board deliberations and determinations with regards to the engagement of Saba and the New Management Agreement. |

Q15: Will the Fund bear the costs

associated with the Adviser Transition and the Special Meeting?

| A: |

No. The New Investment Adviser will bear all costs associated with the Shareholder approval process, including the costs and expenses incurred in connection with preparing and mailing the Proxy Statement and soliciting the Shareholder votes in connection with the Special Meeting. |

Q16: How do I vote by proxy and how

many votes do I have?

| A: |

If you properly sign and date the accompanying proxy

card, and the Fund receives it in time for the Special Meeting, the persons named as proxies on the proxy card will vote the shares in

the manner that you specified. If you sign the proxy card, but do not make specific choices, the shares represented by such proxy will

be voted as recommended by the Board. You may also vote your shares by calling toll free or through the Internet by following the instructions

set forth on the enclosed proxy card.

If your shares are registered in the name of

a bank or brokerage firm, you will receive a copy of the Proxy Statement, either by paper or electronically, and you may be eligible to

vote your shares electronically via the Internet or by telephone by following the instructions set forth on your voting instruction form.

If you require assistance with voting your

proxy or have any questions about the Special Meeting, please contact our proxy solicitor, Campaign Management, LLC, North American toll-free

at 1-855-422-1042 or outside North America at +1 (212) 632-8422.

If any other matter is presented, the shares

represented by such proxy will be voted in accordance with the best judgment of the person or persons exercising authority conferred by

the proxy at the Special Meeting. You have one vote for each share that you own on the Record Date, and any fractional share shall be

entitled to a proportionate fractional vote. The proxy card indicates the number of shares that you owned on the Record Date. |

Q17: What does it mean if I receive more

than one proxy card?

| A: |

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted. |

Q18: May I revoke my proxy?

| A: |

Yes. You may change your mind after you send in your proxy card or authorize your shares by telephone, through the Internet or at the Special Meeting by following these procedures. To revoke your proxy: |

| |

• |

|

deliver a written revocation notice prior to 12:00 p.m., Eastern Time, on October 24, 2023 to our proxy tabulator at Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717; |

| |

|

|

|

| |

• |

|

indicate your revocation prior to 12:00 p.m., Eastern Time, on October 24, 2023 by calling toll free at 1-800-690-6903 or through the Internet website www.proxyvote.com; |

| |

|

|

|

| |

• |

|

deliver a later-dated proxy by following the instructions on your proxy card; or |

| |

|

|

|

| |

• |

|

vote virtually at the Special Meeting on October 25, 2023. If you hold common shares through a broker, bank or other nominee, you must follow the instructions you receive from your broker, bank or other nominee in order to revoke your voting instructions. |

Q19: What is the difference between

holding shares as a Shareholder of record and as a beneficial owner?

| A: |

Shareholders of Record. You are a Shareholder

of record if at the close of business on the Record Date your shares were registered directly in your name with our transfer agent, American

Stock Transfer and Trust Company, LLC.

Beneficial Owner. You are a beneficial

owner if at the close of business on the Record Date your shares were held by a bank, brokerage firm or other nominee and not in your

name. Being a beneficial owner means that your shares are held in “street name.” As the beneficial owner, you have the right

to direct your bank, brokerage firm or other nominee how to vote your shares by following the voting instructions your bank, brokerage

firm or other nominee provides. If you do not provide your bank, brokerage firm or other nominee with instructions on how to vote your

shares, your bank, brokerage firm or other nominee will not be able to vote your shares with respect to any of the proposals. Please see

“What if I do not specify how my shares are to be voted?” for additional information. Alternatively, you can access the virtual meeting and vote your shares

yourself using the unique 16 digit control number printed on the enclosed proxy card. If you have lost or misplaced the unique control

number, you can requested it directly from your bank, brokerage firm or other nominee. |

Q20: What will happen if I do

not vote my shares?

| A: |

Shareholders of Record. If you are the Shareholder

of record of your shares and you do not vote by proxy card, via telephone or the Internet virtually at the Special Meeting, your shares

will not be voted at the Special Meeting.

Beneficial Owners. If you are the

beneficial owner of your shares, your broker or nominee may vote your shares only on those proposals on which it has discretion to vote.

“Broker non-votes” represent votes that could have been cast on a particular matter by a brokerage firm, as a Shareholder

of record, but that were not cast because the brokerage firm lacked discretionary voting authority on the matter and did not receive voting

instructions from the beneficial owner of the shares. Under the rules of the New York Stock Exchange (“NYSE”), your brokerage

firm or other nominee does not have discretion to vote your shares on non-routine matters such as the proposals contained herein. Accordingly,

there will be no broker non-votes with respect to all proposals contained herein. |

Q21: What is the vote required for each

proposal?

| |

|

|

|

|

|

|

| Proposal* |

|

Vote Required** |

|

Broker

Discretionary

Voting

Allowed? |

|

Effect of

Abstentions |

| Proposal 1 — To approve the New Management Agreement between the Fund and Saba Capital Management, L.P.; |

|

Affirmative vote of a majority of the outstanding common shares entitled to vote at the Special Meeting. |

|

No |

|

Abstentions will have the effect of a vote against this proposal. |

| |

|

|

|

| Proposal

2 — To make the Fund’s investment objective non-fundamental; and |

|

Affirmative

vote of a majority of the outstanding common shares entitled to vote at the Special Meeting. |

|

No |

|

Abstentions will have the effect of a vote against this proposal. |

|

Proposal 3 — To

remove the Fund’s fundamental policy mandating that at least 65% of the Fund’s total assets be invested in at least three

countries and in various types of debt instruments.

|

|

Affirmative

vote of a majority of the outstanding common shares entitled to vote at the Special Meeting. |

|

No |

|

Abstentions will have the effect of a vote against this proposal. |

| |

|

|

|

| |

* |

The approval of each of the proposals is independent of approval of any other proposal.

|

| |

** |

For purposes of this proposal, consistent with the 1940 Act, “a majority of the outstanding common shares” is the lesser of: (i) 67% or more of our common shares present at the Special Meeting if the holders of more than 50% of our outstanding common shares are present or represented by proxy, or (ii) more than 50% of our outstanding common shares. |

| |

|

|

|

|

|

|

|

|

Since banks, brokerage firms or other

nominees do not have discretion to vote on the proposals contained herein, if you do not provide voting instructions to your bank, brokerage

firm or other nominee, your shares will not be voted at the Special Meeting and if no instruction is provided for any proposal, your shares

will not be counted as present for purposes of meeting the quorum requirement. Abstentions will be counted for purposes of determining

whether a quorum is present.

Saba-managed funds own, in the aggregate, approximately 30.68% of the outstanding

shares of the Fund, of which Saba has discretionary voting authority over 27.26% and will vote these shares pursuant to its proxy voting

policies. The remaining 3.42%, also pursuant to its proxy voting policies, will be echo voted (i.e. meaning they will be voted in the

same proportion as the votes of all other shareholders).

Q22: What if I do not specify how my shares

are to be voted?

| A: |

Shareholders of Record. If you are a Shareholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted as follows: |

| |

• |

|

Proposal 1 — FOR the approval of the new Investment Management Agreement between the Fund and Saba Capital Management, L.P.; |

| |

• |

|

Proposal 2 — FOR making the Fund’s investment objective non-fundamental;

|

| |

• |

|

Proposal 3 — FOR removing the Fund’s fundamental policy mandating that at least 65% of the Fund’s total assets be invested in at least three countries and in various types of debt instruments; and |

| |

• |

|

In the discretion of the named proxies regarding any other matters properly presented for a vote at the Special Meeting. |

Beneficial Owners. If you

are a beneficial owner and you do not provide the bank, brokerage firm or other nominee that holds your shares with voting instructions,

your bank, brokerage firm or other nominee will not vote your shares on the proposals contained herein.

Q23: What are abstentions and broker

non-votes?

| A: |

An abstention represents action by a Shareholder to refrain from voting “for” or “against” a proposal. “Broker non-votes” represent votes that could have been cast on a particular matter by a brokerage firm, as a Shareholder of record, but that were not cast because the brokerage firm (i) lacked discretionary voting authority on the matter and did not receive voting instructions from the beneficial owner of the shares, or (ii) had discretionary voting authority but nevertheless refrained from voting on the matter. Since brokerage firms do not have discretion to vote on non-routine matters such as the proposals contained herein (and consequently there will be no broker non-votes with respect to the proposals contained herein), if you do not provide voting instructions to your brokerage firm for any proposal, your shares will not be voted at the Special Meeting. Abstentions will be counted for purposes of determining whether a quorum is present. |

Q24: What will happen if Proposal

1 is not approved?

| A: |

If the New Management Agreement is not approved by Shareholders, the Board will consider such other actions, including the approval of an investment management agreement with a firm other than Saba, as it determines to be in the best interests of the Fund and Shareholders. The Board may also determine to approve an interim investment management agreement to enable Saba to serve as investment adviser of the Fund. However, such interim agreement may remain in effect for a period of not more than 150 days, and a new investment management agreement must be approved by the Board and by Shareholders for Saba to continue to serve as adviser to the Fund after expiration of the term of such interim agreement. |

Q25: What will happen if Proposals 2 and

3 are not approved?

| A: |

If Proposal 2 is not approved, the Fund’s investment objective will remain fundamental. If Proposal 3 is not approved, the 65% credit strategy will remain unchanged and fundamental, and the Fund would have less flexibility to make non-debt investments. |

Q26: How do I find out the results

of the voting at the Special Meeting?

| A: |

Preliminary voting results will be announced at the Special Meeting. The Fund expects to disclose final voting results in a future filing with the SEC after the results have been finalized. |

Q27: Who should I call if I have

any questions?

| A: |

If you have any questions about the Special Meeting, voting or your ownership of the Fund’s common shares, please contact Campaign Management, LLC: |

Strategic Shareholder Advisor and Proxy Solicitation

Agent

15 West 38th Street, Suite #747, New York, New York

10018

North American Toll-Free Phone:

1-855-422-1042

Email: info@campaign-mgmt.com

Call Collect Outside North America: +1 (212) 632-8422

TEMPLETON GLOBAL INCOME FUND

September 26, 2023

PROXY STATEMENT

Special Meeting of Shareholders

This Proxy Statement is furnished in

connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Templeton Global Income Fund (the

“Fund,” “we,” “us” or “our”) for use at the Fund’s Special Meeting of

Shareholders (the “Special Meeting”) to be held on October 25, 2023 at 12 p.m., Eastern Time. You will be able to

participate in the Special Meeting and vote by visiting www.virtualshareholdermeeting.com/GIM2023SM. It is important

to note that shareholders of the Fund (“Shareholders”) have substantially the same rights and opportunities by

participating in a virtual meeting as they would if attending an in-person meeting. This Proxy Statement and the accompanying proxy

card are first being sent to Shareholders on or about September 26, 2023. This Proxy Statement is also available on the proxy

tabulator’s website at www.proxyvote.com.

We encourage you to vote your shares, either

by voting virtually at the Special Meeting or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly

sign and date the accompanying proxy card, or otherwise provide voting instructions, either via the Internet or by telephone, and the

Fund receives it in time for the Special Meeting, the persons named as proxies will vote the shares registered directly in your name in

the manner that you specified. If you give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR

the matters listed in the accompanying Notice of Special Meeting of Shareholders.

If your shares are registered in the name of

a bank or brokerage firm, you will receive a copy of the Proxy Statement, either by paper or electronically, and you may be eligible to

vote your shares electronically via the Internet or by telephone by following the instructions set forth on your voting instruction form.

Purpose of Meeting

At the Special Meeting, you will be asked to

vote on the following proposals:

| |

1. |

To approve the New Management Agreement (as defined below) between the Fund and Saba Capital Management, L.P. (Proposal 1); |

| |

2. |

To

make the Fund’s investment objective non-fundamental (Proposal 2); and |

| |

3. |

To remove the Fund’s fundamental policy mandating that at least 65% of the Fund’s total assets be invested in at least three countries and in various types of debt instruments (Proposal 3). |

*The approval of each of the proposals is independent

of approval of any other proposal.

Record Date and Voting Securities

You may vote your shares, virtually or by proxy,

at the Special Meeting only if you were a Shareholder of record at the close of business on September 15, 2023 (the “Record Date”).

On the Record Date, there were 102,746,371 of the Fund’s common shares of beneficial interest. Each share of record is entitled to

one vote (and a proportionate fractional vote for each fractional share) on each matter presented at the Special Meeting.

Quorum Required

A quorum must be present at the Special Meeting

for any business to be conducted. The presence at the Special Meeting, virtually or by proxy, of the holders of a majority of the shares

outstanding and entitled to vote on the Record Date will constitute a quorum. Abstentions will be treated as shares present for quorum

purposes. Since banks, brokerage firms or other nominees do not have discretion to vote on non-routine matters such as the proposals contained

herein, if you do not provide voting instructions to your bank, brokerage firm or other nominee, your shares will not be voted at the

Special Meeting and if no instruction is provided for any proposal, your shares will not be counted as present for purposes of meeting

the quorum requirement. As of the Record Date, there were 102,746,371 shares of the Fund’s shares outstanding and entitled to vote

thereon. Thus, 51,373,186 shares must be represented by Shareholders present at the Special Meeting or by proxy to have quorum.

Submitting Voting Instructions for Shares

Held Through a Bank, Brokerage Firm or Other Nominee

If you hold your shares through a bank, brokerage

firm or other nominee, you must follow the voting instructions you receive from your bank, brokerage firm or other nominee. If you hold

shares through a bank, brokerage firm or other nominee and you want to vote virtually at the Special Meeting, you will be required to

provide the unique 16 digit control number printed on the enclosed proxy card to access the virtual meeting and vote your shares. If you

do not vote virtually at the Special Meeting or submit voting instructions to your bank, brokerage firm or other nominee, your shares

will not be voted at the Special Meeting and if no instruction is provided for any proposal, your shares will not be counted as present

for purposes of meeting the quorum requirement. Abstentions, however, will be counted for purposes of determining whether a quorum is

present.

If your shares are registered in the name of

a bank or brokerage firm, you will receive a copy of the Proxy Statement, either by paper or electronically, and you may be eligible to

vote your shares electronically via the Internet or by telephone by following the instructions set forth on your voting instruction form.

Authorizing a Proxy for Shares Held in Your

Name

If you are a record holder of common shares,

you may authorize a proxy to vote on your behalf, as described on the enclosed proxy card. Authorizing your proxy will not limit your

right to vote virtually at the Special Meeting. A properly completed and submitted proxy will be voted in accordance with your instructions,

unless you subsequently revoke your instructions. If you authorize a proxy without indicating your voting instructions, the proxy holder

will vote your shares according to the Board’s recommendations. You may return the enclosed proxy card by mail in the enclosed,

self-addressed envelope, or you may vote your shares by calling toll free or voting through the Internet by following the instructions

set forth on the enclosed proxy card.

Revoking Your Proxy

| |

• |

|

If you are a Shareholder of record, you can revoke your proxy at any time before it is exercised by: |

| |

• |

|

delivering

a written revocation notice prior to 12 p.m., Eastern Time, on October 24, 2023 to our proxy tabulator at Vote Processing, c/o Broadridge, 51

Mercedes Way, Edgewood, NY 11717.; |

| |

• |

|

indicating your revocation prior to 12:00 p.m., Eastern Time, on October 24, 2023 by calling toll free at 1-800-690-6903 or through the Internet website at www.proxyvote.com; |

| |

• |

|

delivering a later-dated proxy by following the instructions set forth on the enclosed proxy card; or |

| |

• |

|

voting virtually at the Special Meeting on October 25, 2023. |

Attending the Special Meeting does not revoke

your proxy unless you also vote virtually at the Special Meeting.

If you require assistance with voting your

proxy or have any questions about the Special Meeting, please contact our proxy solicitor, Campaign Management, LLC, North American toll-free

at 1-855-422-1042 or outside North America at +1 (212) 632-8422.

If you hold common shares through a broker,

bank or other nominee, you must follow the instructions you receive from your broker, bank or other nominee in order to revoke your voting

instructions.

Vote Required for Each Proposal

Approval of the new investment management agreement

between the Fund and Saba Capital Management, L.P. (“Saba” and such new investment management agreement, the “New Management

Agreement”), as well as approval for each of Proposals 2 and 3, requires the affirmative vote of “a majority of outstanding

voting securities” entitled to vote at the Special Meeting, as defined under the Investment Company Act of 1940, as amended (the

“1940 Act”). Since the Fund’s only voting securities are common shares, consistent with the 1940 Act, the affirmative

vote of a majority of the outstanding common shares entitled to vote at the Special Meeting is required to approve Proposals 1, 2 and

3. For these purposes, “a majority of outstanding common shares” is the lesser of: (i) 67% or more of the common shares present

at the Special Meeting if the holders of more than 50% of the outstanding common shares are present or represented by proxy; or (ii) more

than 50% of the Fund’s outstanding common shares as of the Record Date. Abstentions for any of the proposals will have the effect

of a vote against such proposal. Since banks, brokerage firms or other nominees do not have discretion to vote on non-routine matters

such as the proposals contained herein, if you do not provide voting instructions to your bank, brokerage firm or other nominee, your

shares will not be voted at the Special Meeting and if no instruction is provided for any proposal, your shares will not be counted as

present for purposes of meeting the quorum requirement.

Additional Solicitation. If there are

not enough votes to approve the New Management Agreement or to approve Proposals 2 or 3, the holders of shares entitled to vote holding

not less than a majority of the shares present virtually or by proxy at the Special Meeting, or the chairperson of the Board in consultation

with the chairperson of the Special Committee may adjourn the Special Meeting to permit the further solicitation of proxies. The persons

named as proxies will vote those proxies for such adjournment, unless marked to be voted against the proposal for which an adjournment

is sought, to permit the further solicitation of proxies.

Also, a Shareholder vote may be taken to approve

the New Management Agreement prior to any such adjournment if there are sufficient votes for approval of the New Management Agreement.

Information Regarding This Solicitation

Saba will bear the costs associated with the

Shareholder approval process, including the costs and expenses incurred in connection with preparing and mailing the Proxy Statement and

soliciting the Shareholder votes in connection with the Special Meeting.

In addition to

the solicitation of proxies by the use of the mail, proxies may be solicited in person and/or by telephone or facsimile transmission by

trustees, officers or employees of the Fund and/or officers or employees of Saba. Saba is located at 405 Lexington Ave., 58th

Floor, New York, NY 10174. No additional compensation will be paid to trustees, officers or regular employees

of the Fund or Saba for such services. The Fund has also retained Campaign Management LLC to assist in the solicitation of proxies for

a fee of approximately $16,500 plus reimbursement of certain out of pocket expenses, which Saba agreed to pay on behalf of the Fund.

Preliminary voting results will be announced

at the Special Meeting. The Fund expects to disclose final voting results in a future filing with the SEC after the results have been

finalized.

Appraisal Rights

Shareholders do not have any appraisal rights

in connection with the proposals.

Security Ownership of Certain Beneficial

Owners and Management

The following table sets forth, as of the Record

Date, the beneficial ownership of each current trustee, the Fund’s executive officers, each person known to us to beneficially own

5% or more of our outstanding common shares, and our executive officers and trustees as a group.

Beneficial ownership is determined in accordance

with the rules of the Securities and Exchange Commission (“SEC”) and includes voting or investment power with respect to the

securities. Ownership information for those persons who beneficially own 5% or more of our common shares is based upon Schedule 13G, 13D

and/or 13F filings by such persons with the SEC and other information obtained from such persons, if available.

Unless otherwise indicated, the Fund believes

that each beneficial owner set forth in the table has sole voting and investment power and has the same address as the Fund. The Fund’s

current address is 300 S.E. 2nd Street, Fort Lauderdale, Florida 33301-1923.

| |

|

|

|

|

|

|

| Name and Address of Beneficial Owner |

|

Number of

Shares Owned

Beneficially(1) |

|

Percentage of

Class(2) |

|

| Non-interested Trustees (not affiliated with Saba) |

|

|

|

|

|

| Garry Khasidy |

|

– |

|

|

* |

|

| Anatoly Nakum |

|

– |

|

|

* |

|

| Frederic P. Gabriel |

|

– |

|

|

* |

|

| Mark Hammitt |

|

– |

|

|

* |

|

| Karen Caldwell(3) |

|

– |

|

|

* |

|

| Ketu Desai(3) |

|

– |

|

|

* |

|

| |

|

|

|

|

|

|

| Trustees Affiliated with Saba |

|

|

|

|

|

|

| Aditya Bindal |

|

– |

|

|

* |

|

| Paul C. Kazarian |

|

– |

|

|

* |

|

| Pierre Weinstein |

|

– |

|

|

* |

|

| |

|

|

|

|

|

|

| Name and Address of Beneficial Owner |

|

Number of

Shares Owned

Beneficially(1) |

|

Percentage of

Class(2) |

|

| Current Executive Officers |

|

|

|

|

|

|

| Rupert H. Johnson, Jr. |

|

– |

|

|

* |

|

| Alison E. Baur |

|

– |

|

|

* |

|

| Ted P. Becker |

|

– |

|

|

* |

|

| Steven J. Gray |

|

– |

|

|

* |

|

| Michael J. Hasenstab Ph.D. |

|

– |

|

|

* |

|

| Matthew T. Hinkle |

|

– |

|

|

* |

|

| Marc De Oliveira(4) |

|

– |

|

|

* |

|

| Susan Kerr |

|

– |

|

|

* |

|

| Christopher Kings |

|

– |

|

|

* |

|

| Navid J. Tofigh |

|

– |

|

|

* |

|

| Christine Zhu |

|

– |

|

|

* |

|

| Current Executive officers and trustees as a group |

|

– |

|

|

* |

|

| |

|

|

| Incoming Executive Officers(5) |

|

|

|

|

|

|

| |

|

|

| Boaz Weinstein (President)(6) |

|

31,712,061 |

|

|

30.86 |

% |

| Pierre Weinstein (CEO) |

|

– |

|

|

* |

|

| Michael D’Angelo (Secretary) |

|

– |

|

|

* |

|

| Troy Statczar (PFO, Treasurer) |

|

|

|

|

|

|

| Nitin Sapru (VP) |

|

– |

|

|

* |

|

| Patrick Keniston (CCO) |

|

– |

|

|

* |

|

| |

|

|

|

|

|

|

| Five Percent Owner |

|

|

|

|

|

|

| Saba Capital Management, L.P.(7) |

|

31,525,790 |

|

|

30.68 |

% |

| Franklin Resources, Inc.(8) |

|

10,147,515 |

|

|

9.88 |

% |

| First Trust Portfolios L.P.(9) |

|

6,249,770 |

|

|

6.08 |

% |

* Represents less than one percent.

| (1) |

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Assumes no other purchases or sales of our common shares since the information most recently available to us. This assumption has been made under the rules and regulations of the SEC and does not reflect any knowledge that we have with regard to the present intent of the beneficial owners of our common shares listed in this table. |

| (2) |

Based on a total of 102,746,371 shares of the

Fund’s common shares issued and outstanding as of the Record Date. |

| (3) |

This Trustee also serves as a non-interested trustee of another publicly traded closed-end fund managed by Saba. The Trustee is a “Non-interested Person” of Saba, as such term is defined by the 1940 Act. |

| (4) |

Marc De Oliveira replaced George Hoyt as the Vice President and Secretary of the Fund, effective as of September 6, 2023. |

| (5) |

The individuals identified below would be expected to assume the officer positions noted if the New Management Agreement is approved and upon the effective date of the Adviser Transition. |

| (6) |

Mr. Weinstein may be deemed to beneficially own the shares of the Fund held by certain investment funds and accounts managed by Saba by virtue of his management and control of Saba. In addition, Mr. Weinstein beneficially owns 186,271 shares that he directly holds. |

| (7) |

The nature of beneficial ownership is shared voting and dispositive power and the amount is as reported on Schedule 13D/A filed with the SEC on September 6, 2023. The address for Saba Capital Management, L.P. is 405 Lexington Avenue, 58th Floor, New York, NY 10174. |

| (8) |

The nature of beneficial ownership is sole voting and dispositive power as reported on Schedule 13D/A filed with the SEC on November 10, 2022. Amount as disclosed in a Form 4 filed on November 10, 2022. The address for Franklin Resources, Inc. is One Franklin Parkway, San Mateo, CA 94403. |

| (9) |

The nature of beneficial ownership is shared dispositive power and the amount is as reported on Schedule 13G/A filed with the SEC on January 10, 2023. The address for First Trust Portfolios L.P. is 120 East Liberty Drive, Suite 400, Wheaton, IL 60187. |

Set forth below is the dollar range of equity

securities of the Fund beneficially owned by each of our trustees as of the Record Date.

| |

|

|

|

|

|

| Name of Trustees |

|

Dollar Range of

Equity Securities

Beneficially Owned(1)(2) |

|

|

Aggregate Dollar Range of Equity Securities in all Funds in the Franklin Fund Family |

| |

|

|

|

|

|

| Non-interested Trustees (not affiliated with Saba) |

|

|

|

|

|

| Garry Khasidy |

|

None |

|

|

None |

| Anatoly Nakum |

|

None |

|

|

None |

| Frederic P. Gabriel |

|

None |

|

|

None |

| Mark Hammitt |

|

None |

|

|

None |

| Karen Caldwell(3) |

|

None |

|

|

None |

| Ketu Desai(3) |

|

None |

|

|

None |

| |

|

None |

|

|

None |

| Trustees Affiliated with Saba |

|

|

|

|

|

| Aditya Bindal |

|

None |

|

|

None |

| Paul C. Kazarian |

|

None |

|

|

None |

| Pierre Weinstein |

|

None |

|

|

None |

| (1) |

The dollar ranges are: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, or Over $100,000. |

| (2) |

The dollar range of equity securities beneficially owned in the Fund is based on the closing price for our common shares of $3.98 on the Record Date on the New York Stock Exchange. Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) of the Exchange Act. |

| |

|

| (3) |

This Trustee also serves as a non-interested trustee of another publicly traded closed-end fund managed by Saba. The Trustee is also a “Non-interested Person” of Saba, as such term is defined by the 1940 Act. |

Information about the Fund’s Existing Service

Providers

Franklin Advisers, Inc. (“Franklin”)

serves as the Fund’s current investment adviser and is located at One Franklin Parkway, San Mateo, California 94403-1906. Franklin

Templeton Services, LLC (“FT Services”) serves as the Fund’s current administrator (the “Administrator”)

and is located at 300 S.E. 2nd Street, Fort Lauderdale, Florida 33301-1923.

The foregoing existing service providers will

be replaced effective upon completion of the Adviser Transition.

PROPOSAL I

TO APPROVE THE NEW MANAGEMENT AGREEMENT BETWEEN

THE

FUND AND SABA CAPITAL MANAGEMENT, L.P.

Background

Franklin currently provides investment advisory

services to the Fund pursuant to the current amended and restated investment management agreement, dated June 1, 2014, as amended on May 13,

2020, between the Fund and Franklin (the “Existing Management Agreement”). The Existing Management Agreement was last approved

by the Board, including a majority of trustees who are not “interested persons” of the Fund, as such term is defined under

the 1940 Act (the “Non-interested Trustees”), on April 11, 2023, and was last approved by a vote of the Shareholders on February

27, 2004.

At the Special Meeting, the Shareholders will

vote on a proposal to approve the New Management Agreement. If approved, the New Management Agreement will replace the Existing Management

Agreement. The Board, with the trustees affiliated with Saba having recused themselves (the “Unaffiliated Board”), recommended

the selection of Saba as the Fund’s new investment manager as a result of a request for proposal (“RFP”) process undertaken

by a special committee, consisting solely of independent trustees who have no affiliation with Franklin or Saba (the “Special Committee”),

established by the Board.

Thus, at a meeting of the Board held on August

14, 2023, the Unaffiliated Board, including all of the Non-interested Trustees, after careful consideration and upon the recommendation

of the Special Committee, determined to select Saba to serve as investment manager of the Fund and to assume responsibility for providing

the investment management services that are now provided to the Fund by Franklin (the “Adviser Transition”) and to approve

the New Management Agreement in connection with such Adviser Transition. The New Management Agreement must also be approved by Shareholders

to become effective. Effective upon the Adviser Transition, neither Franklin nor its affiliates will provide services to the Fund.

The Unaffiliated Board, including all of

the Non-interested Trustees, has approved the New Management Agreement and believes it to be in the best interests of the Fund and its

Shareholders. Shareholders are being asked to approve the New Management Agreement between the Fund and Saba. As discussed below,

the material terms and conditions of the New Management Agreement will be substantially similar to all material terms and conditions of

the Existing Management Agreement except for certain revisions which primarily reflect the fact that Saba will not be responsible for

the provision of specific administrative services and, as a result, the Fund would be required to retain a third-party independent administrator

to provide administrative services to the Fund going forward.

In connection with the Adviser Transition, and

as described in Proposals 2 and 3, Shareholders are also being asked to make the Fund’s investment objective non-fundamental and

to remove one fundamental policy of the Fund in order to provide the Fund with greater investment flexibility.

Following the Adviser Transition, the Fund’s

name will change to “Saba Capital Income & Opportunities Fund II”. However, you will still own the same amount and type

of shares in the same Fund. The shares of the Fund will continue to be listed on the New York Stock Exchange, although the ticker symbol

will change upon the change in the name of the Fund to “SABA”.

There will be no changes to the Fund’s

distribution policy in connection with the Adviser Transition. To the extent that the Fund has income available, it intends to continue

to distribute monthly dividends to its Shareholders. The amount of the Fund’s

distributions, if any, will be determined by the Board. Any distributions to the Fund’s Shareholders will be declared out of assets

legally available for distribution.

If Proposal 1 is not approved by the Fund’s

Shareholders, the Board will consider such other actions, including the approval of an investment management agreement with a firm other

than Saba, as it determines to be in the best interests of the Fund and Shareholders. The Board may determine to approve an interim investment

management agreement to enable Saba to serve as investment adviser of the Fund. However, such interim agreement may only remain in effect

for a period of not more than 150 days, and a new investment management agreement must be approved by the Board and by Shareholders for

Saba to continue to serve as adviser to the Fund after expiration of the term of such interim agreement. Implementation of Proposal 1

is not contingent upon approval of Proposal 2 or 3.

Benefits of the Adviser Transition

The Unaffiliated Board, including the Special

Committee, believes the retention of Saba, in light of its investment capabilities and track record, better positions the Fund to achieve

improved risk-adjusted returns and achieve its investment objectives. Saba is a global alternative asset management firm that seeks to

deliver superior risk-adjusted returns for a diverse group of clients. Founded in 2009 by Boaz Weinstein, the Firm is a pioneer of credit

relative value strategies and capital structure arbitrage.

The Unaffiliated Board, as well as the Special

Committee, considered that the Fund will gain access to the senior management team of Saba. Under the Adviser Transition, Boaz Weinstein

is expected to replace Michael Hasenstab Ph.D. as President of the Fund and Pierre Weinstein is expected to replace Matthew T. Hinkle

as Chief Executive Officer. Boaz Weinstein, Pierre Weinstein, Paul Kazarian, Xavier Riera, Vish Shah and Alexander Brown will serve as

portfolio managers of the Fund.

In evaluating potential benefits to the Fund

and its Shareholders, the Special Committee also considered Saba’s organization, philosophy of management, historical performance

and methods of operations, including the following specific considerations, among others:

| · | Saba’s experience and record in managing and operating various funds,

including Saba’s experience in managing Saba Capital Income & Opportunities Fund, another registered closed-end fund managed

by Saba (“BRW”) that has a principal investment strategy that is substantially similar to that which Saba has proposed for

the Fund. |

| · | Access to Saba’s sophisticated investment advisory platform and resources,

including Saba’s credit investment experience and resources as well as its capabilities in identifying and making alternative opportunistic

investments that are intended to generate additional attractive risk-adjusted returns. |

| · | Information showing that Saba is able to attract and retain personnel necessary to provide quality investment

advisory services to the Fund. |

Summary of the Existing Management Agreement and

New Management Agreement

The following description of the terms of the

New Management Agreement is only a summary of its material terms and highlights material differences between the New Management Agreement

and the Existing Management Agreement. A copy of the New Management Agreement is attached to this Proxy Statement as Appendix A.

Following approval by the Shareholders in the

manner required by the 1940 Act, the New Management Agreement will be entered into on or about January 1, 2024 concurrent with the completion

of the Adviser Transition. The New Management Agreement

will remain in effect for a period of two (2) years from the date it is effective, unless sooner terminated. After the initial two-year

period, continuation of the New Management Agreement from year-to-year is subject to annual approval by the Board, including at least

a majority of the Non-interested Trustees.

Advisory and Other Services. Under

the terms of the New Management Agreement, Saba will manage the day-to-day operations of the Fund, provides investment advisory services

to the Fund, manages investment and reinvestment of the Fund’s assets and the purchase and sale of its investment securities, will

be responsible for selecting brokers for execution of the Fund’s portfolio transactions and negotiating commissions therewith, each

in accordance with the Fund’s investment objectives, policies and restrictions and, in general, will superintend and manage the

investment of the Fund, subject to the ultimate supervision and direction of the Board and in accordance with the investment objectives,

policies and restrictions of the Fund. These services are currently provided by Franklin under the Existing Management Agreement.

The Existing Management Agreement also provides

for Franklin to administer the affairs of the Fund. Saba is likewise required to administer the affairs of the Fund under the New Management

Agreement. However, under the Existing Management Agreement, Franklin is required to provide, or procure at its own expense, specific

administrative services for the Fund; whereas, under the New Management Agreement Saba is not required to provide specific administrative

services. Rather, such specific administrative services will be provided by an independent third-party, which is contemplated to be SS&C’s

ALPS Fund Services, Inc. (“AFS”), under a separate administrative services agreement with the Fund, the fees for which would

be borne by the Fund. Saba estimates that such administrative fees to be paid monthly to AFS will be at an annual rate of approximately

0.05% of the Fund’s net assets plus a monthly $7,000 fixed fee. Please see below under Fees and Expenses for a comparison of current

total annual operating expenses of the Fund with the estimated pro-forma annual expenses of the Fund assuming completion of the Adviser

Transition.

Investment Management Fee. In

consideration of the services provided by Franklin to the Fund under the Existing Management Agreement, the Fund pays Franklin an investment

management fee, calculated daily and paid monthly based on the average daily net assets of the Fund as follows:

| Annualized Fee Rate |

Net Assets |

| 0.700% |

Up to and including $200 million |

| 0.635% |

Over $200 million, up to and including $700 million |

| 0.600% |

Over $700 million, up to and including $1 billion |

| 0.580% |