UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2024

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

+34 91-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica: Announcement on Delisting Offer of Telefónica Deutschland | 2 |

The information contained herein is not for publication or distribution, in whole or in part, in, into, within or from any country where such publication or distribution would be in violation of the relevant legal provisions of such countries.

TELEFÓNICA, S.A. (hereinafter, Telefónica), in compliance with the Securities Market legislation, hereby communicates the following:

OTHER RELEVANT INFORMATION

The Executive Commission of Telefónica has decided to make, through Telefónica Local Services GmbH (the "Bidder") (a direct wholly-owned subsidiary of Telefónica), a public delisting acquisition offer with the aim to acquire the shares in Telefónica Deutschland Holding AG (“Telefónica Deutschland”) not yet directly or indirectly held by Telefónica (the “Delisting Offer”). Consequently, the Delisting Offer could be accepted in respect of up to 168,076,494 Telefónica Deutschland shares (corresponding to approximately 5.65% of the share capital and voting rights in Telefónica Deutschland), which corresponds to the stake in Telefónica Deutschland not already held by the Telefónica Group.

The Delisting Offer will be structured as a public tender offer and will not be subject to any closing conditions. The consideration offered to Telefónica Deutschland shareholders amounts to EUR 2.35 in cash for each share. The necessary funds to pay the maximum total consideration are available to Telefónica. Telefónica believes the Delisting Offer provides another opportunity to access liquidity at an attractive price for all remaining Telefónica Deutschland shareholders.

Further, the Bidder today entered into an agreement with Telefónica Deutschland, in which Telefónica Deutschland has undertaken to support a delisting of Telefónica Deutschland. Upon the delisting becoming effective, the trading of Telefónica Deutschland shares on the regulated market of the Frankfurt Stock Exchange will cease, which can result in a further limitation of liquidity and price availability for the Telefónica Deutschland shares from that point in time onwards which may result in share price declines. The delisting will also reduce the financial reporting obligations of Telefónica Deutschland since it will no longer be obliged to comply with financial reporting obligations applicable to a publicly listed company.

The acceptance period for the Delisting Offer will commence upon the publication of the offer document which is expected in late March/early April 2024. The settlement of the Delisting Offer (expected in late April/early May 2024) will occur without undue delay following the expiry of the acceptance period. The Annual General Shareholders’ Meeting of Telefonica Deutschland which will also resolve on the distribution of the Telefónica Deutschland dividend for the fiscal year 2023 will take place several weeks after the settlement of the Delisting Offer and no earlier than mid-June 2024.

The specific characteristics and terms of the Delisting Offer will be set out in the relevant offer document, which will be published after its review and approval by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht).

Likewise, we hereby inform that the Bidder and Telefónica have informed Telefónica Deutschland that currently they do not intend to support dividend payments beyond the already confirmed EUR 0.18 dividend per share for the financial year 2023. The Bidder and Telefónica intend to evaluate Telefónica Deutschland’s dividend policy over time jointly with Telefónica Deutschland’s management team,

provided that neither the Bidder nor Telefónica currently see a need to pay dividends in the future beyond the minimum legally required.

Additional information on the Delisting Offer is set out in the announcement published today in the manner prescribed by German law. An English translation of the announcement is attached hereto for informational purposes.

Lastly, the Bidder and Telefónica have no intentions to implement a domination agreement and/or profit and loss transfer agreement, nor to initiate a squeeze-out.

In Madrid, on 7 March 2024

Important notice:

This announcement is for information purposes and neither represents an offer to purchase or sell nor a solicitation of an offer to purchase, sell or tender shares of Telefónica Deutschland. The complete terms of the Delisting Offer will be published in the offer document once it is approved by the German Federal Financial Supervisory Authority.

THE INFORMATION CONTAINED HEREIN IS NOT FOR PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO, WITHIN OR FROM ANY COUNTRY WHERE SUCH PUBLICATION OR DISTRIBUTION WOULD BE IN VIOLATION OF THE RELEVANT LEGAL PROVISIONS OF SUCH COUNTRIES.

Publication of the decision to make a public delisting acquisition offer pursuant to Section 10 para. 1 and para. 3 of the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz – “WpÜG”) in conjunction with Section 39 para. 2 sent. 3 no. 1 of the German Stock Exchange Act (Börsengesetz – “BörsG”)

Bidder:

Telefónica Local Services GmbH

Adalperostraße 82-86

85737 Ismaning

Germany

registered with the commercial register of the local court of Munich under HRB 287256

Target:

Telefónica Deutschland Holding AG

Georg-Brauchle-Ring 50

80992 Munich

Germany

registered with the commercial register of the local court of Munich under HRB 201055

ISIN: DE000A1J5RX9 / WKN: A1J5RX

Information by the Bidder:

Today, on 7 March 2024, Telefónica Local Services GmbH (the “Bidder”) has decided to make a public delisting acquisition offer (öffentliches Delisting-Erwerbsangebot) pursuant to Section 39 para. 2 sent. 3 no. 1 BörsG to the shareholders of Telefónica Deutschland Holding AG, with registered office in Munich, Germany (“Telefónica Deutschland”), to acquire all non-par value registered shares in Telefónica Deutschland not yet directly held by the Bidder (the “Delisting Offer”), each share representing a proportionate amount of EUR 1.00 of the share capital of Telefónica Deutschland (ISIN DE000A1J5RX9) (the “Telefónica Deutschland Shares”).

For each tendered Telefónica Deutschland Share, the Bidder will, subject to the final terms set forth in the offer document, offer a cash consideration in the amount of EUR 2.35. Telefónica, S.A. and the Bidder believe the Delisting Offer provides another opportunity to access liquidity at an attractive price for all remaining Telefónica Deutschland shareholders.

The Bidder, a direct wholly-owned subsidiary of Telefónica, S.A., with registered office in Madrid, Spain, currently holds approximately 7.86% of Telefónica Deutschland’s share capital and voting rights. Telefónica Germany Holdings Limited, an indirect subsidiary of Telefónica, S.A., directly holds approximately 69.22% of the share capital and voting rights in Telefónica Deutschland. Telefónica, S.A. directly holds approximately 17.27% and, directly and indirectly, holds approximately 94.35% of Telefónica Deutschland’s share capital and voting rights. The Bidder entered into binding agreements with Telefónica S.A. and Telefónica Germany Holdings Limited in which they irrevocably undertake not to accept the Delisting Offer for the Telefónica Deutschland Shares held by them. It is therefore expected that the Delisting Offer could be accepted by a maximum of up to 5.65% of Telefónica Deutschland’s shareholders. The Bidder and Telefónica S.A. agreed to coordinate closely with regard to material decisions, in particular with regard to the exercise of voting rights attaching to the Telefónica Deutschland Shares held by them or attributed to them.

Further, the Bidder today entered into an agreement with Telefónica Deutschland, in which Telefónica Deutschland has undertaken to support a delisting of Telefónica Deutschland, inter alia, by applying prior to the expiry of the acceptance period of the Delisting Offer for the revocation of the admission to trading of the Telefónica Deutschland Shares on the regulated market of the Frankfurt Stock Exchange, pursuant to Section 39 para. 2 BörsG.

Upon the delisting becoming effective, the trading of Telefónica Deutschland shares on the regulated market of the Frankfurt Stock Exchange will cease, which can result in a further limitation of liquidity and price availability for the Telefónica Deutschland Shares from that point in time onwards which may result in share price declines. The delisting will also reduce the financial reporting obligations of Telefónica Deutschland since it will no longer be obliged to comply with financial reporting obligations applicable to a publicly listed company.

As announced in the offer document relating to the partial acquisition offer which was published by the Bidder on 5 December 2023, the Bidder and Telefónica S.A. intend to promote a revision of the current Telefónica Deutschland dividend policy beyond the already-confirmed EUR 0.18 dividend per share for the financial year 2023. The Bidder and Telefónica S.A. have informed Telefónica Deutschland that currently they do not intend to support dividend payments beyond the already confirmed EUR 0.18 dividend per share for the financial year 2023. The Bidder and Telefónica S.A. intend to evaluate Telefónica Deutschland’s dividend policy over time jointly with Telefónica Deutschland’s management

team, provided that neither the Bidder nor Telefónica S.A. currently see a need to pay dividends in the future beyond the minimum legally required.

The acceptance period for the Delisting Offer will commence upon the publication of the offer document which is expected in late March/early April 2024. The offer document will provide for an acceptance period of approximately four weeks (subject to statutory extensions applying). The settlement of the Delisting Offer will occur without undue delay following the expiry of the acceptance period. The Delisting Offer is expected to settle in late April/early May 2024. The Annual General Shareholders’ Meeting of Telefonica Deutschland which will also resolve on the distribution of the Telefónica Deutschland dividend for the fiscal year 2023 will take place several weeks after the settlement of the Delisting Offer and not earlier than mid-June 2024.

The Delisting Offer will not be subject to any offer conditions. The Bidder and Telefónica S.A. have no intentions to implement a domination agreement and/or profit and loss transfer agreement, nor to initiate a squeeze-out.

The Delisting Offer will be made in accordance with the terms set forth in the offer document to be approved by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht – BaFin). The offer document and other information relating to the Delisting Offer will be available at https://www.td-offer.com.

Important Notice:

This announcement is for information purposes and neither represents an offer to purchase or sell nor a solicitation of an offer to purchase, sell or tender shares of Telefónica Deutschland. The complete terms of the Delisting Offer, as well as further provisions concerning the Delisting Offer, will be published in the offer document after the approval of the offer document by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht – BaFin). The Bidder reserves the right, to the extent legally permissible, to change the terms referred to herein in the final terms of the Delisting Offer.

Investors and shareholders of Telefónica Deutschland are strongly advised to read the offer document and any other relevant documents in connection with the Delisting Offer as soon as such documents are published as they will contain important information. Where appropriate, it is furthermore recommended that investors and shareholders seek independent advice in order to receive individual assessment regarding the Delisting Offer.

The Delisting Offer relates to the shares of a German stock corporation (Aktiengesellschaft) and will be conducted exclusively under the laws of the Federal Republic of Germany on the implementation of such an offer and certain applicable provisions of the U.S. securities laws. Any contract concluded on the basis

of the Delisting Offer will be exclusively governed by the laws of the Federal Republic of Germany and is to be interpreted in accordance with such laws.

The Bidder and/or persons acting jointly with the Bidder within the meaning of section 2 para. 5 sentences 1 and 3 WpÜG may acquire, or make arrangements to acquire, Telefónica Deutschland Shares other than in the course of the Delisting Offer on or off the stock exchange prior to publication of the offer document and/or during the period in which the Delisting Offer remains open for acceptance, provided that such acquisitions or arrangements to acquire comply with the applicable German statutory provisions, in particular the WpÜG, and the applicable provisions under the U.S. Securities Exchange Act of 1934. These purchases may be completed on the stock exchange at market prices or outside the stock exchange at negotiated terms. Information about such acquisitions or arrangements to acquire will be disclosed (i) if concluded or consummated prior to the publication of the offer document, in the offer document and (ii) if concluded or consummated during the period in which the Offer remains open for acceptance, in the form prescribed by section 23 para. 2 WpÜG, with a non-binding English translation being made available on the Bidder’s website at https:///www.td-offer.com. Any information about such acquisitions or arrangements that is made public in Germany will be accessible from the United States.

7 March 2024

Telefónica Local Services GmbH

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | March 7, 2024 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

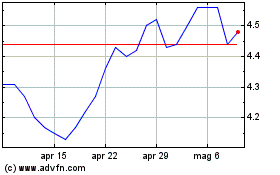

Grafico Azioni Telefonica (NYSE:TEF)

Storico

Da Mar 2025 a Mar 2025

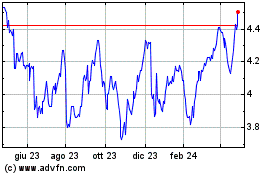

Grafico Azioni Telefonica (NYSE:TEF)

Storico

Da Mar 2024 a Mar 2025