Enel Launches Dual-Tranche EUR1.75 Billion Sustainability-Linked Bond

17 Gennaio 2024 - 8:24AM

Dow Jones News

By Mauro Orru

Enel launched a dual-tranche sustainability-linked bond for

institutional investors in the Eurobond market for 1.75 billion

euros ($1.90 billion).

The Rome-based energy company said late Tuesday that the

issue--conducted through Enel Finance International--was more than

three times oversubscribed, collecting orders of roughly EUR5.8

billion.

Enel Finance International plans to use the proceeds to

refinance the group's ordinary financing needs relating to debt

maturities.

Write to Mauro Orru at mauro.orru@wsj.com

(END) Dow Jones Newswires

January 17, 2024 02:09 ET (07:09 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

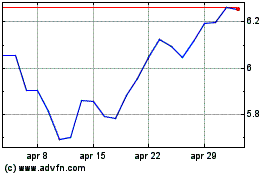

Grafico Azioni Enel (BIT:ENEL)

Storico

Da Gen 2025 a Feb 2025

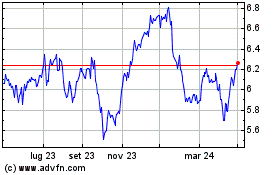

Grafico Azioni Enel (BIT:ENEL)

Storico

Da Feb 2024 a Feb 2025

Notizie in Tempo Reale relative a Enel Spa (Borsa Italiana): 0 articoli recenti

Più Enel Spa Articoli Notizie