Excerpt of the shareholders? agreement disseminated upon request and on behalf of GIAN MARCO MORATTI S.a.p.A.

04 Ottobre 2013 - 10:18AM

Annunci Borsa (Testo)

Excerpt of the shareholders' agreement communicated to the

Commissione Nazionale per le Società e la Borsa ("CONSOB") pursuant

to art. 122 of the Legislative Decree no. 58 of February 24, 1998,

as subsequently amended and supplemented ("T.U.F.") and the

applicable provisions of the Regulation adopted by Consob by

resolution no. 11971 of May 14, 1999, as subsequently amended and

supplemented GIAN MARCO MORATTI S.a.p.A. di Gian Marco Moratti

Registered office in Milan, Foro Buonaparte 69 Share capital: Euro

50,000,000.00 fully paid-in Registered with the Register of

Enterprises of Milan at no. 08379580965 On October 1, 2013, the

companies Gian Marco Moratti S.a.p.A. di Gian Marco Moratti ("GMM

S.a.p.A.") and Massimo Moratti S.a.p.A. di Massimo Moratti ("MM

S.a.p.A.") executed a shareholders' agreement relating to the

shares respectively held by each of the aforementioned companies in

Saras S.p.A., having as object, inter alia, the appointment of the

company's bodies of Saras S.p.A., the exercise of the voting right

at the shareholders' meetings of Saras S.p.A. and a reciprocal

prohibition of transfer the shares respectively held by each of the

aforementioned companies in Saras S.p.A.. (the "Saras Shareholders'

Agreement") 1. Company whose financial instruments are subject to

the shareholders' agreement. Saras S.p.A. Â Raffinerie Sarde, an

Italian company with shares listed on the Mercato Telematico

Azionario organized and managed by Borsa Italiana S.p.A., with

registered office at S.S. Sulcitana 195 Km 19, 09018 Sarroch

(Cagliari), with headquarters and administrative offices at

Galleria de Cristoforis 1, 20122 Â Milano, share capital of Euro

54,629,667.00 fully paid-in, divided into 951,000,000 ordinary

shares without par value ("Saras"). 2. Financial instruments

subject to the shareholders' agreement and percentage in respect of

the share capital. All the Saras shares owned, respectively, by GMM

S.a.p.A. and MM S.a.p.A. (the "Parties"), representing,

respectively, 25.01% of the share capital of Saras and, in the

aggregate, 50.02% of the share capital of Saras, are subject to the

Saras Shareholders' Agreement. In addition, GMM S.a.p.A. and MM

S.a.p.A. have agreed that all Saras shares that may be held by GMM

S.a.p.A. and MM S.a.p.A. in the future shall be subject to the

Saras Shareholders' Agreement.

3. Parties to the agreement. The following parties are Parties to

the Saras Shareholders' Agreement: (i) Gian Marco Moratti S.a.p.A.

di Gian Marco Moratti, società in accomandita per azioni with share

capital of Euro 50,000,000.00 and registered office in Milano, Foro

Buonaparte 69; owner of 237,854,559 Saras shares, representing

25.01% of the share capital of Saras (and 50% of the syndacated

shares), and (ii) Massimo Moratti S.a.p.A. di Massimo Moratti,

società in accomandita per azioni with share capital of Euro

50,000,000.00 and registered office in Milano, Foro Buonaparte 69,

owner of 237,854,558 Saras shares, representing 25.01% of the share

capital of Saras (and 50% of the syndacated shares). It is also

specified that pursuant to article 93 of the T.U.F. none of the

Parties has the right to individually exercise the control of the

issuer. The control of the issuer is therefore exercised jointly by

the Parties through the Saras Shareholder's Agreement. 4. Content

of the shareholders' agreement. 4.1 Appointment of the company's

bodies of Saras 4.1.1 The Parties shall do everything in their

power to ensure that the board of directors is comprised of twelve

members and agree to submit and vote at the shareholders' meetings

of Saras that shall be convened for the appointment of the

company's offices, a list of candidates for the appointment as

members of the board of directors of Saras in which half of the

candidates shall be designated by GMM S.a.p.A. and the other half

shall be designated by MM S.a.p.A. 4.1.2 The Parties agree to

present and vote at the shareholders' meetings of Saras that shall

be convened for the appointment of the company's offices, a list of

candidates for the appointment as members of the board of statutory

auditors of Saras composed as follows: for the first appointment

following the effective date, GMM S.a.p.A. shall designate

candidate no. 1 on the list of statutory auditors and candidate no.

2 on the list of alternate auditors, and MM S.a.p.A. shall

designate candidates no. 2 and no. 3 on the list of statutory

auditors and candidate no. 1 on the list of alternate auditors.

Such designation rights shall alternate between GMM S.a.p.A. and MM

S.a.p.A. for the following appointment of the members of the board

of statutory auditors of Saras and the same alternation shall

continue for subsequent appointments. 4.1.3 In the event, for any

reason, a director appointed from the list filed pursuant to the

Saras Shareholders' Agreement terminates from his or her office,

the Parties shall procure that, both in the event of cooptation, by

the board of directors, and in the event of confirmation or

substitution by shareholder's meeting resolution, the member of the

board of directors cooptated, appointed or substituted is

designated by the Party which designated the director terminated

from his or her 2

office. 4.2 Exercise of the voting right at the shareholders'

meetings of Saras 4.2.1 The Parties agree to meet in advance to

examine and discuss the items on the agenda of each ordinary and

extraordinary shareholders' meeting of Saras, except for

resolutions on the appointment of the company's offices. 4.2.2 The

Parties shall consult in good faith in order to agree upon their

vote on any matter on the agenda for upcoming shareholders'

meetings of Saras. After their consultations, the Parties shall

give to the secretary appointed pursuant the Saras Shareholders'

Agreement their agreed voting instructions, granting him their

respective voting proxies. 4.2.3 In the event the Parties do not

reach an agreement on the voting instructions relating to one or

more items on the agenda, the Secretary (as defined below) of the

Saras Shareholders' Agreement shall refrain from voting in respect

to such items at the shareholder's meeting of Saras. In the event

the Parties do not reach an agreement on the voting instructions

relating to all the items on the agenda, the proxy vote to the

Secretary (as defined below) of the Saras Shareholders' Agreement

for the related shareholders' meeting shall be deemed revoked and

the Parties shall refrain from attending the shareholders' meeting.

4.3 Prohibition of Transfer The Parties have agreed not to transfer

their respective Saras shares, and the rights arising from or

relating thereto, which are covered by the Saras Shareholders'

Agreement. The term "transfer" (and any other related term having

the same root) includes, inter alia, any transfer, other

transaction or inter vivos deed of any nature, whether gratuitous

or for consideration, having as its object or effect, directly or

indirectly, the assignment, conveyance, or transfer of shares of

Saras or rights relating thereto to any person other than the

Parties. 4.4 Purchase and subscription of Saras shares Neither

Party shall become the owner of Saras shares in addition to their

respective Saras shares held at the date of execution of the Saras

Shareholders' Agreement without the prior consent of the other

Party, except in the case of subscription to capital increases or

stock split, provided that the Parties shall not purchase Saras

shares and or rights thereunder or relating thereto or execute any

other transaction or inter vivos deed of any nature, whether

gratuitous or for consideration, or any other transaction, directly

or indirectly, having as its object or effect shares of Saras

and/or rights thereof or relating thereto or that may trigger the

application of the provisions of the Legislative Decree no. 58 of

February 24, 1998 concerning mandatory takeover bids. 5. Duration

and renewal of the shareholders' agreement. 3

The Saras Shareholders' Agreement shall be effective until the

expiration of the third year from the date of effectiveness of the

Demerger and shall be automatically renewed for further periods of

three years each if none of the Parties gives written notice to the

others of its intention not to renew the Saras Shareholders'

Agreement at least six months before the first or any subsequent

expiration date 6. Type of shareholders' agreement. The Saras

Shareholders' Agreement may be ascribed to the type contemplated by

art. 122, fifth paragraph, letters a) and b) of the T.U.F. 7.

Filing of the shareholders' agreement. The Saras Shareholders'

Agreement is to be communicated to Consob and has been filed with

the Register of Enterprises of Cagliari on October 2, 2013 at no.

PRA 56118/2013. 8. Other information. 8.1 The Saras Shareholders'

Agreement provides for the appointment of a secretary (the

"Secretary") in relation to the Parties' performance thereunder.

The Secretary of the Saras Shareholders' Agreement shall be in

office for the duration of the Saras Shareholders' Agreement or

until it will be jointly revoked by the Parties. 8.1 The Saras

Shareholders' Agreement does not contemplate any obligation put in

escrow the shares subject to the Saras Shareholders' Agreement.

4

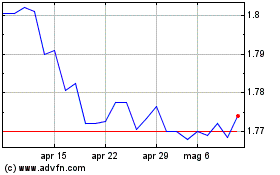

Grafico Azioni Saras Raffinerie Sarde (BIT:SRS)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Saras Raffinerie Sarde (BIT:SRS)

Storico

Da Lug 2023 a Lug 2024