Banks Bust, Bitcoin Booms: Price Skyrockets 40% During US Banking Crisis

05 Giugno 2024 - 7:10AM

NEWSBTC

Bitcoin, the enigmatic digital currency, is back in the spotlight

as the US banking system grapples with mounting stress. While some

predict a stratospheric rise to $1 million per coin, fueled by

economic woes, others remain skeptical. Related Reading: Is This

The Next Meme Stock Frenzy? ROAR Explodes Over 300% After Kitty’s

GME Move Banking On Bitcoin’s Rise? Bitcoin advocates see it as a

beacon of stability in a storm. Unlike traditional assets tied to

the health of institutions, Bitcoin boasts a finite supply and

decentralized nature. This, they argue, positions it perfectly to

benefit from a “flight to safety” scenario, where investors seek

refuge from a potentially collapsing banking system. The recent

history seems to support this narrative. In March 2023, the

failures of prominent institutions like Silicon Valley Bank

coincided with a 40% surge in Bitcoin’s price within a week.

Industry figures point to this as evidence of Bitcoin’s role as an

“uncorrelated asset class” – a hedge against traditional financial

turmoil. Further bolstering this argument is the latest report by

the Federal Deposit Insurance Corporation (FDIC). The report paints

a concerning picture, highlighting a worrying trend of unrealized

losses on securities held by US banks. These losses, driven by

rising interest rates, have ballooned to over $500 billion.

Additionally, the number of banks on the FDIC’s “Problem Bank List”

has grown from 52 to 63 in just one quarter, raising fears about

the overall health of the sector. Million-Dollar Dream Or Flight Of

Fancy? While the potential for Bitcoin to gain value seems

undeniable, the ambitious price target of $1 million faces strong

headwinds. Experts warn that such a dramatic surge might come at

the cost of a full-blown economic meltdown, a scenario that

wouldn’t necessarily benefit Bitcoin in the long run. Furthermore,

Bitcoin’s historical correlation with other assets is not static.

While periods of weak correlation exist, there have also been

instances of strong correlation, particularly during broader market

downturns. This casts doubt on Bitcoin’s ability to completely

decouple itself from a struggling traditional financial system.

Related Reading: Dogecoin Under The Microscope – Historical Data

Points To Rebound Another factor to consider is the recent uptick

in the M2 money supply, a metric representing the total money

circulating in the economy. Historically, periods of M2 expansion

have coincided with Bitcoin price increases. However, the interplay

between money supply and Bitcoin in an environment with a

potentially shaky banking system remains an open question. The Road

Ahead For Bitcoin Bitcoin’s future is a bit of a guessing game

right now. Banks in the US are having some problems, and that could

make Bitcoin more valuable. But if the whole economy goes downhill,

even Bitcoin might suffer. So, it all depends on how bad things get

with the banks and the economy in general. Featured image from

Pngtree, chart from TradingView

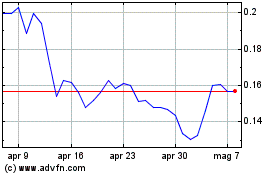

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Mag 2024 a Giu 2024

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Giu 2023 a Giu 2024