Massive Bitcoin Rally Predicted For Next 6 Months After Fed Rate Cut

18 Settembre 2024 - 4:00AM

NEWSBTC

As the crypto community awaits the Federal Reserve’s (Fed) rate cut

announcement on September 18, the stakes are high for Bitcoin (BTC)

and the broader financial landscape. This upcoming decision

marks the first central bank rate cut since the Fed slashed its key

rate to near zero in March 2020 amid the COVID-19 pandemic.

Will A 50bps Cut Spark A Bitcoin Bull Run? According to CME Group’s

FedWatch tool, markets are currently pricing in a 59% chance of a

half-percentage-point rate cut and a 41% chance of a quarter-point

cut. There’s an overwhelming expectation that by the end of 2024,

the Fed could implement up to 100 basis points in cuts, with nearly

60% odds of 125 basis points. This suggests that investors

anticipate at least one or two substantial rate cuts in the three

remaining Fed meetings of the year, starting with this week’s

announcement. Related Reading: Shiba Inu Competitor FLOKI Forms

Falling Wedge That Could Trigger 54% Breakout The potential effects

of a 50 basis point cut remain hotly debated within the crypto

industry. Market expert Crypto Rover argues that such a cut could

reignite a bull run for Bitcoin, stating that the conditions could

lead to “super bullish” prospects. Similarly, analyst Lark

Davis recalls how Bitcoin previously surged following past rate

cuts, predicting that if history repeats, the next 6-12 months

could see significant price increases for the largest

cryptocurrency on the market. Optimism Vs Historical Caution In

Crypto Market In addition to optimism and bullish expectations,

other analysts express caution. EmperorBTC predicts an initial

market pump following the rate cut, driven by cheaper borrowing

costs. However, the analyst warns of profit-taking by

short-term holders leading to a subsequent market dump, suggesting

a “sell the news” scenario that could leave many investors

disillusioned before the market stabilizes and resumes growth. On

the other hand, technical analyst Justin Bennett offers a more

cautionary historical perspective. He points to the market’s

performance during the Fed’s rate cuts in 2007, when the Nasdaq 100

Index retraced significantly after the initial cuts, suggesting

that the same pattern could emerge in 2023. Bennett’s

analysis suggests that current market conditions may mirror

previous downturns, calling into question the optimistic

projections shared by some for the broader digital asset market.

Related Reading: Bearish Signal For Ethereum: Funding Rates Hit New

2024 Lows—Is A Rally Still Possible? In a similar vein, NewsBTC

reported on Monday the analysis of crypto strategist Doctor Profit,

in which he highlights a divided sentiment in the market regarding

the rate cut, with equal chances of a 0.25% or 0.50%

reduction. However, the analyst is leaning towards the larger

cut, arguing that failure to take decisive action could lead to

turmoil reminiscent of “Blood Monday” on August 5, when Bitcoin

experienced a sharp decline to $48,900. Despite the divided

sentiment in the market, Bitcoin has jumped from the $57,000 mark

traded on Monday to a current price of $61,000, recording a surge

of nearly 6% in a matter of hours in anticipation of tomorrow’s

announcements. Featured image from DALL-E, chart from

TradingView.com

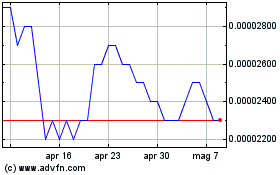

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Set 2024 a Ott 2024

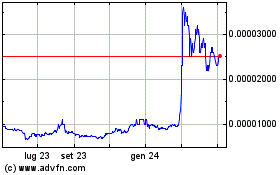

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Ott 2023 a Ott 2024