Swiss Franc Advances Against Majors

19 Febbraio 2024 - 11:16AM

RTTF2

The Swiss franc climbed against its most major counterparts in

the European session on Monday, as fading chances for early

interest rate cuts from the Federal Reserve dampened investor

sentiment.

U.S. consumer and producer inflation came in stronger than

expected in January, prompting investors to scale back their

expectations for rate cuts this year.

The minutes from the Federal Reserve's January policy meeting

will be published on Wednesday.

No major data releases are scheduled from the U.S.

U.S. markets are closed in observance of the Presidents' Day

holiday.

The franc rebounded to 1.1098 against the pound and 0.9484

against the euro, off its early 4-day lows of 1.1128 and 0.9505,

respectively. The franc may find resistance around 1.09 against the

pound and 0.93 against the euro.

The franc recovered to 0.8799 against the greenback during

European deals. It is likely to locate resistance around the 0.86

level.

In contrast, the franc eased against the yen and was trading at

170.10. This may be compared to a previous 4-day low of 170.05. The

franc is seen finding support around the 167.00 level.

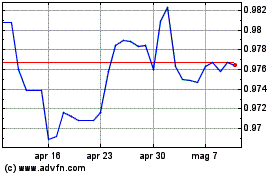

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Apr 2024 a Mag 2024

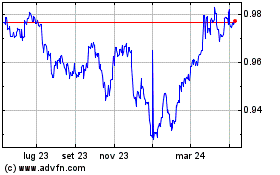

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mag 2023 a Mag 2024