Euro Advances On Easing Middle East Fears

19 Aprile 2024 - 2:26PM

RTTF2

The euro was higher against its major counterparts in the New

York session on Friday, as concerns about an escalation in the

Middle East conflict eased after a subdued response from Iran to

Israel's retaliatory attack.

Iran's state-run media reported that there was no missile attack

and the explosions heard in Isfahan were the result of the

activation of the missile defenses.

Also, the nuclear facilities in Iran's central Isfahan province

are completely safe, the semi-official news agency Tasnim

reported.

The International Atomic Energy Agency (IAEA) also confirmed

that there has been no damage to Iranian nuclear sites as a result

of the Israeli strike confirmed by U.S. officials. The limited

Israeli strikes in Isfahan province in Iran scaled back fears of a

wider regional conflict.

The euro rose to 1.0677 against the greenback and 0.9716 against

the franc, from an early 2-day low of 1.0610 and a 1-1/2-month low

of 0.9565, respectively. The euro is poised to challenge resistance

around 1.08 against the greenback and 0.98 against the franc.

The euro climbed to 10-day highs of 0.8581 against the pound and

165.02 against the yen, from an early low of 0.8554 and a 4-day low

of 163.02, respectively. The euro is likely to find resistance

around 0.88 against the pound and 166.00 against the yen.

In contrast, the euro eased against the loonie and was trading

at 1.4644. This may be compared to a prior 4-day low of 1.4635. If

the euro falls further, it is likely to test support around the

1.44 region.

The euro was trading at 1.6608 against the aussie and 1.8091

against the kiwi, after easing from an early 1-1/2-month high of

1.6681 and nearly a 5-month high of 1.8134, respectively. The euro

may face support around 1.61 against the aussie and 1.74 against

the kiwi.

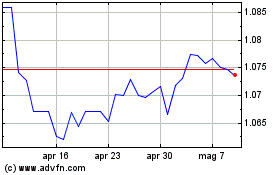

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Apr 2024 a Mag 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Mag 2023 a Mag 2024