U.S. Dollar Lower Ahead Of Inflation Data

27 Giugno 2024 - 2:33PM

RTTF2

The U.S. dollar weakened against its major counterparts in the

New York session on Thursday, as investors digested mixed economic

data and awaited key inflation data due on Friday.

Data from the Labor Department showed that initial jobless

claims fell more than expected in the week ended June 22.

The Labor Department said initial jobless claims dropped to

233,000, a decrease of 6,000 from the previous week's revised level

of 239,000.

Economists had expected jobless claims to edge down to 236,000

from the 238,000 originally reported for the previous week.

Data from the Commerce Department showed that the U.S. economy

grew by slightly more than previously estimated in the first

quarter of 2024.

Gross domestic product jumped by 1.4 percent in the first

quarter compared to the previously estimated 1.3 percent increase.

The upward revision matched economist estimates.

Investors await directional cues from the U.S. PCE price index

data on Friday, which is the Federal Reserve's preferred inflation

gauge.

Market participants look forward to the first Trump-Biden

Presidential debate of the year later in the day.

U.S. Democrat and Republican front-runners Joe Biden and Donald

Trump will meet for a debate in Atlanta, Georgia at 9.00 pm ET

before CNN moderators Jake Tapper and Dana Bash, ahead of

November's hotly contested U.S. election.

The greenback edged down to 160.27 against the yen and 0.8957

against the franc, off its early highs of 160.79 and 0.8979,

respectively. The greenback is poised to challenge support around

147.00 against the yen and 0.88 against the franc.

The greenback touched 1.0726 against the euro, setting a 2-day

low. The greenback is likely to face support around the 1.08

region, if it falls again.

The greenback retreated to 1.3675 against the loonie and 0.6108

against the kiwi, from an early 6-day high of 1.3712 and a

1-1/2-month high of 0.6068, respectively. The currency is seen

finding support around 1.34 against the loonie and 0.63 against the

kiwi.

The greenback eased to 1.2670 against the pound, from an early

1-1/2-month high of 1.2612. On the downside, 1.31 is likely seen as

its next support level.

Meanwhile, the greenback was higher against the aussie, at

0.6645. Next key resistance for the currency is seen around the

0.64 level.

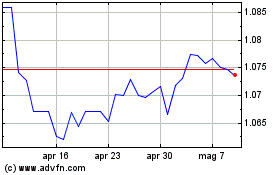

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Mag 2024 a Giu 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Giu 2023 a Giu 2024