0001498710false00014987102024-01-192024-01-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported) January 19, 2024

SPIRIT AIRLINES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35186 | 38-1747023 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | | |

| 2800 Executive Way | Miramar, | Florida | 33025 |

| (Address of Principal Executive) | (Zip Code) |

(954) 447-7920

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | SAVE | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 19, 2024, Spirit Airlines, Inc. (the "Company" or "Spirit") provided an update to investors (the "Investor Update") announcing certain preliminary estimates for the fourth quarter and full year 2023. The Company’s unaudited interim consolidated financial statements for the fourth quarter and full year 2023 are not yet complete and results may vary from these preliminary estimates upon completion of closing procedures.

A copy of the Investor Update is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 2.02. The information contained in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). It may only be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, as amended, if such subsequent filing specifically references the information furnished pursuant to Item 2.02 of this report.

Item 7.01 Regulation FD Disclosure.

On January 19, 2024, Spirit provided an update to investors regarding the Company's fourth quarter and full year 2023 (as described in Item 2.02 above) and first quarter 2024 guidance and other items (the "Investor Update"); a copy of which is furnished pursuant to this Item 7.01 as Exhibit 99.1 and is incorporated herein by reference. The guidance provided therein is only an estimate of what the Company believes is realizable as of the date of the Investor Update. Actual results may vary from the guidance and the variations may be material. The Company undertakes no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law. The Company reserves the right to discontinue availability of the Investor Update from its website at any time.

The information set forth above in Item 2.02 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 7.01

A copy of the Investor Update is attached in this report furnished pursuant to Item 7.01 shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). It may only be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, as amended, if such subsequent filing specifically references the information furnished pursuant to Item 7.01 of this report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following is furnished as an exhibit to this report and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act:

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Date: January 19, 2024 | SPIRIT AIRLINES, INC. |

| |

| By: /s/ Thomas Canfield |

| Name: Thomas Canfield |

| Title: Senior Vice President and General Counsel |

| |

| |

| |

| |

| |

EXHIBIT 99.1

EXHIBIT 99.1

Investor Update as of January 19, 2024

The fourth quarter and full year 2023 estimates and first quarter 2024 guidance items provided below are based on the Company's current estimates and are not a guarantee of future performance. The Company’s unaudited interim consolidated financial statements for the fourth quarter and full year 2023 are not yet complete and results may vary from these preliminary estimates upon completion of closing procedures. There could be significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in the Company's reports on file with the Securities and Exchange Commission. Spirit undertakes no duty to update any forward-looking statements or estimates.

Total revenue for the fourth quarter 2023 is expected to be at the high end of the Company’s initial guidance, as bookings for the peak travel period over Christmas and New Years were strong. Operating expenses are estimated to come in better than expected primarily due to lower fuel costs driven by better than expected fuel efficiency, lower airport costs and other items, driven by strong operational performance and reliability, with the Company reporting a top 3 completion factor of 99.7% during the holiday period. Adjusted operating margin guidance for the fourth quarter 2023 is positively revised 450 basis points from negative 15 to 19 percent to negative 12 to 13 percent.

As of December 31, 2023, Spirit had $1.3 billion of liquidity, including unrestricted cash and cash equivalents, short-term investment securities and $300 million of liquidity under the Company’s revolving credit facility.

During the fourth quarter, the Company took several steps to shore up its liquidity to allow it time to make the necessary strategic shifts to enable the Company to compete effectively in the current demand backdrop and to return the business to profitability.

In November 2023, Spirit modified its Revolving Credit Facility to, among other things, extend the final maturity to September 30, 2025.

In December 2023, the Company completed sale-leaseback transactions for 20 aircraft, resulting in repayment of approximately $325 million of indebtedness on those aircraft and net cash proceeds of $320 million. In January 2024, the Company completed sale-leaseback transactions for an additional five aircraft, resulting in repayment of approximately $140 million of indebtedness on those aircraft and net cash proceeds of $99 million. In total, these transactions resulted in net cash proceeds to the Company of approximately $419 million.

Spirit and Pratt & Whitney have been in negotiations regarding fair compensation for the financial damages related to the geared turbo fan (GTF) neo engine availability issues. Discussions with Pratt have progressed considerably since October, and while no agreement has been reached to date, the Company believes the amount of compensation it will receive will be a significant source of liquidity over the next couple of years.

The Company is also assessing options to refinance its 2025 debt maturities, including the $1.1 billion of aggregate principal amount of 8.00% Senior Secured Notes.

For the first quarter 2024, the Company estimates capacity growth will be up 1 to 2 percent year over year.

Spirit plans to conduct a conference call to discuss fourth quarter results and its forward outlook on February 8, 2024 at 10:00 a.m. Eastern US Time.

The Merger Agreement between Spirit and JetBlue and Sundown Acquisition Corp., wholly owned subsidiary of JetBlue, dated July 28, 2022 remains in full force and effect.

On January 16, 2024, Spirit Airlines, Inc. (“Spirit”) and JetBlue Airways Corporation (“JetBlue”) issued a joint statement announcing (i) that the United States District Court for the District of Massachusetts (the “Court”) has granted the U.S. Department of Justice’s request for a permanent injunction against the proposed merger of Spirit and JetBlue and (ii) that JetBlue and Spirit are reviewing the Court’s decision and evaluating next steps.

Spirit has stated that it disagrees with the U.S. District Court’s ruling and continues to believe that a combination with JetBlue is the best opportunity to increase much needed competition and choice by bringing low fares and great service

to more customers in more markets while enhancing their ability to compete with the dominant U.S. carriers. JetBlue’s termination of the Northeast Alliance and commitment to significant divestitures have removed any reasonable anti-competitive concerns that the Department of Justice raised.

The Company’s unaudited interim consolidated financial statements for the fourth quarter and full year 2023 are not yet complete and results may vary from these preliminary estimates upon completion of closing procedures.

| | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Fourth Quarter 2023E | | | | | | | |

| Total revenues ($millions) | $1,320 | | | | | | | |

| | | | | | | | |

Adjusted Operating margin (%)(1) | (12)% - (13)% | | | | | | | |

Fuel cost per gallon ($)(2) | $3.18 | | | | | | | |

| Fuel gallons (millions) | 153 | | | | | | | |

Total other (income) expense ($millions)(3) | $29 | | | | | | | |

Tax rate for adjusted income(4) | 22.6% | | | | | | | |

| Weighted average diluted share count (millions) | 109.2 | | | | | | | |

| | | | | | | | |

| Full Year 2023E | | | | | | | |

Total capital expenditures ($millions)(5) | | | | | | | | |

| Pre-delivery deposits, net of refunds | $(25) | | | | | | | |

| Aircraft and engine purchases | $30 | | | | | | | |

| Other capital expenditures | $225 | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | |

| | | | | 4Q23A | |

| Available seat miles % change vs. 2022 | | | | | 14.8% | |

| | | | | | |

| | | | | | |

| | | | | 1Q24E | |

|

| Available seat miles % change vs. 2023 | | | | | 1% to 2% | |

|

EXHIBIT 99.1

EXHIBIT 99.1Footnotes

(1)Excludes special items, which may include loss on disposal of assets, special charges and credits and other items which are not estimable at this time.

(2)Includes fuel taxes and into-plane fuel cost.

(3)Includes interest expense, capitalized interest, interest income and other income and expense. Includes a $0.3 million unfavorable mark to market adjustment related to the derivative portion of the 2026 Convertible Notes.

(4)Based on the Company’s statutory tax rate.

(5)Total capital expenditures assumes all new aircraft deliveries are either delivered under direct leases or financed through sale-leaseback transactions.

Non-GAAP Financial Measures

Adjusted operating expenses and adjusted operating margin are non-GAAP financial measures, which are provided on a forward-looking basis. The Company does not provide a reconciliation of non-GAAP measures on a forward-looking basis where the Company believes such reconciliation would imply a degree of precision and certainty that could be confusing to investors and is unable to reasonably predict certain items included in/excluded from the GAAP financial measures without unreasonable efforts. This is due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred and are out of the Company’s control or cannot be reasonably predicted. For the same reasons, the Company is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. These non-GAAP financial measures are provided because management believes that they supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods. Investors are encouraged to read this investor update in conjunction with the company's Earnings Release which provides additional information about the company's non-GAAP financial measures and is included along with this investor update in the Current Report on Form 8-K furnished to the U.S. Securities and Exchange Commission. The Earnings Release is also available at https://ir.spirit.com.

Because the non-GAAP financial measures are not calculated in accordance with GAAP, they should not be considered superior to and are not intended to be considered in isolation or as a substitute for the related GAAP financial measures presented in the press release and may not be the same as or comparable to similarly titled measures presented by other companies due to possible differences in the method of calculation and in the items being adjusted. We encourage investors to review our financial statements and other filings with the Securities and Exchange Commission in their entirety and not to rely on any single financial measure.

Forward Looking Statements

Forward-Looking Statements in this investor update and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, without limitation, guidance for 2023 and 2024 and statements regarding the Company's intentions and expectations regarding revenues, cash burn, capacity and passenger demand, additional financing, capital spending, operating costs and expenses, pre-tax income, pre-tax margin, taxes, hiring, aircraft deliveries and stakeholders, negotiations with Pratt & Whitney regarding neo engine availability issues, vendors and government support. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors include, among others, results of operations and financial condition, the competitive environment in our industry, our ability to keep costs low and the impact of worldwide economic conditions, including the impact of economic cycles or downturns on customer travel behavior, the consummation of the merger with JetBlue and other factors, as described in the Company’s filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as supplemented in the Company's Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2023. Furthermore, such forward-looking statements speak only as of the date of this investor update. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. Additional information concerning certain factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

v3.23.4

Cover Page

|

Jan. 19, 2024 |

| Cover page. [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 19, 2024

|

| Entity Registrant Name |

SPIRIT AIRLINES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35186

|

| Entity Tax Identification Number |

38-1747023

|

| Entity Address, Address Line One |

2800 Executive Way

|

| Entity Address, City or Town |

Miramar,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33025

|

| City Area Code |

954

|

| Local Phone Number |

447-7920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

SAVE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001498710

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

save_Coverpage.Abstract |

| Namespace Prefix: |

save_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

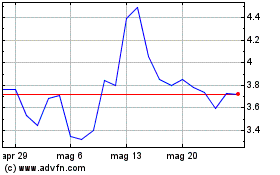

Grafico Azioni Spirit Airlines (NYSE:SAVE)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Spirit Airlines (NYSE:SAVE)

Storico

Da Mag 2023 a Mag 2024