Mediobanca Vows to Step Up Transformation to Boost Profit by 2019 -- Update

17 Novembre 2016 - 11:38AM

Dow Jones News

By Giovanni Legorano

MILAN--Italy's Mediobanca SpA (MB.MI) vowed to step up its

transformation into a more tightly focused investment bank and

wealth manager with a plan to improve profit by more than a third

by 2019 partly through around 1 billion euros ($1.07 billion) in

acquisitions.

The bank, long at the heart of the Italian economy through its

array of investments in Italian financial services and industry,

said it would continue to reduce its direct investments in other

companies, earmarking a 3% tranche of its 13% sake in insurer

Assicurazioni Generali SpA (G.MI) for sale.

In laying out new targets for its 2019 fiscal year, the

Milan-based bank said on Thursday that it aims to notch up gross

operating profit of EUR1 billion, a 43% improvement from EUR700

million reported in the year to end-June.

Mediobanca plans to cut by half to 20% the contribution to

profit made by its investments in other companies while doubling to

15% the contribution of its wealth-management business.

The bank, which has a staff of around 4,000 and assets of EUR56

billion, said it plans to sell another EUR1.3 billion worth of its

investments in other companies.

Chief Executive Alberto Nagel said doesn't rule out selling a

bigger stake in Generali, should more resources be needed for

acquisitions. Mediobanca said Thursday it agreed to buy the 50%

stake it doesn't already own in private bank Banca Esperia from

Mediolanum Group for EUR141 million.

The move is part of Mr. Nagel's plan bolster Mediobanca's

investment-banking, wealth management and retail businesses, in a

revamp that began three years ago. In deciding to shed large stakes

in some of Italy's pre-eminent companies, the bank brought the

curtain down on a decades-long era where the bank had enormous

influence over the Italian economy and corporation's

strategies.

Mediobanca's continued strategic shift comes amid renewed

tensions in the Italian banking sector this year.

Investors' have been battering Italian banking shares since the

beginning of the year, which lost half of their market value,

fretting about their huge exposures to bad loans and chronically

low profitability. Political uncertainty has also weighed on

sentiment as the country heads for a constitutional referendum that

threatens to unseat Prime Minister Matteo Renzi's government and

unleash a period of market turmoil.

Mediobanca's larger, more retail-focused rivals have focused on

cutting costs and selling assets to boost profitability and capital

ratios when low interest rates ar penalizing core activities of

lending to individuals and companies.

At Mediobanca, consumer banking and corporate and investment

banking are set to contribute in equal parts to the 65% in gross

operating profit derived from activities other than investments and

wealth management in 2019, the bank said.

Mr. Nagel said he is looking at acquisitions in fee-generating

businesses, in wealth management and specialty finance such as

factoring and bad-loans management.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

November 17, 2016 05:23 ET (10:23 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

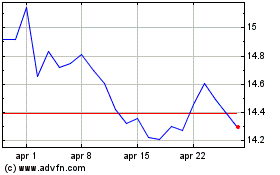

Grafico Azioni Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Storico

Da Mag 2024 a Giu 2024

Grafico Azioni Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Storico

Da Giu 2023 a Giu 2024