Alphabet Inc. Focused on Creating Long-Term Value

21 Gennaio 2016 - 12:40PM

Dow Jones News

DAVOS, Switzerland—Google parent Alphabet Inc. is focusing on

creating long-term value rather than on incremental results, the

company's chief financial officer said Thursday, adding strong

internal controls and infrastructure that improves visibility are

fundamental in today's tumultuous global markets.

Ruth Porat, who joined the Silicon Valley giant as CFO last May

from Morgan Stanley, said that the $480-billion company sees itself

as in the early stages of a revolution in how people use devices

and interact in a connected world. The result: she has spent the

2016 focused on long-term capital allocation for the company's

collection of businesses, from health care to self-driving cars,

that it internally calls "bets."

"If we're not constantly pushing the frontier, we are not

creating value for the long term," Ms. Porat said during The Wall

Street Journal's CFO Breakfast at the World Economic Forum in Davos

on Thursday. "If you're not disrupting your own business, somebody

else will disrupt your business."

Ms. Porat, who was involved in advising Fannie Mae and Freddie

Mac during the 2008 financial crisis, also said that she has taken

a lesson from those times with her to the West Coast: Companies

must build infrastructure that allows them to see what is going on

throughout their businesses.

"You would not get into a car and drive 100 miles an hour with

mud on your windshield," Ms. Porat said. "That is the lesson,

particularly in businesses moving as rapidly as tech."

Ms. Porat's comments underscore her role in adding clarity to

the former Google, melding experience from the banking world with

the resources and vision of Silicon Valley, since joining the

company some eight months ago. Shareholders have cheered the firm's

push for more transparency, with the stock rising sharply since its

decision to turn itself into a holding company that includes former

namesake Google as well as other firms.

Ms. Porat said Thursday that she believed that the different

units of Alphabet nevertheless belong together, because they can

share resources, computing power and capital. She also said she

doesn't expect to see Google's video site YouTube separated from

Google to become its own "bet" within Alphabet.

"Our view is that there's a really strong interrelationship

between all these businesses. They all benefit from one core

infrastructure," she said.

On stage Thursday, Ms. Porat was also joined by Hugh Johnston,

PepsiCo Inc.'s CFO, who said that his company also focuses on

disruptive business ideas over the long term, despite being in the

business of selling beverages and snacks.

Among PepsiCo's bets is investing in direct to consumer

e-commerce in China. Another idea: personalized drinks based on

information gleaned from a consumer's own sweat.

"I can design a Gatorade that's perfect for you," Mr. Johnston

said. "I think lots more of our products will be much more

personalized than before."

Write to Sam Schechner at sam.schechner@wsj.com

(END) Dow Jones Newswires

January 21, 2016 06:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

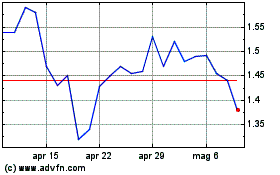

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Apr 2023 a Apr 2024