Euro Climbs Amid Rising Risk Appetite

15 Maggio 2017 - 5:45AM

RTTF2

The euro firmed against its most major opponents in pre-European

deals on Monday amid rising risk appetite, as most Asian stocks

rose despite worries over North Korea missile launch and the

weekend cyber attack that affected computers across over 150

countries.

Traders shrugged off concerns over North Korea's nuclear

program, with South Korea's military saying it needs further

analysis to verify North Korea's claim that Sunday's test-launch of

a ballistic missile was a new mid-to-long range missile built to

carry a large scale heavy nuclear warhead.

In a communique issued after a 2-day meeting in Italy, the G-7

nations acknowledged that the group would use all policy tools -

fiscal, structural and monetary - to boost economic growth. Several

officials raised concerns about risks to global growth from the

Trump administration's stance on trade and tax policy.

Investors assessed the possible impact of Friday's global

cyber-attack, at which a cyber worm infected 2 lakh devices in 150

countries.

The euro was higher against its major rivals on Friday, with the

exception of the yen.

The single currency hit a weekly high of 1.0947 against the

greenback, after having fallen to 1.0923 at 7:30 pm ET. The next

possible resistance for the euro-greenback pair is seen around the

1.12 area.

Reversing from an early low of 123.62 against the yen, the euro

advanced to a 4-day high of 124.37. If the euro-yen pair extends

rise, 127.00 is likely seen as its next resistance level.

Data from the Bank of Japan showed that Japan's producer prices

rose 0.2 percent on month in April.

That was unchanged from the March reading, and it surpassed

expectations for a decline of 0.1 percent.

The euro edged up to 1.0950 against the Swiss franc, off its

early low of 1.0928. The euro is seen finding resistance around the

1.12 mark.

On the flip side, the euro declined to 0.8458 against the pound,

following a high of 0.8484 hit at 8:00 pm ET. Further weakness may

take the euro to a support around the 0.83 region.

Looking ahead, Canada existing home sales for April, U.S. NAHB

housing market index and New York Fed's empire manufacturing survey

for May are set for release in the New York session.

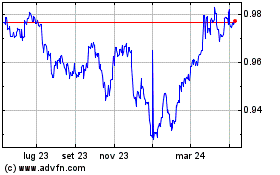

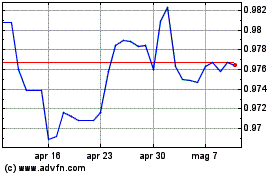

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Apr 2024

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Apr 2023 a Apr 2024