TIDMBLT

RNS Number : 2002C

BHP Billiton PLC

17 January 2018

Release Time IMMEDIATE

18 January

Date 2018

Release Number 01/18

BHP OPERATIONAL REVIEW

FOR THE HALF YEARED 31 DECEMBER 2017

-- Full year production and unit cost guidance(1) maintained for

Petroleum, Copper, Iron Ore and Energy Coal. At Western Australia

Iron Ore (WAIO), a record annualised production rate of 284 Mt (100

per cent basis) was achieved for the December 2017 quarter.

-- Production guidance for Metallurgical Coal reduced to between

41 and 43 Mt as a result of challenging roof conditions at

Broadmeadow, which are expected to continue through the March 2018

quarter, and geotechnical issues triggered by wet weather impacts

at Blackwater. Unit cost guidance is also expected to be negatively

impacted and is currently under review.

-- We continue to release latent capacity across our portfolio,

with the Los Colorados Extension project successfully ramped up

during the December 2017 quarter.

-- In Onshore US, our operated rig count remained at nine during

the December 2017 quarter but is expected to fall as we tailor

plans to maximise value in the exit process. We continue to

progress a number of alternatives to divest our Onshore US assets

for value.

-- All major projects under development are tracking to plan.

-- Underlying EBIT(2) in the December 2017 half year is expected

to include impairment charges, predominately related to conveyors

at Escondida, in a range of US$250 million to US$350 million.

Production Dec vs Dec

H17 H16

Lower volumes reflect the

impact of Hurricane Harvey

and Hurricane Nate on US

Petroleum petroleum assets and natural

(MMboe) 99 (7%) field decline.

Increased volumes at Escondida

supported by the ramp-up

of the Los Colorados Extension

Copper (kt) 833 17% project.

Record production at Jimblebar

and Mining Area C offset

by planned maintenance and

lower opening stockpile levels

Iron ore(3) following the Mt Whaleback

(Mt) 117 0% fire in June 2017.

Record production at four

Queensland Coal mines offset

by the lower volumes at Broadmeadow

Metallurgical (roof conditions) and Blackwater

coal(3) (Mt) 20 (4%) (geotechnical issues).

Strong performance at New

South Wales Energy Coal offset

Energy coal(3) by the impacts of unfavourable

(Mt) 14 4% wet weather at Cerrejón.

BHP Chief Executive Officer, Andrew Mackenzie, said: "A strong

operating performance in the first half allowed us to capture the

benefit of higher prices. The successful Los Colorados Extension

project ramp-up contributed to a 17 per cent increase in copper

output and production records were achieved at a number of Western

Australia Iron Ore and Queensland Coal mines. We have revised down

our metallurgical coal production forecast for the full year as a

result of geotechnical issues at both Broadmeadow and Blackwater.

The momentum we've built across the wider portfolio during the

second quarter will flow through to an expected stronger second

half operating performance. Together with incremental production

from latent capacity projects in iron ore and copper, we expect

volume growth of six per cent for the full year."

1

Summary

Operational performance

Production for the December 2017 half year and guidance for the

2018 financial year are summarised in the table below.

Dec Dec Dec

H17 Q17 Q17

vs vs vs Previous Current

Dec Dec Dec Dec Sep FY18 FY18

Production H17 Q17 H16 Q16 Q17 guidance guidance

Petroleum (MMboe) 99 48 (7%) (6%) (4%) 180 -190 180 -190

Onshore US 61 - 61 -

(MMboe) 35 18 (13%) (10%) 1% 67 67

Conventional 119 - 119 -

(MMboe) 64 31 (3%) (3%) (6%) 123 123

1,655 1,655

Copper (kt) 833 429 17% 20% 6% - 1,790 - 1,790

1,130 1,130

Escondida (kt) 583 315 29% 34% 17% - 1,230 - 1,230

Other copper(i) 525 - 525 -

(kt) 250 114 (4%) (7%) (16%) 560 560

Iron ore(ii) 239 - 239 -

(Mt) 117 62 0% 3% 11% 243 243

WAIO (100% 275 - 275 -

basis) (Mt) 136 72 0% 3% 11% 280(iii) 280(iii)

Metallurgical 44 - 41 -

coal(ii) (Mt) 20 10 (4%) (9%) (8%) 46 43

Energy coal(ii) 29 - 29 -

(Mt) 14 7 4% 10% 8% 30 30

(i) Other copper comprises Pampa Norte, Olympic Dam and Antamina.

(ii) Excludes production from Samarco, Haju (IndoMet Coal) and New Mexico Coal.

(iii) Subject to regulatory approvals to increase capacity above 270 Mt.

Major development projects

During the December 2017 half year, the BHP Board approved an

investment of US$2.5 billion for the development of the Spence

Growth Option.

BHP has four major projects under development in Petroleum,

Copper and Potash, with a combined budget of US$7.5 billion over

the life of the projects. All projects remain on time and on

budget.

Corporate update

BHP expects Underlying EBIT in the December 2017 half year to

include impairment charges (predominately related to conveyors at

Escondida that are no longer planned to be utilised due to the

successful completion of the Los Colorados Extension project) in a

range of US$250 million to US$350 million.

The Group's adjusted effective tax rate(4) for the December 2017

half year is currently being finalised and is expected to be below

the full year guidance range of 32 to 37 per cent.

As previously highlighted, during the December 2017 half year we

made final corporate income tax cash payments in Australia of

approximately US$1.3 billion relating to the prior year. We also

successfully concluded a US$2.9 billion multi-currency bond

repurchase plan, with total costs in relation to the repurchase

program of approximately US$100 million to be reported in net

finance costs in the December 2017 half year financial results.

On 16 November 2017, Samarco and its shareholders, Vale S.A. and

BHP Billiton Brasil, entered into an agreement with the Federal

Prosecutors' Office in Brazil and the Minas Gerais State

Prosecutors Office (Amendment Agreement). The Amendment Agreement,

subject to ratification by the 12th Federal Court of Minas Gerais,

amends the Preliminary Agreement(5) entered into on 18 January 2017

in relation to the Samarco dam failure (Preliminary Agreement). The

Amendment Agreement provides for the State Prosecutors to become a

party to the Preliminary Agreement and provides for additional

community consultation.

2

Samarco, Vale S.A., BHP Billiton Brasil and the Federal

Prosecutors also jointly requested, and the 12th Federal Court has

approved, an additional 150 days, ending on 20 April 2018, for the

parties to continue negotiations for the settlement of the Public

Civil Claims.

On 22 December 2017, BHP announced a total of US$181 million in

further financial support for the Renova Foundation and Samarco

until 30 June 2018. This comprises US$133 million to fund the

Renova Foundation which will be offset against the Group's

provision for the Samarco dam failure, US$6 million of fees payable

to experts appointed in connection with remediation and

compensation programs and a short-term facility of up to US$42

million to be made available to Samarco.

As at the date of this Operational Review, we are not in a

position to provide an update, for the purpose of the December 2017

half year financial results, on the ongoing potential financial

impacts on BHP Billiton Brasil of the Samarco dam failure. Any

financial impacts will continue to be classified as an exceptional

item.

On 22 December 2017, the US President signed a new US tax law

(H.R. 1). BHP is currently working through the financial impacts of

the tax reform, which will include a non-cash revaluation of the

Group's US net deferred tax assets. The financial impact is

expected to give rise to an exceptional item in the December 2017

half year financial results. Longer term, we expect US attributable

profits to be positively impacted by the lower US corporate income

tax rate.

Marketing update

The average realised prices achieved for our major commodities

are summarised in the table below. The majority of iron ore

shipments were linked to the index price for the month of shipment,

with price differentials predominantly a reflection of product

quality and market fundamentals. The majority of metallurgical coal

and energy coal exports were linked to the index price for the

month of shipment or sold on the spot market at fixed or

index-linked prices, with price differentials reflecting product

quality.

Dec H17 Dec H17 Dec H17

vs vs vs

Average realised prices(i) Dec H17 Dec H16 Jun H17 FY17 Dec H16 Jun H17 FY17

Oil (crude and condensate) (US$/bbl) 54 45 50 48 20% 8% 13%

Natural gas (US$/Mscf)(ii) 3.54 3.21 3.48 3.34 10% 2% 6%

US natural gas (US$/Mscf) 2.84 2.79 2.98 2.88 2% (5%) (1%)

LNG (US$/Mscf) 7.48 6.35 7.37 6.84 18% 1% 9%

Copper (US$/lb) 3.20 2.41 2.70 2.54 33% 19% 26%

Iron ore (US$/wmt, FOB) 57 55 62 58 4% (8%) (2%)

Hard coking coal (US$/t) 182 179 180 180 2% 1% 1%

Weak coking coal (US$/t) 121 122 121 121 (1%) 0% 0%

Thermal coal (US$/t)(iii) 87 74 75 75 18% 16% 16%

Nickel metal (US$/t) 11,083 10,581 9,799 10,184 5% 13% 9%

(i) Based on provisional, unaudited estimates. Prices exclude

sales from equity accounted investments, third party product and

internal sales, and represent the weighted average of various sales

terms (for example: FOB, CIF and CFR), unless otherwise noted.

Includes the impact of provisional pricing and finalisation

adjustments.

(ii) Includes internal sales.

(iii) Export sales only. Includes thermal coal sales from metallurgical coal mines.

At 31 December 2017, the Group had 348 kt of outstanding copper

sales that were revalued at a weighted average price of US$3.28 per

pound. The final price of these sales will be determined over the

remainder of the 2018 financial year. In addition, 254 kt of copper

sales from the 2017 financial year were subject to a finalisation

adjustment in the current period. The provisional pricing and

finalisation adjustments will increase Underlying EBITDA(2) by

US$246 million in the December 2017 half year.

3

Petroleum

Production

Dec Dec Dec

H17 Q17 Q17

vs vs vs

Dec Dec Dec Dec Sep

H17 Q17 H16 Q16 Q17

Crude oil, condensate

and natural gas liquids

(MMboe) 45 22 (8%) (7%) 1%

Natural gas (bcf) 325 157 (6%) (5%) (7%)

Total petroleum production

(MMboe) 99 48 (7%) (6%) (4%)

Petroleum - Total petroleum production for the December 2017

half year decreased by seven per cent to 99 MMboe. Guidance for the

2018 financial year remains unchanged at between 180 and 190 MMboe,

comprising Conventional volumes between 119 and 123 MMboe and

Onshore US volumes between 61 and 67 MMboe.

Production Dec vs Dec

breakdown H17 H16

---------------------- ----------- -------------

Crude oil, condensate and natural gas liquids

(MMboe)

Decrease due to the impact

of Hurricane Harvey and Hurricane

Nate in the Gulf of Mexico

and natural field decline across

Conventional 30 (6%) the portfolio.

Decrease due to the impact

of Hurricane Harvey and natural

field decline, which more than

offset additional wells put

online in the Black Hawk and

Onshore US 15 (12%) Permian.

Total 45 (8%)

Natural gas

(bcf)

Conventional 203 (1%) Production broadly unchanged.

Decrease due to the impact

of Hurricane Harvey and natural

field decline, partially offset

by additional wells put online

in the Eagle Ford, Permian

Onshore US 122 (14%) and Haynesville.

Total 325 (6%)

Completion of the agreement with Chevron and ExxonMobil to

withdraw from our 4.95 per cent interest in the Genesis deepwater

asset in the Gulf of Mexico occurred in December 2017, with an

effective date of 1 January 2017.

Projects

Initial

Capital production

Project and expenditure target

ownership (US$m) date Capacity Progress

North West 314 CY19 To maintain On schedule

Shelf Greater LNG plant throughput and budget.

Western Flank-B from the North The overall

(Australia) West Shelf operations. project is 66%

16.67% (non-operator) complete.

Mad Dog Phase 2,154 CY22 New floating On schedule

2 production facility and budget.

(US Gulf with the capacity The overall

of Mexico) to produce up project is 10%

23.9% (non-operator) to 140,000 gross complete.

barrels of crude

oil per day.

Petroleum capital expenditure of approximately US$1.9 billion is

now planned in the 2018 financial year, a reduction from our

previous guidance of US$2.0 billion. Onshore US capital expenditure

is expected to be lower at US$1.1 billion, reflecting development

activity tailored to support value in the exit process and meet

Hold by Production obligations. Conventional capital expenditure of

US$0.8 billion remains unchanged, focused on high-return infill

drilling opportunities in the Gulf of Mexico, a life extension

project at North West Shelf and investment in the Mad Dog Phase 2

project.

4

Onshore US development activity

Onshore US drilling and development expenditure for the December

2017 half year was US$336 million (US$511 million on an activity

basis). Our operated rig count remained at nine during the December

2017 quarter.

-- We have adjusted our Onshore US capital plans to optimise value for our planned exit.

-- In the Permian, sub-surface trials have confirmed first year

production improvements associated with larger completions. We

reduced our rig count from three to two (in December 2017 quarter)

as we focused on meeting Hold by Production obligations and

progressing sub-surface trials.

-- In the Eagle Ford, we increased our rig count from two to

three in the December 2017 quarter to test the Austin Chalk horizon

and trial larger completions in Hawkville. We anticipate a return

to two rigs during the March 2018 quarter.

-- In the Haynesville, we recently incorporated larger

completions and have been operating new wells with larger chokes,

both of which have improved results. We will continue to implement

these changes in future wells, but expect to lower our rig count

during the second half of the 2018 financial year as rig contracts

expire and we optimise future investments ahead of our planned

exit.

-- In the Fayetteville, our plans remain unchanged at this time.

We continue to assess the potential of the Moorefield horizon based

on data from the new non-operated wells.

December 2017 half year Liquids focused areas Gas focused areas

(December 2016 half year) Eagle Ford Permian Haynesville Fayetteville Total

Capital expenditure(i) US$ billion 0.1 (0.1) 0.1 (0.1) 0.1 (0.0) 0.0 (0.0) 0.3 (0.3)

Rig allocation At period end 3 (1) 2 (1) 4 (1) 0 (0) 9 (3)

Net wells drilled and

completed(ii) Period total 9 (43) 10 (15) 10 (0) 0 (2) 29 (60)

Net productive wells At period end 931 (942) 136 (118) 405 (394) 1,043 (1,042) 2,515 (2,496)

(i) Includes land acquisition, site preparation, drilling,

completions, well site facilities, mid-stream infrastructure and

pipelines.

(ii) Can vary between periods based on changes in rig activity

and the inventory of wells drilled but not yet completed at period

end.

We continue to progress a number of alternatives to exit our

Onshore US assets for value. We are preparing all appropriate

documentation ahead of data rooms being opened to potential trade

sale buyers by the end of the March 2018 quarter. In parallel, we

continue to explore a potential exit via demerger or Initial Public

Offering.

Petroleum exploration

Exploration and appraisal wells drilled during the December 2017

quarter are summarised below.

Total

Water well

Well Location Target BHP equity Spud date depth depth Status

US Gulf

of Mexico 1 October 1,289 9,386 Drilling

Scimitar GC392 Oil 65% 2017 m m ahead

In the US Gulf of Mexico, the Scimitar well was spud on 1

October 2017, with results expected in the March 2018 quarter. BHP

holds a 65 per cent working interest and is the operator of the

Scimitar prospect, with partner Repsol (20 per cent working

interest) and Statoil (15 per cent working interest).

In Mexico, an Exploration and Appraisal plan for the Trion

contractual area licence number CNH-A1-Trion/2016 (formerly

referred to as blocks AE-0092 and AE-0093) was submitted to the

Comisión Nacional de Hidrocarburos of Mexico by BHP and Pemex on 29

August 2017, in line with regulatory requirements. We have received

positive feedback and planning continues for the exploration and

appraisal wells which are expected to be drilled in the 2019

financial year.

5

In Trinidad and Tobago, we continued appraisal work to assess

the potential commercialisation of the gas discovery at LeClerc.

Preparations continued for Phase 2 deepwater exploration which is

expected to commence in the second half of the 2018 financial

year.

Petroleum exploration expenditure for the December 2017 half

year was US$378 million, of which US$137 million was expensed. A

US$715 million exploration program is planned for the 2018

financial year. This program comprises the Wildling-2 side track

and Scimitar exploration well in the US Gulf of Mexico and two

wells in Trinidad and Tobago, with the third well now expected to

be drilled at the beginning of the 2019 financial year.

Copper

Production

Dec Dec Dec

H17 Q17 Q17

vs vs vs

Dec Dec Dec Dec Sep

H17 Q17 H16 Q16 Q17

Copper (kt) 833 429 17% 20% 6%

Zinc (t) 58,255 29,054 54% 30% (1%)

Uranium oxide concentrate

(t) 1,123 243 (43%) (77%) (72%)

Copper - Total copper production for the December 2017 half year

increased by 17 per cent to 833 kt. Guidance for the 2018 financial

year remains unchanged at between 1,655 and 1,790 kt.

Escondida copper production for the December 2017 half year

increased by 29 per cent to 583 kt, supported by the start-up of

the Los Colorados Extension (LCE) project on 10 September 2017. LCE

successfully ramped up during the December 2017 quarter, enabling

utilisation of the three concentrators. Production guidance for the

2018 financial year remains unchanged at between 1,130 and 1,230

kt. Escondida and Union Ndeg2 of Supervisors and Staff signed a new

Collective Agreement, valid from 1 October 2017, which has a

duration of 36 months. The existing agreement with Union Ndeg1 will

expire on 1 August 2018, with planning underway for early

negotiations.

Pampa Norte copper production for the December 2017 half year

increased by nine per cent to 126 kt, supported by record material

mined at Cerro Colorado and rapid ramp-up at the Spence tank house

post unplanned maintenance during the September 2017 quarter. Pampa

Norte production guidance for the 2018 financial year remains

unchanged and is expected to be higher than the prior year.

Olympic Dam copper production for the December 2017 half year

decreased by 31 per cent to 54 kt as a result of the planned major

smelter maintenance campaign recently completed. Smelting

operations have now resumed with the first anode cast from the

flash furnace on 23 December 2017. Operations will continue to

ramp-up to full capacity in the March 2018 quarter, with production

guidance unchanged at 150 kt for the 2018 financial year. We expect

production to increase to approximately 215 kt in the 2019

financial year, underpinned by improved operating performance and

higher ore grades from the Southern Mine Area.

Antamina copper production for the December 2017 half year

increased by five per cent to 70 kt and zinc production increased

54 per cent to 58 kt due to higher head grades and mining

progressing through a zinc-rich ore zone consistent with the mine

plan. Guidance for the 2018 financial year remains unchanged, with

copper production of approximately 125 kt and zinc production of

approximately 100 kt.

6

Projects

Initial

Capital production

Project and expenditure target

ownership (US$m) date Capacity Progress

Spence Growth Option 2,460 FY21 New 95 ktpd concentrator is expected to increase Spence's payable copper in concentrate production On schedule and budget. The overall

by approximately 185 ktpa in the first 10 years of operation and extend the mining operations project is 4% complete.

by more than 50 years.

(Chile)

100%

Iron Ore

Production

Dec H17 Dec Q17 Dec Q17

vs vs vs

Dec H17 Dec Q17 Dec H16 Dec Q16 Sep Q17

Iron ore(i) (kt) 117,144 61,557 0% 3% 11%

(i) Represents Western Australia Iron Ore (WAIO). Excludes production from Samarco.

Iron ore - Total iron ore production for the December 2017 half

year was in line with the same period last year at 117 Mt, or 136

Mt on a 100 per cent basis. Guidance for the 2018 financial year

remains unchanged at between 239 and 243 Mt, or between 275 and 280

Mt on a 100 per cent basis, with volumes weighted to the second

half of the financial year as expected.

At WAIO, record production at Jimblebar and Mining Area C was

offset by the impact of lower opening stockpile levels following

the fire at the Mt Whaleback screening plant in June 2017, and

planned maintenance in the previous quarter. Volumes increased by

11 per cent from the September 2017 quarter with a record

annualised rate of 284 Mt (100 per cent basis) achieved for the

December 2017 quarter. The higher volumes reflect increased plant

availability and improved rail performance. Port debottlenecking

activities were completed in the December 2017 quarter and will

support higher volumes in the second half of the financial

year.

BHP continues to work with the relevant authorities in relation

to the necessary approvals to increase system capacity to 290 Mtpa

(100 per cent basis).

Mining and processing operations at Samarco remain suspended

following the failure of the Fundão tailings dam and Santarém water

dam on 5 November 2015.

Coal

Production

Dec H17 Dec Q17 Dec Q17

vs vs vs

Dec H17 Dec Q17 Dec H16 Dec Q16 Sep Q17

Metallurgical coal (kt) 20,252 9,685 (4%) (9%) (8%)

Energy coal (kt) 14,029 7,297 4% 10% 8%

7

Metallurgical coal - Metallurgical coal production for the

December 2017 half year decreased by four per cent to 20 Mt.

Guidance for the 2018 financial year has been reduced to between 41

and 43 Mt and reflects lower volumes now expected at Broadmeadow

and Blackwater. As a result of the reduced Broadmeadow and

Blackwater volumes and compensatory increased production from

higher cost pits, unit cost guidance is also expected to be

negatively impacted and is currently under review.

At Queensland Coal, production for the December 2017 half year

was lower due to the impacts of ongoing challenging roof conditions

at Broadmeadow and geotechnical issues brought on by wet weather at

Blackwater. This was partially offset by record production at South

Walker Creek, Saraji, Caval Ridge and Daunia, underpinned by

improved truck and shovel performance, utilisation of latent

dragline capacity at Caval Ridge and increased wash-plant feed

rates.

The Caval Ridge Southern Circuit project is progressing

according to plan, with production expected to ramp-up early in the

2019 financial year.

Energy coal - Energy coal production for the December 2017 half

year increased by four per cent to 14 Mt. Guidance for the 2018

financial year remains unchanged at 29 to 30 Mt.

New South Wales Energy Coal production increased by 10 per cent

as it benefitted from improved stripping performance, higher truck

utilisation and additional bypass coal. This was partially offset

by a six per cent decline in Cerrejón production, which was

impacted by wet weather conditions during the September 2017

quarter.

Other

Nickel production

Dec H17 Dec Q17 Dec Q17

vs vs vs

Dec H17 Dec Q17 Dec H16 Dec Q16 Sep Q17

Nickel (kt) 45.2 22.4 11% 1% (2%)

Nickel - Nickel West production for the December 2017 half year

increased by 11 per cent to 45 kt of nickel primarily due to

improved performance at the Kalgoorlie smelter. Nickel production

guidance for the 2018 financial year remains unchanged and is

expected to be broadly in line with the 2017 financial year.

Potash project

Project

and Investment

ownership (US$m) Scope Progress

Jansen 2,600 Investment to finish The project is 75%

Potash the excavation and complete and within

lining of the production the approved budget.

and service shafts, Shaft excavation

and to continue is progressing.

the installation

of essential surface

infrastructure and

utilities.

(Canada)

100%

Minerals exploration

Minerals exploration expenditure for the December 2017 half year

was US$86 million, of which US$55 million was expensed. Greenfield

minerals exploration is predominantly focused on advancing copper

targets within Chile, Ecuador, Peru, Canada, South Australia and

the South-West United States.

Variance analysis relates to the relative performance of BHP

and/or its operations during the December 2017 half year compared

with the December 2016 half year, unless otherwise noted.

Production volumes, sales volumes and capital and exploration

expenditure from subsidiaries are reported on a 100 per cent basis;

production and sales volumes from equity accounted investments and

other operations are reported on a proportionate consolidation

basis. Copper equivalent production based on 2017 financial year

average realised prices.

8

The following footnotes apply to this Operational Review:

(1) 2018 financial year unit cost guidance is based on exchange

rates of AUD/USD 0.75 and USD/CLP 663.

(2) Underlying EBIT and Underlying EBITDA are used to reflect

the underlying performance of BHP. Underlying EBIT is earnings

before net finance costs, taxation and any exceptional items.

Underlying EBITDA is Underlying EBIT before depreciation,

amortisation and impairment.

(3) Excludes production from Samarco, Haju (IndoMet Coal) and New Mexico Coal.

(4) Adjusted effective tax rate comprises Total taxation

(expense)/benefit excluding exceptional items and exchange rate

movements included in taxation (expense)/benefit divided by

Profit/(loss) before taxation and exceptional items.

(5) The Preliminary Agreement outlines the process and timeline

for negotiation of a settlement of the BRL 155 billion

(approximately US$47 billion) and BRL 20 billion (approximately

US$6 billion) Public Civil Claims relating to the dam failure.

The following abbreviations may have been used throughout this

report: barrels (bbl); billion cubic feet (bcf); cost and freight

(CFR); cost, insurance and freight (CIF); dry metric tonne unit

(dmtu); free on board (FOB); grams per tonne (g/t); kilograms per

tonne (kg/t); kilometre (km); metre (m); million barrels of oil

equivalent (MMboe); million cubic feet per day (MMcf/d); million

tonnes (Mt); million tonnes per annum (Mtpa); ounces (oz); pounds

(lb); thousand barrels of oil equivalent (Mboe); thousand ounces

(koz); thousand standard cubic feet (Mscf); thousand tonnes (kt);

thousand tonnes per annum (ktpa); thousand tonnes per day (ktpd);

tonnes (t); and wet metric tonnes (wmt).

9

Further information on BHP can be found at: bhp.com

Media Relations Investor Relations

Email: media.relations@bhpbilliton.com Email: investor.relations@bhpbilliton.com

Australia and Asia Australia and Asia

Ben Pratt Tara Dines

Tel: +61 3 9609 3672 Mobile: Tel: +61 3 9609 2222 Mobile:

+61 419 968 734 +61 499 249 005

United Kingdom and South United Kingdom and South

Africa Africa

Neil Burrows Rob Clifford

Tel: +44 20 7802 7484 Mobile: Tel: +44 20 7802 4131 Mobile:

+44 7786 661 683 +44 7788 308 844

North America Americas

Judy Dane James Wear

Tel: +1 713 961 8283 Mobile: Tel: +1 713 993 3737 Mobile:

+1 713 299 5342 +1 347 882 3011

BHP Billiton Limited ABN BHP Billiton Plc Registration

49 004 028 077 number 3196209

LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768

Registered in England and

Registered in Australia Wales

Registered Office: Level Registered Office: Nova

18, 171 Collins Street South, 160 Victoria Street

Melbourne Victoria 3000 London SW1E 5LB United

Australia Kingdom

Tel +61 1300 55 4757 Fax Tel +44 20 7802 4000 Fax

+61 3 9609 3015 +44 20 7802 4111

Members of BHP which is

headquartered in Australia

Follow us on social media

10

Production summary

Year to

Quarter ended date

BHP Dec Mar Jun Sep Dec Dec Dec

interest 2016 2017 2017 2017 2017 2017 2016

Petroleum (1)

Petroleum

Crude oil, condensate

and NGL (Mboe)

Onshore US 8,143 9,439 8,501 7,079 7,423 14,502 16,431

Conventional 15,768 15,369 15,612 15,090 14,869 29,959 31,727

Total 23,911 24,808 24,113 22,169 22,292 44,461 48,158

Natural gas (bcf)

Onshore US 67.8 66.1 67.2 61.4 60.5 121.9 141.7

Conventional 97.1 88.4 99.5 107.3 96.1 203.4 204.9

Total 164.9 154.5 166.7 168.7 156.6 325.3 346.6

Total petroleum

production (MMboe) 51.4 50.6 51.9 50.3 48.4 98.7 105.9

Copper (2)

Copper

Payable metal in

concentrate (kt)

Escondida (3) 57.5% 162.6 67.6 162.4 196.3 238.5 434.8 309.6

Antamina 33.8% 32.0 29.2 38.5 35.9 33.8 69.7 66.1

Total 194.6 96.8 200.9 232.2 272.3 504.5 375.7

Cathode (kt)

Escondida (3) 57.5% 71.5 27.2 62.8 71.9 76.1 148.0 142.0

Pampa Norte (4) 100% 53.8 66.1 72.3 58.0 68.4 126.4 115.9

Olympic Dam 100% 37.2 36.8 51.4 42.0 12.2 54.2 78.1

Total 162.5 130.1 186.5 171.9 156.7 328.6 336.0

Total copper (kt) 357.1 226.9 387.4 404.1 429.0 833.1 711.7

Lead

Payable metal in

concentrate (t)

Antamina 33.8% 1,220 1,308 1,799 1,415 1,009 2,424 2,366

Total 1,220 1,308 1,799 1,415 1,009 2,424 2,366

Zinc

Payable metal in

concentrate (t)

Antamina 33.8% 22,406 20,653 29,076 29,201 29,054 58,255 37,773

Total 22,406 20,653 29,076 29,201 29,054 58,255 37,773

Gold

Payable metal in

concentrate (troy

oz)

Escondida (3) 57.5% 37,784 11,572 33,941 50,525 50,279 100,804 65,345

Olympic Dam (refined

gold) 100% 29,651 21,941 28,188 13,101 15,969 29,070 54,017

Total 67,435 33,513 62,129 63,626 66,248 129,874 119,362

11

Year to

Quarter ended date

BHP Dec Mar Jun Sep Dec Dec Dec

interest 2016 2017 2017 2017 2017 2017 2016

Silver

Payable metal in

concentrate (troy

koz)

Escondida (3) 57.5% 1,323 540 1,234 1,737 2,193 3,930 2,552

Antamina 33.8% 1,446 1,301 1,691 1,596 1,331 2,927 2,791

Olympic Dam (refined

silver) 100% 188 174 243 131 135 266 351

Total 2,957 2,015 3,168 3,464 3,659 7,123 5,694

Uranium

Payable metal in

concentrate (t)

Olympic Dam 100% 1,060 948 737 880 243 1,123 1,976

Total 1,060 948 737 880 243 1,123 1,976

Molybdenum

Payable metal in

concentrate (t)

Antamina 33.8% 225 30 328 402 579 981 786

Total 225 30 328 402 579 981 786

12

Production summary

Year to

Quarter ended date

BHP Dec Mar Jun Sep Dec Dec Dec

interest 2016 2017 2017 2017 2017 2017 2016

Iron Ore

Iron Ore

Production

(kt) (5)

Newman 85% 17,751 16,283 16,241 13,842 18,317 32,159 35,759

Area C Joint

Venture 85% 12,179 11,165 13,016 13,099 13,575 26,674 24,563

Yandi Joint

Venture 85% 17,555 14,656 17,415 14,559 16,348 30,907 33,284

Jimblebar (6) 85% 5,178 4,824 5,891 6,283 4,583 10,866 11,235

Wheelarra 85% 7,386 6,647 7,578 7,804 8,734 16,538 12,795

Samarco 50% - - - - - - -

Total 60,049 53,575 60,141 55,587 61,557 117,144 117,636

Coal

Metallurgical

coal

Production

(kt) (7)

BMA 50% 8,684 7,996 6,394 8,296 7,394 15,690 17,068

BHP Mitsui

Coal (8) 80% 1,929 2,138 2,100 2,271 2,291 4,562 4,074

Haju (9) 75% 27 - - - - - 129

Total 10,640 10,134 8,494 10,567 9,685 20,252 21,271

Energy coal

Production

(kt)

USA 100% - - - - - - 451

Australia 100% 3,851 4,662 5,711 4,235 4,383 8,618 7,803

Colombia 33.3% 2,800 2,756 2,475 2,497 2,914 5,411 5,728

Total 6,651 7,418 8,186 6,732 7,297 14,029 13,982

Other

Nickel

Saleable production

(kt)

Nickel West 100% 22.1 19.0 25.2 22.8 22.4 45.2 40.9

Total 22.1 19.0 25.2 22.8 22.4 45.2 40.9

(1) LPG and ethane are reported as natural gas liquids (NGL).

Product-specific conversions are made and NGL is reported in

barrels of oil equivalent (boe). Total boe conversions are based on

6 bcf of natural gas equals 1 MMboe.

(2) Metal production is reported on the basis of payable metal.

(3) Shown on a 100% basis. BHP interest in saleable production is 57.5%.

(4) Includes Cerro Colorado and Spence.

(5) Iron ore production is reported on a wet tonnes basis.

(6) Shown on a 100% basis. BHP interest in saleable production is 85%.

(7) Metallurgical coal production is reported on the basis of

saleable product. Production figures include some thermal coal.

(8) Shown on a 100% basis. BHP interest in saleable production is 80%.

(9) Shown on a 100% basis. BHP interest in saleable production is 75%.

Throughout this report figures in italics indicate that this

figure has been adjusted since it was previously reported.

13

Production and sales report

Year to

Quarter ended date

Dec Mar Jun Sep Dec Dec Dec

2016 2017 2017 2017 2017 2017 2016

Petroleum (1)

Bass Strait

Crude oil and

condensate (Mboe) 1,770 1,355 1,552 1,815 1,513 3,328 3,692

NGL (Mboe) 1,460 1,236 1,661 1,950 1,584 3,534 3,562

Natural gas (bcf) 31.3 28.7 37.4 42.6 32.9 75.5 73.2

Total petroleum

products (MMboe) 8.4 7.4 9.4 10.9 8.6 19.4 19.5

North West Shelf

Crude oil and

condensate (Mboe) 1,468 1,239 1,314 1,474 1,442 2,916 2,954

NGL (Mboe) 263 200 209 227 200 427 555

Natural gas (bcf) 36.9 32.2 32.5 36.2 36.2 72.4 75.6

Total petroleum

products (MMboe) 7.9 6.8 6.9 7.7 7.7 15.4 16.1

Pyrenees

Crude oil and

condensate (Mboe) 1,726 1,509 1,606 1,510 1,210 2,720 3,402

Total petroleum

products (MMboe) 1.7 1.5 1.6 1.5 1.2 2.7 3.4

Other Australia

(2)

Crude oil and

condensate (Mboe) 8 8 9 9 8 17 18

Natural gas (bcf) 17.1 15.2 16.3 16.1 13.3 29.4 34.6

Total petroleum

products (MMboe) 2.9 2.5 2.7 2.7 2.2 4.9 5.8

Atlantis (3)

Crude oil and

condensate (Mboe) 3,263 3,881 3,637 3,022 3,377 6,399 6,317

NGL (Mboe) 207 295 213 218 195 413 415

Natural gas (bcf) 1.6 2.1 1.9 1.6 1.8 3.4 3.1

Total petroleum

products (MMboe) 3.7 4.5 4.2 3.5 3.9 7.4 7.2

Mad Dog (3)

Crude oil and

condensate (Mboe) 1,170 1,185 1,167 1,020 1,231 2,251 2,120

NGL (Mboe) 52 59 68 44 72 116 88

Natural gas (bcf) 0.2 0.2 0.2 0.1 0.2 0.3 0.3

Total petroleum

products (MMboe) 1.3 1.3 1.3 1.1 1.3 2.4 2.3

Shenzi (3)

Crude oil and

condensate (Mboe) 2,692 2,675 2,588 2,291 2,513 4,804 5,324

NGL (Mboe) 131 161 179 141 184 325 225

Natural gas (bcf) 0.5 0.5 0.6 0.4 0.5 0.9 1.0

Total petroleum

products (MMboe) 2.9 2.9 2.9 2.5 2.8 5.3 5.7

Eagle Ford (4)

Crude oil and

condensate (Mboe) 4,008 5,451 4,278 3,457 3,720 7,177 7,879

NGL (Mboe) 2,159 2,354 2,240 1,856 2,100 3,956 4,427

Natural gas (bcf) 15.2 17.0 15.1 13.8 14.4 28.2 31.7

Total petroleum

products (MMboe) 8.7 10.6 9.0 7.6 8.2 15.8 17.6

14

Year to

Quarter ended date

Dec Mar Jun Sep Dec Dec Dec

2016 2017 2017 2017 2017 2017 2016

Permian (4)

Crude oil and

condensate (Mboe) 1,378 1,202 1,336 1,179 1,142 2,321 2,793

NGL (Mboe) 580 428 646 587 460 1,047 1,314

Natural gas (bcf) 4.4 4.0 6.2 4.5 3.6 8.1 8.8

Total petroleum

products (MMboe) 2.7 2.3 3.0 2.5 2.2 4.7 5.6

Haynesville

(4)

Crude oil and

condensate (Mboe) 3 1 1 - 1 1 3

NGL (Mboe) 15 3 - - - - 15

Natural gas (bcf) 24.0 22.0 21.4 21.5 22.0 43.5 52.2

Total petroleum

products (MMboe) 4.0 3.7 3.6 3.6 3.7 7.3 8.7

Fayetteville

(4)

Natural gas (bcf) 24.2 23.1 24.5 21.6 20.5 42.1 49.0

Total petroleum

products (MMboe) 4.0 3.9 4.1 3.6 3.4 7.0 8.2

15

Production and sales report

Year to

Quarter ended date

Dec Mar Jun Sep Dec Dec Dec

2016 2017 2017 2017 2017 2017 2016

Petroleum (1)

(continued)

Trinidad/Tobago

Crude oil and

condensate (Mboe) 156 127 139 118 135 253 296

Natural gas (bcf) 8.4 8.4 9.4 9.7 10.5 20.2 14.8

Total petroleum

products (MMboe) 1.6 1.5 1.7 1.7 1.9 3.6 2.8

Other Americas

(3) (5)

Crude oil and

condensate (Mboe) 269 257 238 229 207 436 544

NGL (Mboe) 5 6 10 5 3 8 6

Natural gas (bcf) 0.1 0.1 0.1 0.1 0.1 0.2 0.2

Total petroleum

products (MMboe) 0.3 0.3 0.3 0.3 0.2 0.5 0.6

UK

Crude oil and

condensate (Mboe) 63 72 64 40 22 62 132

NGL (Mboe) 49 32 16 39 13 52 71

Natural gas (bcf) 1.0 1.0 1.1 0.5 0.6 1.1 2.1

Total petroleum

products (MMboe) 0.3 0.3 0.3 0.2 0.1 0.3 0.6

Algeria

Crude oil and

condensate (Mboe) 1,016 1,072 942 938 960 1,898 2,006

Total petroleum

products (MMboe) 1.0 1.1 0.9 0.9 1.0 1.9 2.0

BHP Petroleum

Crude oil and

condensate

Onshore US (Mboe) 5,389 6,654 5,615 4,636 4,863 9,499 10,675

Conventional (Mboe) 13,601 13,380 13,256 12,466 12,618 25,084 26,805

Total (Mboe) 18,990 20,034 18,871 17,102 17,481 34,583 37,480

NGL

Onshore US (Mboe) 2,754 2,785 2,886 2,443 2,560 5,003 5,756

Conventional (Mboe) 2,167 1,989 2,356 2,624 2,251 4,875 4,922

Total (Mboe) 4,921 4,774 5,242 5,067 4,811 9,878 10,678

Natural gas

Onshore US (bcf) 67.8 66.1 67.2 61.4 60.5 121.9 141.7

Conventional (bcf) 97.1 88.4 99.5 107.3 96.1 203.4 204.9

Total (bcf) 164.9 154.5 166.7 168.7 156.6 325.3 346.6

Total petroleum

products

Onshore US (Mboe) 19,443 20,456 19,701 17,312 17,506 34,819 40,048

Conventional (Mboe) 31,951 30,102 32,195 32,973 30,886 63,859 65,877

Total (Mboe) 51,394 50,558 51,896 50,286 48,392 98,678 105,925

(1) Total boe conversions are based on 6 bcf of natural gas

equals 1 MMboe. Negative production figures represent finalisation

adjustments.

(2) Other Australia includes Minerva and Macedon.

(3) Gulf of Mexico volumes are net of royalties.

(4) Onshore US volumes are net of mineral holder royalties.

(5) Other Americas includes Neptune, Genesis and Overriding Royalty Interest.

16

Production and sales report

Year to

Quarter ended date

Dec Mar Jun Sep Dec Dec Dec

2016 2017 2017 2017 2017 2017 2016

Copper

Metals production is payable

metal unless otherwise stated.

Escondida, Chile

(1)

Material mined (kt) 90,863 26,045 93,389 104,867 101,371 206,238 197,367

Sulphide ore

milled (kt) 19,866 8,054 18,777 24,080 30,260 54,340 40,653

Average copper

grade (%) 1.02% 1.01% 1.07% 1.06% 0.98% 1.02% 0.94%

Production ex

mill (kt) 168.6 68.7 167.0 204.2 245.7 449.9 321.8

Production

Payable copper (kt) 162.6 67.6 162.4 196.3 238.5 434.8 309.6

Copper cathode

(EW) (kt) 71.5 27.2 62.8 71.9 76.1 148.0 142.0

- Oxide leach (kt) 24.4 8.9 20.3 22.4 27.4 49.8 51.2

- Sulphide leach (kt) 47.1 18.3 42.5 49.5 48.7 98.2 90.8

Total copper (kt) 234.1 94.8 225.2 268.2 314.6 582.8 451.6

Payable gold (troy

concentrate oz) 37,784 11,572 33,941 50,525 50,279 100,804 65,345

Payable silver (troy

concentrate koz) 1,323 540 1,234 1,737 2,193 3,930 2,552

Sales

Payable copper (kt) 172.7 63.7 163.3 195.1 236.7 431.8 307.6

Copper cathode

(EW) (kt) 71.8 39.4 56.0 61.6 84.1 145.7 137.4

Payable gold (troy

concentrate oz) 37,784 11,572 33,941 50,525 50,278 100,803 65,345

Payable silver (troy

concentrate koz) 1,323 540 1,234 1,737 2,193 3,930 2,552

(1) Shown on a 100% basis. BHP interest in saleable production

is 57.5%.

Pampa Norte,

Chile

Cerro Colorado

Material mined (kt) 14,286 15,178 15,760 21,381 20,191 41,572 27,297

Ore milled (kt) 3,342 4,179 4,411 3,951 4,611 8,562 6,583

Average copper

grade (%) 0.65% 0.57% 0.53% 0.62% 0.59% 0.60% 0.66%

Production

Copper cathode

(EW) (kt) 12.1 16.7 18.8 13.3 17.4 30.7 29.2

Sales

Copper cathode

(EW) (kt) 13.7 15.6 19.8 12.3 17.7 30.0 30.1

Spence

Material mined (kt) 22,635 22,939 24,230 22,314 23,457 45,771 46,273

Ore milled (kt) 5,187 5,225 4,968 5,375 4,919 10,294 9,900

Average copper

grade (%) 1.19% 1.09% 1.13% 1.21% 0.95% 1.09% 1.18%

Production

Copper cathode

(EW) (kt) 41.7 49.4 53.5 44.7 51.0 95.7 86.7

Sales

Copper cathode

(EW) (kt) 41.5 49.0 55.7 43.0 52.2 95.2 82.7

17

Production and sales report

Year to

Quarter ended date

Dec Mar Jun Sep Dec Dec Dec

2016 2017 2017 2017 2017 2017 2016

Copper (continued)

Metals production is payable

metal unless otherwise stated.

Antamina, Peru

Material mined

(100%) (kt) 61,355 55,771 62,254 59,216 59,125 118,341 126,466

Sulphide ore milled

(100%) (kt) 13,399 11,955 13,229 12,822 13,098 25,920 26,921

Average head grades

- Copper (%) 0.84% 0.88% 1.00% 0.94% 0.89% 0.91% 0.84%

- Zinc (%) 0.83% 0.84% 0.95% 0.99% 0.93% 0.96% 0.71%

Production

Payable copper (kt) 32.0 29.2 38.5 35.9 33.8 69.7 66.1

Payable zinc (t) 22,406 20,653 29,076 29,201 29,054 58,255 37,773

(troy

Payable silver koz) 1,446 1,301 1,691 1,596 1,331 2,927 2,791

Payable lead (t) 1,220 1,308 1,799 1,415 1,009 2,424 2,366

Payable molybdenum (t) 225 30 328 402 579 981 786

Sales

Payable copper (kt) 33.0 30.2 36.9 31.9 37.0 68.9 65.8

Payable zinc (t) 22,334 23,669 27,936 25,224 30,340 55,564 38,377

(troy

Payable silver koz) 1,388 1,304 1,513 1,475 1,470 2,945 2,665

Payable lead (t) 1,100 1,475 1,493 1,624 972 2,596 1,867

Payable molybdenum (t) 476 - - 168 693 861 1,124

Olympic Dam, Australia

Material mined

(1) (kt) 1,887 1,943 1,974 1,851 1,391 3,242 4,091

Ore milled (kt) 2,116 2,112 2,097 2,302 554 2,856 4,395

Average copper

grade (%) 2.00% 2.07% 2.30% 2.10% 2.22% 2.12% 1.98%

Average uranium

grade (kg/t) 0.68 0.61 0.58 0.55 0.58 0.56 0.64

Production

Copper cathode

(ER and EW) (kt) 37.2 36.8 51.4 42.0 12.2 54.2 78.1

Uranium oxide

concentrate (t) 1,060 948 737 880 243 1,123 1,976

(troy

Refined gold oz) 29,651 21,941 28,188 13,101 15,969 29,070 54,017

(troy

Refined silver koz) 188 174 243 131 135 266 351

Sales

Copper cathode

(ER and EW) (kt) 41.2 33.5 51.5 31.6 24.3 55.9 78.7

Uranium oxide

concentrate (t) 883 839 1,298 680 338 1,018 1,968

(troy

Refined gold oz) 28,234 22,333 24,726 22,435 17,999 40,434 50,135

(troy

Refined silver koz) 203 108 251 219 118 337 387

(1) Material mined refers to run of mine ore mined and hoisted.

18

Production and sales report

Year to

Quarter ended date

Dec Mar Jun Sep Dec Dec Dec

2016 2017 2017 2017 2017 2017 2016

Iron Ore

Iron ore production and sales are reported on

a wet tonnes basis.

Pilbara, Australia

Production

Newman (kt) 17,751 16,283 16,241 13,842 18,317 32,159 35,759

Area C Joint

Venture (kt) 12,179 11,165 13,016 13,099 13,575 26,674 24,563

Yandi Joint

Venture (kt) 17,555 14,656 17,415 14,559 16,348 30,907 33,284

Jimblebar (1) (kt) 5,178 4,824 5,891 6,283 4,583 10,866 11,235

Wheelarra (kt) 7,386 6,647 7,578 7,804 8,734 16,538 12,795

Total production (kt) 60,049 53,575 60,141 55,587 61,557 117,144 117,636

Total production

(100%) (kt) 69,730 62,177 69,714 64,287 71,611 135,898 136,411

Sales

Lump (kt) 14,127 12,804 15,104 13,896 15,145 29,041 28,283

Fines (kt) 45,447 41,043 46,249 40,733 45,769 86,502 87,725

Total (kt) 59,574 53,847 61,353 54,629 60,914 115,543 116,008

Total sales

(100%) (kt) 69,196 62,513 71,149 63,322 70,733 134,055 134,564

(1) Shown on a 100% basis. BHP interest in saleable production is 85%.

Samarco, Brazil (1)

Production (kt) - - -- - - -

Sales (kt) - 35 --14 14 12

(1) Mining and processing operations remain suspended following

the failure of the Fundão tailings dam and Santarém water dam on 5

November 2015.

19

Production and sales report

Quarter ended Year to date

Dec Mar Jun Sep Dec Dec Dec

2016 2017 2017 2017 2017 2017 2016

Coal

Coal production is reported

on the basis of saleable

product.

Queensland Coal

Production (1)

BMA

Blackwater (kt) 1,855 1,694 1,766 1,985 1,470 3,455 3,836

Goonyella (kt) 2,204 1,871 1,157 1,639 1,369 3,008 4,327

Peak Downs (kt) 1,715 1,582 1,238 1,602 1,367 2,969 3,235

Saraji (kt) 1,307 1,276 913 1,414 1,198 2,612 2,545

Daunia (kt) 680 674 560 662 718 1,380 1,326

Caval Ridge (kt) 923 899 760 994 1,272 2,266 1,799

Total BMA (kt) 8,684 7,996 6,394 8,296 7,394 15,690 17,068

BHP Mitsui Coal

(2)

South Walker Creek (kt) 1,080 1,354 1,348 1,400 1,524 2,924 2,421

Poitrel (kt) 849 784 752 871 767 1,638 1,653

Total BHP Mitsui

Coal (kt) 1,929 2,138 2,100 2,271 2,291 4,562 4,074

Total Queensland

Coal (kt) 10,613 10,134 8,494 10,567 9,685 20,252 21,142

Sales

Coking coal (kt) 7,658 7,133 5,496 7,934 6,341 14,275 14,898

Weak coking coal (kt) 2,659 2,761 2,502 3,150 2,816 5,966 5,458

Thermal coal (kt) 154 96 142 102 173 275 360

Total (kt) 10,471 9,990 8,140 11,186 9,330 20,516 20,716

(1) Production figures include some thermal coal.

(2) Shown on a 100% basis. BHP interest in saleable production is 80%.

Haju, Indonesia

(1)

Production (kt) 27 -- - - - 129

Sales - export (kt) - -- - - - -

(1) Shown on 100% basis. BHP interest in saleable production is

75%. BHP completed the sale of IndoMet Coal on 14 October 2016.

New Mexico, USA

Production

Navajo Coal (1) (kt) - - - - - - 451

Total (kt) - - - - - - 451

Sales thermal coal

- local utility - - - - - - 105

(1) The divestment of Navajo Coal was completed on 29 July 2016,

with no further production reported by BHP. Management of Navajo

Coal was transferred to Navajo Transitional Energy Company on 31

December 2016.

20

NSW Energy Coal,

Australia

Production (kt) 3,851 4,662 5,711 4,235 4,383 8,618 7,803

Sales

Export thermal

coal (kt) 3,539 4,407 4,913 3,622 4,048 7,670 7,179

Inland thermal

coal (kt) 311 431 327 405 411 816 642

Total (kt) 3,850 4,838 5,240 4,027 4,459 8,486 7,821

Cerrejón,

Colombia

Production (kt) 2,800 2,756 2,475 2,497 2,914 5,411 5,728

Sales thermal coal

- export (kt) 2,722 2,613 2,803 2,518 2,619 5,137 5,627

Production and sales report

Quarter ended Year to date

Dec Mar Jun Sep Dec Dec Dec

2016 2017 2017 2017 2017 2017 2016

Other

Nickel production is reported on the basis of

saleable product

Nickel West, Australia

Production

Nickel contained

in concentrate (kt) 0.2 0.2 - - - - 0.5

Nickel contained

in finished matte (kt) 4.1 2.3 5.3 6.8 4.6 11.4 5.9

Nickel metal (kt) 17.8 16.5 19.9 16.0 17.8 33.8 34.5

Total nickel production (kt) 22.1 19.0 25.2 22.8 22.4 45.2 40.9

Sales

Nickel contained

in concentrate (kt) 0.2 0.2 - - - - 0.5

Nickel contained

in finished matte (kt) 4.1 2.2 4.9 4.6 6.4 11.0 5.9

Nickel metal (kt) 17.6 17.1 18.1 16.6 17.9 34.5 34.1

Total nickel sales (kt) 21.9 19.5 23.0 21.2 24.3 45.5 40.5

21

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLFKODDDBKBPDD

(END) Dow Jones Newswires

January 18, 2018 02:00 ET (07:00 GMT)

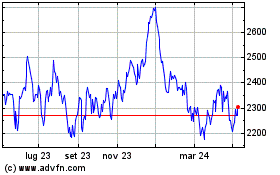

Grafico Azioni Bhp (LSE:BHP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Bhp (LSE:BHP)

Storico

Da Apr 2023 a Apr 2024