truefalse--12-310002000046FYMassachusettsUnlimited00020000462024-05-242024-05-240002000046us-gaap:FairValueInputsLevel2Member2024-12-3100020000462024-05-242024-12-310002000046Investment in ether Global Total Investment in ether2024-12-310002000046us-gaap:FairValueInputsLevel3Member2024-12-3100020000462024-06-032024-06-0300020000462024-10-012024-12-3100020000462024-07-232024-12-310002000046us-gaap:FairValueInputsLevel1Member2024-12-310002000046Investment in ether Global Other Assets Less Liabilities2024-12-310002000046ck0002000046:EtherInvestmentMemberus-gaap:FairValueInputsLevel1Member2024-12-310002000046ck0002000046:EtherInvestmentMemberus-gaap:FairValueInputsLevel3Member2024-12-310002000046Investment in ether Global Total Net Assets2024-12-3100020000462024-05-230002000046Investment in ether Global Ether Quantity of Ether 471,7502024-12-3100020000462024-06-042024-06-0400020000462024-07-220002000046ck0002000046:EtherInvestmentMemberus-gaap:FairValueInputsLevel2Member2024-12-310002000046ck0002000046:EtherInvestmentMember2024-12-3100020000462024-12-3100020000462025-03-1000020000462024-06-04xbrli:purexbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM ____________________ TO ____________________ |

Commission File Number 001-42163

Fidelity® Ethereum Fund

(Exact name of Registrant as specified in its Charter)

|

|

Delaware |

99-6342530 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

245 Summer Street V13E Boston, MA |

02210 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (800) 343-3548

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Fidelity® Ethereum Fund Shares |

|

FETH |

|

Cboe BZX Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: NoT APPLICABLE

Number of Shares outstanding as of March 10, 2025: 43,525,000

DOCUMENTS INCORPORATED BY REFERENCE: None

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains “forward-looking statements” that generally relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this Annual Report that address activities, events or developments that will or may occur in the future, including such matters as movements in the digital asset markets and indexes that track such movements, the Trust’s operations, the Sponsor’s plans and references to the Trust’s future success and other similar matters, are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor has made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and are difficult to predict, that could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements including, without limitation, the risks, uncertainties and other factors we identify in this Annual Report and in our filings with the Securities and Exchange Commission (the “SEC”).

Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this Annual Report, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. Consequently, all the forward-looking statements made in this Annual Report are qualified by these cautionary statements, and there can be no assurance that actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of its Shares.

Should one or more of these risks discussed in this Annual Report or other uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those described in forward-looking statements. Forward-looking statements are made based on the Sponsor’s beliefs, estimates and opinions on the date the statements are made and neither the Trust nor the Sponsor is under a duty or undertakes an obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, other than as required by applicable laws. Moreover, neither the Trust, the Sponsor, nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Investors are therefore cautioned against placing undue reliance on forward-looking statements.

PART I

Item 1. Business.

Summary

Fidelity Ethereum Fund (the “Trust”) is a Delaware statutory trust formed on October 31, 2023. The Trust issues common shares of beneficial interest (“Shares”), which represent fractional undivided beneficial interest in and ownership of the Trust. The Shares of the Trust are listed on the Cboe BZX Exchange, Inc. (“Cboe BZX”). FD Funds Management LLC (the “Sponsor”) is the sponsor of the Trust, CSC Delaware Trust Company (the “Trustee”) is the trustee of the Trust, State Street Bank and Trust Company (“State Street” or the “Transfer Agent”) is the Trust’s transfer agent (in such capacity, the “Transfer Agent”) and cash custodian (in such capacity, the “Cash Custodian”), and Fidelity Digital Asset Services, LLC (“FDAS” or the “Custodian”) is the custodian for the Trust, and will hold all of the Trust’s ether on the Trust’s behalf. The operations of the Trust are governed by the Trust Agreement, as amended and/or restated from time to time (the “Trust Agreement”). The Trust is an exchange-traded product. When the Trust sells or redeems its Shares, it will do so in blocks of 25,000 Shares (a “Basket”) based on the quantity of ether attributable to each Share of the Trust (net of accrued but unpaid expenses and liabilities).

The Trust’s inception of operation was July 23, 2024. The Trust has not had any operations prior to July 23, 2024, other than matters relating to its organization and the registration of the Shares under the Securities Act of 1933 (the “1933 Act”).

The Sponsor maintains a website www.fidelity.com, through which the Trust’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “1934 Act”), can be accessed free of charge, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the U.S. Securities and Exchange Commission (the “SEC”). The information on the Trust’s website is not, and shall not be deemed to be, part of this report or incorporated into any other filings we make with the SEC. Additional information regarding the Trust may also be found on the SEC’s EDGAR database at www.sec.gov.

Investment Objectives and Principal Investment Strategies

Investment Objectives

The Trust’s investment objective is to seek to track the performance of ether, the native token of the Ethereum blockchain, as measured by the performance of the Fidelity Ethereum Reference Rate (the “Index”), adjusted for the Trust’s expenses and other liabilities. In seeking to achieve its investment objective, the Trust holds ether.

Principal Investment Strategies

The Trust will hold ether and values its Shares daily as of 4:00 p.m. Eastern time (“EST”) using the same methodology used to calculate the Index. All of the Trust’s ether is held by the Custodian.

The Index is designed to reflect the performance of ether in U.S. dollars. The Index is constructed using ether price feeds from eligible ether spot markets and a volume-weighted median price (“VWMP”) methodology, calculated every 15 seconds based on VWMP spot market data over rolling sixty-minute increments to develop an ether price composite. The Index methodology was developed by Fidelity Product Services LLC (the “Index Provider”) and is monitored by the Fidelity Index Committee (the “Committee”) with the assistance of the Fidelity Digital Asset Indices Advisory Committee. Coin Metrics, Inc. is the third-party calculation agent (“Calculation Agent”) for the Index.

The Trust provides exposure to the value of ether, and the Shares of the Trust are valued on a daily basis using the same methodology used to calculate the Index. The Trust provides investors with the opportunity to access the market for ether through a traditional brokerage account without the potential barriers to entry or risks involved with holding or transferring ether directly or acquiring it from an ether spot market. The Trust is passively managed and does not pursue active management investment strategies. The Trust keeps custody of its ether at an affiliate of the Sponsor, Fidelity Digital Asset Services, LLC (“FDAS” or the “Custodian”), a New York state limited purpose trust company that provides custody and trade execution services for digital assets. The Trust will not stake the ether custodied at the Custodian. The Trust will not invest in derivatives.

Information About Ether, Ether Markets and Regulation of Ether

This section of the Annual Report provides a more detailed description of ether, including information about the historical development of ether, how a person holds ether, how to use ether in transactions, how to trade ether, the spot markets where ether can be bought, held and sold, the ether over-the-counter (“OTC”) market and the proof-of-stake concept.

Ether and the Ethereum network

Ether is a digital asset that is created and transmitted through the operations of the Ethereum peer-to-peer network and associated blockchain ledger (the “Ethereum blockchain” and together the “Ethereum network”), a network of computers, known as nodes, that operates on cryptographic computer-code based logic, called a protocol. No single entity owns or operates the Ethereum network, the infrastructure of which is collectively maintained by a distributed user base, a phenomenon known as decentralization. Ether is not issued by governments, banks or any other centralized authority. The Ethereum network allows people to exchange tokens of value, called ether, which are recorded on a public transaction ledger known as the Ethereum blockchain. Ether can be used to pay for goods and services, including computational power on the Ethereum network, or it can be converted to fiat currencies, such as the U.S. dollar, at rates determined on digital asset exchanges or in individual end-user-to-end-user transactions under a barter system.

The Ethereum network allows users to write and implement computer programs called smart contracts—that is, general-purpose code that executes on every computer in the network and can instruct the transmission of information and value based on a sophisticated set of logical conditions. Using smart contracts, users can create markets, store registries of debts or promises, represent the ownership of property, move funds in accordance with conditional instructions and create digital assets other than ether on the Ethereum network. Smart contract operations are executed on the Ethereum blockchain in exchange for payment of ether. The Ethereum network is one of a number of projects intended to expand blockchain use beyond just a peer-to-peer money system.

The Ethereum network is commonly understood to be decentralized and does not require governmental authorities or financial institution intermediaries to create, transmit or determine the value of ether. Rather, following the initial distribution of ether, ether is created, burned and allocated by the Ethereum network protocol through a process that is currently subject to an issuance and burn rate as further described under “Limits on Ether Supply” below. The value of ether is determined by the supply of and demand for ether on the digital asset exchanges or in private end-user-to-end-user transactions. There is no hard cap which would limit the number of outstanding ether at any one time to a predetermined maximum.

New ether are created and rewarded to the validators of a block in the Ethereum blockchain for verifying transactions. The Ethereum blockchain is effectively a decentralized database that includes all blocks that have been validated and it is updated to include new blocks as they are validated. Each ether transaction is broadcast to the Ethereum network and, when included in a block, recorded in the Ethereum blockchain. As each new block records outstanding ether transactions, and outstanding transactions are settled and validated through such recording, the Ethereum blockchain represents a complete, transparent and unbroken history of all transactions of the Ethereum network.

Among other things, ether is used to pay for transaction fees and computational services (i.e., smart contracts) on the Ethereum network; users of the Ethereum network pay for the computational power of the machines executing the requested operations with ether. Requiring payment in ether on the Ethereum network incentivizes developers to write quality applications and increases the efficiency of the Ethereum network because wasteful code costs more. It also ensures that the Ethereum network remains economically viable by compensating people for their contributed computational resources.

History of Ethereum

The Ethereum network was originally described in a 2013 white paper by Vitalik Buterin, a programmer involved with bitcoin, with the goal of creating a peer-to-peer, open-source network enabling users to create so-called decentralized applications powered by smart contracts, which are general-purpose code that executes on the Ethereum network. By combining the Ethereum blockchain with a flexible scripting language that is designed to be capable of implementing sophisticated logic and to execute a wide variety of instructions, the Ethereum network was designed to act as a programmable infrastructure layer that would enable users to create their own rules for ownership, transaction formats and state transition functions that they could build into custom software programs of their own creation. The formal development of the Ethereum network began through a Swiss firm called Ethereum Switzerland GmbH (“EthSuisse”) in conjunction with several other entities. Subsequently, the Ethereum Foundation, a Swiss non-profit organization, was set up to oversee the Ethereum network protocol’s development. The Ethereum network went live on July 30, 2015. Decentralized applications may be controlled by a single user or small group. Smart contracts, including those relating to decentralized finance (“DeFi”) applications, are a new technology and their ongoing development and operation may result in problems, which could reduce the demand for ether or cause a wider loss of confidence in the Ethereum network, either of which could have an adverse impact on the value of ether.”

Ether is the digital asset that powers the Ethereum network and serves as the network’s native unit of account that is used to pay the “gas” fees needed to power decentralized applications and smart contracts and execute transactions. Unlike other digital assets, such as bitcoin, which are solely created through a progressive mining process, 72.0 million ether were created in connection with the launch of the Ethereum network. Coinciding with the network launch, it was decided that EthSuisse would be dissolved, designating the Ethereum Foundation as the sole organization dedicated to protocol development.

Smart Contracts and Development on the Ethereum Network

Smart contracts are programs that run on a blockchain that can execute automatically when certain conditions are met. Smart contracts facilitate the exchange of anything representative of value, such as money, information, property, or voting rights. Using smart contracts, users can send or receive digital assets, create markets, store registries of debts or promises, represent ownership of property or a company, move funds in accordance with conditional instructions and create new digital assets.

Development on the Ethereum network involves building more complex tools on top of smart contracts, such as decentralized applications (“DApps”); organizations that are autonomous, known as decentralized autonomous organizations (“DAOs”); and entirely new decentralized networks. For example, a company that distributes charitable donations on behalf of users could hold donated funds in smart contracts that are paid to charities only if the charity satisfies certain pre-defined conditions.

The Ethereum network has also been used as a platform for creating new digital assets and conducting their associated initial coin offerings. As of December 31, 2024, it is believed that a majority of digital assets not issued as the native token on their own blockchains were built on the Ethereum network, with such assets representing a significant amount of the total market value of all digital assets.

More recently, the Ethereum network has been used for DeFi or open finance platforms, which seek to democratize access to financial services, such as borrowing, lending, custody, trading, derivatives and insurance, by removing third-party intermediaries. DeFi can allow users to lend and earn interest on their digital assets, exchange one digital asset for another and create derivative digital assets such as algorithmic stablecoins, which are digital assets pegged to a reserve asset such as fiat currency. During 2024, between $29.4 billion and $79.2 billion worth of digital assets were locked up as collateral on DeFi platforms on the Ethereum network.

In addition, the Ethereum network and other smart contract platforms have been used for creating non-fungible tokens (“NFTs”). Unlike digital assets native to smart contract platforms which are fungible and enable the payment of fees for smart contract execution, NFTs allow for digital ownership of assets that convey certain rights to other digital or real-world assets. This new paradigm allows users to own rights to other assets through NFTs, which enable users to trade them with others on the Ethereum network. For example, an NFT may convey rights to a digital asset that exists in an online game or a DApp, and users can trade their NFT in the DApp or game, and carry them to other digital experiences, creating an entirely new free-market internet-native economy that can be monetized in the physical world.

The DAO and Ethereum Classic

In July 2016, the Ethereum network experienced what is referred to as a permanent hard fork that resulted in two different versions of its blockchain: Ethereum and Ethereum Classic.

In April 2016, a blockchain solutions company known as Slock announced the launch of a decentralized autonomous organization, known as “The DAO” on the Ethereum network. The DAO was designed as a decentralized crowdfunding model, in which anyone could contribute ether to The DAO in order to become a voting member and equity stakeholder in the organization. Members of The DAO could then make proposals about different projects to pursue and put them to a vote. By committing to profitable projects, members would be rewarded based on the terms of a smart contract and their proportional interest in The DAO. As of May 27, 2016, $150 million, or approximately 14% of all ether outstanding, was contributed to, and invested in, The DAO.

On June 17, 2016, an anonymous hacker exploited The DAO’s smart contract code to siphon approximately $60 million, or 3.6 million ether, into a segregated account. Upon the news of the breach, the price of ether was quickly cut in half as investors liquidated their holdings and members of the Ethereum community worked to determine a solution.

In the days that followed, several attempts were made to retrieve the stolen funds and secure the Ethereum network. However, it soon became apparent that direct interference with the protocol (i.e., a hard fork) would be necessary. The argument for the hard fork was that it would create an entirely new version of the Ethereum blockchain, erasing any record of the theft, and restoring the stolen funds to their original owners. The counterargument was that it would be antithetical to the core principle of immutability of the Ethereum blockchain.

The decision as to whether or not to hard fork the Ethereum blockchain was put to a vote of Ethereum community members. A majority of votes were cast in favor of a hard fork. On July 15, 2016, a hard fork specification was implemented by the Ethereum Foundation. On July 20, 2016, the Ethereum network completed the hard fork, and a new version of the blockchain, without recognition of the theft, was born.

Many believed that after the hard fork the original version of the Ethereum blockchain would dissipate entirely. However, a group of validators continued to mine the original Ethereum blockchain for philosophical and economic reasons. On July 20, 2016, the original Ethereum protocol was rebranded as “Ethereum Classic,” and its native token as ether classic (ETC), preserving the untampered transaction history (including the theft involving The DAO). Following the hard fork of Ethereum, each holder of ether automatically received an equivalent number of ETC tokens.

Overview of the Ethereum Network’s Operations

In order to own, transfer or use ether directly on the Ethereum network on a peer-to-peer basis (as opposed to through an intermediary, such as a custodian or centralized exchange), a person generally must have internet access to connect to the Ethereum network. Ether transactions may be made directly between end-users without the need for a third-party intermediary. To prevent the possibility of double-spending ether, a user must notify the Ethereum network of the transaction by broadcasting the transaction data to its network peers. The Ethereum network provides confirmation against double-spending by memorializing every peer-to-peer transaction in the Ethereum blockchain, which is publicly accessible and transparent. This memorialization and verification against double-spending of peer-to-peer transactions is accomplished through the Ethereum network validation process, which adds “blocks” of data, including recent transaction information, to the Ethereum blockchain.

Summary of an Ether Transaction

A “transaction request” refers to a request to the Ethereum network made by a user, in which the requesting user (the “sender”) asks the Ethereum network to send some ether or execute some code. A “transaction” refers to a fulfilled transaction request and the associated change in the Ethereum network’s state. An Ethereum client (“Ethereum Client”) is a software application that implements the Ethereum network specification and communicates with the Ethereum network. A node is a computer or other device, such as a mobile phone, running an individual Ethereum Client that is connected to other computers also running their own Ethereum Clients, which collectively form the Ethereum network. Nodes can be full nodes (meaning they host a local copy of the entire Ethereum blockchain) or light nodes, which only host a local copy of a sub-portion of the full Ethereum blockchain with reduced data. Nodes may (but do not have to) be validators, which requires them to download an additional piece of software in the node’s Ethereum Client and stake a certain amount of ether, which is discussed below.

Any user can broadcast a transaction request to the Ethereum network from a node located on the network. A user can run their own node, or they can connect to a node operated by others. For the transaction request to actually result in a change to the current state of the Ethereum network, it must be validated, executed, and “committed to the network” by another node (specifically, a validator node). Execution of the transaction request by the validator results in a change to the Ethereum network’s state once the transaction is broadcast to all other nodes across the Ethereum network. Transactions can include, for example, sending ether from one account to another, as discussed below; publishing a new smart contract onto the Ethereum network; or activating and executing the code of an existing smart contract, in accordance with the terms and conditions specified in the sender’s transaction request.

The Ethereum blockchain can be thought of as a ledger recording a history of transactions and the balances associated with individual accounts, each of which has an address on the Ethereum network. An Ethereum network account can be used to store ether. There are two types of Ethereum accounts: “externally owned accounts,” which are controlled by a private key, and “smart contract accounts,” which are controlled by their own code. Externally owned accounts are controlled by users, do not contain executable code, and are associated with a unique “public key” and “private key” pair, commonly referred to as a “wallet,” with the private key being used to execute transactions. Smart contract accounts contain, and are controlled by, their own executable code: every time the smart contract account receives a transaction from, or is “called” by, another user, the smart contract account’s code activates, allowing it to read and write to internal storage, send ether, or perform other operations. Both externally owned accounts and smart contract accounts can be used to send, hold, or receive ether, and both can interact with other smart contracts. However, only externally owned accounts have the power to initiate transactions; smart contract accounts can only send transactions of their own after they are first activated or called by another transaction. An externally owned account is associated with both a public address on the Ethereum network and a private key, while a smart contract account is only associated with a public address. While a smart contract account does not use a private key to authorize transactions, including transfers of ether, the developer of a smart contract may hold an “admin key” to the smart contract account, or have special access privileges, allowing the developer to make changes to the smart contract, enable or disable features on the smart contract, or change how the smart contract receives external inputs and data, among others.

Accounts depend on nodes to access the peer-to-peer Ethereum network. Through the node’s Ethereum Client, a user’s Ethereum wallet and its associated Ethereum network address enable the user to connect to the Ethereum network and transfer ether to, and receive ether from, other users, and interact with smart contracts, on a peer-to-peer basis. A user with an externally owned account can run their own node (and their own Ethereum Client) and connect that node to their Ethereum wallet, allowing them to make transactions from their Ethereum wallet on the Ethereum network, or a user’s wallet can connect to third-party nodes operated as a service (e.g., Infura) and access the Ethereum network that way. Multiple accounts can access the Ethereum network through one node.

Each user’s Ethereum wallet is associated with a unique “public key” and “private key” pair. To receive ether in a peer-to-peer transaction, the ether recipient must provide its public key to the sender. This activity is analogous to a recipient for a transaction in U.S. dollars providing a routing address in wire instructions to the payor so that cash may be wired to the recipient’s account. The sender approves the transfer to the address provided by the recipient by “signing” a transaction that consists of the recipient’s public key with the private key of the address from which the sender is transferring the ether. The recipient, however, does not make public or provide to the sender the recipient’s related private key, only its public key.

Neither the recipient nor the sender reveal their private keys in a peer-to-peer transaction because the private key authorizes transfer of the funds in that address to other users. Therefore, if a user loses their private key, the user may permanently lose access to the ether contained in the associated address. Likewise, ether is irretrievably lost if the private key associated with them is deleted and no backup has been made. When sending ether, a user’s Ethereum wallet must sign the transaction with the sender’s associated private key. In addition, since every computation on the Ethereum network requires processing power, there is a mandatory transaction fee involved with the transfer that is paid by the sender to the Ethereum network itself (“base fee”), plus additional transaction fees the sender can elect (or not) to pay at their discretion to the validators who validate their transaction (“tip”). The resulting digitally signed transaction is sent by the user’s Ethereum wallet, via a node (whether run by the user or operated by others), to other Ethereum network nodes, who in turn broadcast it on a peer-to-peer basis to validators to allow transaction confirmation.

Ethereum network validators record and confirm transactions when they validate and add blocks of information to the Ethereum blockchain. Validators operate through nodes whose Ethereum Clients have an extra piece of software that permits the node to perform validation transactions. In a proof-of-stake consensus protocol like that used by the Ethereum network, validators are randomly selected to validate transactions. A validator must stake 32 ether to become a validator, which allows it to activate a unique validator key pair (consisting of a public and private validator key). Each 32 ether that is staked results in issuance of a validator key pair, meaning that multiple validators can operate through a single validator node (including a validator node operated by a third party as a service). Validators generally both propose blocks (“proposers”) and participate in a committee that approves the block (“attesters”). Validators are selected based on a random process. A single person or entity running a group of validators does not gain an advantage in any one of their validators being selected. Further, an ether balance less than 32 ether (implying a slashing or inactivity leak penalty) will reduce the probability of being selected providing a bias to the better performing validators and good actors. A single person or entity can increase the numerical chances that any of their validators will be randomly selected by staking ether over multiple validators. When a validator is randomly selected by the protocol’s algorithm to propose a block, it submits a proposal for the block to be committed to the blockchain subject to completion of validation by other validators on the network, which includes data relating to (i) the verification of newly submitted transaction requests submitted by senders and (ii) a reference to the prior block in the Ethereum blockchain to which the new block is being added. The proposing validator becomes aware of outstanding transaction requests through peer-to-peer data packet transmission and distribution enforced by the Ethereum protocol rules, which connects the proposer to users who want transactions recorded. If, once created, the proposing validator’s block is confirmed by a committee of randomly selected attesters, the block is committed to the Ethereum network and added to the Ethereum blockchain. Any smart contract code that has been called by the transaction request is also executed (provided the base fee is paid for the Ethereum network’s computational power associated with executing the code, and up to the amount of the base fee). Upon the addition of a block included in the Ethereum blockchain, an adjustment to the ether balance in both the sender’s and the recipient’s Ethereum network public key will occur, completing the ether transaction. Once a transaction is confirmed on the Ethereum blockchain, it is irreversible.

As a reward for their services in adding the block to the Ethereum blockchain, the proposing validators receive redistributed ether (i.e., “tips”) and the attesting validators receive newly minted ether. If the proposing validator’s block is determined by the approving validator committee to be faulty or to break protocol rules, the proposer is penalized by having their staked ether reduced. Validators can also be penalized for attesting to transactions that break protocol rules or are inconsistent with the majority of other validators, or for inactivity or missing attestations that the Ethereum network protocol assigned to them. In extreme cases, a proposing or attesting validator can be “slashed”, meaning forcibly ejected by other validators, with their staked ether continuously drained, potentially up to the loss of their entire stake. In this way, the Ethereum network attempts to reduce double-spend and other attacks by validators and incentivize validator integrity.

Some ether transactions are conducted “off-blockchain” and are therefore not recorded in the Ethereum blockchain. Some “off-blockchain transactions” involve the transfer of ownership of a specific digital wallet holding ether or the reallocation of ownership of certain ether in a pooled-ownership digital wallet, such as a digital wallet owned by a digital asset exchange. If a transaction takes place through a centralized digital asset exchange or a custodian’s internal books and records, it is not broadcast to the Ethereum network or recorded on the Ethereum blockchain. In contrast to on-blockchain transactions, which are publicly recorded on the Ethereum blockchain, information and data regarding off-blockchain transactions are generally not publicly available. Therefore, off-blockchain transactions are not peer-to-peer ether transactions in that they do not involve a transaction on the Ethereum network and do not reflect a movement of ether between addresses recorded in the Ethereum blockchain. For these reasons, off-blockchain transactions are not immutable or irreversible as any such transfer of ether ownership is not cryptographically protected by the protocol behind the Ethereum network or recorded in, and validated through, the blockchain mechanism.

Ether Markets and Exchanges

Ether spot markets hosted on centralized venues typically permit investors to open accounts with the market and then purchase and sell ether via websites or through mobile applications. Prices for trades on ether spot markets are typically reported publicly. In general, an investor opening a trading account on such a venue must deposit an accepted government-issued currency into its account with the spot market, or a previously acquired digital asset, before they can purchase or sell assets on the spot market. The process of establishing an account with an ether market and trading ether is different from, and should not be confused with, the process of users sending ether from one ether address to another ether address on the Ethereum network. This latter process is an activity that occurs on the Ethereum network, while the former is an activity that occurs entirely within the order book operated by the spot market. The spot market typically records the investor’s ownership of ether in its internal books and records, rather than on the Ethereum blockchain. The spot market ordinarily does not transfer ether to the investor on the Ethereum blockchain unless the investor makes a request to the exchange to withdraw the ether in its exchange account to an off-exchange ether wallet.

Outside of the spot markets, ether can be traded OTC. The OTC market is largely institutional in nature, and OTC market participants generally consist of institutional entities, such as firms that offer two-sided liquidity for ether, investment managers, proprietary trading firms, high-net-worth individuals that trade ether on a proprietary basis, entities with sizable ether holdings and family offices. The OTC market provides a relatively flexible market in terms of quotes, price, quantity, and other factors, although it tends to involve large blocks of ether. The OTC market has no formal structure and no open-outcry meeting place. Parties engaging in OTC transactions will agree upon a price—often via chat or voice—and then one of the two parties will initiate the transaction. For example, a seller of ether could initiate the transaction by sending the ether to the buyer’s Ethereum network address. The buyer would then wire U.S. dollars to the seller’s bank account. OTC trades are sometimes hedged and eventually settled with accompanying trades on ether spot markets.

In addition, ether futures and options trading occurs on exchanges in the United States regulated by the Commodity Futures Trading Commission (the “CFTC”). The market for CFTC-regulated trading of ether derivatives has developed substantially. Ether futures on the CME (“CME Ether Futures”) traded around $16.33 billion per month in the one year ending December 31, 2024 and represented around $31.21 billion in open interest per month.

Initial Creation of Ether

Unlike other digital assets, such as bitcoin, which are solely created through a progressive mining process, 72.0 million ether were created in connection with the launch of the Ethereum network. The initial 72.0 million ether were distributed as follows:

Initial Distribution: 60.0 million ether, or 83.33% of the supply, was sold to the public in a crowd sale conducted between July and August 2014 that raised approximately $18 million.

Ethereum Foundation: 6.0 million ether, or 8.33% of the supply, was distributed to the Ethereum Foundation for operational costs.

Ethereum Developers: 3.0 million ether, or 4.17% of the supply, was distributed to developers who contributed to the Ethereum network.

Developer Purchase Program: 3.0 million ether, or 4.17% of the supply, was distributed to members of the Ethereum Foundation to purchase at the initial crowd sale price.

Following the launch of the Ethereum network, ether supply initially increased through a progressive validation process. Following the introduction of EIP-1559, described below, the ether supply and issuance rate has varied based on factors such as recent use of the network.

Proof-of-Work Validation Process

Prior to September 2022, Ethereum operated using a proof-of-work consensus mechanism. Under proof-of-work, in order to incentivize those who incurred the computational costs of securing the network by validating transactions, there was a reward given to the computer (under proof-of-work, validators were known as “miners”) that was able to create the latest block on the chain. Every 12 seconds, on average, a new block was added to the Ethereum blockchain with the latest transactions processed by the network, and the miner that generated this block was awarded a variable amount of ether, depending on use of the network at the time. In certain validation scenarios, ether was sometimes sent to another miner if they were also able to find a solution but their block was not included. This is referred to as an “uncle/aunt reward.” Due to the nature of the algorithm for block generation, this process (generating a “proof-of-work”) was guaranteed to be random. Prior to the Merge upgrade, described below, miners on the Ethereum network engaged in a set of prescribed complex mathematical calculations in order to add a block to the Ethereum blockchain and thereby confirm ether transactions included in that block’s data.

Proof-of-Stake Process

In the second half of 2020, the Ethereum network began the first of several stages of an upgrade that was initially known as “Ethereum 2.0.” and eventually became known as the “Merge” to transition the Ethereum network from a proof-of-work consensus mechanism to a proof-of-stake consensus mechanism. The Merge was completed on September 15, 2022, and the Ethereum network has operated on a proof-of-stake model since such time.

Unlike proof-of-work, in which validators expend computational resources to compete to validate transactions and are rewarded coins in proportion to the amount of computational resources expended, in proof-of-stake, validators risk or “stake” coins to compete to be randomly selected to validate transactions and are rewarded coins in proportion to the amount of coins staked. Any malicious activity, such as validating multiple blocks, disagreeing with the eventual consensus or otherwise violating protocol rules, results in the forfeiture or “slashing” of a portion of the staked coins. Proof-of-stake is believed by some to be more energy efficient and scalable than proof-of-work. Every 12 seconds, approximately, a new block is added to the Ethereum blockchain with the latest transactions processed by the network, and the validator that generated this block is awarded ether.

Limits on Ether Supply

The rate at which new ether are issued and put into circulation is expected to vary. In September 2022 the Ethereum network converted from proof-of-work to a new proof-of-stake consensus mechanism. Following the Merge, approximately 1,700 ether are issued per day, though the issuance rate varies based on factors such as recent use of the network. In addition, the issuance of new ether could be partially or completely offset by the burn mechanism introduced by the EIP-1559 modification, under which ether are removed from supply at a rate that varies with network usage. See “Modifications to the Ethereum Protocol.” On occasion, the ether supply has been deflationary over a 24-hour period as a result of the burn mechanism. The attributes of the new consensus algorithm are subject to change but, in sum, the new consensus algorithm and related modifications reduced total new ether issuances and could turn the ether supply deflationary over the long term.

As of December 31, 2024, the current circulating supply of ether is estimated to be around 120.47 million coins.

Modifications to the Ethereum Protocol

The Ethereum network is an open-source project with no official developer or group of developers that controls it. However, historically the Ethereum network’s development has been overseen by the Ethereum Foundation and other core developers. The Ethereum Foundation and core developers are able to access and alter the Ethereum network source code and, as a result, they are responsible for quasi-official releases of updates and other changes to the Ethereum network’s source code. However, the release of proposed updates to the Ethereum network’s source code by core developers does not guarantee that the updates will be adopted. Nodes must accept any changes made to the Ethereum source code by choosing to download the proposed modification of the Ethereum network’s source code in their individual Ethereum Client, and ultimately a critical mass (in practice, a substantial majority) of validators and users—such as DApp and smart contract developers, as well as users of DApps and smart contracts, and anyone else who transacts on the Ethereum blockchain or Ethereum network—must support the shift, or the upgrades will lack adoption. A modification of the Ethereum network’s source code is only effective with respect to the Ethereum nodes that download it and modify their Ethereum Clients accordingly, and in practice such decisions are heavily influenced by the preferences of validators and users. If a modification is accepted by less than a substantial majority of users and validators, a division in the Ethereum network will occur such that one network will run the pre-modification source code and the other network will run the modified source code. Such a division is known as a “fork.” See “Risk Factors-Risk Factors Related to Digital Assets—A temporary or permanent “fork” could adversely affect an investment in the Shares.” Consequently, as a practical matter, a modification to the source code becomes part of the Ethereum network only if accepted by a sufficiently broad cross-section of the Ethereum network’s participants.

For example, in 2019 the Ethereum network completed a network upgrade called Metropolis that was designed to enhance the usability of the Ethereum network and was introduced in two stages. The first stage, called Byzantium, was implemented in October 2017. The purpose of Byzantium was to increase the network’s privacy, security, and scalability and reduce the block reward for validators (at that time, validators on the proof-of-work consensus version of Ethereum were known as “miners”) who created new blocks in proof-of-work consensus from 5.0 ether to 3.0 ether. The second stage, called Constantinople, was implemented in February 2019, along with another upgrade, called St. Petersburg. Another network upgrade, called Istanbul, was implemented in December 2019. The purpose of Istanbul was to make the network more resistant to denial-of-service attacks, enable greater ether and Zcash interoperability as well as other Equihash-based proof-of-work digital assets, and to increase the scalability and performance for solutions on zero-knowledge privacy technology like SNARKs and STARKs. The purpose of these upgrades was to prepare the Ethereum network for the introduction of a proof-of-stake algorithm and reduce the block reward from 3.0 ether to 2.0 ether.

In the second half of 2020, the Ethereum network began the first of several stages of an upgrade culminating in the Merge. The Merge amended the Ethereum network’s consensus mechanism to be proof-of-stake, and was intended to address the perceived shortcomings of the proof-of-work consensus mechanism in terms of labor intensity and duplicative computational effort expended by validators (known under proof-of-work as “miners”) who did not win the race, under proof of work, to be the first in time to solve the cryptographic puzzle that would allow them to be the only validator permitted to validate the block and receive the resulting block reward (which was given only to the first validator to successfully solve the puzzle and hash a given block, and not to others).

Following the Merge, core development of the Ethereum source code has increasingly focused on modifications of the Ethereum protocol to increase speed, throughput and scalability and also improve existing or next generation uses. Future upgrades to the Ethereum protocol and Ethereum blockchain to address scaling issues—such as network congestion, slow throughput and periods of high transaction fees owing to spikes in network demand—have been discussed by network participants, such as sharding. The purpose of sharding, which has been discussed for years, is to increase scalability of the Ethereum blockchain by splitting the blockchain into subsections, called shards, and dividing validation responsibility so that a defined subset of validators would be responsible for each shard, rather than all validators being responsible for the entire blockchain, allowing for parallel processing and validation of transactions. However, there appears to be uncertainty and a lack of existing widespread consensus among network participants about how to solve the scaling challenges faced by the Ethereum network.

The rapid development of other competing scalability solutions, such as those that would rely on handling the bulk of computational work relating to transactions or smart contracts and decentralized applications (“DApps”) outside of the main Ethereum network and Ethereum blockchain, has caused alternatives to sharding to emerge. “Layer 2” is a collective term for solutions that are designed to help increase throughput and reduce transaction fees by handling or validating transactions off the main Ethereum network (known as “Layer 1”) and then attempting to take advantage of the perceived security and integrity advantages of the Layer 1 Ethereum network by uploading the transactions validated on the Layer 2 protocol back to the Layer 1 Ethereum network. The details of how this is done vary significantly between different Layer 2 technologies and implementations. For example, “rollups” perform transaction execution outside the Layer 1 blockchain and then post the data, typically in batches, back to the Layer 1 Ethereum blockchain where consensus is reached. “Zero knowledge rollups” are generally designed to run the computation needed to validate the transactions off-chain, on the Layer 2 protocol, and submit a proof of validity of a batch of transactions (not the entire transactions themselves). By contrast, “optimistic rollups” assume transactions are valid by default and only run computation, via a fraud proof, in the event of a challenge. Other proposed Layer 2 scaling solutions include, among others, “state channels”, which are designed to allow participants to run a large number of transactions on the Layer 2 side channel protocol and only submit two transactions to the main Layer 1 Ethereum blockchain (the transaction opening the state channel, and the transaction closing the channel); and “side chains,” in which an entire Layer 2 blockchain network with capabilities similar to those of the existing Layer 1 Ethereum blockchain runs in parallel with the existing Layer 1 Ethereum blockchain and allows smart contracts and DApps to run on the Layer 2 side chain without burdening the main Layer 1 network. To date, the Ethereum network community has not coalesced overwhelmingly around any particular Layer 2 solution, though this could change.

Apart from solutions designed to address scalability challenges, there have been other upgrades as well. In 2021, the Ethereum network implemented the EIP-1559 upgrade. EIP-1559 changed the methodology used to calculate the fees paid to validators. EIP 1559 resulted in the splitting of fees into two components: a base fee and tip. Ether used to pay the base fee is as a result of EIP 1559 removed from circulation, or “burnt,” and the tip is paid to validators. EIP-1559 has reduced the total net issuance of ether fees to validators. Future updates may impact the supply of or demand for ether or its price. On March 13, 2024, the Ethereum network underwent a planned fork called “Dencun” implementing a series of EIPs. EIP 4844, which some commentators perceive to be the most significant EIP within the Dencun series, is intended to improve the economics of Layer 2s by introducing a temporary storage solution, called Binary Large Objects (“blobs”), which is expected to reduce the cost of recording batched transactions on the Ethereum Network. Operators of Layer 2 blockchains now have a choice of using two types of data storage: as temporary blob space stored for 4096 epochs (approximately 18 days) or as permanent smart contract call data. Because the data is pruned from the Ethereum Network new service providers are likely to emerge which store the historical blob data beyond the pruning period. As expected, and immediately following the upgrade, some Layer 2s reported reduced gas fees when batching transactions to the Ethereum network which in turn lowered the transaction costs on the Layer 2. As with any change to software code, planned forks such as Dencun could introduce bugs, coding defects, unanticipated or undiscovered problems, flaws, security risks, or problematic incentive structures, or such planned forks could otherwise fail to work as intended or achieve the expected benefits that proponents hope for in the short term or the long term, which could also have an adverse effect on adoption of the Ethereum network and the value of ether, and therefore the Shares.

The Trust’s activities will not directly relate to scalability or upgrade projects, though such projects may potentially increase demand for ether and the utility of the Ethereum network as a whole. Conversely, if they are unsuccessful or they cause users or application or smart contract developers to migrate away from the Ethereum blockchain, demand for ether could potentially be reduced. Also, projects that operate and are built within the Layer 1 Ethereum blockchain and network may increase the data flow on the Ethereum network and could either “bloat” the size of the Ethereum blockchain or slow confirmation times.

Forms of Attack Against the Ethereum Network

All networked systems are vulnerable to various kinds of attacks. As with any computer network, the Ethereum network contains certain flaws. For example, the Ethereum network is currently vulnerable to a “51% attack” where, if a validator or group of validators acting in concert were to gain control of more than 50% of the staked ether, a malicious actor would be able to gain full control of the network and the ability to manipulate the Ethereum blockchain. The top three largest staking pools controlled nearly 50% of the ether staked on the Ethereum network.

In addition, many digital asset networks have been subjected to a number of denial-of-service attacks, which have led to temporary delays in block creation and in the transfer of Ethereum. Any similar attacks on the Ethereum network that impact the ability to transfer ether could have a material adverse effect on the price of ether and the value of the Shares.

Market Participants

Validators

In proof-of-stake, validators risk or stake coins to be randomly selected to validate transactions and are rewarded for performing their responsibilities and behaving in accordance with protocol rules. Malfunctions that cause validators to go offline and, in turn, inhibit them from performing their duties can result in financial penalties (e.g., inactivity leak). Any malicious activity, such as proposing multiple blocks for the same slot, making incorrect attestations or otherwise violating protocol rules, results in the penalization or slashing of staked coins and forced exit from performing validator duties. The penalty varies depending on the type of offense and correlation to potential offenses by other validators.

Validators range from Ethereum enthusiasts to professional operations that design and build dedicated machines and data centers. On the Ethereum network, a validator must stake 32 ether in order to participate in maintaining the network. Once consensus is reached, the participating validator receives newly issued ETH as part of their consensus rewards and the priority fee as part of their execution rewards. The priority fee represents one of two components of the transaction fee. The second component is the base fee, which makes up the vast majority of the transaction fees paid by users and is not received by validators, but is instead taken out of circulation, or burnt. The base fee and the priority fee both fluctuate with network usership.

Investment and Speculative Sector

This sector includes the investment and trading activities of both private and professional investors and speculators. Historically, larger financial services institutions are publicly reported to have limited involvement in investment and trading in digital assets, although the participation landscape is beginning to change. Currently, there is relatively limited use of digital assets in the retail and commercial marketplace in comparison to relatively extensive use by speculators, and a significant portion of demand for digital assets is generated by speculators and investors seeking to profit from the short- or long-term holding of digital assets.

Retail Sector

The retail sector includes users transacting in direct peer-to-peer ether transactions through the direct sending of ether over the Ethereum network. The retail sector also includes transactions in which consumers pay for goods or services from commercial or service businesses through direct transactions or third-party service providers, although the use of ether as a means of payment is still developing and has not been accepted in the same manner as bitcoin due to ether’s relative nascency and because ether has a generally different purpose than bitcoin.

Service Sector

This sector includes companies that provide a variety of services including the buying, selling, payment processing and storing of ether. For example, Coinbase, Kraken, Bitstamp, Gemini, and LMAX Digital are some of the largest digital asset exchanges by volume traded. As the Ethereum network continues to grow in acceptance, it is anticipated that service providers will expand the currently available range of services and that additional parties will enter the service sector for the Ethereum network.

Competition

As of December 31, 2024, more than 10,000 other digital assets, as tracked by CoinMarketCap.com, have been developed since the inception of bitcoin, which is currently the most developed digital asset because of the length of time it has been in existence, the investment in the infrastructure that supports it, and the network of individuals and entities that are using bitcoin in transactions. While ether has enjoyed some success in its limited history, the aggregate value of outstanding ether is smaller than that of bitcoin and may be eclipsed by the more rapid development of other digital assets. In addition, while ether was the first digital asset with a network that served as a smart contracts platform, newer digital assets also function as smart contracts platforms, including Solana, Avalanche and Cardano. Some industry groups are also creating private, permissioned blockchain versions of Ethereum.

Government Oversight, Though Increasing, Remains Limited

As digital assets have grown in both popularity and market size, the U.S. Congress and a number of U.S. federal and state agencies (including Financial Crimes Enforcement Network (“FinCEN”), SEC, CFTC, the Financial Industry Regulatory Authority (“FINRA”), the Consumer Financial Protection Bureau (“CFPB”), the Department of Justice, the Department of Homeland Security, the Federal Bureau of Investigation, the IRS and state financial institution and securities regulators) have been examining the operations of digital asset networks, digital asset users and the digital asset markets, with particular focus on the extent to which digital assets can be used to launder the proceeds of illegal activities or fund criminal or terrorist enterprises and the safety and soundness of exchanges or other service providers that hold or custody digital assets for users. Many of these state and federal agencies have issued consumer advisories regarding the risks posed by digital assets to investors. In addition, federal and state agencies and other countries and international bodies have issued rules or guidance about the treatment of digital asset transactions or requirements for businesses engaged in digital asset activity.

In addition, the SEC, U.S. state securities regulators and several foreign governments have issued warnings and instituted legal proceedings in which they argue that certain digital assets may be classified as securities and that both those digital assets and any related initial coin offerings are subject to securities regulations. The outcomes of these proceedings, as well as ongoing and future regulatory actions may alter, perhaps to a materially adverse extent, the nature of an investment in the Shares or the ability of the Trust to continue to operate. Additionally, U.S. state and federal as well as foreign regulators and legislatures have taken action against virtual currency businesses or enacted restrictive regimes in response to adverse publicity arising from hacks, consumer harm, or criminal activity stemming from virtual currency activity.

The CFTC has regulatory jurisdiction over the ether futures markets. In addition, because the CFTC has determined that ether is a “commodity” under the CEA and the rules thereunder, it has jurisdiction to prosecute fraud and manipulation in the cash, or spot, market for ether. The CFTC has pursued enforcement actions relating to fraud and manipulation involving ether and ether markets. Beyond instances of fraud or manipulation, the CFTC generally does not oversee cash or spot market exchanges or transactions involving ether that do not use collateral, leverage, or financing.

On February 8, 2021, the CME, a designated contract market (“DCM”) registered with the CFTC launched new contracts for ether futures products. DCMs are boards of trades (or exchanges) that operate under the regulatory oversight of the CFTC, pursuant to Section 5 of the Commodity Exchange Act. To obtain and maintain designation as a DCM, an exchange must comply on an initial and ongoing basis with twenty-three Core Principles established in Section 5(d) of the CEA. Among other things, a DCM is required to establish self- regulatory programs designed to enforce the DCM’s rules, prevent market manipulation and customer and market abuses, and ensure the recording and safe storage of trade information. The CFTC engaged in a “heightened review” of the self-certification of ether futures, which required DCMs to enter direct or indirect information sharing agreements with spot market platforms to allow access to trade and trader data; to monitor data from cash markets with respect to price settlements and other ether prices more broadly, and identify anomalies and disproportionate moves in the cash markets compared to the futures markets; to engage in inquiries, including at the trade settlement level when necessary; and agree to regular coordination with CFTC surveillance staff on trade activities, including providing the CFTC surveillance team with trade settlement data upon request.

Various foreign jurisdictions have adopted, and may continue to, in the near future, adopt laws, regulations or directives that affect the Ethereum network, the ether markets, and their users, particularly ether spot markets and service providers that fall within such jurisdictions’ regulatory scope.

The effect of any future regulatory change on the Trust or ether is impossible to predict, but such change could be substantial and adverse to the Trust and the value of the Shares.

Calculation of Net Asset Value

For purposes of calculating the Trust’s net asset value (“NAV”) per Share, the Trust’s holdings of ether will be valued using the same methodology as used to calculate the Index. The Index is constructed using ether price feeds from eligible spot markets and the VWMP methodology, calculated every 15 seconds based on VWMP market data over rolling sixty-minute increments.

The Sponsor believes that use of the Index mitigates against idiosyncratic market risk, as the failure of any individual spot market will not materially impact pricing for the Trust. It also allows the Administrator to calculate the NAV in a manner that significantly deters manipulation.

The Sponsor believes fact that there are multiple ether spot markets contributing prices to the NAV makes manipulation more difficult in a well-arbitraged and fractured market, as a malicious actor would need to manipulate multiple spot markets simultaneously to impact the NAV, or dramatically skew the historical distribution of volume between the various markets.

Since the Index is intended to represent the U.S. dollar value of one ether every 15 seconds based on VWMP spot market data over rolling sixty-minute increments, malicious actors would need to sustain efforts to manipulate the market over an extended period of time, or would need to replicate efforts multiple times across markets, potentially triggering review. This extended period also supports Authorized Participant activity by capturing volume over a longer time period, rather than forcing Authorized Participants to mark an individual close or auction. The use of a median price eliminates the ability of outlier prices to impact the NAV, as it systematically excludes those prices from the NAV calculation. The use of a volume-weighted median (as opposed to a traditional median) protects against attempts to manipulate the NAV by executing a large number of low-dollar trades, because any manipulation attempt would have to involve a majority of global spot ether volume in a narrow window to have any influence on the NAV.

The Trust’s NAV per Share is calculated by:

• taking the fair market value of its total assets based on the volume-weighted median price of ether used for the calculation of the Index;

• subtracting any liabilities; and

• dividing that total by the total number of outstanding Shares.

The Administrator calculates the NAV of the Trust once each Exchange trading day. The NAV for a normal trading day will be released after 4:00 p.m. EST. Trading during the core trading session on the Exchange typically closes at 4:00 p.m. EST. However, NAVs are not officially struck until after 4:00 p.m. EST. The pause after 4:00 p.m. EST provides an opportunity for the Sponsor to algorithmically detect, flag, investigate, and correct unusual pricing should it occur. The Sponsor has established a Valuation Committee to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Valuation Committee. If the Valuation Committee determines in good faith that the Index does not reflect an accurate ether price, then the Valuation Committee will instruct the Administrator to employ an alternative method to determine the fair value of the Trust’s assets. In determining an alternative fair value method, the Valuation Committee generally considers such criteria as observable market-based inputs, including market quotations and last sale information from third-party pricing services and/or trading platforms on which ether are traded. The Valuation Committee’s selection of third-party pricing services used considers the qualifications, experience, and history of the pricing services and whether their valuation methodologies and procedures are reasonably designed to produce prices that reflect fair value under the prevailing market conditions. Moreover, the terms of the Trust Agreement do not prohibit the Sponsor from changing the Index or other valuation method used to calculate the NAV of the Trust. Any such change in the Index or other valuation method could affect the value of the Shares and investors could suffer a substantial loss on their investment in the Trust. In the event of a material change, the Sponsor will notify Shareholders in a prospectus supplement and/or a current report on Form 8-K or in its annual or quarterly reports, as applicable.

In addition, in order to provide updated information relating to the Trust for use by Shareholders and market professionals, a third-party financial data provider will calculate and disseminate throughout the core trading session on each trading day an updated intraday indicative value (“IIV”). The IIV will be calculated based on the Trust’s ether holdings and any other assets expected to comprise that day’s NAV calculation. The third-party financial data provider will use the Blockstream Crypto Data Feed Streaming Level 1 as the pricing source for the spot ether. The Blockstream Crypto Data Feed Streaming Level 1 calculates an average of current ether price levels of the ether trading platforms that are available on its feed. The ether trading platforms included in the Blockstream Crypto Data Feed Streaming Level 1 include Bitfinex, Bitstamp, and Gemini. The Trust will provide an IIV per Share updated every 15 seconds, as calculated by the Exchange or a third-party financial data provider during the Exchange’s regular trading hours of 9:30 a.m. to 4:00 p.m. EST (“Regular Trading Hours”). The IIV disseminated during Regular Trading Hours should not be viewed as an actual real-time update of the NAV, which will be calculated only once at the end of each trading day as described herein. The IIV will be widely disseminated on a per Share basis every 15 seconds during Regular Trading Hours through the facilities of the consolidated tape association (CTA) and Consolidated Quotation System (CQS) high speed lines. In addition, the IIV will be available through on-line information services such as Bloomberg and Reuters.

The Trust’s periodic financial statements may not utilize the NAV of the Trust determined by reference to the Index to the extent the methodology used to calculate the Index is deemed not to be consistent with GAAP. The Trust’s periodic financial statements will be prepared in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic 820, “Fair Value Measurements and Disclosures” (“ASC Topic 820”) and utilize an exchange-traded price from the Trust’s principal market for ether on the Trust’s financial statement measurement date. The Sponsor will determine in its sole discretion the valuation sources and policies used to prepare the Trust’s financial statements in accordance with GAAP. The Trust intends to engage a third-party vendor to obtain a price from a principal market for ether, which will be either the market the Trust normally transacts in for ether or, if the Trust does not normally transact in any market or such market suffers an operational interruption and is unavailable, determined and designated by such third-party vendor daily based on its consideration of several exchange characteristics, including oversight, and the volume and frequency of trades. Under GAAP, such a price is expected to be deemed a Level 1 input in accordance with the ASC Topic 820 because it is expected to be a quoted price in active markets for identical assets or liabilities.

The Sponsor reserves the right to adjust the Share price of the Trust in the future to maintain convenient trading ranges for Shareholders. Any adjustments would be accomplished through stock splits or reverse stock splits. Such splits would decrease (in the case of a split) or increase (in the case of a reverse split) the proportionate NAV per Share but would have no effect on the net assets of the Trust or the proportionate voting rights of Shareholders or the value of any Shareholder’s investment.

Fees and Expenses

Sponsor Fee

The Trust will pay the Sponsor an annual unified fee of 0.25% of the Trust’s Ether Holdings (the “Sponsor Fee”). The Trust’s “Ether Holdings” is the quantity of the Trust’s ether plus any cash or other assets held by the Trust represented in ether as calculated using the Index price, less its liabilities (which include estimated accrued but unpaid fees and expenses) represented in ether as calculated using the Index price. The Sponsor Fee is paid by the Trust to the Sponsor as compensation for services performed under the Trust Agreement. The Administrator will calculate the Sponsor Fee in respect of each day by reference to the prior day’s Ether Holdings. The Sponsor Fee will accrue daily in ether and be payable monthly in ether or cash. To the extent there are any on-chain transaction fees incurred in connection with the transfers of ether to pay the Sponsor Fee, the Sponsor, and not the Trust, shall bear such fees. The Sponsor may, at its sole discretion and from time to time, waive all or a portion of the Sponsor Fee for stated periods of time. The Sponsor is under no obligation to waive any portion of its fees and any such waiver shall create no obligation to waive any such fees during any period not covered by the waiver.

Routine Operational, Administrative and Other Ordinary Expenses

As partial consideration for its receipt of the Sponsor Fee, the Sponsor is obligated under the Trust Agreement to assume and pay all fees and other expenses incurred by the Trust in the ordinary course of its affairs, excluding taxes, but including: (i) the fees of the Trust’s third-party service providers including, but not limited to, the Distributor, the Administrator, the Custodian, the Cash Custodian, the Transfer Agent, the Index Provider, and the Trustee, (ii) the fees and expenses related to the listing, quotation or trading of the Shares on the Exchange (including customary legal, marketing and audit fees and expenses), (iii) legal fees and expenses incurred in the ordinary course, (iv) audit fees, (v) regulatory fees, including, if applicable, any fees relating to the registration of the Trust and Shares, including any ongoing filings related to the offering of Shares, under the 1933 Act or the 1934 Act, (vi) printing and mailing costs, (vii) costs of maintaining the Trust’s website and (viii) applicable license fees (each, a “Sponsor-paid Expense” and collectively, the “Sponsor-paid Expenses”), provided that any expense that qualifies as an Extraordinary Expense (as defined below) will not be deemed to be a Sponsor-paid Expense. There is no cap on the amount of Sponsor-paid Expenses. The Sponsor has also assumed all fees and expenses related to the organization and offering of the Trust and the Shares.

Non Recurring Fees and Expenses

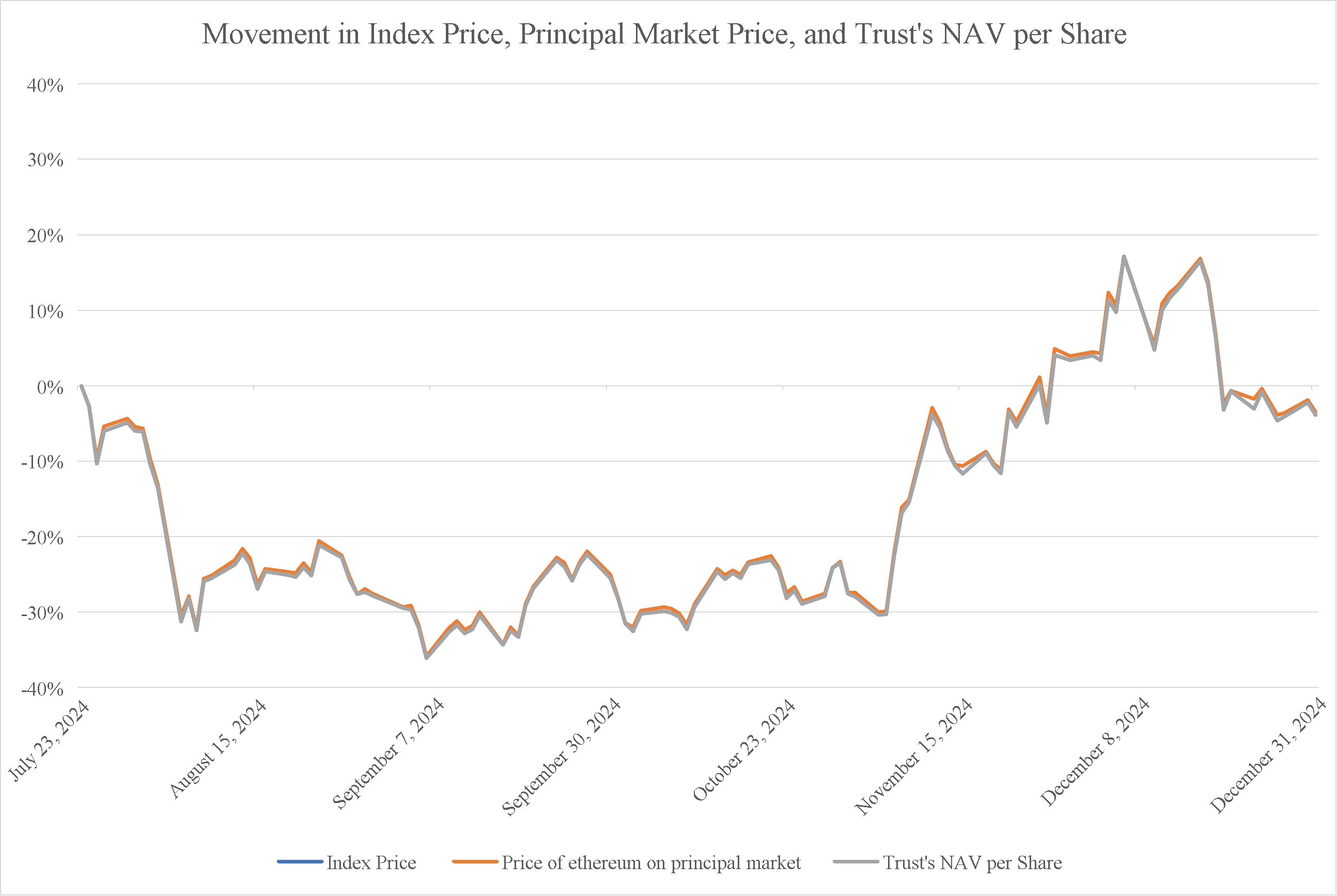

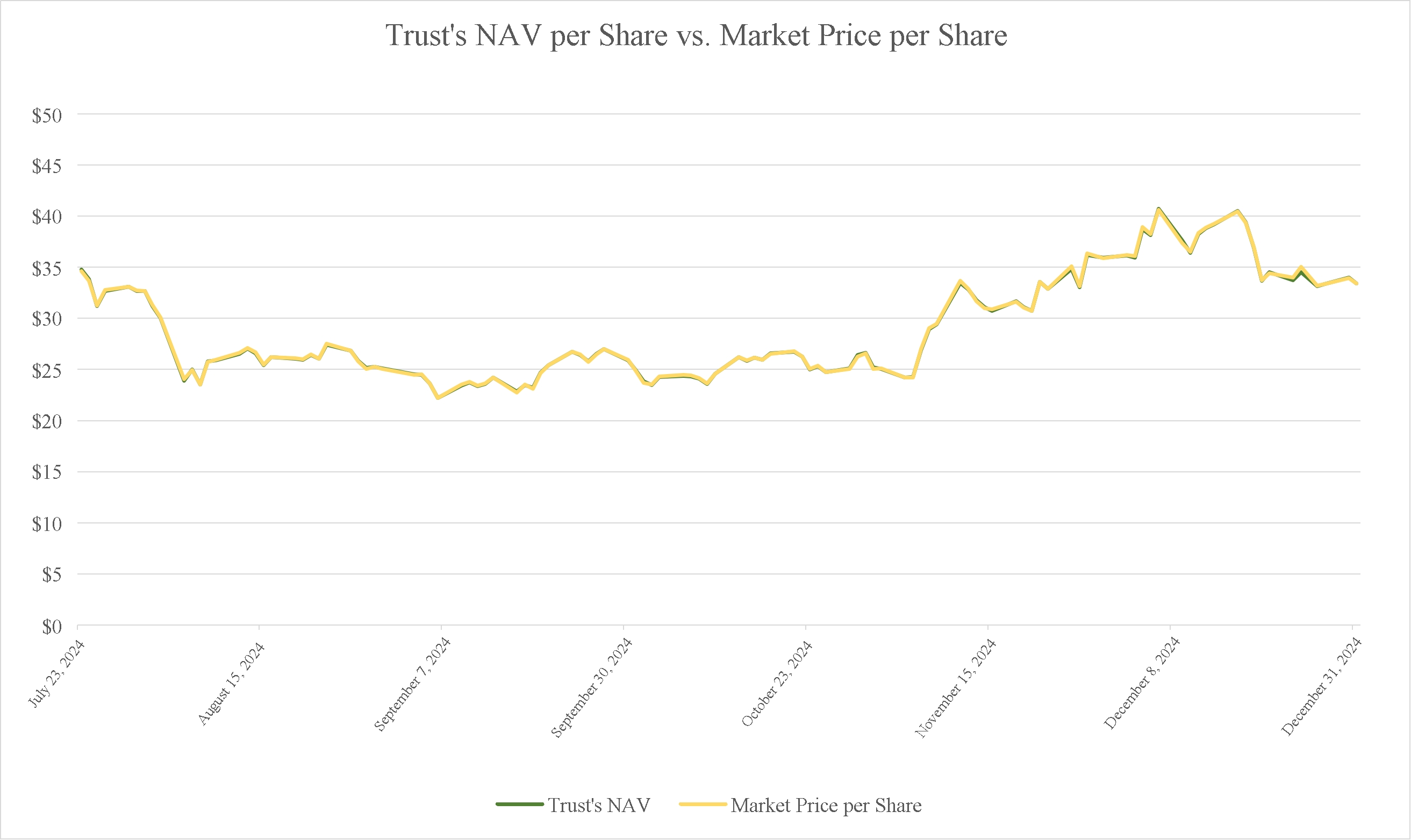

The Trust may incur certain extraordinary, nonrecurring expenses that are not Sponsor-paid Expenses, including, but not limited to, brokerage and transaction costs associated with the sale or transfer of ether, taxes and governmental charges, expenses and costs of any extraordinary services performed by the Sponsor (or any other service provider) on behalf of the Trust to protect the Trust, the Trust’s assets, or the interests of Shareholders, any indemnification of the Custodian or other agents, service providers or counterparties of the Trust, and extraordinary legal fees and expenses, including any legal fees and expenses incurred in connection with litigation, regulatory enforcement or investigation matters (collectively, “Extraordinary Expenses”). To the extent on-chain transaction fees are incurred in connection with transfers or sales of ether to pay Extraordinary Expenses, the Trust will bear such fees.