United

States

Securities

and Exchange Commission

Washington,

D.C. 20549

Form

N-CSR

Certified

Shareholder Report of Registered Management

Investment

Companies

Investment

Company Act file number: 811-05807

Eagle

Capital Growth Fund, Inc.

(Exact

name of registrant as specified in charter)

225

East Mason Street, Suite 802, Milwaukee, WI 53202

(Address

of principal executive offices) (zip code)

Luke

E. Sims, President and Chief Executive Officer

Eagle

Capital Growth Fund, Inc.

225

East Mason Street, Suite 802,

Milwaukee,

WI 53202

(Name

and address of agent for service)

Registrant’s

telephone number, including area code: (414) 765-1107

Date

of fiscal year end: December 31

Date

of reporting period: December 31, 2024

| ITEM

1. |

REPORT

TO STOCKHOLDERS |

Eagle Capital Growth Fund,

Inc.

Annual Report

December 31, 2024

Top Ten Holdings,

as of December 31, 2024

| Company | |

Market

Value | |

Percentage

of Portfolio |

| Berkshire

Hathaway Inc. B | |

$ | 5,666,000 | | |

| 12.4 | % |

| Alphabet, Inc. A | |

$ | 3,218,100 | | |

| 7.0 | % |

| Markel Corp. | |

$ | 2,882,804 | | |

| 6.3 | % |

| Amazon.com Inc. | |

$ | 1,974,510 | | |

| 4.3 | % |

| AutoZone Inc. | |

$ | 1,921,200 | | |

| 4.2 | % |

| O’Reilly Automotive

Inc. | |

$ | 1,778,700 | | |

| 3.9 | % |

| Illinois Tool Works

Inc. | |

$ | 1,774,920 | | |

| 3.9 | % |

| Stryker Corp. | |

$ | 1,620,225 | | |

| 3.5 | % |

| PepsiCo, Inc. | |

$ | 1,520,600 | | |

| 3.3 | % |

| T. Rowe Price Group,

Inc. | |

$ | 1,515,406 | | |

| 3.3 | % |

Dear Fellow Shareholders,

The first couple of weeks

of 2025 have been a little sobering. Wildfires in California, concerns about U.S. tariff policy, and then a strong December jobs report,

have jolted investors out of the euphoria of 2024. We don’t know what the full year holds, but we remain convinced that overall

stock market prices are starting the year elevated. More about that later.

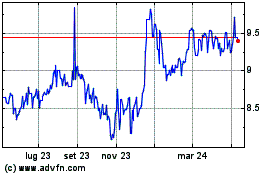

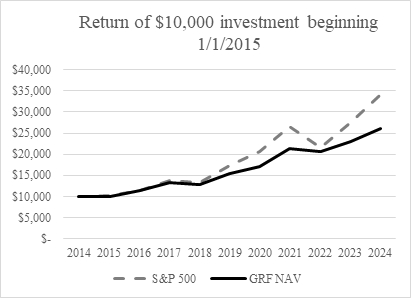

For the year our Fund was

up 14%, compared to the S&P 500 (Total Return) Index of 25%. As we have often noted, our Fund does well in flat to down stock markets,

but lags in a strong up market. We are more interested in protecting the downside (and our capital) while we wait for suitable investment

opportunities.

We love high quality businesses,

but history teaches us that investors can overpay for even great businesses. We’ve talked in the past about how Coca-Cola (KO)

became overvalued in the late 1990s and early 2000s when it traded at something like 40x earnings. Coca-Cola is truly a wonderful, high-quality

business, but the market went a little crazy on the high side. Eventually KO shares returned to earth. KO shares are not cheap currently

at around 25x earnings, but they are still well below the high-water mark of the past.

With that thought--- great

companies trading at exorbitant multiples--- in mind, let’s look at Colgate-Palmolive (CL). We love the CL business. It has all

of the hallmarks of a quality business, with recognizable brands, a 45% share of the worldwide toothpaste market, a gross margin of 58%,

and a ROIC (return on invested capital) of 34%. And it is not a flash in the pan. Colgate has been performing like this for decades.

During 2024 CL shares traded

between a range of approximately $80 to $109. Our Fund, even though we love the company, sold some CL shares during the past year towards

the higher end of that range. (We didn’t necessarily get the absolute high, but then generally nobody ever does despite what they

may tell you.) We sold some of our higher-basis CL shares because we couldn’t justify paying close to 30x earnings, even for such

a great business as CL. As of yesterday (January 10th), CL shares are back trading around $87.

We should note that the

Fund continues to own some very low tax basis CL shares acquired decades ago; we’re convinced that holding temporarily-overvalued

CL shares is better than the certainty that Fund shareholders, in a sale, would be paying high long-term capital gains. Owning high-quality

stocks for extended time periods is tax efficient, both because of the favorable taxation of long-term capital gains, as well as the

deferral in paying taxes, and allows the portfolio companies to compound their earnings internally over an extended time period. Our

Fund generally has annual portfolio turnover of less than 10% (suggesting an average 10-year holding period), and our unrealized appreciation

of over $22 Million represents approximately 48% of the Fund’s year-end net assets.

Should there be a market

fall-off that carries CL shares with it, we’d be ready, willing and able to buy more CL shares at the right price. That

is the key. One needs the discipline to not overpay, even for great companies.

From about 2009 until recently

there was no reasonable place for investors to earn money market rates (currently in the 4.3% range) on cash sitting on the sidelines

waiting to be invested. This phenomenon was largely the result of misguided Federal Reserve policy. (Aside: the zero interest rate policy

should have been abandoned in about 2011 when the economy normalized after the Great Recession. The continuation of a zero interest rate

policy through the decade and continuing until late 2022 resulted in a great deal of misdirected capital, and we haven’t yet seen

all of the consequences of that errant policy.) At least now, investors, facing a highly-priced stock market, have some place to wait.

There has been a lot of

discussion lately about the 60/40 (60% equities/40% fixed income) portfolio, and its role in the investor toolbox. We’ve never

been fans of 60/40, mostly because we don’t care for the “40”, and particularly not when invested in fixed income with

a term (duration) of more than three or four years. Over the long-term, bonds do not deliver acceptable after-tax, inflation-adjusted

returns.

Instead of buying long-term

(duration) fixed income, we’re much more comfortable owning high quality, dividend-paying companies, such as PepsiCo, Inc (PEP).

(We do own very high-quality money market funds pending investment in equities, but these money market funds are merely the default option

when we don’t have anything better to buy.) Yes, the earnings growth at Pepsi will be modest unlike many of our other Fund portfolio

holdings, but the dividend is secure and increases regularly. And that is what protects investors against one of our major enemies---inflation.

Longer-term, fixed income is a fool’s game. It is not the place for long-term investors, and it is particularly not appropriate

for younger investors with a long investment runway.

As always, we love hearing

from our Fund shareholders. As we constantly remind you, we won’t comment on any Fund portfolio purchase or sale that hasn’t

been publicly reported, or that is contemplated. With that one caveat, all other topics are on the table.

| |

Luke E. Sims |

|

David C. Sims |

|

| |

Email: |

luke@simscapital.com |

|

Email: |

dave@simscapital.com |

|

| |

Phone: |

414/530-5680 |

|

Phone: |

414/765-1107 |

|

January 11, 2025

| |

|

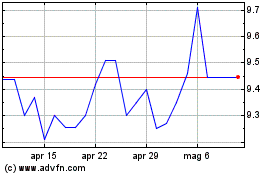

1-year |

|

5-year |

|

10-year |

| Net

Asset Value Return |

|

13.63% |

|

11.01% |

|

10.10% |

| Market

Price Return |

|

9.92% |

|

10.32% |

|

8.63% |

| Returns

are average annualized returns for periods greater than one year. |

Disclosures:

The

Fund has not had a public offering of shares during the period covered; shareholders and potential shareholders should not confuse the

Eagle Capital Growth Fund (“Fund”) with investment funds that have share offerings.

Past

performance does not guarantee future performance.

The

table and graph do not reflect the deduction of taxes an investor may pay on Fund distributions or the sale of Fund shares. Likewise,

the S&P 500 Index information does not factor in taxes on dividends nor the impact of realized gains had an investor owned the underlying

index securities.

Reinvestment

in Fund shares is calculated at the price received by participants of the Fund’s Dividend Reinvestment and Cash Purchase Plan (“DRIP”),

which understates Fund performance; however, this price is the best metric for characterizing an investment in the Fund with cash dividends

reinvested.

The

S&P 500 Index is included as an equity comparable; however, the Fund holds short-term investments and cash, with different returns

and a different impact on Fund returns.

The

Fund’s return can be estimated using net asset value (NAV) or market price. Net asset value is used for the graph.

The

Fund has a total return fundamental investment objective. The S&P 500 Index has no fundamental investment objective.

Eagle Capital Growth Fund, Inc.

Statement of Assets and Liabilities

As of December 31, 2024

| Assets | |

| | | |

| | |

| Common stock--at

market value (cost $15,878,514) | |

$ | 38,007,278 | | |

| | |

| Money market funds

(cost $7,691,096) | |

| 7,691,096 | | |

| | |

| Dividends receivable | |

| 131,194 | | |

| | |

| Prepaid fees | |

| 13,564 | | |

| | |

| Total assets | |

| | | |

$ | 45,843,132 | |

| Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 32,500 | | |

| | |

| Investment advisor

fee payable | |

| 30,608 | | |

| | |

| Total liabilities | |

| | | |

$ | 63,108 | |

| Total net assets | |

| | | |

$ | 45,780,024 | |

| Shareholders’

Equity | |

| | | |

| | |

| Net Assets

are Comprised of: | |

| | | |

| | |

| Paid-in capital $0.001 par value per

share; authorized 50,000,000 shares, outstanding 3,967,836 shares | |

| 23,560,335 | | |

| | |

| Accumulated earnings | |

| 22,219,689 | | |

| | |

| Total net assets | |

| | | |

$ | 45,780,024 | |

| Net asset value per share | |

| | | |

$ | 11.54 | |

See Notes to Financial Statements.

Eagle Capital Growth Fund, Inc.

Statement of Operations

For the Year Ended December 31, 2024

| Investment

Income | |

| | | |

| | | |

| | |

| Dividends | |

$ | 665,023 | | |

| | | |

| | |

| Interest | |

| 296,471 | | |

| | | |

| | |

| Total

investment income | |

| | | |

$ | 961,494 | | |

| | |

| Expenses | |

| | | |

| | | |

| | |

| Advisory fees | |

$ | 346,742 | | |

| | | |

| | |

| Directors’

fees and expenses | |

| 95,750 | | |

| | | |

| | |

| Transfer agent | |

| 59,841 | | |

| | | |

| | |

| Audit/Tax Fee | |

| 32,500 | | |

| | | |

| | |

| Legal fees | |

| 15,694 | | |

| | | |

| | |

| Listing fee | |

| 15,000 | | |

| | | |

| | |

| Insurance | |

| 13,564 | | |

| | | |

| | |

| Custodian fees | |

| 10,446 | | |

| | | |

| | |

| Other fees and expenses | |

| 16,844 | | |

| | | |

| | |

| Total

expenses | |

| | | |

$ | 606,381 | | |

| | |

| Net investment income | |

| | | |

| | | |

$ | 355,113 | |

| Realized Gain

and Change in Unrealized Appreciation on Investments | |

| | | |

| | | |

| | |

| Realized gain on

investments: | |

| | | |

| | | |

| | |

| Net

realized gain on investments | |

| | | |

$ | 2,433,938 | | |

| | |

| Unrealized appreciation

on investments: | |

| | | |

| | | |

| | |

| Net

change in unrealized appreciation on investments | |

| | | |

$ | 2,751,811 | | |

| | |

| Net realized gain and change in unrealized appreciation on investments | | |

| | | |

$ | 5,185,749 | |

| Net increase

from operations | |

| | | |

| | | |

$ | 5,540,862 | |

See Notes to Financial Statements.

Eagle Capital Growth Fund, Inc.

Statements of Changes in Net Assets

| |

Year

Ended

December 31, 2023 | | |

Year

Ended

December 31, 2024

| |

| From

Operations: | |

| | | |

| | |

| Net investment income | |

$ | 186,688 | | |

$ | 355,113 | |

| Net realized gain

on investments | |

| 1,107,684 | | |

| 2,433,938 | |

| Net change in unrealized

appreciation on investments | |

| 3,318,062 | | |

| 2,751,811 | |

| Net increase from

operations | |

| 4,612,434 | | |

| 5,540,862 | |

| Distributions

to Shareholders: | |

| (1,388,743 | ) | |

| (2,698,128 | ) |

| From Capital

Stock Transactions: | |

| | | |

| | |

| Reinvested capital

from distribution of shares | |

| — | | |

| — | |

| Share repurchases | |

| — | | |

| — | |

| Increase (Decrease)

from capital stock transactions | |

| — | | |

| — | |

| Total Net Assets: | |

| | | |

| | |

| Beginning of year | |

| 39,713,598 | | |

| 42,937,289 | |

| End of year | |

$ | 42,937,289 | | |

$ | 45,780,024 | |

| Shares: | |

| | | |

| | |

| Shares outstanding

at beginning of year | |

| 3,967,836 | | |

| 3,967,836 | |

| Shares issued, due

to the distribution | |

| — | | |

| — | |

| Shares repurchased | |

| — | | |

| — | |

| Shares outstanding at end of period | |

| 3,967,836 | | |

| 3,967,836 | |

See Notes to Financial Statements.

Eagle Capital Growth Fund, Inc.

Financial Highlights

| For

the periods ended December 31: | |

2020 | |

2021 | |

2022 | |

2023 | |

2024 |

| Net

asset value at beginning of year | |

$ | 9.21 | | |

$ | 9.53 | | |

$ | 10.78 | | |

$ | 10.01 | | |

$ | 10.82 | |

| Net

investment income (A) | |

| 0.05 | | |

| 0.03 | | |

| 0.02 | | |

| 0.05 | | |

| 0.09 | |

Net

realized gain and unrealized

appreciation (loss) on investments |

|

|

0.82 |

|

|

|

2.15 |

|

|

|

(0.47 |

) |

|

|

1.11 |

|

|

|

1.31 |

|

| Total

from investment operations | |

| 0.87 | | |

| 2.18 | | |

| (0.45 | ) | |

| 1.16 | | |

| 1.40 | |

Distribution

from:

Net investment income |

|

|

(0.06 |

) |

|

|

(0.02 |

) |

|

|

(0.03 |

) |

|

|

(0.07 |

) |

|

|

(0.08 |

) |

| Realized

gains | |

| (0.49 | ) | |

| (0.95 | ) | |

| (0.34 | ) | |

| (0.28 | ) | |

| (0.60 | ) |

| Total

distributions | |

| (0.55 | ) | |

| (0.97 | ) | |

| (0.37 | ) | |

| (0.35 | ) | |

| (0.68 | ) |

| Impact

of capital share transactions | |

| — | | |

| 0.04 | | |

| 0.05 | | |

| — | | |

| — | |

| Net

asset value at end of year | |

$ | 9.53 | | |

$ | 10.78 | | |

$ | 10.01 | | |

$ | 10.82 | | |

$ | 11.54 | |

| Per

share market price, end of year last traded price |

|

$ |

7.98 |

|

|

$ |

9.51 |

|

|

$ |

8.57 |

|

|

$ |

9.36 |

|

|

$ |

9.75 |

|

| Total

Investment Return: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average annual return, based on market value (B): |

| 6.36 | % | |

| 30.70 | % | |

| -6.57 | % | |

| 14.44 | % | |

| 9.92 | % |

| Average

annual return, based on net asset value: | |

| 10.75 | % | |

| 24.05 | % | |

| -3.73 | % | |

| 12.18 | % | |

| 13.63 | % |

| Net

assets, end of year (000s omitted) | |

$ | 38,842 | | |

$ | 43,029 | | |

$ | 39,714 | | |

$ | 42,937 | | |

$ | 45,780 | |

Ratios

to average net assets:

Expenses to average net assets (C) |

|

|

1.30 |

% |

|

|

1.26 |

% |

|

|

1.36 |

% |

|

|

1.34 |

% |

|

|

1.32 |

% |

| Net

investment income to average net assets | |

| 0.57 | % | |

| 0.30 | % | |

| 0.20 | % | |

| 0.45 | % | |

| 0.77 | % |

| Portfolio

turnover (annualized) | |

| 19 | % | |

| 5 | % | |

| 10 | % | |

| 11 | % | |

| 2 | % |

| Average

commission paid per share | |

$ | 0.04 | | |

$ | 0.01 | | |

$ | 0.01 | | |

$ | 0.01 | | |

$ | 0.01 | |

| (A) | Per share calculations for net investment income and gains are calculated

using the average shares outstanding. |

| (B) | Market value return is computed based on market price of the Fund’s

shares and excludes the effect of brokerage commissions. Net asset value return is computed based on

net asset value of the Fund’s shares and excludes the effect of brokerage commissions. Dividends

and distributions are assumed to be reinvested at the prices obtained under the Fund’s dividend

reinvestment plan. |

| (C) | Expense ratio does not reflect fees and expenses incurred by the Fund

as a result of its investments in shares of investment companies. If fees for Fund investments in investment

companies were included in the expense ratio, the net impact would be an increase for the years ended

December 31, 2022 and 2024 of 0.01%. For the years ended December 31, 2020, 2021, and 2023 there would

have been no increase in the expense ratio. |

See Notes to Financial Statements.

Eagle Capital Growth Fund, Inc.

Portfolio of Investments as of December

31, 2024

| Industry | |

Shares | |

Cost | |

Fair

Value | |

Percent

of

Net

Assets |

| Common Stock (83.2%

of total investments) | |

| |

| |

|

| Advertising | |

| |

| |

| |

|

| Alphabet,

Inc. A | |

| 17,000 | | |

$ | 1,376,922 | | |

$ | 3,218,100 | | |

| | |

| MediaAlpha, Inc.* | |

| 9,876 | | |

| 166,690 | | |

| 111,500 | | |

| | |

| | |

| | | |

| | | |

| 3,329,600 | | |

| 7.3% | |

| Bank | |

| | | |

| | | |

| | | |

| | |

| US Bancorp | |

| 24,000 | | |

| 857,537 | | |

| 1,147,920 | | |

| | |

| | |

| | | |

| | | |

| 1,147,920 | | |

| 2.5% | |

| Brokerage | |

| | | |

| | | |

| | | |

| | |

| Charles Schwab Corp. | |

| 20,000 | | |

| 882,187 | | |

| 1,480,200 | | |

| | |

| | |

| | | |

| | | |

| 1,480,200 | | |

| 3.2% | |

| Closed-end

Funds | |

| | | |

| | | |

| | | |

| | |

| Central and Eastern

Europe Fund Inc. | |

| 103,306 | | |

| 1,077,312 | | |

| 1,128,102 | | |

| | |

| | |

| | | |

| | | |

| 1,128,102 | | |

| 2.5% | |

| Conglomerate | |

| | | |

| | | |

| | | |

| | |

| Berkshire Hathaway

Inc. B* | |

| 12,500 | | |

| 1,489,340 | | |

| 5,666,000 | | |

| | |

| | |

| | | |

| | | |

| 5,666,000 | | |

| 12.4% | |

| Consumer | |

| | | |

| | | |

| | | |

| | |

| Colgate-Palmolive

Company | |

| 12,000 | | |

| 72,938 | | |

| 1,090,920 | | |

| | |

| Procter & Gamble

Company | |

| 2,000 | | |

| 145,879 | | |

| 335,300 | | |

| | |

| | |

| | | |

| | | |

| 1,426,220 | | |

| 3.1% | |

| Credit Card | |

| | | |

| | | |

| | | |

| | |

| Mastercard Inc | |

| 1,000 | | |

| 219,636 | | |

| 526,570 | | |

| | |

| Visa Inc. | |

| 1,500 | | |

| 225,957 | | |

| 474,060 | | |

| | |

| | |

| | | |

| | | |

| 1,000,630 | | |

| 2.2% | |

| Data Processing | |

| | | |

| | | |

| | | |

| | |

| Automatic Data Processing,

Inc. | |

| 3,000 | | |

| 82,775 | | |

| 878,190 | | |

| | |

| Paychex, Inc. | |

| 6,000 | | |

| 140,075 | | |

| 841,320 | | |

| | |

| | |

| | | |

| | | |

| 1,719,510 | | |

| 3.8% | |

| Drug/Medical

Device | |

| | | |

| | | |

| | | |

| | |

| Johnson & Johnson | |

| 3,071 | | |

| 34,933 | | |

| 444,128 | | |

| | |

| Stryker Corp. | |

| 4,500 | | |

| 19,055 | | |

| 1,620,225 | | |

| | |

| | |

| | | |

| | | |

| 2,064,353 | | |

| 4.5% | |

| Food | |

| | | |

| | | |

| | | |

| | |

| Kraft Heinz Company | |

| 29,000 | | |

| 772,000 | | |

| 890,590 | | |

| | |

| PepsiCo, Inc. | |

| 10,000 | | |

| 168,296 | | |

| 1,520,600 | | |

| | |

| | |

| | | |

| | | |

| 2,411,190 | | |

| 5.3% | |

| Industrial | |

| | | |

| | | |

| | | |

| | |

| Danaher Corporation | |

| 1,000 | | |

| 225,262 | | |

| 229,550 | | |

| | |

| Illinois Tool Works

Inc. | |

| 7,000 | | |

| 295,051 | | |

| 1,774,920 | | |

| | |

| Veralto Corporation* | |

| 333 | | |

| 29,705 | | |

| 33,916 | | |

| | |

| Waters Corp.* | |

| 2,000 | | |

| 100,780 | | |

| 741,960 | | |

| | |

| | |

| | | |

| | | |

| 2,780,346 | | |

| 6.1% | |

| Insurance | |

| | | |

| | | |

| | | |

| | |

| Markel Corp.* | |

| 1,670 | | |

| 1,296,670 | | |

| 2,882,804 | | |

| | |

| | |

| | | |

| | | |

| 2,882,804 | | |

| 6.3% | |

See Notes to Financial Statements.

Eagle Capital Growth Fund, Inc.

Portfolio of Investments as of December

31, 2024, continued

| Industry | |

Shares | |

Cost | |

Fair

Value | |

Percent

of

Net Assets |

| Mutual Fund Management | |

| | | |

| | | |

| | | |

| | |

| Diamond

Hill Investment Group, Inc. | |

| 9,576 | | |

$ | 1,338,331 | | |

$ | 1,485,238 | | |

| | |

| Franklin Resources,

Inc. | |

| 50,000 | | |

| 1,183,351 | | |

| 1,014,500 | | |

| | |

| T. Rowe Price Group,

Inc. | |

| 13,400 | | |

| 1,480,248 | | |

| 1,515,406 | | |

| | |

| | |

| | | |

| | | |

| 4,015,144 | | |

| 8.8% | |

| Restaurant | |

| | | |

| | | |

| | | |

| | |

| Starbucks Corp. | |

| 12,000 | | |

| 588,432 | | |

| 1,095,000 | | |

| | |

| | |

| | | |

| | | |

| 1,095,000 | | |

| 2.4% | |

| Retail | |

| | | |

| | | |

| | | |

| | |

| AutoZone Inc.* | |

| 600 | | |

| 319,026 | | |

| 1,921,200 | | |

| | |

| eBay Inc. | |

| 3,000 | | |

| 68,886 | | |

| 185,850 | | |

| | |

| O’Reilly Automotive

Inc.* | |

| 1,500 | | |

| 305,534 | | |

| 1,778,700 | | |

| | |

| | |

| | | |

| | | |

| 3,885,750 | | |

| 8.5% | |

| Technology

Services | |

| | | |

| | | |

| | | |

| | |

| Amazon.com Inc.* | |

| 9,000 | | |

| 915,707 | | |

| 1,974,510 | | |

| | |

| | |

| | | |

| | | |

| 1,974,510 | | |

| 4.3% | |

| Total common stock

investments (Cost $15,878,514) | |

| | | |

| | | |

| 38,007,278 | | |

| | |

| Money Market Funds | |

| | | |

| | | |

| | | |

| | |

| Morgan Stanley Inst.

Liq. Fund, Treasury,Institutional

Class, 4.42%** | |

| 7,691,096 | | |

| | | |

| 7,691,096 | | |

| 16.8% | |

| (Cost $7,691,096) | |

| | | |

| | | |

| 7,691,096 | | |

| | |

| Total

investments (Cost $23,569,610) | |

| | | |

| | | |

$ | 45,698,374 | | |

| | |

| Other

assets in excess of liabilities | |

| | | |

| | | |

| 81,650 | | |

| | |

| Total

net assets | |

| | | |

| | | |

$ | 45,780,024 | | |

| | |

| * | | Non-dividend paying security |

See Notes to Financial Statements.

Eagle

Capital Growth Fund, Inc.

Notes to Financial

Statements

Eagle Capital Growth Fund, Inc.,

a Maryland corporation (“Fund”), began in 1989 with a total return investment objective.

The Fund is a diversified closed-end investment company subject to the Investment Company Act of 1940. The Fund has opted into the Maryland

Control Share Acquisition Act.

| (2) | Significant Accounting Policies. |

The Fund

follows the accounting and reporting requirements of investment companies under ASC 946 (ASC 946-10-50-1) Financial Services- Investment

Companies. The policies followed by the Fund are in conformity with the accounting principles generally accepted in the United States

of America (“GAAP”).

Security

Transactions and Related Income—Dividends and distributions paid to the Fund from portfolio investments are recorded on the

ex-dividend date. Investment security purchases and sales are accounted for on a trade date basis. Interest income is accrued on a daily

basis. Realized gains and losses are determined using the specific identification method.

Investments—Investments

are valued at fair value. Investments in equity securities are valued at the closing market price as of the close of regular trading

on the applicable valuation date. If no such closing market price is available on the valuation date, the Fund uses the then most recent

closing market price.

In the unlikely

event that there is no current or recent closing market price for a portfolio security (whether equity or debt) traded in the over-the-counter

market, then the Fund uses the most recent closing bid price. If there is no closing bid price for a portfolio security for a period

of ten (10) consecutive trading days, then the Fund’s Audit Committee or other appropriate committee shall determine the value

of such illiquid security. From inception to December 31, 2024, the Fund has not held a security which required an illiquid pricing valuation.

Consistent

with Rule 2a-5 under the Investment Company Act of 1940, the Fund’s Board analyzes the risks associated with pricing for and valuation

of investments as well as the suitability of the investments held.

Use of estimates—The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of increase (decrease) in operations during the reporting period. Actual results could differ from those estimates.

Federal income taxes—The Fund intends to continue to comply with the general qualification requirements of the Internal

Revenue Code applicable to regulated investment companies such as the Fund. The Fund distributes annually at least 90% of its taxable

income, including net long-term capital gains, to its shareholders. In order to avoid imposition of the excise tax applicable to regulated

investment companies, the Fund intends to declare as dividends in each calendar year an amount equal to at least 98% of its net investment

income and 98.2% of its net realized capital gains (including undistributed amounts from previous years).

As of and

during the fiscal year ended December 31, 2024, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes

interest and penalties, if any, related to unrecognized tax benefits as income tax expense when incurred, reflected on the Statement

of Operations. During the year, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken

in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year-ends

and the interim tax period

Eagle

Capital Growth Fund, Inc.

Notes to Financial

Statements

since, as

applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and

does not expect this to change for the next twelve months.

The following

information is based upon the Federal income tax basis of portfolio investments as of December 31, 2024:

| Gross

unrealized appreciation | |

$ | 22,517,311 | |

| Gross unrealized

depreciation | |

| (388,546) | |

| Net unrealized appreciation | |

$ | 22,128,765 | |

| Cost basis of securities

on tax basis: | |

$ | 23,569,610 | |

At December

31, 2024, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed

ordinary income | |

$ | 47,113 | |

| Undistributed capital

gains | |

| 43,810 | |

| Unrealized appreciation

on investments | |

| 22,128,765 | |

| Total accumulated

earnings | |

$ | 22,219,688 | |

Expenses—The

Fund’s service providers bear all of their expenses in connection with the performance of their services. The Fund bears all of

its expenses incurred in connection with its operations including, but not limited to, investment advisory fees (as discussed in Note

3), legal and audit fees, taxes, insurance, shareholder reporting and other related costs. As noted in Note 3, the Fund’s investment

advisor, as part of its responsibilities under the Investment Advisory Agreement, is required to provide certain internal administrative

services to the Fund at such investment advisor’s expense. The Investment Advisory Agreement provides that the Fund may not incur

annual aggregate expenses in excess of two percent (2%) of the first $10 million of the Fund’s average net assets, one and a half

percent (1.5%) of the next $20 million of the average net assets, and one percent (1%) of the remaining average net assets for any fiscal

year. Any excess expenses are the responsibility of the investment advisor.

Repurchases—The

Fund repurchases shares from time to time with the purpose of reducing total shares outstanding. The price paid for the repurchased shares

is recorded to reduce common stock and paid-in capital.

Fair Value Accounting—Accounting standards require certain assets and liabilities be reported at fair value in the financial

statements and provides a framework for establishing that fair value. The framework for determining fair value is based on a hierarchy

that prioritizes the inputs and valuation techniques used to measure fair value.

In general, fair values determined

by Level 1 inputs use quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. All

of the Fund’s investments are classified as Level 1.

Fair values determined by Level 2

inputs use other inputs that are observable, either directly or indirectly. These Level 2 inputs include quoted prices for similar assets

and liabilities in active markets, and other inputs such as interest rates and yield curves that are observable at commonly quoted intervals.

Level 3 inputs are unobservable inputs,

including inputs that are available in situations where there is little, if any, market activity for the related asset. These Level 3

fair value measurements are based primarily on management’s own estimates using pricing models, discounted cash flow methodologies,

or similar techniques taking into account the characteristics of the asset.

Eagle

Capital Growth Fund, Inc.

Notes to Financial

Statements

| (3) | Service Providers Arrangements |

Investment

advisor—For its services under the Investment Advisory agreement, the investment

advisor receives a monthly fee calculated at an annual rate of three-quarters of one percent (0.75%) of the weekly net asset value

of the Fund, as long as the weekly net asset value is at least $3.8 million. The investment advisor is not entitled to any

compensation for any week in which the average weekly net asset value falls below $3.8 million. Pursuant to the Investment Advisory

Agreement, the investment advisor is required to provide certain internal administrative services to the Fund at the investment

advisor’s expense.

Sims Capital Management

LLC (“SCM”) serves as the Fund’s investment advisor. Pursuant to the Investment Advisory Agreement, SCM is

responsible for the management of the Fund’s portfolio, subject to oversight by the Fund’s Board of Directors. Luke E.

Sims, a Director, President and Chief Executive Officer of the Fund and owner of more than five percent of the Fund’s

outstanding shares, owns 50% of SCM. David C. Sims, the Chief Financial Officer, Chief Compliance Officer, Secretary, Treasurer,

Director of the Fund, the son of Luke E. Sims and owner of more than five percent of the Fund’s outstanding shares, owns the

remaining 50% of SCM.

Custodian—US Bancorp, NA serves

as the Fund’s custodian pursuant to a custodian agreement. As the Fund’s custodian, US Bancorp receives fees and compensation

of expenses for services provided including, but not limited to, an annual account charge and security transaction fees.

Transfer Agent— Equiniti Trust

Company, LLC (“EQ”) serves as the Fund’s transfer agent and dividend disbursing agent. American Stock Transfer &

Trust underwent a name change in 2023, becoming Equiniti Trust Company. EQ receives fees for services provided including, but not limited

to, account maintenance fees, activity and transaction processing fees and reimbursement for its out-of-pocket expenses. EQ also acts

as the agent under the Fund’s Dividend Reinvestment and Cash Purchase Plan.

| (4) | Dividend Reinvestment and Cash

Purchase Plan. |

The Fund has a Dividend

Reinvestment and Cash Purchase Plan (“DRIP”) which allows shareholders to reinvest cash dividends and make cash

contributions. Pursuant to the terms of the DRIP, cash dividends may be used by the DRIP agent to either purchase shares from the

Fund or in the open market, depending on the most favorable pricing available to DRIP participants. Voluntary cash contributions

from DRIP participants are used to purchase Fund shares in the open market. A complete copy of the DRIP is available on the

Fund’s website (www.eaglecapitalgrowthfund.com) or from EQ, the DRIP agent.

| (5) | Distributions to Shareholders. |

Distributions to shareholders from

the Fund’s net investment income and realized net long- and short-term capital gains will be declared and distributed at least

annually. The amount and timing of distributions are determined in accordance with federal income tax regulations.

On November 18, 2024, a

distribution of $0.68 per share aggregating $2,698,128 was declared from net investment income and net realized capital gains. The

dividend was paid on December 19, 2024, to shareholders of record on November 29, 2024. The tax character of distributions paid

during 2023 and 2024 was as follows:

| |

2023 | |

2024 |

| Distributions paid from: | |

| | | |

| | |

| Ordinary income | |

$ | 281,059 | | |

$ | 308,000 | |

| Short-term capital gains | |

| 114,033 | | |

| — | |

| Long-term capital gains | |

| 993,651 | | |

$ | 2,390,128 | |

Eagle

Capital Growth Fund, Inc.

Notes to Financial

Statements

In 2023 and 2024, the distributions

were paid in cash.

For more information about

the Fund’s tax information, please refer to Note 2, Federal income taxes.

| (6) | Fund Investment Transactions. |

Purchases and sales of securities,

other than short-term securities, for the year ended December 31, 2024, were $1,077,312 and $8,412,311, respectively.

Management of the Fund has evaluated

the need for disclosures and/or adjustments resulting from subsequent events through the date when these financial statements were published.

Based upon this evaluation, there were no items requiring adjustment of the financial statements or additional disclosure.

| (8) | Guarantees and Indemnifications. |

Under Maryland law and the Fund’s

organizational documents, the Fund will indemnify its officers and directors against certain liabilities arising out of the performance

of their duties to the Fund. In addition, certain of the Fund’s contracts with its service providers contain general indemnification

clauses. The Fund’s maximum exposure under these arrangements is unknown since the amount of any future claims that may be made

against the Fund cannot be determined, and the Fund has no historical basis for predicting the likelihood of any such claims.

In this reporting period, the fund

adopted FASB Accounting Standards Update 2023-07, Segment Reporting (Topic 280) - Improvements to Reportable Segment Disclosures (“ASU

2023-07”). Adoption of the new standard impacted financial statement disclosures only and did not affect the fund’s financial

position or the results of its operations. The Fund is deemed to be an individual reporting segment. The objective and strategy of the

Fund is used by the Adviser, as defined in the Additional Information, to make investment decisions, and the results of the operations,

as shown on the Statement of Operations and the financial highlights for the Fund is the information utilized for the day-to-day management

of the Fund. Due to the significance of oversight and their role, the Adviser is deemed to be the Chief Operating Decision Maker, the

party responsible for identifying and managing operating segments.

REPORT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and

Board of Directors of

Eagle Capital Growth

Fund, Inc.

Opinion on the Financial

Statements

We have audited the accompanying

statement of assets and liabilities, including the portfolio of investments, of Eagle Capital Growth Fund, Inc. (the “Fund”)

as of December 31, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each

of the two years in the period then ended, the financial highlights for each of the three years in the period then ended, and the related

notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly,

in all material respects, the financial position of the Fund as of December 31, 2024, the results of its operations for the year then

ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three

years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial

highlights for the years ended December 31, 2021, and prior, were audited by other auditors whose report dated February 17, 2022, expressed

an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements

are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements

based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”)

and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules

and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits

in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance

about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing

procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures

that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the

financial statements. Our procedures included confirmation of securities owned as of December 31, 2024, by correspondence with the custodian.

Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating

the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the

Fund’s auditor since 2022.

COHEN & COMPANY,

LTD.

Cleveland, Ohio

February 20, 2025

Directors Who Are

Interested Persons of the Fund and Officers

| Name,

Address and Age |

Position(s)

Held with Fund |

Term

of Office and Length of Time Served |

Principal

Occupation(s) During Past Five Years (in addition to positions held in the Fund) |

Number

of Portfolios in Fund Complex Overseen by Director or Nominee for Director |

Other

Directorships Held by Director or Nominee for Director

(Public

Companies) |

David

C. Sims*,

age 43 |

VP, CFO, CCO,

Treasurer, Secretary, and Director |

Term

of office expires 2027 (Class II). Served as a director since 2015. |

President

of Sims Capital Management LLC (investment advisor to the Fund); Manager of Peregrine Investment Fund LLC (private investment fund);

and roles with the Fund as previously identified. |

One |

None |

Luke

E. Sims**,

age 75 |

President,

CEO and Director |

Term

of office expires 2025 (Class III); nominee for director. Served as a director since 2002 |

President

and Chief Executive Officer of the Fund; Chairman of Sims Capital Management LLC (the Advisor to the Fund); and Retired Partner of

Foley & Lardner LLP (national law firm) where he was affiliated from 1976 through 2010. |

One |

None |

* The address of Mr. David Sims is the address

of the principal executive office of the Fund. David C. Sims is an Interested Person within the meaning of Section 2(a) (19) of the Investment

Company Act of 1940 because he is the Chief Financial Officer, Chief Compliance Officer, Treasurer, and Secretary of the Fund, beneficially

owns more than 5% of the Fund’s outstanding shares of common stock, and he is affiliated with the Fund’s investment advisor,

Sims Capital Management LLC (the “Advisor” or “SCM”). David C. Sims is the son of Luke E. Sims, the President,

Chief Executive Officer, and a Director of the Fund.

** The address of Mr. Luke Sims is the address

of the principal executive office of the Fund. Luke E. Sims is an Interested Person within the meaning of Section 2(a) (19) of the Investment

Company Act of 1940 because he is the President and Chief Executive Officer of the Fund, beneficially owns in excess of five percent

(5%) of the Fund’s outstanding shares of common stock, and he is affiliated with the Fund’s investment advisor, Sims Capital

Management LLC (the “Advisor” or “SCM”). Luke E. Sims is the father of David C. Sims, the Chief Financial Officer,

Chief Compliance Officer, Secretary, Treasurer, and a Director of the Fund.

Directors Who Are

Not Interested Persons

| Name,

Address and Age* |

Position(s)

Held with Fund |

Term

of Office and Length of Time Served |

Principal

Occupation(s) During Past Five Years |

Number

of Portfolios in Fund Complex Overseen by Director or Nominee for Director |

Other

Directorships Held by Director or Nominee for Director

(Public

Companies) |

| Jason

W. Allen, age 53 |

Director |

Term

of office expires 2026 (Class I). Served as a director since 2021. |

Partner

of Foley & Lardner LLP (national law firm) where he has been a practicing corporate lawyer since 1999. |

One |

None |

Robert

M. Bilkie, Jr.,

age 64 |

Chairman;

Director |

Term

of office expires 2026 (Class I). Served as a director since 2006. |

President

and Chief Executive Officer of Sigma Investment Counselors, Inc. (a registered investment advisor) since 1987; member of the Better

Investing Securities Review Committee and of the Better Investing Editorial Advisory Committee (non-remunerative). |

One |

None |

Phillip J. Hanrahan,

age 85 |

Director |

Term

of office expires 2026 (Class I). Served as a director since 2008. |

Retired

partner of Foley & Lardner LLP (national law firm) since February 2007 and, prior thereto, active partner of that firm since

1973. |

One |

None |

Carl A. Holth,

age 92 |

Director |

Term

of office expires 2027 (Class II). Served as a director since 1989. |

Retired.

Former banker. |

One |

None |

Anne

M. Nichols,

age 63 |

Director |

Term

of office expires 2027 (Class II). Served as a director since 2021. |

Managing

director at Fern Capital Inc, an investment advisor. |

One |

None |

Donald G. Tyler,

age 72 |

Director |

Term

of office expires 2025 (Class III); nominee for director. Served as a director since 2010. |

Retired.

Director of Administrative Services, County of Milwaukee, 2012 to 2014. Retired Interim President & Executive Director, Milwaukee

Symphony Orchestra 2010; Vice President of Investment Products and Services, Northwestern Mutual, 2003-2010. |

One |

None |

Neal

F. Zalenko,

age 79 |

Director |

Term

of office expires 2025 (Class III); nominee for director. Served as a director since 2008. |

Retired;

Founder and Managing Partner of Zalenko & Associates, P.C. (accounting firm), that merged with Baker Tilly in early 2005. |

One |

None |

* The address of each is the address of the

principal executive office of the Fund.

Compensation.

The following tables identify

the aggregate compensation paid to all directors and nominees in 2024. Directors’ fees are only payable to directors who are not

officers of the Fund or affiliated with the Advisor. The fees for 2024 were $13,000 for directors, $1,750 for Audit Committee service

and a $1,000 retainer for the Audit Committee Chairman.

Luke E. Sims and David

C. Sims, who are deemed to be Interested Persons of the Fund, are not entitled to receive directors’ fees from the Fund.

No Fund officer receives

compensation in his capacity as an officer of the Fund. Fund officers are: Luke E. Sims, President and Chief Executive Officer; and David

C. Sims, Chief Financial Officer, Chief Compliance Officer, Treasurer, Secretary and Director. Robert M. Bilkie, Jr. is the Fund’s

Chairman, which is not an executive officer position.

Sims Capital Management

LLC (“SCM”), the investment advisor for the Fund, was paid $346,742 by the Fund in 2024. SCM is 50% owned by Luke E. Sims,

the President, CEO and a Director of the Fund, as well as an owner of more than five percent of the Fund’s outstanding shares.

David C. Sims, the Fund’s Vice-President, Chief Financial Officer, Chief Compliance Officer, Treasurer, Secretary and Director

as well as an owner of more than five percent of the Fund’s outstanding shares, owns the remaining 50% of SCM.

Directors who are Interested Persons of the

Fund:

| Name,

Position |

Aggregate

Compensation

From Fund

|

Pension

or Retirement

Benefits Accrued

as

part of Fund

Expenses

|

Estimated

Annual

Benefits

upon Retirement

|

Total

Compensation

from

Fund and

Complex paid to Directors |

David

C. Sims,

VP, CFO, CCO,

Treasurer, Secretary,

and Director |

None |

None |

None |

None |

Luke

E. Sims,

Director, President,

CEO |

None |

None |

None |

None |

Directors who are not Interested Persons of

the Fund:

| Name,

Position | |

Aggregate

Compensation

From Fund | |

Pension

or Retirement

Benefits Accrued as

part of Fund

Expenses | |

Estimated

Annual

Benefits upon

Retirement | |

Total

Compensation

from Fund and

Complex paid to Directors |

| Jason W. Allen, | |

| |

| |

| |

|

| Director | |

$ | 13,000 | |

None | |

None | |

$ | 13,000 |

| Robert M.

Bilkie, Jr., | |

| | |

| |

| |

| |

| Director | |

$ | 13,000 | |

None | |

None | |

$ | 13,000 |

| Phillip

J. Hanrahan, | |

| | |

| |

| |

| |

| Director | |

$ | 14,750 | |

None | |

None | |

$ | 14,750 |

| Carl A.

Holth, | |

| | |

| |

| |

| |

| Director | |

$ | 14,750 | |

None | |

None | |

$ | 14,750 |

| Anne M.

Nichols, | |

| | |

| |

| |

| |

| Director | |

$ | 13,000 | |

None | |

None | |

$ | 13,000 |

| Donald G.

Tyler, | |

| | |

| |

| |

| |

| Director | |

$ | 14,750 | |

None | |

None | |

$ | 14,750 |

| Neal F.

Zalenko, | |

| | |

| |

| |

| |

| Director | |

$ | 15,750 | |

None | |

None | |

$ | 15,750 |

Board of Directors

| Jason

W. Allen |

Robert

M. Bilkie, Jr. |

Phillip

J. Hanrahan |

| Director |

Chairman of

the Board |

Director |

| Fox Point,

WI |

Northville,

MI |

Whitefish Bay,

WI |

| |

|

|

| Carl A. Holth |

Anne M. Nichols |

Luke E. Sims |

| Director |

Director |

Director, President

& CEO |

| Dearborn, MI |

Huntington

Woods, MI |

Milwaukee,

WI |

| |

|

|

| David C. Sims |

Donald G. Tyler |

Neal F. Zalenko |

| VP, Treasurer,

CFO, CCO |

Director |

Director |

Secretary & Director

Bayside, WI |

Whitefish Bay,

WI |

Birmingham,

MI |

EAGLE CAPITAL GROWTH

FUND, INC. (“Fund”)

DIVIDEND REINVESTMENT

AND CASH PURCHASE PLAN (“Plan”)

ADVANTAGE OF THE PLAN

Participants in the Plan

have the ability to have cash dividends from the Fund reinvested in additional Fund shares. Participants may also make cash contributions

to the Plan to acquire additional Fund shares.

JOINING THE PLAN

You can enroll in the Plan by going to https://equiniti.com/

or calling Equiniti Stock Transfer (formerly American Stock Transfer & Trust Company) (the “Plan Agent” or “EQ”)

at 877-739-9994. Plan information is also available at the Fund’s website at www.eaglecapitalgrowthfund.com/drip.html.

COSTS OF PARTICIPATION

IN THE PLAN

You are not charged any

fee or expense for enrolling in the Plan. Shareholders depositing certificated shares are charged a fee of $7.50. Sales of shares incur

a sales commission of $15.00, plus $0.10 per share. In the event a shareholder sends in a check to buy more shares and the check is returned,

a $35.00 charge will apply. Fees may change from time to time; please contact EQ for information about current fees.

REINVESTMENT OF FUND

DISTRIBUTIONS

If the Fund pays a distribution

in Fund shares, Participants’ accounts under the Plan will be credited with newly-issued Fund shares at the distribution price,

which is the price described in the distribution notice to shareholders. These shares will be held by the Plan Agent pursuant to the

Plan.

The Fund may pay distributions

in cash. In the event that the Fund makes a cash distribution, the Plan will first seek to buy shares on the open market up to and including

the most recent net asset value (“NAV”) of each Fund share. The NAV of each Fund share shall be calculated within forty-eight

hours of the distribution, excluding Sundays and holidays. Should the market price rise to or above the calculated NAV per share, the

Fund may issue new shares to the Plan at the greater of NAV per share or 95% of the market price. For purposes of the Plan, the market

price is the most recently traded price of a Fund share on the NYSE American exchange. The reinvestment of cash distributions will occur

as soon as practicable, and in no case later than 30 days after the Plan Agent’s receipt of the cash distributions, except where

necessary to comply with federal securities laws.

In the event that the open

market purchases take more than one day, the Fund will recalculate the NAV on a daily basis. Such recalculated NAV will be used to determine

whether the market price per share has risen to or above the calculated NAV per share. If the Plan Agent terminates open market purchases

based on the recalculated NAV and the Fund issues new shares to the Plan at the greater of NAV per share or 95% of the market price,

the number of shares received by the participant in respect of the cash dividend or distribution will be based on the weighted average

of prices paid for shares purchased in the open market and the price at which the Fund issues remaining shares.

VOLUNTARY CASH PAYMENTS

Plan participants may

make voluntary cash payments of not less than $50 per month (but in any event not more than $250,000 in any year) for the purpose of

acquiring additional Fund shares.

Voluntary cash payments

received by the Plan Agent on or prior to the last day of any month will be invested beginning on or about the first (1st)

business day of the following month (the “Investment Date”). The Plan will purchase Fund shares in the open market. If the

Plan Agent has not completed its open market purchase of Fund shares within thirty (30) days of the Investment Date, then the balance

of such voluntary cash payments will be returned to participants on a pro rata basis. All cash received by the Plan Agent in connection

with the Plan will be held without earning interest or income.

Optional cash payments

may be made online at https://equiniti.com/. You will need to know your 10-digit Plan account number to access your account.

The Fund recommends that participants making voluntary cash payments send their cash payments so that they reach the Plan Agent as close

as possible but prior to the Investment Date. A participant should be aware of possible delays in the mail if payment is to be made in

that manner. Accordingly, it is recommended that a participant mail the voluntary cash payment no later than ten days prior to an Investment

Date, or make cash payments online.

HOLDING OF SHARES

For your convenience,

EQ will hold in safekeeping all Fund shares you own by reason of your participation in the Plan. Upon your request (whether online at

https://equiniti.com/ , by mail, or telephonically to the Plan Agent at 800-937-5449), EQ will send you a physical stock

certificate representing a specified number of whole shares acquired or held the Plan in your account.

The Plan Agent will allow

you to deposit with it for safekeeping under the Plan any additional stock certificates for Fund shares that you may hold. Such shares,

once deposited, will be retained in “book-entry” form under the Plan.

STATEMENT OF ACCOUNT

At least annually, a detailed

statement of transactions in your Plan account for each calendar year will be sent to you by the Plan Agent. You may also access your

account information online at https://equiniti.com/. You will also receive the customary Internal Revenue Service Form 1099 to

report taxable income as a result of Fund distributions with respect to Fund shares held in your Plan account.

FEDERAL INCOME TAX

CONSIDERATIONS

You should consult your

accountant or tax advisor with respect to the Federal and/or other tax consequences resulting from participating in the Plan. However,

as a general rule, participants are taxed on Fund distributions, whether those distributions are paid directly in additional Fund shares,

or are in cash (whether such cash is used to purchase additional Fund shares in the open market or otherwise).

SHAREHOLDERS’

RIGHTS

Plan participants enjoy

the same rights as Fund shareholders generally with respect to Fund shares held in the Plan, including, without limitation, rights with

respect to stock dividends, stock splits, and voting rights. In the event of a major corporate event affecting the Fund, such as a stock

split or a stock dividend, the resulting Fund shares will be properly credited to your Plan account. In the event that a Plan participant

holds shares in both a Plan account and individually in his or her own name, any Fund shares resulting from a major corporate event affecting

the Fund will be distributed to the Plan account and the participant individually on a pro rata basis. EQ reserves the right to delay,

curtail or suspend any action otherwise required of it under the Plan during the pendency of any major corporate action affecting the

Fund.

ADDITIONAL INFORMATION

If you have any questions

regarding participation in the Plan, please visit the Plan Agent online at https://equiniti.com/, call the Plan Agent at

800-937-5449, or write the Plan Agent at:

Equiniti Trust Company,

LLC (“EQ”)

PO Box 10027

Newark, NJ 07101

ADDITIONAL TERMS AND

CONDITIONS OF PARTICIPATION IN THE EAGLE CAPITAL

GROWTH FUND, INC. DIVIDEND REINVESTMENT AND CASH PAYMENT PLAN

1. By enrolling in the Plan, all of the participant’s

cash distributions from the Fund and/or voluntary cash payments will be reinvested in additional Fund shares.

If the Fund declares a

distribution in Fund shares but includes a provision allowing shareholders to elect to receive cash in lieu of Fund shares, the Plan

Agent will receive the distribution in Fund shares on behalf of each Plan participant with respect to the Fund shares the participant

holds through the Plan, provided that if you (as a Plan participant) desire to elect to receive cash in lieu of Fund shares, you must

promptly terminate your participation in the Plan in accordance with paragraph 5 below. You must also notify the Fund in writing of your

election to receive cash. Such written notice to the Plan and to the Fund must be received at least three business days prior to the

cut-off election date in order to be effective prior to the receipt of the declared dividend. If a Plan participant beneficially owns

Fund shares outside of the Plan and desires to elect to receive cash in lieu of Fund shares, the participant must individually make this

election.

2. The Plan Agent may commingle participant

funds in connection with the receipt of cash distributions from the Fund, and from voluntary cash payments from participants. The Plan

Agent will allocate purchased Fund shares among participant accounts based upon the average price paid (net of any costs).

3. The Plan Agent shall hold shares for participants

in its own name or in the name of its nominee. The Plan Agent will acquire Fund shares in the open market at such price or prices then

reasonably available to it. Participants understand that from time to time, Fund shares may not be available for purchase, or may not

be available for purchase at a reasonable price. Moreover, any temporary or continued closing of the securities trading generally might

require the temporary curtailment or suspension of the Plan Agent’s efforts to purchase Fund shares. The Plan Agent is not responsible

or liable for, and shall not be accountable for, any inability on such its part to purchase Fund shares.

4. With respect to the voting of Fund shares

held in the Plan, the Plan Agent will provide participants with proxy solicitation materials and request their direction. If a participant

does not direct the Plan Agent as to the manner of voting, the Plan Agent will not vote such participant’s shares.

5. Plan participation may be terminated upon

request to the Plan Agent. A participant may terminate by providing written notice to the Plan Agent (the tear-off section at the bottom

of participant’s account statement is available for this purpose). Such written notice must be signed by all persons who are listed

on the Plan account. If a request is received fewer than three business days prior to the cut-off election date in the case of a share

distribution, or three days prior to the ex-dividend date in the case of a cash dividend, then the termination will begin after the receipt

of Fund shares or reinvestment of the declared dividend, as applicable. The Plan Agent will send to a participant who has terminated

participation in the Plan a certificate(s) representing the number of full shares held by the Plan Agent in such participant’s

account under the Plan. In case of termination, a participant’s interest in a fractional share will be converted to, and remitted

in cash, in an amount based upon the then current market value of the share (less service fees). However, the foregoing does not apply

to voluntary cash payments held for investment on the Investment Date as a result of voluntary cash payments. A participant may request

the return of any voluntary cash payment, if the participant makes a separate written request which is received by the Plan Agent at

the address above at least forty-eight (48) hours prior to the time when such voluntary cash payment is scheduled to be invested. If

a participant so requests, the Plan Agent may sell a terminating participant’s shares and remit the proceeds (less related brokerage

commissions and service fees).

6. The Plan Agent shall not be liable for

any action taken in good faith or for any good faith failure to act, including without limitation, any claim of liability (a) arising

out of a failure to terminate the participant’s account upon the participant’s death, prior to receipt of notice in writing

of such death and submission of documentation, by the personal representative of the deceased participant, in form and substance satisfactory

to the Plan Agent and (b) with respect to the price or prices at which Fund shares are purchased or sold for a participant’s account

and/or the timing of such purchases and/or sales.

7. The Fund reserves the right to amend or

terminate the Plan; significant revisions will become effective upon thirty (30) days written notice (from the date of mailing) to all

Plan participants. All inquiries with respect to the Plan should be directed to the Plan Agent at the addresses and phone numbers identified

in the Plan.

8. The Plan shall be governed by, and construed

in accordance with, the internal laws of the State of Wisconsin.

9. The Plan has been last amended and revised

as of December 13, 2023.

Recent Changes

The following

information is a summary of certain changes during the fiscal year ended December 31, 2024. This information may not reflect all of the

changes that have occurred since you purchased shares of the Fund.

During the applicable period, there have been:

(i) no material changes to the Fund’s investment objectives and policies that constitute its principal portfolio emphasis that

have not been approved by shareholders, (ii) no material changes to the Fund’s principal risks, (iii) no changes to the persons

primarily responsible for day-to-day management of the Fund; and (iv) no changes to the Fund’s charter or by-laws that would delay

or prevent a change of control that have not been approved by shareholders.

Investment Objectives

The Fund’s

primary investment objective is long-term growth. The Fund utilizes the concept of “total return” for selecting investments;

“total return” means the total of all income derived from, and the capital appreciation in value of, a particular investment.

There can be no assurance that the Fund will achieve its investment objectives or be able to structure its investment portfolio as anticipated.

Investment

Strategy

The

Fund seeks to achieve its investment objectives by employing a strategy of investing in primarily US issuer common stock. There is a

preference for “high-quality” companies, where “high-quality” denotes substantial operating income margins, high

returns on capital, and strong balance sheets. While the Fund is not constrained to investing solely in such companies, there is a distinct

preference for doing so.

Risk

Factors

Investment and Market Risk. An investment

in the Fund involves a considerable amount of risk. Before making an investment decision, a prospective investor should (i) consider

the suitability of this investment with respect to his or her investment objectives and personal situation and (ii) consider factors

such as his or her personal net worth, income, age, risk tolerance and liquidity needs. The value of the investments owned by the Fund

will fluctuate, sometimes rapidly and unpredictably, and such investments are subject to investment risk, including the possible loss

of the entire principal amount invested. At any point in time, an investment in the Fund’s common shares could be worth less than

the original amount invested, even after taking into account distributions paid by the Fund.

The Fund and its portfolio securities are

materially affected by market, economic and political conditions and events, such as natural disasters, epidemics and pandemics, globally

and in the jurisdictions and sectors in which it invests or operates, including factors affecting interest rates, the availability of

credit, currency exchange rates and trade barriers. Epidemics and pandemics have and may result in, among other things, travel restrictions,

closure of international borders, disruptions to certain businesses and securities markets, restrictions on securities trading activities,

quarantines, supply chain disruptions and reduced consumer demand, as well as general concern and uncertainty. Market, economic and political

conditions and events are outside the Fund’s control and could adversely affect the liquidity and value of the Fund’s investments

and reduce the ability of the Fund to make attractive new investments.

Closed-end Fund shares. As with any

security, shares of the Fund may increase or decrease in value from time to time, and these changes may or may not be related to changes

in the value of the securities held by the Fund (as reflected in its net asset value, or NAV). In addition, shares of closed-end investment

companies like the Fund frequently trade at a discount from net asset value. The possibility that shares of the Fund will trade at a

discount to net asset value (based on the value of the Fund’s portfolio securities), and the possibility that such discount could

increase, is a risk which is separate from the risk that the Fund’s net asset value will decrease. The Fund cannot predict whether

its shares will trade in the future at a premium to or a discount from net asset value or the level of any premium or discount.

Portfolio Concentration. While the

Fund qualifies as a “diversified” regulated investment company under the Investment Company Act of 1940, the Fund tends to

have a more concentrated portfolio that other mutual funds. Portfolio concentration can cause the Fund’s NAV to fluctuate more

than other diversified funds. At the end of 2024, the Fund’s top five equity investments represented slightly over 41% of the Fund’s

total equity portfolio.

In addition, the Fund’s largest portfolio

position is its investment in Berkshire Hathaway, Inc. (Class B). As of December 31, 2024, the Fund’s investment in Berkshire Hathaway

represented nearly 15% of the Fund’s equity portfolio. The death or disability of Warren Buffett could have a material adverse

impact on the price of Berkshire Hathaway shares.

Secondary Market for Fund Shares. The

Fund issues shares through its Dividend Reinvestment and Cash Purchase Plan. See “Dividend Reinvestment and Cash Purchase Plan.”

Shares may be issued under the Dividend Reinvestment and Cash Purchase Plan at a discount to the market price for the shares, which may

also put downward pressure on the market price for shares of the Fund.

Anti-Takeover Provisions. The Fund’s

By-laws provide for a staggered Board. Moreover, the Fund has opted into the Maryland Control Share Acquisition Act. These provisions

may have the effect of discouraging a hostile bidder.

Regulated Investment Company. The Fund

has conducted and intends to continue to conduct its operations so that it qualifies as a “regulated investment company”

for purposes of the Internal Revenue Code of 1986, as amended (the “Code”). This relieves the Fund of any material liability

for federal income tax to the extent that its earnings are distributed to its shareholders. If the Fund fails at any time to qualify

as a “regulated investment company,” the income of the Fund for that fiscal year will be taxed at the corporate level. This

would result in a decrease in income for distribution to shareholders of the Fund and a reduction in the net asset value of the Fund.

Counterparty and Prime Brokerage Risk.

The Fund is subject to the risk of loss of Fund assets on deposit or being settled or cleared with a broker in the event of the broker’s

bankruptcy, the bankruptcy of any clearing broker through which the broker executes and clears transactions on behalf of the Fund, the

bankruptcy of an exchange clearing house or the bankruptcy of any other counterparty. If a prime broker or counterparty becomes bankrupt

or otherwise fails to perform its obligations under a derivative contract due to financial difficulties, the Fund could experience significant

delays in obtaining any recovery in a bankruptcy or other reorganization proceeding; if the Fund’s claim is unsecured, the Fund

will be treated as a general creditor of such prime broker or counterparty and will not have any claim with respect to the underlying

security. In the case of any such bankruptcy, the Fund might recover, even in respect of property specifically traceable to the Fund,

only a pro rata share of all property available for distribution to all of the counterparty’s customers and counterparties. Such

an amount could be less than the amounts owed to the Fund. It is possible that the Fund will obtain only a limited recovery or no recovery

in such circumstances. Such events would have an adverse effect on the NAV of the Fund. Certain counterparties have general custody of,

or title to, the Fund’s assets. The failure of any such counterparty could result in adverse consequences to the NAV of the Fund.

Legal and Regulatory Risk. Legal and

regulatory changes could occur that would materially adversely affect the Fund. The regulation of securities markets and investment funds

such as the Fund has undergone substantial change in recent years, and such change could continue. The Fund does not know in what form,

when and in what order significant regulatory initiatives will be implemented or the impact any such implemented regulations will have

on the Fund, the markets or instruments in which the Fund invests or the counterparties with which the Fund conducts business. The effect

of regulatory change on the Fund, while impossible to predict, could be substantial, adverse and potentially limit or completely restrict

the ability of the Fund to implement its investment strategy.

Dependence on Advisor. The Fund depends

on the efforts, skills, reputations and business contacts of its investment advisor, Sims Capital Management LLC (“Advisor”).

The loss of the Advisor’s services could have a material adverse effect on the Fund. The Advisor’s principals possess substantial

experience and expertise. The loss of these personnel could affect the Fund’s investment opportunities as well as cause increased

costs for the Fund to replace them.

Market Disruptions from Natural Disasters

or Geopolitical Risks. Political instability, the ongoing epidemics of infectious diseases in certain parts of the world, terrorist

attacks in the United States and around the world, natural disasters, social and political discord, debt crises (such as the Greek debt

crisis), sovereign debt downgrades, or the exit or potential exit of one or more countries from the European Union (such as the United

Kingdom) or the European Economic and Monetary Union, among others, could result in market volatility, could have long-term effects on

the United States and worldwide financial markets, and could cause further economic uncertainties in the United States and worldwide.

The Fund cannot predict the effects of natural disasters or geopolitical events in the future on the economy and securities markets.

Portfolio Turnover. The Fund’s

annual portfolio turnover rate could vary greatly from year to year, as well as within a given year. Portfolio turnover rate is not considered

a limiting factor in the execution of investment decisions for the Fund. High portfolio turnover could result in the realization of net

short-term capital gains by the Fund which, when passed through and distributed to shareholders, will be taxable as ordinary income.

Higher portfolio turnover could also trigger higher levels of capital gains at the Fund level which, when passed through to Fund shareholders,

would trigger potential capital gains liability at the Fund shareholder level. In addition, a higher portfolio turnover rate results

in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Fund.

Cybersecurity. Increased reliance on