UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by the Party other than the Registrant ☒

Check the appropriate box:

☐ Preliminary Proxy Statement.

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☒ Soliciting Material under § 240.14a-12

SERVOTRONICS, INC.

(Name of Registrant as Specified In Its Charter)

PAUL L. SNYDER III

FOUNDERS SOFTWARE, INC.

BEAVER HOLLOW WELLNESS, LLC

KATHLEEN ANN SCHEFFER

CHRISTINE R. MARLOW

MICHAEL W. DOLPP

CHARLES C. ALFIERO

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

On March 18, 2025, Paul L. Snyder III, Chief Executive Officer of Beaver Hollow Wellness, LLC, was quoted in the following article published by the Buffalo News:

Elma-based Servotronics Weighs Options, Including Sale

** Servotronics, the embattled Elma motion control equipment maker, is weighing options for its future, including a possible sale of the company.

"The board will evaluate all options which may include investments of capital, sale of the company, or continuing on our current path," said Christopher Marks, chairman of Servotronics' board, in a statement.

The disclosure comes as Servotronics faces a battle for control from a dissident shareholder campaign. The leader of the campaign, Paul Snyder III, has said he is concerned about Servotronics' future under its current leadership and wants to ensure the longtime manufacturer's jobs and operations remain in Western New York.

"I fear that we will lose Servotronics because of what is occurring in the announcement that the company has made, and that would be devastating to Western New York," Snyder said in an interview.

The Elma-based manufacturer's board disclosed it has hired an investment banking firm, Houlihan Lokey, as its lead financial adviser as it reviews alternatives. Servotronics set no timeline for completing the review or completing a transaction that might result from it.

"The Servotronics team has achieved significant progress in our transformation efforts over the past three years as a valued supplier to the commercial aerospace industry," Marks said. "Our board and leadership team see significant opportunities for continued growth given the strong fundamentals in our major markets."

Snyder, who is Servotronics' largest individual shareholder through his firm, Beaver Hollow Wellness, took the company to task over its decision to explore its options, including a potential sale.

"This confirms our worst fears – that this board would rather abandon Servotronics' employees and the Western New York community rather than take responsibility for its own failures," Snyder wrote to the board.

Snyder said he has been frustrated by a lack of response from the company's leadership to his questions and his offers to help.

In letters to Servotronics officials, government leaders echoed Snyder's concerns about the company's future, based on media reports they have read, and extended offers to help.

"My administration can only be of assistance if we are engaged before a crisis arises," wrote Erie County Executive Mark Poloncarz.

"This is an inflection point where all parties have a chance to stand together in the name of responsible corporate stewardship to commit to their workforce, and put the company's fundamentals back on track," wrote U.S. Rep. Nick Langworthy.

As of last April, Servotronics had about 250 employees. Servotronics shares are down about 8% over the past year, compared with a 9% gain by the benchmark Standard & Poor's 500 index.

Servotronics has been struggling financially, with losses from continuing operations for two straight years. The company reported a fourth quarter net loss from continuing operations of $1.3 million, compared to a $378,000 gain the year before. Its quarterly revenues dropped 21% from a year earlier, to $9.8 million.

For all of 2024, the company reported a net loss from continuing operations of $1.5 million, compared to a net loss of $3.5 million in 2023. Its full-year revenues rose 3%, to $45 million.

“We achieved a number of significant milestones in 2024, posting increased revenues, improved margins and improved bottom-line results, even in a year where commercial aircraft deliveries decreased nearly 10%,” CEO William Farrell Jr. said in a statement. “Although the year ended on a challenging note, the industry and Servotronics are well positioned for growth in 2025.”

Snyder is much more pessimistic about the trajectory of Servotronics under its current leadership. He sees the continued losses as a worrisome trend, and said the company failed to deliver on the optimistic tone of a full-year outlook for investors published in April 2024.

Snyder is frustrated that the company's leaders have not engaged with him on a turnaround proposal he has published, called S.A.V.E. Servotronics, that was endorsed by the company's former chief operating officer.

"They talk about strategic alternatives – a strategic alternative is the S.A.V.E. Servotronics proposal," he said. "You would think Houlihan Lokey or the company, if they were actually considering alternatives other than selling the company, would be considering our proposal."

Snyder's campaign is aiming to win a majority of seats on Servotronics' board. If his campaign succeeds, Snyder would become board chairman and one of the members of his slate of candidates would become interim CEO.

Servotronics has yet to announce a date for its annual shareholders meeting, where a vote on board candidates would take place. In recent years, the company has held its meeting in either May or June.

Snyder said he was concerned that Servotronics could agree to sell the company before shareholders can vote on the dissident slate of directors at the annual meeting.

"They could attempt to sell the company before they actually have a vote for the board," Snyder said.**

**********

On March 18, 2015, Paul Snyder sent the following letter to the Servotronics, Inc. Board of Directors

** Dear Mr. Marks, Mr. Farrell, and Members of the Servotronics Board,

On behalf of Beaver Hollow Wellness, LLC, I am compelled to address the ongoing and deeply concerning failures in leadership at Servotronics, Inc. The failure of the Board of Directors and CEO William Farrell to respond to legitimate shareholder concerns, combined with ongoing financial mismanagement, has led to a crisis of confidence in this company's governance.

Most egregiously, the Board has failed to acknowledge or act upon:

1. The formal demand for an internal investigation into potential unjust enrichment and fiduciary breaches, sent on January 28, 2025, which has yet to receive a response.

2. The SAVE Servotronics proposal, which was presented as a constructive and actionable plan to restore financial discipline, implement meaningful governance reforms, and protect shareholder value. The Board has ignored every offer of assistance and real solutions proposed.

Rather than addressing these serious issues, the Board has now "announced a strategic review of alternatives, including the potential sale of the company", as revealed in the March 17, 2025 press release. This confirms our worst fears that-this Board would rather abandon Servotronics' employees and the Western NY community than take responsibility for its own failures. This process is nothing more than a desperate attempt to cover up for the Board's mismanagement and arrogance, at the expense of those who have worked tirelessly to build this company.

In addition, on March 17, 2025, the Board and its hand-pick CEO William Farrell released the final financial results of their efforts for 2024. It is now painfully clear that the April 2024 Shareholder Update presented by this Board and Mr. Farrell painted an overly optimistic and misleading financial picture, only to be completely contradicted by the 2024 10-K filing, which revealed persistent operating losses, liquidity struggles, and ineffective cost control efforts. As an investor and stakeholder, I have lost confidence in this leadership team, as the company's persistent underperformance is a direct result of poor executive oversight and misguided strategic decisions.

Discrepancies Between Leadership's Statements and Reality

1. Profitability and Revenue Growth: Misleading Projections

- The April 2024 Shareholder Update projected profitability and improved margins, citing revenue growth.

- The 2024 10-K filing instead revealed continued net losses, driven by high legal and operational costs that were not accounted for in prior projections.

- Rather than achieving meaningful profitability, the company remains financially unstable.

2. Discontinued Operations: A Persistent Financial Drain

- The Ontario Knife Company divestiture was falsely framed as a success, yet the company continues to lose money on a mostly vacant building that requires maintenance and upkeep.

- These losses contradict the notion that the divestiture was a strategic win and further erode shareholder value.

3. Liquidity Crisis and Over-Reliance on Debt

- The April update failed to disclose the severity of Servotronics' reliance on borrowed funds.

- The 2024 10-K revealed a $7M credit facility, with only $4.3M remaining available as of year-end-a clear sign of liquidity distress.

- Instead of generating organic revenue growth, the company is financing its daily operations, including cash payments to the Board of Directors- through debt, a dangerous and unsustainable path.

4. Deferred Tax Assets: Misrepresented Stability

- Management failed to acknowledge the risk that deferred tax assets may not be realizable due to historical pre-tax losses.

- This oversight further exposes poor financial planning and unrealistic forecasting.

Leadership Failures of CEO William Farrell and the Board

It is undeniably clear that William Farrell and the Board, under Christopher Marks, have failed in their fiduciary duty to shareholders. Instead of taking corrective action, they have consistently:

- Overstated growth potential while failing to control expenses.

- Provided misleading or incomplete financial projections.

- Failed to generate profitability despite favorable market conditions in aerospace.

- Relied excessively on debt rather than strengthening the company's financial position.

This blatant misrepresentation of financial stability demonstrates either a reckless disregard for transparency or an intentional effort to mislead shareholders.

Immediate Demands for Action and Accountability

Servotronics cannot afford 2025 to be a year of inaction, mismanagement and worse yet another botched sale process- just like it conducted with Ontario Knife. Given the Board's repeated failures to address these concerns, we demand the following actions:

1. Immediate acknowledgement of the January 28, 2025 internal investigation request, with a commitment to initiate an independent review.

2. A written response detailing the Board's position on the SAVE Servotronics plan, including specific reasons for its rejection or any willingness to adopt elements of it.

3. A clear public statement on the intent behind the "strategic alternatives review", and whether the Board has already been in discussions regarding a sale.

4. A firm commitment to protect Servotronics' employees and Western NY operations, including transparency regarding any sale process.

As Chairman of Beaver Hollow Wellness, LLC, I request a formal response from the Board, outlining the specific actions that will be taken to address the ongoing financial mismanagement of the Company, as well as the urgent concerns outlined in this letter. The disastrous decline in shareholder value under your failed leadership must end now.

Shareholders, Employees, and the Western New York Community deserve better!

Sincerely,

Paul Snyder, III

Chairman

Beaver Hollow Wellness, LLC **

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Beaver Hollow Wellness, LLC, together with the other participants named herein (collectively, the “Group”), intends to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2025 annual meeting of stockholders of Servotronics, Inc., a Delaware corporation (the “Company”).

THE GROUP STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation are anticipated to be Beaver Hollow Wellness, LLC, Founders Software, Inc., Paul L. Snyder, III, Kathleen Scheffer Christine R. Marlow, Michael W. Dolpp and Charles C. Alfiero.

As of the date hereof, Beaver Hollow Wellness, LLC beneficially owns directly 388,745 shares of common stock, par value $0.20 per share, of the Company (the “Common Stock”). Founders Software, Inc., as a member of, and holder of approximately 92 percent of the issued and outstanding membership interest of Beaver Hollow Wellness, LLC, may be deemed to beneficially own the 388,745 shares of Common Stock owned directly by Beaver Hollow Wellness, LLC. Paul L. Snyder III, as the indirect, majority shareholder and Chairman of the Board of Directors of Founders Software, may be deemed to beneficially own the 388,745 shares of Common Stock owned directly by Beaver Hollow Wellness, LLC. As of the date hereof, Kathleeen Ann Scheffer beneficially owns directly 2,173 shares of Common Stock. As of the date hereof, none of Christine R. Marlow, Michael W. Dolpp or Charles C. Alfiero beneficially owns any Common Stock.

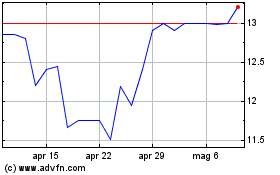

Grafico Azioni Servotronics (AMEX:SVT)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Servotronics (AMEX:SVT)

Storico

Da Apr 2024 a Apr 2025