BNP PARIBAS SA: Restatement of 2024 format of 2023 quarterly series

29 Febbraio 2024 - 6:30PM

BNP PARIBAS SA: Restatement of 2024 format of 2023 quarterly series

This restatement has no impact on the Group’s published and

distributable 2023 results and only changes the analytical

breakdown of business lines, divisions and “Corporate Centre”

segment.

In order to present a homogeneous reference with

the presentation of the financial statements and the results,

applied from 1 January 2024, the quarterly series for 2023 include

the effects described below:

- Taking into account the end of the ramp-up of the Single

Resolution Fund (SRF) as from 1 January 2024 (reminder: 1 002

million euros in 2023), and the assumption of a similar

contribution to local banking taxes at an estimated amount around

200 million euros per year from 2024.

- Regarding the 2023 net income, the contribution to the SRF (EUR

1 002 million) was entirely allocated to the divisions and business

lines. The restatement entails reallocating approximately EUR 800

million not intended to continue from 2024 to the “Corporate

Centre” segment, and allocating only the 200 million euros

mentioned above to the divisions and business lines,

- Concerning the distributable income specific to the 2023 year

(reflecting the intrinsic performance of the BNP Paribas Group

after impact of the sale of Bank of the West, the ramp-up of the

SRF and excluding extraordinary items): by consistency, only the

amount of 200 million euros mentioned above is retained at Group

level and allocated to the divisions and business lines.

- Since 4Q23, "Other net charges for risk on financial

instruments” is an accounting line item separate from “cost of

risk”. It records expenses relating to risks which call into

question the validity or enforceability of financial instruments

granted. The restatement entails reclassifications for a value of

130 million euros between the two lines of the profit and loss

account at the level of the Europe-Mediterranean business line and

“Corporate Centre”.

- The business indicators are restated to take into account both

internal transfers of non-significant activities, notably within

Commercial & Personal Banking in Belgium (transfer of clients

from the individual segment, in particular SMEs, to the corporate

segment in connection with the new commercial organization) as well

as new activity indicators within the New Digital Businesses

(integration of Nickel deposits).

The following non-audited appendices detail the

2023 quarterly results in accordance with this restatement.

- Appendix 1: 2023 restated Group published net income and 2023

restated Group Distributable net income - (unchanged from the

publication of 1 February 2024)

- Appendix 2: Effects of the restatement on the operating

divisions

- Appendix 3: Effect of the restatement on Corporate Centre

- Appendix 4: Effects of the transfer of clients within

Commercial & Personal Banking in Belgium and integration of

Nickel deposits

- Appendix 5: Restated quarterly series for all divisions and

business lines

Details of the restatement are available at:Investors &

Shareholders | BNP Paribas Bank

- 2024 restatement of 2023 quarterly series - GB

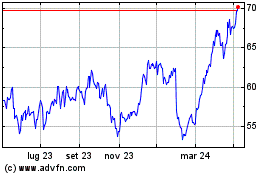

Grafico Azioni BNP Paribas (BIT:1BNP)

Storico

Da Feb 2025 a Mar 2025

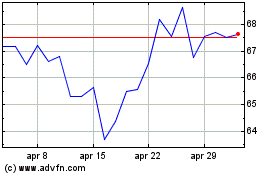

Grafico Azioni BNP Paribas (BIT:1BNP)

Storico

Da Mar 2024 a Mar 2025