Bitcoin rebounds as traders spot China ‘weaker yuan’ chart, but US trade war caps $80K BTC rally

08 Aprile 2025 - 5:37PM

Cointelegraph

Bitcoin (BTC) danced around $80,000 at the

April 8 Wall Street open as US stock markets staged a fresh

recovery, but unresolved tensions between China and the US continue

to put a damper on BTC’s upside.

BTC/USD 1-hour chart. Source:

Cointelegraph/TradingView

Hayes: Bitcoin can repeat historic China inflows

Data from Cointelegraph

Markets Pro and TradingView

showed BTC price volatility cooling while the S&P 500 and

Nasdaq Composite Index gained up to 4.3% in the first few hours of

trading.

Stocks built on a strong

rebound that had accompanied the start of the week’s TradFi

trading, alleviating fears of a 1987 “Black Monday” style

crash.

US trade tariffs nonetheless stayed top of the agenda for

traders, who in particular eyed the ongoing war of words with

China.

In a post on Truth

Social, US President Donald Trump claimed that Beijing “wants to

make a deal, badly, but they don't know how to get it started.”

“We are waiting for their call,” he told readers.

Source: Truth Social

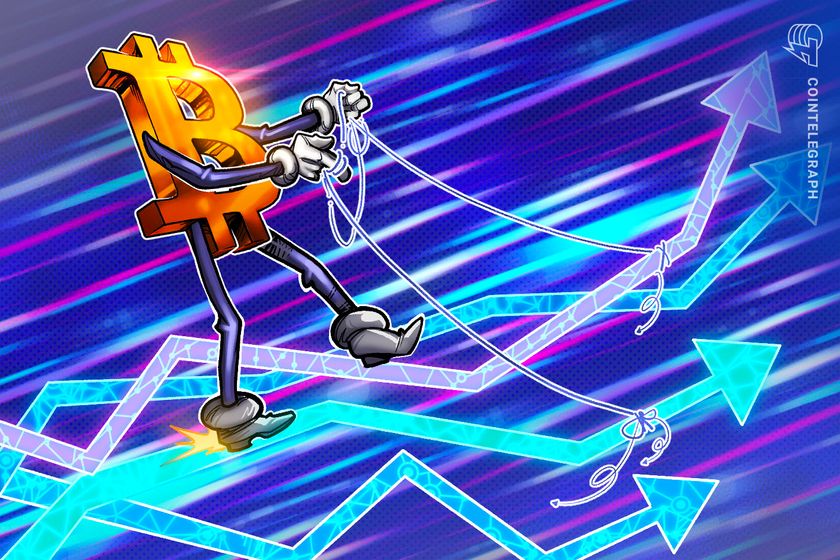

Bitcoin advocates eyed the devaluation of the yuan as part of

China’s tariff response and the potential inflows to hedges such as

BTC as a result.

“Xi's major weapon is independent monetary policy which

necessitates a weaker yuan,” Arthur Hayes, ex-CEO of crypto

exchange BitMEX, wrote in part of X coverage of the topic.

Hayes suggested that either the People’s Bank of China (PBoC) or

the US Federal Reserve would ultimately provide the fuel for a BTC

price rally.

“If not the Fed then the PBOC will give us the yachtzee

ingredients,” he argued in his

characteristic style.

“CNY deval = narrative that Chinese capital flight will

flow into $BTC. It worked in 2013 , 2015, and can work in 2025.

Ignore China at your own peril.”

USD/CNY 3-day chart. Source:

Cointelelgraph/TradingView

The Fed, meanwhile, could boost Bitcoin and risk assets by

lowering interest rates to stimulate growth. In a

blog post on

the day, AllianceBernstein predicted this happening even as tariffs

added to inflationary pressures.

“If the economy slows, as we expect it will, the Fed will be

inclined to cut rates even if price levels are high,” Eric

Winograd, the firm’s Developed Market Economic Research director

wrote.

“The view is that actual inflation tells us what the

economy was doing but not what it will do. The Fed has cut rates

before with inflation elevated, and we expect it to do so again

unless—a very big ‘unless’—inflation expectations become

unanchored.”

Fed target rate probabilities (screenshot). Source: CME

Group

Winograd said that AllianceBernstein expected 75 basis points of

rate cuts in 2025, with the latest data from CME Group’s

FedWatch Tool showing markets betting on the first of these

coming at the Fed’s June meeting.

Related: $2T

fake tariff news pump shows ‘market is ready to

ape’

Fibonacci offers a “big level to watch” for BTC price

Considering the global market tumult of the last three days,

Bitcoin’s price action has remained eerily cool on the shorter

timeframes as snap price moves gave way to consolidation.

For traders, among the key levels to watch was the 0.382

Fibonacci retracement level, currently near $73,500.

“In a bull market, the 38.2% Fibonacci retracement acts as key

support,” popular trader Titan of Crypto explained,

describing BTC/USD as “in a reversal zone.”

“As long as BTC closes above it, the uptrend remains

intact, even with a wick below.”

BTC/USD 1-month chart with Fibonacci levels. Source: Titan

of Crypto/X

Fellow trader Daan Crypto Trades also underscored the level’s

potential significance, with it coinciding with old all-time highs

from March 2024.

“$BTC Has respected its .382 Fibonacci retracements, measured

from the cycle bottom to the local tops, quite well so far,” he

told X

followers.

“This is the 3rd time we get such a test this cycle.

This time we got some confluence from the 2024 highs as well. Big

level to watch.”

Other important trend lines, as

Cointelegraph reported, include the 200-day simple moving

average (SMA), a classic bull market support line that was lost

when BTC first fell below $82,000.

BTC/USD 1-day chart with 200 SMA. Source:

Cointelegraph/TradingView

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Bitcoin rebounds as traders spot

China ‘weaker yuan’ chart, but US trade war caps $80K BTC

rally

The post

Bitcoin rebounds as traders spot China ‘weaker yuan’

chart, but US trade war caps $80K BTC rally appeared first on

CoinTelegraph.

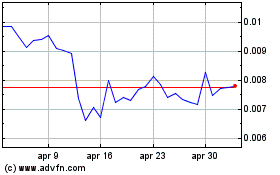

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Apr 2024 a Apr 2025