Bitcoin Data Reveals Bulls Are Growing But Still Behind March 2024 Peak – Details

11 Novembre 2024 - 8:30PM

NEWSBTC

Bitcoin has proven unstoppable, breaking all-time highs five times

in six days and surging past the $82,000 mark. This latest

milestone cements Bitcoin’s momentum as it pushes into uncharted

territory, capturing the bulls’ attention and sparking new levels

of optimism in the market. According to recent data from

CryptoQuant, the number of bullish investors is growing rapidly,

yet there’s reason to believe Bitcoin’s rally is far from over.

Related Reading: Ethereum Analyst Sees Altseason Potential As BTS

Is Still Outpacing ETH – Time To Buy Altcoins? CryptoQuant’s

insights indicate that BTC remains significantly below its March

2024 peak in several key metrics, which suggests that Bitcoin may

still have room to climb within this cycle. This gap highlights

that, despite the impressive gains, Bitcoin could still be building

toward a true cycle peak, with potential gains yet to be

realized. As investor sentiment strengthens and Bitcoin shows

resilience at each new level, the market watches closely for signs

of continued upward momentum. The next few days will be crucial in

determining just how far Bitcoin can go as it solidifies its place

in the next phase of this bull run. Bitcoin Bulls Enter The Room

Bitcoin bulls have returned after eight months of sideways

consolidation and significant selling pressure. With Bitcoin now

trading 11% above its previous all-time high from March, market

sentiment has turned decisively bullish, marking the start of a new

trend. According to data from CryptoQuant analyst Axel Adler,

the number of bullish investors in the market is steadily rising,

signaling growing confidence. However, despite this uptick, the

current rally lacks the frenzied demand seen during the March 2024

rally, when both retail and institutional interest reached euphoric

levels. Adler’s data indicates that while bulls have a strong

foothold in the market, the pace of accumulation by new retail and

institutional participants is still relatively modest. This gap

between the current market dynamics and those seen in March

suggests that Bitcoin’s latest surge may be just the beginning

rather than the end of its upward trajectory in this cycle.

Related Reading: Cardano Skyrockets Over 40% – Funding Rate

Suggests Further Upside The slower but steady rise in buying

interest could indicate that Bitcoin is still in the early stages

of this bullish phase, with room for further growth before reaching

a cycle peak. For investors, this could present a promising

opportunity. The subdued retail and institutional excitement level

suggests that Bitcoin has yet to capture mainstream attention as it

did during previous peaks. If demand rises gradually, Bitcoin may

experience sustained growth over the coming months, potentially

reaching new highs as momentum builds. BTC Setting New High

Bitcoin recently set a new all-time high above $82,000, which many

investors previously viewed as a likely local top. However, BTC’s

price action remains robust, and it may be too soon to call for a

definitive peak. Despite this upward momentum, a potential

pullback to $77,000 could be on the horizon, as there is an

unfilled gap in the CME futures market between $77,000 and

$81,000—a technical level that often attracts price action as

traders look to close the gap. This week will likely bring

significant volatility as bulls control the market. With Bitcoin in

uncharted territory, some investors may seize the opportunity to

lock in profits, which could introduce selling pressure.

Related Reading: Avalanche Nears Breakout – Top Analyst Sets $420

Target For AVAX This Cycle Nonetheless, the dominant trend is

bullish, and a brief correction to $77,000 could provide a

foundation for further upside. Bitcoin’s strength remains intact

for now, but all eyes will be on how it responds to the volatility

and whether it can maintain this high range or dip slightly before

resuming its climb. Featured image from Dall-E, chart from

TradingView

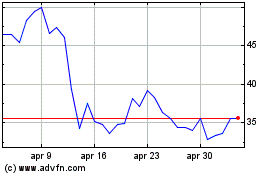

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Apr 2024 a Apr 2025